| Metric | Value |

|---|---|

| Total Liquidation Across Network | $186 million |

| ETH Liquidations | $103 million |

| BTC Liquidations | $59.31 million |

| Liquidation in Long Positions | $174 million |

Summary

ETH liquidations reached a significant milestone recently, accounting for a substantial portion of the overall liquidation total. In a short span of time, a staggering $186 million was liquidated across the network, highlighting the volatility and risks associated with cryptocurrency trading. Investors and traders must remain vigilant as such liquidations can heavily impact market sentiment and price movements.

ETH liquidations have emerged as a significant factor in the volatile world of cryptocurrency trading, particularly highlighted by a recent surge amidst a notable ETH price drop. Within the past hour alone, a staggering $186 million was liquidated across the network, with ETH liquidations accounting for a substantial $103 million. This latest liquidation data sheds light on the ongoing challenges traders face in the crypto market. As the volatility continues, it’s crucial for investors to stay updated on these developments, including trends in BTC liquidations, to make informed decisions. Understanding the dynamics of crypto liquidations not only helps in predicting market movements but also plays a vital role in risk management strategies.

Recent events in the cryptocurrency landscape have brought attention to the impact of forced sales and margin calls, often resulting in significant losses across various crypto assets. Such occurrences, commonly referred to as margin liquidations, have created ripples in the trading community, especially as ETH and BTC liquidations have intensified. Within the last hour, the total value of liquidated positions soared, illustrating the dramatic shifts that can affect traders. Monitoring these liquidation trends is essential for grasping the broader crypto market update and navigating investment risks effectively. As traders respond to the unpredictable nature of the market, understanding the underlying factors driving these forced closures is imperative for future strategies.

Understanding ETH Liquidations and Their Impact on the Market

In the past hour, Ethereum (ETH) liquidations have surged dramatically, totaling $103 million out of a staggering $186 million liquidated across the entire crypto market. This significant level of ETH liquidations reflects a broader trend affecting long positions, contributing to the overall volatility within the cryptocurrency sector. Investors must understand that liquidations occur when leveraged trades are forcibly closed due to a drop in asset prices, leading to heightened market reactions and often causing further price drops.

As the crypto market experiences shifts, the impact of ETH liquidations can ripple through other assets, leading to a decline in market confidence and potential BTC liquidations as traders panic or react to falling prices. This phenomenon is especially notable when ETH prices drop sharply, resulting in liquidation data that shows increased activities in both short and long positions, affecting the broader trading environment. It is essential for traders to monitor these liquidation trends to make informed decisions and manage risks accordingly.

Analyzing Recent Crypto Market Updates

Recent data highlights a challenging environment for cryptocurrency traders as total liquidations across the network reached $186 million within a brief period. This includes not only ETH liquidations but also significant BTC liquidations, which totaled $59.31 million. Such market activity often signals underlying volatility and trader sentiment, revealing how quickly liquidations can escalate in response to market conditions.

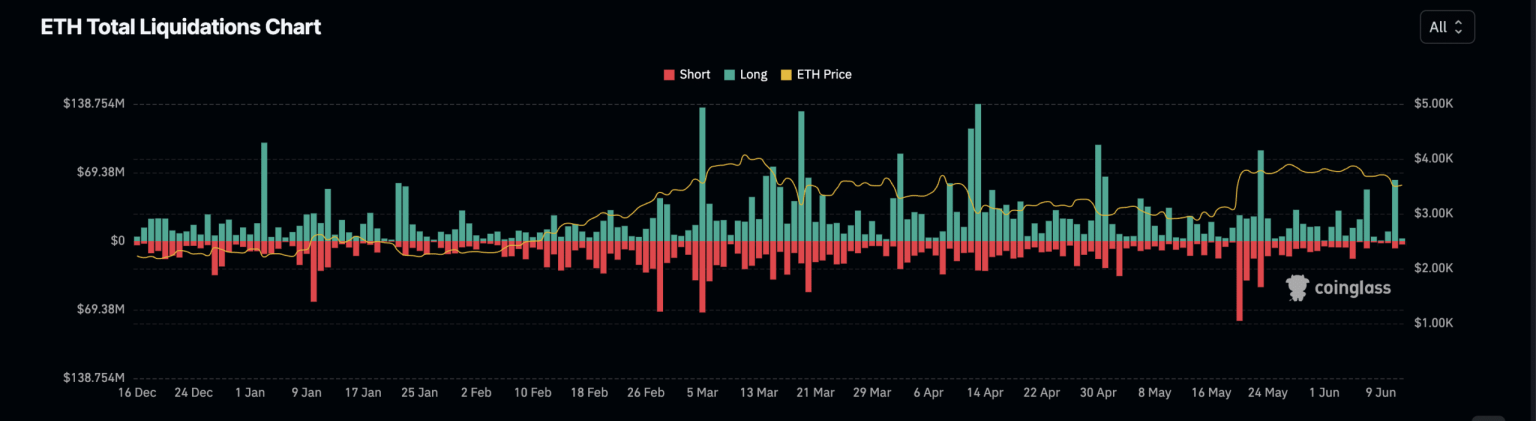

In the backdrop of these events, staying updated with regular crypto market updates becomes crucial for active traders. Liquidation data from platforms like Coinglass provide insights into current trends and potential areas of opportunity or risk. Investors must remain vigilant in these unpredictable times, recognizing how ETH and BTC price fluctuations can lead to substantial changes in overall market dynamics.

The Role of Liquidations in Crypto Volatility

Liquidations play a pivotal role in the overall volatility of the cryptocurrency market, often leading to dramatic price shifts that can affect trading strategies. The recent figure of $186 million liquidated within an hour highlights just how quickly leverage can amplify market movements, particularly in assets like Ethereum and Bitcoin. Indeed, ETH liquidations alone have reached $103 million, underscoring the importance of managing positions carefully to avoid forced closures.

Moreover, the correlation between liquidation events and ETH price drops cannot be overstated. Traders are frequently caught off-guard by sudden downward trends, leading to cascading liquidations that further depress prices. Understanding the dynamics of liquidations in crypto markets can help traders anticipate potential downturns and prepare strategies that mitigate risk, transforming potential losses into opportunities for recovery.

Key Factors Contributing to ETH Liquidations

Several key factors contribute to the high levels of ETH liquidations observed recently, including market sentiment, economic indicators, and sudden news events. Traders often react to negative news or broader market trends, causing a rush to liquidate positions before further losses occur. Such reactions can exacerbate existing volatility, leading to an environment ripe for liquidation events.

Additionally, with the growing prevalence of leverage in trading practices, many traders find themselves in precarious positions as prices fluctuate. With ETH liquidations reaching over $103 million, it becomes evident that traders must be aware of their risk exposure. Shifts in BTC prices and overarching trends in crypto liquidations can lead to unexpected movements, making it all the more crucial to stay informed on relevant market conditions.

Implications of Increased Liquidations on ETH and BTC

The recent spike in liquidations, particularly concerning ETH and BTC, has significant implications for traders and investors alike. With total liquidations exceeding $186 million recently, it raises questions about market stability and long-term price trajectories. The combination of significant ETH liquidations of $103 million and substantial BTC liquidations reflects a moment of uncertainty where market players must recalibrate their strategies to manage risk.

Understanding the implications of these liquidations also includes recognizing how they can create opportunities for new entrants or seasoned traders looking to capitalize on price recovery. Acknowledge that while liquidations signify short-term pain, they can also precede rebounds in market momentum. This duality of liquidations illustrates the complexity of trading in the crypto environment where rapid changes can lead to both challenge and opportunity.

Looking Ahead: Strategies Amidst Liquidation Events

As the cryptocurrency landscape continues to evolve, traders must develop robust strategies to navigate the potential for high liquidations. Observing the current trend of ETH liquidations, with $103 million recorded recently, traders should reassess their risk profiles and consider diversifying their positions. Strategies such as employing lower leverage or utilizing stop-loss orders can help cushion against sudden market volatility.

Furthermore, staying informed about ongoing crypto market updates and broader economic indicators can greatly enhance decision-making. Understanding when and why liquidations occur is crucial in formulating a proactive rather than reactive trading approach. As the crypto market remains unpredictable, adapting quickly to shifts in liquidation data will be essential for success.

The Future of Liquidation Trends in Crypto

Looking ahead, the trends surrounding ETH and BTC liquidations will likely remain a significant focus for traders. As seen from recent data, with ETH liquidations reaching $103 million, it becomes increasingly evident that market fluctuations can lead to rapid and large-scale positions being liquidated. This trend underscores the necessity for traders to remain vigilant and well-informed.

Moreover, as the cryptocurrency market matures, we may observe changes in how liquidations are perceived and managed. Newer technologies and platforms are being developed to provide better insights and precautions against liquidation risks. Keeping abreast of these developments, along with traditional liquidation data analysis, will be vital for traders aiming to thrive in a volatile market.

Navigating Market Volatility Through Liquidation Data

Navigating the complexities of market volatility often requires careful analysis of liquidation data, especially in times of significant shifts like those currently seen. With recent ETH liquidations totaling $103 million, traders can see a tangible representation of market sentiment and associated risk. Utilizing liquidation data can help inform trading decisions and enhance risk management strategies.

In periods of extreme volatility, understanding the nature of liquidations can provide valuable insights into market psychology and behavior. Analyzing past liquidation events alongside current ETH and BTC data allows traders to predict potential triggers and adopt preventive measures to protect their investments. Maintain a proactive stance by utilizing all available information to create an informed trading strategy.

The Interconnectedness of Crypto Markets and Liquidation Events

The interconnectedness of various cryptocurrencies is a fundamental aspect of trading dynamics and can significantly influence liquidation events. Last hour’s data shows that total liquidations reached a staggering $186 million, including both ETH and BTC, proving that movements in one asset often affect the others. Understanding this interrelationship is crucial for traders aiming to anticipate shifts in the market.

As price shifts reverberate across the crypto sphere, the cascading effects on ETH and BTC prices highlight the importance of a holistic approach to trading. Traders should consider the larger market ecosystem and assess how liquidations in one segment can impact another. Maintaining a broader perspective on market indicators will enable informed decisions when facing rapid changes, especially during volatile liquidation periods.

Frequently Asked Questions

What caused the recent ETH liquidations?

The recent ETH liquidations, totaling $103 million, were primarily driven by a significant price drop in the crypto market, leading to extensive liquidations of long positions. Market volatility and shifting sentiment can result in sharp declines in ETH prices, triggering liquidation events.

How do ETH liquidations impact the overall crypto market?

ETH liquidations can have a profound effect on the overall crypto market by increasing volatility, especially during substantial price drops. When ETH prices drop, it often leads to a cascading effect as many long positions are liquidated, further driving prices down and impacting other cryptocurrencies such as BTC.

Where can I find the latest liquidation data for ETH?

For the latest liquidation data on ETH, you can check platforms like Coinglass, which provide real-time updates on crypto liquidations. These platforms typically display detailed statistics on ETH liquidations, BTC liquidations, and overall market liquidations.

What is the current state of ETH liquidations in the context of the crypto market update?

In the latest crypto market update, ETH liquidations have reached $103 million within the past hour. This indicates a significant movement in the market, reflecting the broader influences of trader sentiment and market conditions that can lead to such large-scale liquidations.

How do ETH liquidations relate to BTC liquidations?

ETH liquidations are often parallel to BTC liquidations in the crypto market. In a recent incident, ETH liquidations were at $103 million, while BTC liquidations stood at $59.31 million. These figures suggest a trend in the market where large price movements in one leading cryptocurrency can influence liquidation events in others.

What impact do ETH price drops have on liquidations?

ETH price drops can lead to increased liquidations as margin calls are triggered for traders holding leveraged positions. A rapid decline in the ETH price can result in a wave of liquidations, like the recent $103 million in ETH liquidations, as traders are forced to exit positions to cover losses.

How often do crypto liquidations occur, particularly with ETH?

Crypto liquidations, particularly with ETH, can occur frequently, especially during periods of heightened volatility in the market. Events such as sudden ETH price drops can lead to significant liquidations, sometimes totaling millions of dollars in just a few hours, as seen with the recent $186 million liquidated across the network.

What should traders consider to avoid ETH liquidations?

To avoid ETH liquidations, traders should implement risk management strategies, such as setting stop-loss orders, maintaining lower leverage, and being mindful of market trends that could lead to significant price drops. Staying updated on crypto market dynamics and liquidation data can also help traders make informed decisions.