In the dynamic world of cryptocurrency, ETH trading strategies have become essential for traders seeking to maximize their gains. With Ethereum’s increasing price volatility, savvy traders are leveraging various tactics to capitalize on market movements, whether through long positions or short selling. Recent market activities reveal that informed decisions can lead to significant trader profits, as exemplified by a notable trade that realized a $910,000 profit from closing a short position. Such crypto market insights serve as a reminder of the vital importance of having a clear strategy. As more traders flock to the Ethereum market, understanding these trading strategies can pave the way for successful investments.

When it comes to navigating the Ethereum landscape, grasping effective approaches to trading is crucial. Traders are constantly exploring diverse techniques ranging from bullish maneuvers to hedging against downturns, all aimed at enhancing their investment returns. The strategies employed, such as engaging in long position trading or considering short position opportunities, help traders adapt to the fluctuating nature of the digital asset market. With Ethereum’s growing influence and the accompanying surge in interest, understanding these trading methodologies not only fosters better decision-making but also opens up avenues for potential profitability in this ever-evolving sector.

Understanding Ethereum Trading Dynamics

The dynamic nature of the Ethereum trading landscape is critical for traders seeking to maximize their profits. Recent activity highlights an interesting case where a trader closed their ETH short position profitably, netting a staggering $910,000. This move reflects not just personal success but also important insights into market conditions. The trader’s timely action indicates an adept understanding of market fluctuations, which can lead to significant profits in a volatile environment.

Traders who stay attuned to the nuances of Ethereum trading are more likely to make informed decisions that result in lucrative outcomes. Recent reports indicate a rise in trader interest surrounding Ethereum due to its inherent volatility. Understanding these dynamics ensures that traders can act swiftly, locking in profits and effectively managing their risk exposure. In the crypto market, insights into trading strategies can provide a significant edge.

Effective ETH Trading Strategies for Profit Maximization

Implementing effective ETH trading strategies can be the difference between profit and loss in the bustling world of cryptocurrency. One promising approach is the long position strategy, which our featured trader recently embraced after closing their short position. By leveraging ETH’s price momentum, traders can amplify their potential gains, as seen in the trader’s choice to adopt a 2x long position. This strategy not only allows traders to benefit from price increases but also adds a layer of risk management if timed appropriately.

Moreover, the ability to transition from short to long positions demonstrates the flexibility required in today’s trader market. Long position strategy can be particularly beneficial in a bullish market environment where Ethereum is anticipated to gain traction. Coupled with a meticulous monitoring process, traders can capitalize on market dips and surges, thus driving their trader profits higher. Understanding these strategies equips traders with the understanding needed to tap into the complexities of Ethereum trading.

The Power of Market Insights in Crypto Trading

Market insights play a pivotal role in a trader’s decision-making process, particularly in the fast-paced world of crypto. For instance, the recent moves by the pension-usdt.eth trader exemplify the importance of real-time analysis in achieving substantial profits. The ability to interpret market signals and act accordingly can lead to the closure of short positions at the peak of price fluctuations, ensuring that profits are secured before any potential downturn.

In the constantly evolving landscape of Ethereum, leveraging crypto market insights can provide a competitive advantage. Traders who engage with these insights can better understand patterns and trends, allowing them to make more informed predictions. As Ethereum market dynamics continue to shift, those equipped with analytical tools and awareness of market movements stand to benefit significantly in their trading endeavors.

Leveraging Short and Long Positions Effectively

The strategic execution of short and long positions is fundamental in crypto trading, particularly for Ethereum. The successful closure of the ETH short position by the trader underlines a critical trading strategy that many can learn from. Recognizing when to close a position is just as crucial as knowing when to open one, and can result in considerable profits, as demonstrated by the trader’s timely transaction.

Transitioning into a long position, as this trader did following the closing of their short, illustrates a keen sense of timing and market prediction. By employing such strategies effectively, traders can not only safeguard their existing profits but also position themselves for future gains. As the landscape of Ethereum continues to fluctuate, the ability to fluidly navigate between these two types of positions stands as a hallmark of a seasoned trader.

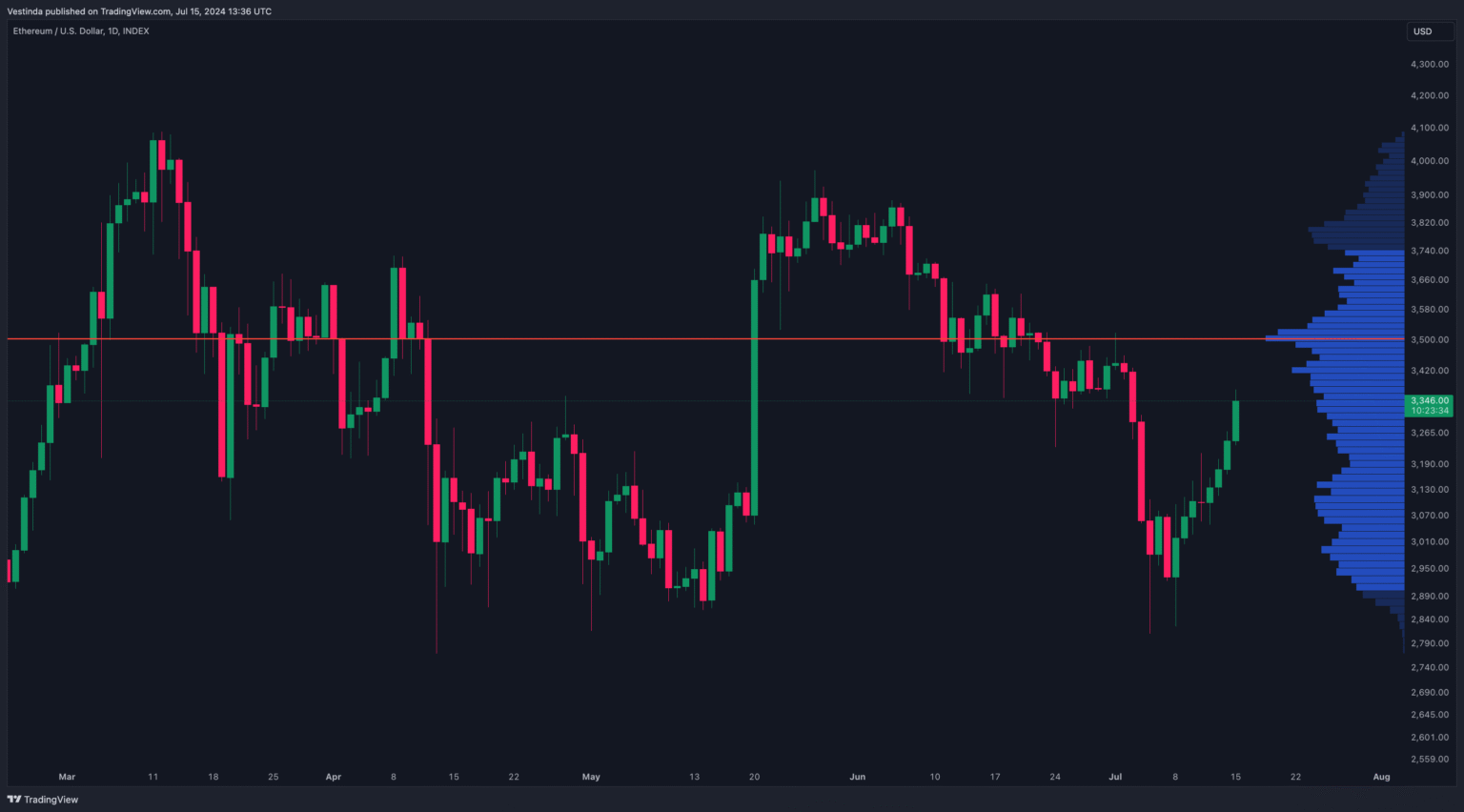

Analyzing Ethereum’s Market Volatility

Understanding Ethereum’s market volatility is crucial for any trader aiming for success in cryptocurrency trading. The recent actions taken by traders, characterized by significant profits from both short and long positions, highlight a pivotal feature of Ethereum—its price swings. These fluctuations create real opportunities for profit but also come with inherent risks that can lead to losses if not properly managed.

Market volatility in Ethereum is often influenced by broader market sentiments and specific events in the DeFi space, which can impact trader behavior. Analysts suggest that, as the Ethereum ecosystem expands, these volatile swings may intensify, presenting further opportunities to adept traders. By honing their skills to navigate such volatility, traders can unlock the potential for enhanced profitability while balancing the risks involved.

Institutional Influences on ETH Trading

The influence of institutional players on Ethereum trading cannot be overstated. As more institutional investments pour into the Ethereum market, the overall market sentiment changes, potentially leading to increased volatility and new trading strategies. The recent trends highlight how these entities are not only contributing to the financial growth of Ethereum but are also driving innovation within the DeFi sector.

As institutional interests grow, retail traders must adapt their strategies, often looking to align with or counter these moves. The established trader’s switch from a profitable short position to a long one reflects a broader trend of adapting strategies in response to institutional behaviors. Understanding how these influences impact market dynamics will be essential for traders looking to capitalize on Ethereum’s evolving landscape.

Risk Management in Ethereum Trading

Risk management remains a pivotal consideration in Ethereum trading. The reality of cryptocurrency markets, especially Ethereum’s, being highly volatile necessitates a comprehensive risk strategy. The ability of a trader to minimize risk while maximizing potential returns, as evidenced by the recent profit from a short position, showcases effective risk management in action.

Utilizing various trading tools and approaches, such as setting stop-loss orders and diversifying positions, can help traders maintain control over their investments. Moreover, by understanding specific market indicators and their implications, traders can make educated decisions about when to enter or exit trades. As Ethereum continues to present opportunities and challenges, robust risk management strategies are essential for sustainable trader profits.

The Future of Ethereum Trading

Looking ahead, the future of Ethereum trading appears promising yet complex. As the Ethereum ecosystem matures and more applications emerge, traders must stay informed about potential changes in market dynamics. Recent movements in the market suggest that traders are betting on Ethereum’s growth, evidenced by the successful transition from a short to a long position by a prominent trader.

Trends indicate a bullish outlook for Ethereum, especially as the market reacts to changes in the DeFi sector and institutional interest. Traders who are agile and willing to adapt based on current market insights will be well-positioned to harness the opportunities that lie ahead. With proper strategy implementation and an eye on the evolving landscape, trader profits in Ethereum could witness considerable growth in the near future.

Embracing Technology in ETH Trading

The adoption of technology in Ethereum trading has transformed how traders engage with the market. From sophisticated trading algorithms to advanced analytics platforms, technology provides traders with tools to enhance their decision-making capabilities. The use of high-tech strategies allows traders to execute highly responsive trades, capitalizing on minute-by-minute market movements that can lead to significant profits.

Moreover, the integration of technology facilitates greater access to market insights and trends, empowering traders to react swiftly to changes. As demonstrated by the trader closing their short Ethereum position for a substantial profit, technological advantages can make a significant impact on trading outcomes. As the crypto market continues to innovate, embracing these advancements will be crucial for traders looking to thrive.

Frequently Asked Questions

What are the most effective ETH trading strategies for maximizing trader profits?

Effective ETH trading strategies include both long and short position trading. A long position strategy allows traders to profit from rising prices, while short position trading can capitalize on decreasing values. Combining technical analysis with market insights, such as trends in Ethereum’s price volatility, can enhance trader profits significantly.

How can I employ a long position strategy in Ethereum trading?

To employ a long position strategy in Ethereum trading, traders should identify potential entry points where the price is expected to rise. Utilizing bold strategies like 2x leverage can amplify profits during upward trends, as demonstrated by traders who gained substantial profits after transitioning from short to long positions based on market movements.

What insights can enhance my Ethereum trading strategy?

Gaining crypto market insights requires analyzing Ethereum’s price patterns, monitoring market sentiment, and staying updated on news impacting the Ethereum blockchain. Tools such as on-chain analytics and trading signals can inform decisions, helping traders optimize their strategies for better outcomes.

When should I consider closing my ETH short position during trading?

Closing an ETH short position should be considered when market signals indicate a potential price rebound or when a trader has achieved a desired profit level. Successful traders often monitor fluctuations closely, as with the experienced trader who closed a short position for a $910,000 profit.

What factors influence the success of Ethereum trading strategies?

The success of Ethereum trading strategies can be influenced by market volatility, overall crypto market trends, trading volume, and institutional interest in DeFi. Staying responsive to these factors allows traders to adjust their strategies, whether employing long position strategies or short position trading approaches.

How does leverage impact Ethereum trading profits?

Using leverage, such as a 2x ETH long position, can significantly amplify profits in Ethereum trading. However, it also increases risk; thus, traders should use it judiciously and ensure they have a solid market understanding, as leveraged trades can lead to significant gains or losses.

What are the benefits of transitioning from short to long positions in ETH trading?

Transitioning from short to long positions in ETH trading allows traders to capitalize on perceived market rebounds, ensuring they can lock in profits from a successful short while positioning themselves to profit from future price increases. This strategy illustrates adaptability in response to market shifts.

What role does market insight play in Ethereum trading strategies?

Market insight is crucial in developing effective Ethereum trading strategies. By analyzing current trends and historical data, traders can make informed decisions that align with market conditions, maximizing their potential for profits and minimizing risks through timely trade executions.

| Key Points | Details |

|---|---|

| Closing the ETH short position | The trader successfully closed their short position to secure $910,000 in profit, demonstrating effective market analysis. |

| Opening a long position | The trader opened a 2x leveraged long position on 20,000 ETH, signaling positive future expectations for ETH prices. |

| Market Insights | This trading strategy highlights the trader’s ability to react swiftly to market changes and reflects the broader trading activity in the Ethereum landscape. |

| Future Trends | Analysts point toward the growth of Ethereum L1 and DeFi momentum as factors that could influence Ethereum’s market trends. |

Summary

ETH trading strategies are becoming increasingly vital for traders capitalizing on Ethereum’s price volatility. The recent successful trades, including the closing of a $910,000 short position followed by a substantial long position, signify not just individual trader success, but highlight the overall promising ecosystem surrounding Ethereum. As institutional interest continues to grow, understanding key trading dynamics and potential market trends will be essential for traders looking to maximize their investment returns in this rapidly evolving space.

Related: More from Market Analysis | Related Box Test | Crypto Worries Over Iranian Oil Supply: Is It Overhyped? in Crypto Market