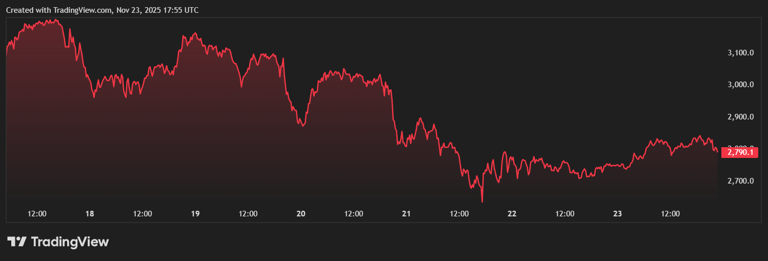

The recent ETH price drop has raised concerns among investors as it falls below 3100 USDT, currently resting at 3098.38 USDT. According to the latest Ethereum price update from OKX market data, this decline has resulted in a 24-hour downturn of 0.67%. Such fluctuations are not uncommon in the cryptocurrency market, where volatility often dictates investor behavior. As the ETH market news unfolds, traders are tuning in to understand the factors driving this cryptocurrency decline. Keeping abreast of these developments is crucial for those looking to navigate the ever-changing landscape of Ethereum USDT valuations.

In today’s ever-evolving digital currency scene, the recent downturn in Ethereum’s value, notably its slip below the 3100 USDT mark, highlights significant trends for traders and enthusiasts alike. The ETH market is buzzing with activity, as investors assess the implications of such price movements on their portfolios. As we delve into the latest updates, it’s evident that fluctuations like this are part of a broader pattern of market dynamics influencing the digital asset arena. Awareness of key market indicators can provide valuable insights into the ongoing challenges faced by Ethereum and similar cryptocurrencies. Engaging with real-time data and expert analyses will help investors make informed decisions in light of the current market conditions.

Understanding the Recent ETH Price Drop

The recent decline of Ethereum’s price, with ETH dropping below 3100 USDT, has raised eyebrows among investors and analysts alike. Current market data from OKX reveals that ETH is trading at approximately 3098.38 USDT, marking a 24H decline of 0.67%. This price movement is significant for traders and can impact positions taken in the broader cryptocurrency market. As Ethereum continues to face volatility, it’s crucial for investors to monitor price trends and market sentiment closely.

Market fluctuations are not uncommon in the cryptocurrency world, and the latest Ethereum price update serves as a reminder of the inherent risks involved. Investors should keep an eye on such developments as they often indicate shifts in demand or overall market conditions, which could potentially lead to further declines or corrections in the future. With ETH experiencing this price drop, it’s essential to analyze the contributing factors, including market news and trading volumes, to make informed decisions.

Impact of ETH Market News on Cryptocurrency Trading

The cryptocurrency market is heavily influenced by real-time news and updates, particularly significant developments in leading cryptocurrencies like Ethereum. As ETH drops below 3100 USDT, traders and investors are paying close attention to ETH market news for clues on potential recovery or a deeper decline. This atmosphere demands continuous vigilance as new information can alter market sentiment rapidly. Analysts suggest that understanding the underlying reasons for price shifts is essential for forecasting future movements in ETH and other cryptocurrencies.

Recent updates in market data show a growing concern among traders regarding Ethereum’s ability to rebound after this latest price decline. With a 0.67% drop within a 24-hour window, existing trends highlight the fragility of investor confidence in the current economic climate. As cryptocurrency prices remain susceptible to external factors including regulatory news and technological advancements, it’s vital for investors to stay informed about the broader implications of Ethereum’s market performance on their investment strategies.

Analyzing Ethereum’s Price Trends and Market Sentiment

The current state of the cryptocurrency market, highlighted by ETH’s plunge to below 3100 USDT, showcases a critical period for Ethereum price trends. Observing the patterns and behaviors of Ethereum traders can provide insights into market sentiment and potential future movements. As ETH’s value fluctuates, analysts emphasize the importance of examining both technical indicators and fundamental factors affecting Ethereum USDT pair, which can indicate shifting momentum in trading.

Understanding market sentiment amidst such price fluctuations can empower investors to make strategic decisions regarding their holdings in Ethereum and other cryptocurrencies. With the ongoing volatility, examining the factors driving ETH’s price changes is essential; including the performance of similar cryptocurrencies, fear or optimism among traders, and significant news from the Ethereum ecosystem. This comprehensive analysis will aid in navigating the complexities of cryptocurrency investments.

Economic Factors Driving Cryptocurrency Decline

The broader economic landscape plays a pivotal role in shaping the fortunes of cryptocurrencies like Ethereum. With ETH witnessing a potential downturn as it drops below the critical threshold of 3100 USDT, various economic indicators and global financial trends may contribute to this cryptocurrency decline. Factors such as inflation, interest rates, and shifts in investor confidence can heavily influence market dynamics, leading to increased volatility in cryptocurrency prices.

Investors should remain attentive to these economic factors as they can significantly impact trading behavior within the cryptocurrency realm. A decline in consumer spending or adverse global financial reports, for example, may result in reduced liquidity in the crypto markets, further triggering price drops for cryptocurrencies like Ethereum. By staying informed on these economic variables, traders can better navigate the complexities of the market and safeguard their investments.

Importance of OKX Market Data in Ethereum Trading

Access to reliable market data is crucial for traders looking to make informed decisions in the fast-moving cryptocurrency space. OKX’s market data reveals that Ethereum has recently fallen below 3100 USDT, providing timely insights for market participants. Accurate data tools not only reflect current prices but also offer valuable analytical metrics that can support trading strategies regarding Ethereum, ultimately aiding in better risk management.

The ability to track Ethereum’s performance through platforms like OKX allows traders to react swiftly to changing market conditions. With the price currently at 3098.38 USDT and a noted decline, having access to real-time data can help both novice and experienced traders adjust their strategies accordingly. This responsiveness to market conditions is critical in today’s highly competitive and volatile cryptocurrency environment.

Future Outlook for Ethereum Post-Decline

As ETH drops below 3100 USDT and registers a 24H decline of 0.67%, investors may wonder what the future holds for this leading cryptocurrency. The outlook for Ethereum largely depends on how it responds to this recent dip and whether it can reclaim its previous price levels. Analysts suggest that sustained monitoring of market dynamics, including regulatory changes, technological advancements, and overall market sentiment, will influence Ethereum’s recovery trajectory.

Moreover, the future performance of Ethereum could also hinge on macroeconomic factors and the behavior of larger market forces. As cryptocurrencies continue to gain traction among investors, ETH’s resilience in the face of downturns may become an essential factor in its long-term viability. Therefore, investors are encouraged to keep an eye on market indicators and news that could signal a potential turnaround for Ethereum in the coming weeks.

Comparative Analysis of ETH and Other Cryptocurrencies

In times of price volatility, comparing Ethereum’s performance to other leading cryptocurrencies can provide valuable context for investors. During the recent drop of ETH below 3100 USDT, it is insightful to examine how other major players in the market, such as Bitcoin, are performing. Such comparative analysis can reveal trends that indicate whether movements are specific to Ethereum or part of a broader market behavior affecting several digital assets.

Understanding these comparative dynamics is an essential component of developing a robust trading strategy. If Ethereum’s performance is diverging significantly from other cryptocurrencies during this decline, it might suggest unique challenges facing ETH, prompting investors to reevaluate their strategies. On the contrary, if market trends indicate a collective downturn, investors might adopt a more patient approach, anticipating recovery based on collective market resilience.

Investor Strategies in Light of ETH’s Price Movements

As Ethereum’s price hovers around 3098.38 USDT amidst a recent decline, it prompts investors to reassess their strategies moving forward. Utilizing tools like market analysis, sentiment tracking, and price alerts can help traders adapt to changes in ETH’s market behavior effectively. During periods of decline, prudent investors may consider diversifying their portfolios or employing risk management tactics, such as setting stop-loss orders to limit potential losses.

In addition to tactical adjustments, educational resources remain vital for navigating these turbulent waters in cryptocurrency trading. Investors should familiarize themselves with market trends, emerging technologies, and economic indicators influencing Ethereum’s fluctuations. By staying informed and employing a strategic approach, investors can position themselves to capitalize on potential rebounds as ETH seeks to recover from its recent downturn.

The Role of Technical Analysis in Cryptocurrency Trading

Technical analysis plays an important role in the trading strategy of cryptocurrencies like Ethereum. As ETH experiences a price drop below 3100 USDT, traders often turn to charts and indicators to predict future price movements based on historical data. Key indicators such as moving averages, RSI, and Fibonacci retracements help traders gauge market sentiment and identify potential entry or exit points.

In light of the recent decline, these technical tools can assist investors in making informed decisions about their ETH holdings. Recognizing support and resistance levels through technical analysis may provide traders an edge during volatile periods. Therefore, the proficiency in using these analysis techniques can significantly impact an investor’s trading success in the unpredictable cryptocurrency market.

Frequently Asked Questions

What caused the recent ETH price drop below 3100 USDT?

The recent ETH price drop below 3100 USDT can be attributed to various market pressures including investor sentiment, wider cryptocurrency decline, and uncertainty in the market. According to OKX market data, ETH is currently priced at 3098.38 USDT, reflecting a 24-hour decline of 0.67%.

How does the ETH price drop impact Ethereum investors?

The ETH price drop may cause concern among Ethereum investors, particularly those who are looking for short-term gains. The 24-hour decline of 0.67% noted in recent Ethereum price updates emphasizes the volatility of the cryptocurrency market.

What are the latest Ethereum price updates following the ETH price drop?

As per the latest Ethereum price updates, ETH has dropped below 3100 USDT and is currently trading at 3098.38 USDT. This decline is part of a larger trend observed within the cryptocurrency market, underscoring the need for cautious trading.

Where can I find the latest ETH market news?

For the latest ETH market news, sources like OKX market data and reputable cryptocurrency news websites are recommended. They provide real-time updates and analysis on Ethereum price changes, including the recent ETH price drop.

What should investors do during an ETH price drop?

During an ETH price drop, investors are advised to conduct thorough market research and consider their long-term strategy. Keeping an eye on Ethereum USDT price movements and relevant ETH market news can help inform their decisions amid the current market fluctuations.

What is contributing to the overall cryptocurrency decline affecting ETH prices?

The overall cryptocurrency decline affecting ETH prices can be influenced by factors such as regulatory news, market sentiment, and speculative trading. As noted, the recent ETH price drop to 3098.38 USDT highlights the volatility in this rapidly changing market.

| Key Points | Details |

|---|---|

| Current ETH Price | 3098.38 USDT |

| Price Drop | Below 3100 USDT |

| 24-Hour Decline | 0.67% |

| Date and Time | 2025-12-04 19:13 |

| Source | Odaily Planet Daily (AI-assisted) |

Summary

The recent ETH price drop below 3100 USDT highlights a concerning trend for investors and market watchers. As of December 4, 2025, Ethereum is priced at 3098.38 USDT, reflecting a 0.67% decline over the last 24 hours. This drop is significant, indicating a need for traders to closely monitor market movements and trends that may impact the future price of ETH.