In a significant development in the cryptocurrency world, 56,291 ETH withdrawal from Binance has recently occurred, amounting to a staggering $160 million. This massive exit of Ethereum from the exchange within a mere two-hour window has raised eyebrows among traders and analysts alike, igniting discussions about potential implications for Ethereum market movements. On-chain analysis by experts, including noted analyst Yu Jin, highlights that such large withdrawals often signal shifting market trends and investor sentiment. As Ethereum news continues to flood the airwaves, many are keeping a close eye on Binance withdrawal patterns to gauge the future trajectory of the digital asset. Understanding these dynamics is crucial for anyone looking to navigate the rapidly changing landscape of cryptocurrency trends and investment opportunities.

In the rapidly evolving landscape of digital currencies, a notable shift has emerged with a recent extraction of over 56,291 ETH from the Binance platform. This action not only underscores the larger patterns of asset movement in the bustling cryptocurrency sector but also speaks to the behavior of investors responding to market pressures. As discussions around Ethereum developments gain momentum, the broader implications of such significant withdrawals require thorough consideration, especially in light of on-chain observations revealing a trail of strategic financial maneuvers. Such movements often reflect underlying market sentiments and predictions about future valuations. Stakeholders are advised to keep an informed perspective on these financial flows to better understand ongoing cryptocurrency trends.

Massive Ethereum Withdrawal from Binance: Analyzing the Impact

In a significant development for the cryptocurrency market, a newly created address has withdrawn 56,291 ETH from Binance, translating to an impressive worth of approximately $160 million. This substantial withdrawal, facilitated by one of the leading cryptocurrency exchanges, has raised eyebrows among traders and investors alike. The timing of this transaction coincides with notable shifts in the Ethereum market, reflecting the growing interest in Ethereum news and its implications for future market movements.

On-chain analysis by prominent researcher Yu Jin revealed that this large-scale withdrawal may indicate a strategic move by investors anticipating bullish trends in Ethereum’s pricing. Such withdrawals can often lead to increased speculation as traders seek to understand whether this influx of Ethereum into private wallets is a sign of impending market confidence or potential volatility. These cryptocurrency trends are crucial for investors who keep a keen eye on the Ethereum landscape, leveraging these data points to inform their trading strategies.

Understanding the Implications of High-Volume Withdrawals on Ethereum Markets

High-volume withdrawals like the recent 56,291 ETH transfer from Binance can have far-reaching implications on the Ethereum ecosystem. Such events often trigger significant price movements, as they may suggest that whales or institutional investors are repositioning their assets. Analysts frequently utilize on-chain data to assess these trends, allowing them to predict how such withdrawals might affect supply and demand dynamics within the Ethereum market.

Moreover, observing how these large amounts of ETH are transferred into private wallets can provide insights into broader cryptocurrency trends. When large-scale withdrawals occur, it usually indicates a lack of confidence among traders in holding their assets on exchanges. Therefore, monitoring Ethereum market movements post-withdrawal is essential for gauging investor sentiment. Many in the space believe that this could eventually lead to a rally if confidence rebounds or, conversely, a downturn if it signals fear-driven sell-offs.

The Role of On-Chain Analysis in Monitoring Ethereum Transactions

On-chain analysis has emerged as a vital tool for cryptocurrency investors looking to navigate the complex landscape of digital assets. This analytical method provides deep insights into transaction patterns, wallet movements, and the overall flow of Ethereum within the network. By examining on-chain data, analysts like Yu Jin can identify critical trends, such as the recent massive withdrawal from Binance, which can inform trading strategies and investment decisions.

Such analyses also help in understanding the behavior of large holders (often referred to as “whales”) and their influence on market volatility. With Ethereum’s ongoing developments and the introduction of new protocols, on-chain metrics can serve as a barometer for gauging market confidence. Investors frequently look for these signals to predict future movements based on historical data and current event correlations.

Binance Withdrawal Trends: What Investors Should Watch

The recent Binance withdrawal of 56,291 ETH has triggered discussions among investors regarding withdrawal trends and their implications on market liquidity. As one of the leading platforms for trading Ethereum, Binance’s movements are closely monitored by market participants. Understanding the flow of Ethereum from exchanges to personal wallets can highlight shifts in market sentiment and reveal potential investment opportunities or risks.

When analyzing withdrawal trends, it’s critical to consider not just the numbers, but the context behind them. Large withdrawals might indicate that investors are anticipating changes in Ethereum prices or are preparing for significant market events. Thus, keeping an eye on these withdrawal patterns can be just as important as monitoring price movements. Investors who can identify and act on these trends early may find themselves capitalizing on Ethereum market opportunities as they unfold.

Ethereum Market Movements: Examining Recent Trends

Recent events in the Ethereum ecosystem, including significant withdrawals from major exchanges, have become focal points for assessing market dynamics. The withdrawal of 56,291 ETH from Binance demonstrates the fragile balance between buying power and liquidity, as large holders choose to shift their assets into private wallets for various strategic reasons. Such movements can drastically influence short-term price trends and investor confidence.

Furthermore, the ongoing developments in Ethereum, including updates regarding scalability and smart contract capabilities, play a significant role in dictating market movements. Investors and analysts alike are watching how these technological advancements coincide with significant transactions, including this recent audit of withdrawal activity. The interplay between Ethereum news and actual market movements provides lucrative insights for anyone engaged in Ethereum trading.

Cryptocurrency Trends: The Bigger Picture Behind Ethereum Withdrawals

Analyzing cryptocurrency trends provides context to individual events such as the massive withdrawal of 56,291 ETH from Binance. With the cryptocurrency market witnessing rapid shifts in buyer behavior and regulatory developments, understanding broader trends can give investors an edge. These trends not only influence traders’ short-term strategies but can also have long-term ramifications for the overall vitality of Ethereum and similar digital assets.

As withdrawals increase, especially at significant volumes, market analysts urge investors to pay attention to how these actions correlate with other trends, such as social media sentiment and news cycles surrounding Ethereum. Understanding the connections between these elements can better equip traders to navigate the ever-evolving cryptocurrency landscape.

Future Predictions: What the Withdrawal Signals for Ethereum’s Price

The recent withdrawal of 56,291 ETH from Binance has led to speculation on what this might signal for Ethereum’s future price movements. Historical data suggests that large withdrawals can often lead to upward price pressure, particularly if the assets are moved into long-term holding. As discussions around Ethereum news evolve, this event could mark a pivotal moment for price trajectory, affecting trader sentiment and investment behaviors across the board.

Investors are continuously watching for indicators signaled by such withdrawals to anticipate market corrections or bullish rallies. The combination of on-chain analysis and withdrawal scrutiny forms a speculative landscape where predictions can heavily influence trading behaviors among both retail and institutional investors in the Ethereum space.

Technical Analysis: The Numbers Behind Ethereum Withdrawals

Technical analysis plays a critical role in understanding the fluctuations in the Ethereum market sparked by withdrawals like the recent one from Binance. By examining historical price data, trading volume, and withdrawal patterns, traders can begin to form actionable insights into whether the market is poised for a bullish or bearish shift. The substantial withdrawal of funds can often precede significant resistance or support levels.

Moreover, integrating on-chain metrics with traditional technical indicators allows investors to make more informed decisions regarding entry and exit points in their trading strategies. Thus, understanding the numbers behind Ethereum withdrawals not only sheds light on market sentiment but also equips investors with the analytical tools necessary to navigate the complexity of cryptocurrency trading.

Conclusion: Navigating Ethereum’s Evolution in the Cryptocurrency Space

As Ethereum continues to evolve within the cryptocurrency ecosystem, investor awareness of significant events like the recent withdrawal from Binance becomes imperative. These transactions reflect the inherent volatility in cryptocurrency markets, serving as crucial signals for decision-making. Observing these trends allows investors to adapt their strategies effectively while taking advantage of market movements driven by broader financial narratives.

Given ongoing innovations and developments surrounding Ethereum, adapting to these changes by keeping abreast of withdrawal patterns and trends is essential for any serious investor. The capacity to synthesize this information can provide a competitive advantage, enabling individuals to make more strategic and informed trading decisions amid a rapidly fluctuating market.

Frequently Asked Questions

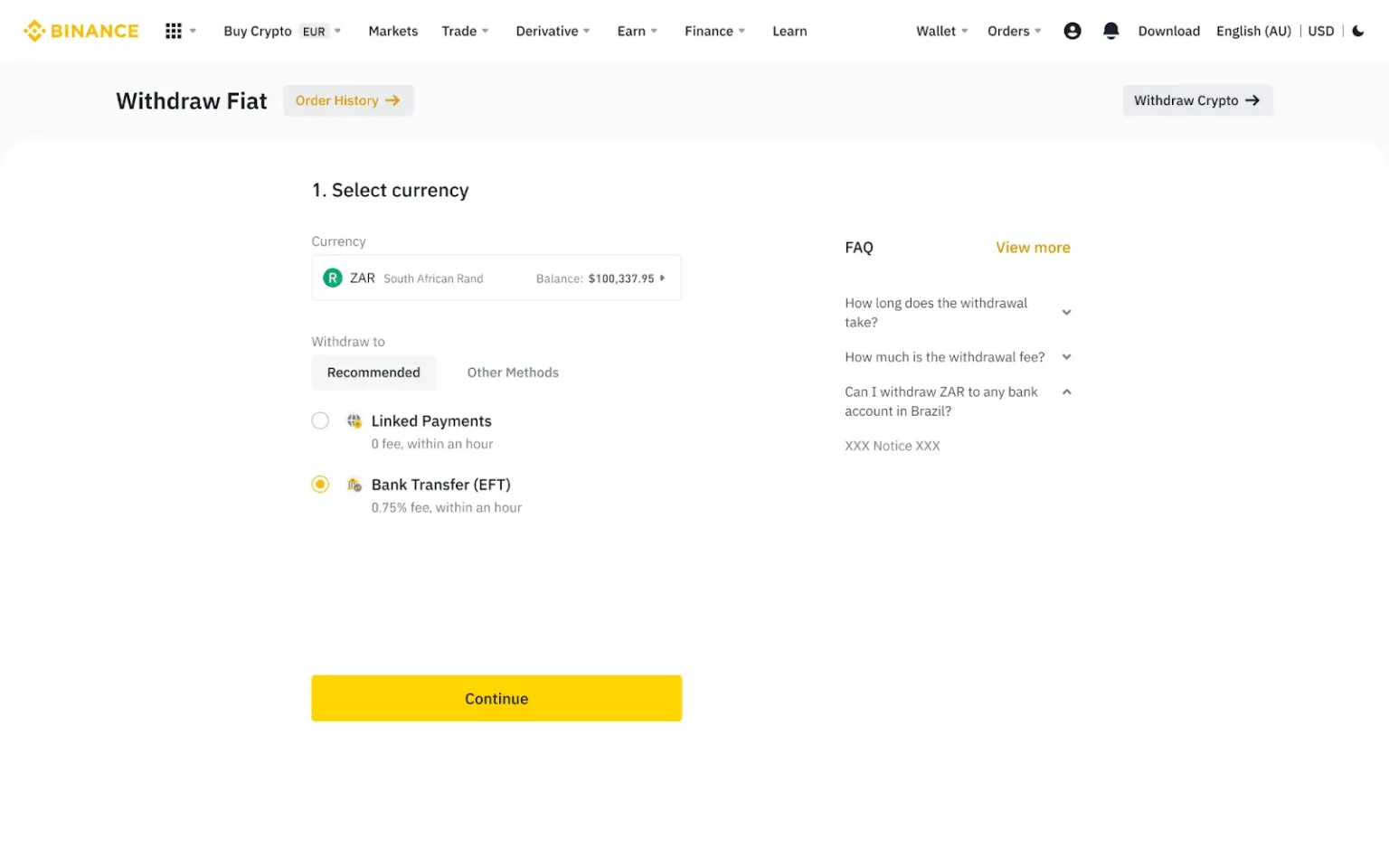

How can I perform an ETH withdrawal from Binance?

To withdraw ETH from Binance, log in to your account, go to the ‘Wallet’ section, select ‘Withdraw’, and then choose Ethereum (ETH) as your withdrawal currency. Enter the recipient’s address and the amount you wish to withdraw.

What does the recent Ethereum withdrawal from Binance signify?

The recent withdrawal of 56,291 ETH from Binance indicates significant market interest and could impact Ethereum market movements. Such large transfers often garner attention from on-chain analysts, hinting at possible shifts in cryptocurrency trends.

Are there any fees associated with ETH withdrawal from Binance?

Yes, there are fees for withdrawing ETH from Binance. The withdrawal fee varies depending on network conditions and Binance’s fee structure. Make sure to check the current fee before initiating your transaction.

What should I do if my ETH withdrawal from Binance is pending?

If your ETH withdrawal from Binance is pending, first check the transaction status on the Binance platform. Delays can occur due to network congestion. If it remains pending for too long, consider reaching out to Binance support for assistance.

What can on-chain analysis tell us about ETH withdrawals from exchanges like Binance?

On-chain analysis provides insights into ETH withdrawals from exchanges like Binance by tracking transaction volumes and wallet activity. It can help identify trends in cryptocurrency movements and predict potential market shifts.

Why did a newly created address withdraw 56,291 ETH from Binance?

The withdrawal of 56,291 ETH from a newly created address on Binance may indicate strategic accumulation or investment plans. This significant movement has drawn attention in the Ethereum news landscape due to its potential implications for market trends.

Can I track my ETH withdrawal from Binance on the blockchain?

Yes, you can track your ETH withdrawal from Binance on the blockchain using an Ethereum block explorer. Simply enter your transaction ID to see its status and details.

What are the risks involved with ETH withdrawal from Binance?

The primary risks involve potential network congestion leading to delays, as well as the possibility of sending ETH to the wrong address. Always double-check recipient addresses to avoid irreversible losses.

How do large ETH withdrawals from Binance affect market trends?

Large ETH withdrawals from Binance can create price volatility as they reflect increased accumulation or selling pressure. On-chain analysis often interprets these events as strong signals of investor sentiment in the Ethereum market.

What does the withdrawal of ETH from exchanges like Binance mean for investors?

The withdrawal of large amounts of ETH from exchanges like Binance often suggests that investors are moving assets to private wallets for long-term holding, which can indicate bullish sentiment in the Ethereum market.

| Key Point | Details |

|---|---|

| Total ETH Withdrawn | 56,291 ETH |

| Withdrawal Value | $160 million |

| Time Frame | Past 2 hours |

| Analyst | Yu Jin |

| Source of Information | On-chain monitoring |

| Market Reaction | Widespread attention |

Summary

ETH withdrawal from Binance has recently seen significant activity with a newly created address withdrawing 56,291 ETH worth approximately $160 million within just two hours. This large transaction, monitored by on-chain analyst Yu Jin, has caught the attention of market participants, highlighting the dynamic nature of cryptocurrency movements and the interest surrounding Ethereum withdrawals from platforms like Binance.

Related: More from Exchange News | Irans Crypto Shadow Economy Evades Sanctions in Crypto Exchange | BSP Proposes Stablecoin Yield Rules: Will It Impact Coinbase? in Crypto Exchange