Ethena Bybit withdrawal has become a noteworthy event within the crypto community, as reports indicate that Ethena has successfully withdrawn 25 million ENA, which translates to approximately $7.05 million. This strategic move underscores Ethena’s significant presence in the blockchain investment space, boasting a total holding of ENA valued at over $100 million. Investors and analysts are keenly watching any Bybit news related to such transfers, as they reflect broader trends in the crypto market updates. Ethena’s actions could potentially impact ENA holdings, making them a focal point of interest for both new and seasoned investors. As the cryptocurrency landscape evolves, understanding withdrawals like this can provide insights into market movements and investor sentiment.

The recent activity surrounding the Ethena Bybit withdrawal highlights a significant maneuver in the cryptocurrency market, illustrating the dynamic interactions between digital asset exchanges. By withdrawing a substantial amount of ENA, Ethena positions itself prominently within the blockchain sector, demonstrating its strategic investment acumen. Such withdrawals not only contribute to the individual asset’s liquidity but also trigger speculation and interest across various platforms. As crypto enthusiasts look for the latest updates on the ENA ecosystem and its potential implications, the focus on these transactions provides a captivating glimpse into the fluid nature of digital currencies and their market behaviors. Overall, these developments serve as critical indicators of shifting trends within the broader cryptocurrency landscape.

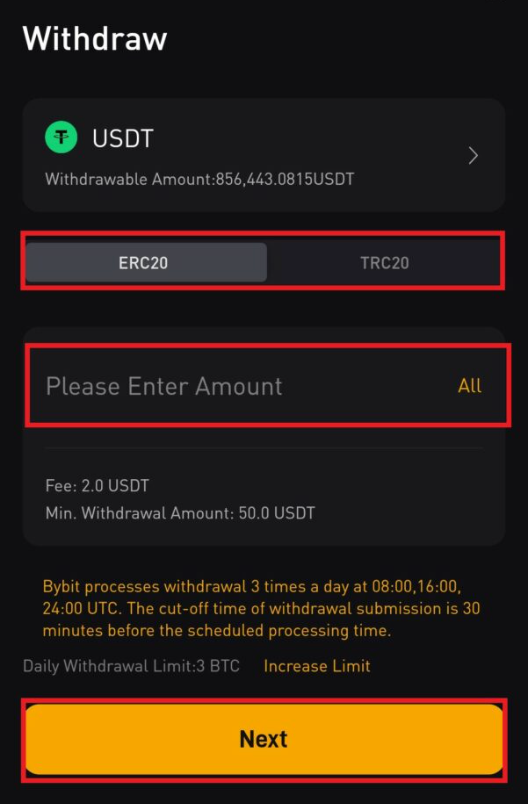

Ethena Bybit Withdrawal Details

Ethena’s recent withdrawal from Bybit signifies a substantial shift in their asset management strategy. Reports indicate that they have pulled 25 million ENA tokens, which equates to a notable $7.05 million. This action reflects Ethena’s confidence in optimizing their ENA holdings, particularly as they now possess a total of 355.15 million ENA with a market value surpassing $100 million. Such movements in the crypto market underline the importance of strategic withdrawals in maximizing investment returns.

The decision to withdraw from Bybit might also be influenced by the volatile nature of cryptocurrency exchanges. Bybit, being one of the prominent platforms for trading digital assets, provides liquidity and trading options that attract investors like Ethena. However, ensuring security and managing assets through different wallets can lead to significant adjustments in holdings, which is precisely what has happened here. Investors should remain attentive to such significant withdrawals as they often signal changes in market sentiment and investment strategies.

Current ENA Market Status

As of the latest updates, Ethena’s ENA holdings have surged ahead, reflecting favorable market conditions for blockchain investments. Currently valued at $100.13 million, these holdings mark a significant achievement for Ethena in the ever-evolving crypto landscape. It’s also essential to monitor Bybit news and analyze how major withdrawals impact overall token performance and investor confidence. Such insights can guide potential investors in assessing the stability and future prospects of their investments.

The position of ENA in the market correlates directly with recent trends and developments, including the inflow of other investment vehicles in the crypto arena. As competition intensifies among various cryptocurrencies and blockchain projects, understanding the status of ENA and observing the investment patterns of major players like Ethena provide valuable clues for prospective investors. Regular updates on the cryptocurrency market will be crucial for those looking to invest in ENA holdings or similar projects.

Impact of Regulatory Changes on Blockchain Investments

Recent regulatory warnings regarding illegal fundraising under the guise of virtual currency have created ripples in the blockchain investment space. Such developments note the importance of adhering to regulatory frameworks while investing in digital currencies. The caution advised by the CBIRC and other institutions highlights the necessity for investors to remain diligent and informed about the regulatory landscape, particularly as it pertains to transactions and withdrawals in major exchanges like Bybit.

The regulatory environment can directly impact investor confidence and market dynamics. As the blockchain ecosystem matures, investors need to stay updated on potential regulatory changes that could affect their investments. This insight is particularly vital for those holding assets in ENA or planning to engage in trading on platforms like Bybit, as shifts in law and policy can influence not just individual platforms, but the overarching crypto market as well.

Broader Market Trends in Crypto Investments

The cryptocurrency market is experiencing dynamic shifts influenced by global economic factors and investor behavior. For instance, as highlighted by the US Solana spot ETF’s recent inflow of $5.37 million, it showcases an increasing interest in cryptocurrency investments. News related to other cryptocurrencies, such as the minting of USDC by Circle, suggests that the market is expanding, providing multiple avenues for investors to diversify their portfolios in blockchain assets.

Staying updated with crypto market updates is crucial for both seasoned investors and newcomers alike. The rise of unique financial products, including spot trading events and new token listings, represents opportunities for growth within the market. Ethena’s strategic decisions regarding ENA and Bybit withdrawals serve as a reminder of the importance of tracking trends and reacting to market changes with informed strategies.

The Future Outlook for ENA Holdings

With Ethena’s withdrawal from Bybit and the stabilization of their ENA holdings, the future outlook for this digital asset appears promising. Investment strategies, particularly in Onchain assets, require adaptation to market trends, and Ethena seems to be positioning themselves for sustainable growth. This is particularly relevant as blockchain continues to attract investor interest due to its innovative applications and potential for high returns.

The outlook for ENA also depends on broader trends in governance and utility within the blockchain ecosystem. If Ethena can leverage their extensive holdings wisely, they possess the potential to influence the ENA market positively. Continuous monitoring of market shifts and regulatory environments will be vital for maintaining their competitive edge and ensuring that their investments yield the desired results.

Understanding Blockchain and Its Challenges

The underlying technology of blockchain presents an array of challenges and opportunities for investors in the digital space. While investments in cryptocurrencies like ENA offer potential for high returns, the accompanying risks necessitate a thorough understanding of blockchain principles and market behaviors. Investors must navigate technological challenges, regulatory gaps, and market volatility, which can significantly impact their holdings.

Moreover, as blockchain technology evolves, so do the associated risks, including cybersecurity threats and regulatory scrutiny. Ethena’s experiences with Bybit withdrawals underline the complexity of managing blockchain investments. Thus, keeping abreast of these challenges can help investors approach the crypto market more strategically, allowing for informed decision-making and enhanced portfolio management.

Investor Sentiment in the Crypto Market

Investor sentiment plays a crucial role in shaping market dynamics within the cryptocurrency sector. The recent withdrawal of ENA by Ethena signals a strategic decision that may resonate with a broader sentiment among investors who are leaning towards increased security and control over their digital assets. As more investors become cautious amid regulatory changes and market fluctuations, understanding these trends becomes essential.

Additionally, positive news and developments can alter investor sentiment rapidly. For example, updates regarding increased ETF inflows or institutional adoption can bolster confidence in certain cryptocurrencies. Ethena’s considerable holdings in ENA amid fluctuating market conditions highlight the need for potential investors to stay informed about current events and market psychology as they navigate the unpredictable landscape of blockchain investment.

Navigating the Crypto Market with Bybit

Bybit has established itself as a significant player in the cryptocurrency exchange realm, offering a platform for traders to engage in various crypto assets. As evidenced by Ethena’s recent withdrawal, strategic decisions on this platform impact broader market sentiment and individual asset trajectories. Traders should navigate Bybit with awareness, leveraging its features to enhance their trading strategies and manage risks effectively.

Moreover, understanding the products and services offered by Bybit can aid investors in making knowledgeable decisions regarding their crypto investments. Bybit’s competitive trading fees and diverse asset offerings provide avenues for both novice and seasoned traders to capitalize on market movements. In the current volatility of the crypto market, entities like Ethena showcase how using platforms like Bybit effectively can align with broader investment goals.

Staying Informed with Blockchain Developments

As the blockchain landscape continues to evolve, remaining informed about developments is essential for all stakeholders. Resources like the Odaily Planet Daily app can provide vital insights into Web 3.0 advancements and ongoing changes within the cryptocurrency market. Monitoring such platforms can enhance understanding, allowing investors to make informed decisions about holdings like ENA and potential future investments.

Furthermore, subscribing to reliable sources for blockchain-related news ensures that investors stay updated on trends, market shifts, and technological innovations. With the rapid pace of change in the crypto sector, proactive engagement with the latest updates can empower investors to navigate their portfolios more effectively and strategically.

Frequently Asked Questions

What is the latest Ethena Bybit withdrawal news?

Recently, Ethena made significant moves by withdrawing 25 million ENA from Bybit, valued at approximately $7.05 million. Following this transaction, Ethena’s wallet now holds a total of 355.15 million ENA, worth about $100 million, reflecting notable activity in the crypto market.

How much ENA has Ethena withdrawn from Bybit?

Ethena has withdrawn 25 million ENA from Bybit, which equates to around $7.05 million. This withdrawal is part of their overall strategy in managing ENA holdings, totaling 355.15 million ENA valued at $100 million.

What are the implications of Ethena’s Bybit withdrawal for the crypto market?

Ethena’s withdrawal of 25 million ENA from Bybit could signal increased liquidity in the crypto market and reflect confidence in blockchain investments. With their substantial holdings now worth over $100 million, this could impact how investors view ENA’s stability and growth potential.

How does Ethena’s withdrawal from Bybit affect its ENA holdings?

Ethena’s recent withdrawal from Bybit, amounting to 25 million ENA, affects its ENA holdings by reducing the amount in the exchange but increasing the total value held in their wallet, which now stands at 355.15 million ENA worth $100 million.

Where can I find updates on Ethena’s Bybit activities?

For the latest updates on Ethena’s Bybit activities and general blockchain investment trends, following platforms like Odaily Planet Daily and crypto news outlets can provide timely information and insights into the crypto market_updates.

What should investors know about Ethena’s ENA withdrawals and the risks involved?

Investors should stay informed about Ethena’s ENA withdrawals from Bybit as they indicate market movement and liquidity. However, it’s crucial to be wary of the risks associated with illegal fundraising in virtual currency and to conduct thorough due diligence before investing.

Is Ethena’s withdrawal from Bybit part of a larger strategy?

Yes, Ethena’s withdrawal of 25 million ENA from Bybit likely aligns with a broader investment strategy, as they currently maintain ENA holdings valued at $100 million, which indicates a significant commitment to the growth of their assets in the blockchain space.

Can I track Ethena’s crypto activities on Bybit?

Yes, Ethena’s activities on Bybit can be tracked through onchain analytics platforms like Onchain Lens, which provide real-time updates on transaction volume and wallet balances, offering insights into their overall investment strategy in the crypto market.

What are the potential benefits of investing in ENA following Ethena’s moves?

Investing in ENA following Ethena’s $7.05 million withdrawal from Bybit may present an opportunity for growth, especially as Ethena’s holdings reflect confidence in the asset’s value and potential in the blockchain investment landscape.

| Key Points | Details |

|---|---|

| Withdrawal Amount | $7.05 million ENA (25 million ENA) |

| Current ENA Holdings | 355.15 million ENA worth $100.13 million |

| Risk Warning | Beware of illegal fundraising related to virtual currencies and blockchain, as advised by CBIRC and other authorities. |

Summary

Ethena Bybit withdrawal highlights significant financial activity in the cryptocurrency world as Ethena has withdrawn $7.05 million worth of ENA from Bybit, increasing concerns about illegal fundraising. Currently, Ethena holds a substantial $100 million in ENA, totaling 355.15 million tokens. Such transactions underscore the volatility and regulatory scrutiny in the crypto market, making it essential for investors to stay informed about the risks associated with virtual currencies.