ETH lending whale liquidation is making headlines as one prominent trader faces a dire situation in the volatile landscape of cryptocurrency. Recent developments have shown this whale, who has mortgaged an impressive 23,800 ETH—valued at $48.56 million—currently teetering on the brink of a forced liquidation, with a precarious liquidation price of $1,800. The Ethereum price recently fell to approximately $2,000, placing the whale just $250 away from financial ruin. To mitigate the risks of further losses and prevent liquidation, the whale has proactively sold 238 ETH for 488,000 DAI to chip away at his mounting debt. As ETH liquidation news continues to unfold, experts and investors alike are watching closely, as this situation could have significant implications for Ethereum price predictions and highlight the ongoing crypto liquidation risks plaguing the market.

In the world of digital assets, the liquidation of substantial Ethereum holdings, often referred to as ETH lending whale liquidation, signals turbulent times ahead for investors. Powerful players in the crypto market, known as lending whales, are facing critical decisions as they operate under the looming threat of liquidation prices in a descending market. Recent reports reveal a particular whale struggling with a hefty debt, highlighting the balance between potential gains and the inherent risks associated with leveraged trading. As these significant actors navigate their financial landscapes, it raises essential discussions about the broader implications for Ethereum’s stability and future trajectory. The dynamics at play not only affect individual investors and lending practices but also potentially influence Ethereum price movements and investor sentiment across the crypto sphere.

| Key Point | Details |

|---|---|

| ETH Lending Whale’s Position | Close to liquidation line with 23,800 ETH mortgaged, worth $48.56 million. |

| Debt Status | Borrowed 35.27 million DAI against the mortgaged ETH. |

| Liquidation Price | Set at $1,800, with current ETH price around $2,000 – just $250 away from liquidation. |

| Recent Action taken by Whale | Sold 238 ETH for 488,000 DAI to repay part of the debt. |

| Future Implications | If ETH continues to decline, more ETH will need to be sold to avoid liquidation. |

Summary

ETH lending whale liquidation is a critical concern as a certain whale’s position approaches the liquidation threshold. With their mortgaged ETH positions significantly impacting the market, the potential need to sell further ETH could amplify price drops. Continuous monitoring and management of leveraged positions are vital to mitigate risks in the volatile crypto landscape.

Understanding ETH Lending Whale Liquidation Risks

The concept of lending whales in the Ethereum blockchain showcases individuals or entities holding significant amounts of ETH while using it as collateral for loans. This practice can be risky, especially when market volatility causes a steep decline in Ethereum’s price. A recent report highlights how a prominent ETH lending whale is dangerously close to hitting the liquidation line. With their position leveraged at a hefty 23,800 ETH, worth approximately $48.56 million, the potential for liquidation looms large if the price dips further. The current liquidation price of $1,800 puts this whale at a precarious distance from Ethereum’s recent valuation around $2,000.

As the price of Ethereum fluctuates, the risk of liquidation becomes increasingly pertinent. When the price approaches the specified liquidation price set by lending platforms, holders are compelled to take action—often selling off assets to repay debts and alleviate financial strain. In this specific case, the whale has begun to take measures by liquidating a portion of their holdings, selling 238 ETH for 488,000 DAI to manage their debt. Such actions underscore the broader implications of crypto liquidation risks that can negatively impact market stability, especially amidst heated trading environments.

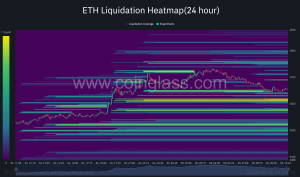

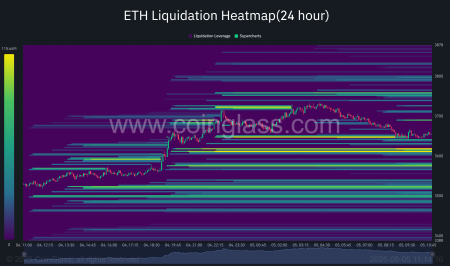

Market Impact of Whale Liquidations on Ethereum Prices

The liquidation of significant holders, such as ETH lending whales, can drastically influence the broader Ethereum market dynamics. When a whale is forced to liquidate part of their assets to prevent a total liquidation scenario, it contributes to an increased supply in the market. This sudden influx often results in a rapid drop in prices, creating a cascading effect that can extend far beyond the original whale’s holdings. Market observers keep a close watch on notable trends and news surrounding ETH liquidation, as these events often foreshadow larger market movements and can influence Ethereum price predictions.

Furthermore, the highlighting of the liquidation price set at $1,800 for this particular lending whale ignites conversations around the potential upcoming shifts in Ethereum’s pricing structure. Traders and investors alike commence active deliberations on whether Ethereum will stabilize above certain thresholds or face continuing downward pressure. As prices hover around critical liquidity levels, it becomes imperative for market participants to maintain vigilance against potential liquidation spikes that can disrupt their investment strategies and predictions for Ethereum’s future valuation.

Ethereum Price Predictions Amidst Liquidation Events

The recent liquidation events involving prominent ETH lending whales play a notable role in shaping Ethereum’s price predictions. Analysts utilize these occurrences to gauge market sentiment, employing them as indicators of potential future price actions. In the case of the aforementioned whale, the liquidation scenario reflects broader trends within the crypto ecosystem. Should Ethereum maintain pricing above $1,800, confidence may re-emerge among traders, potentially stabilizing sentiment and encouraging investments. However, continued volatility leading to further liquidations could provoke fear, prompting bearish price action.

In this transitional phase, Ethereum price predictions must account for both macroeconomic factors and internal market dynamics, including the behavior of major holders. Delta shifts, resulting from lucrative or forced sell-offs, can create unstable conditions with unpredictable outcomes. Having a keen understanding of how lending whale liquidations affect market psychology can help investors navigate turbulent waters while making informed decisions regarding their positions in Ethereum.

The Role of On-Chain Analysis in Detecting Liquidation Risks

On-chain analysis emerges as a crucial tool for understanding liquidation risks associated with ETH lending whales. By investigating transaction data directly on the Ethereum blockchain, analysts can uncover insights regarding the movements and strategies of large holders. For instance, Yu Jin’s observation of this specific lending whale’s precarious position illustrates how on-chain metrics can forewarn risks before they manifest into larger market events. Tracking the collateralized ETH amounts, current debt levels, and trends in the liquidation prices can empower investors to make informed decisions.

Moreover, the advancements in on-chain analytics offer real-time visibility into liquidation risks as they arise. Investors can leverage this data to predict potential crisis points, ensuring active risk management measures are in place. As platforms continue to evolve and expand their analytical capabilities, the crypto community gains more access to critical information. Consequently, being equipped with pertinent data transforms how market participants navigate volatility and reinforces their ability to respond to potential liquidation events preemptively.

Strategies to Mitigate Liquidation Risks for ETH Whales

For ETH lending whales, a strategic approach to mitigating liquidation risk is essential, especially in the current volatile market. Diversifying their collateralization strategy can be a prime strategy, whereby whales can allocate their ETH diversely across different platforms or use multiple forms of collateral. This approach reduces the risk that a drastic drop in ETH price affects their entire position. By carefully managing their margins and understanding their liquidation prices, whales can better navigate the potential downturns and avoid forced sell-offs.

Additionally, active trading strategies, such as setting automated stop-loss orders or regularly monitoring price changes, can enable these whales to limit exposure to sudden market downturns. As seen with the recent necessity for a whale to sell 238 ETH, timely responses to market signals are critical. Maintaining flexible positions and understanding market sentiment surrounding ETH can equip whales with a proactive stance that guards against liquidation scenarios effectively.

The Psychological Impact of Whale Liquidation on the Crypto Market

The psychological impact of whale liquidations transcends mere transactional dynamics; it influences investor behavior on a massive scale. Whales, holding considerable quantities of ETH, often symbolize strength within the market, and any signs of distress can send shockwaves throughout the trading community. When a whale’s position approaches liquidation, it triggers fear and skepticism among retail investors, exacerbating market volatility. This collective sentiment can lead to a mass sell-off, intensifying downward pressure on Ethereum prices.

Additionally, the concern surrounding liquidation risks fosters a cycle of anxiety as traders react to market fluctuations. As seen in the case of the lending whale near the liquidation price, community discussions surrounding ETH liquidation news can significantly sway market perceptions. Understanding the psychological nuances entwined with large-scale liquidations equips market players to better anticipate shifts in sentiment and maintain a level-headed approach amidst the chaos.

Risk Management Techniques for Crypto Investors

Risk management is paramount for any investor navigating the crypto space, particularly in the wake of liquidation events. Investors should adopt strategies that encompass both portfolio diversification and setting thresholds for exposure. Calculating the liquidation price of assets, especially for leveraged positions like those held by ETH lending whales, allows investors to establish safe exit points before crisis modes arise. This proactive approach ensures that holdings are managed effectively, minimizing potential losses.

Furthermore, employing analytical models tailored to the crypto market can enhance decision-making processes. Utilizing stop-loss orders or trailing stops can help protect profits while allowing for some flexibility in trading. By being aware of the liquidation pressures faced by entities holding substantial ETH, investors can formulate long-term strategies that prioritize sustainability while navigating the uncertainties endemic to the crypto trading environment.

Ethical Considerations in Whale Liquidation Scenarios

Ethical considerations in the realm of whale liquidations highlight the complexities entwined within the cryptocurrency ecosystem. The impact of major players on price stability often generates debate surrounding fairness and responsibility. As large holders engage in liquidation to manage risk, they can inadvertently catalyze broader market declines, affecting countless smaller investors. This raises questions about the ethical obligations of whales to maintain market stability and protect the interests of the community.

Moreover, as regulatory frameworks begin to take shape in the crypto landscape, stakeholders must navigate the balancing act between safeguarding personal investments and fostering a healthy market environment. The case of the ETH lending whale demonstrates the ripple effect of liquidation events, prompting renewed discussions on implementing equitable systems that consider the repercussions of significant players on the overall price behavior of cryptocurrencies. Ensuring that all market participants are regarded ethically would foster a more robust and resilient crypto economy.

The Future of Ethereum in Light of Liquidation Events

In light of recent liquidation events, the future trajectory of Ethereum is subject to scrutiny and speculation. As ETH lending whales navigate precarious positions, markets must adapt to the realities of heightened volatility and liquidity constraints. This ongoing situation highlights the necessity for developing infrastructure that can withstand fluctuations while promoting reliable trading practices. As technology in the blockchain space continues to evolve, the potential for improved mechanisms for liquidity management amidst liquidation scenarios arises.

Moreover, as Ethereum’s ecosystem matures, the relationship between whale activity and market stability will become increasingly crucial. Investors and developers alike must focus on creating solutions that mitigate the adverse effects of large-scale liquidations while enhancing transparency and trust in the system. Ultimately, the ongoing evolution will shape Ethereum’s position within the broader cryptocurrency market and signal its potential for longevity as a cornerstone asset.

Frequently Asked Questions

What is the current situation with the ETH lending whale’s liquidation risk?

The ETH lending whale’s position is nearing the liquidation line as the Ethereum price has dropped close to the liquidation price of $1,800, putting significant liquidation risks on the debt borrowed.

How does ETH liquidation news affect lending whales in the market?

ETH liquidation news raises awareness about potential liquidation risks, creating concerns among lending whales who may need to sell ETH to avoid liquidation losses.

What happens when the liquidation price of Ethereum is approached by lenders?

When the liquidation price of Ethereum is approached, lending whales may begin to sell portions of their ETH holdings to pay down debt, thereby mitigating liquidation risks.

What are the implications of recent Ethereum price predictions on lending whale ETH positions?

Recent Ethereum price predictions suggest volatility; if Ethereum prices continue to decline, lending whales may face heightened liquidation risks, prompting them to adjust their positions.

How does selling ETH by lending whales impact the overall market?

When lending whales sell ETH, as seen with the recent sale of 238 ETH, it may lead to increased selling pressure, impacting Ethereum’s price and contributing to crypto liquidation risks.

What strategies can ETH lending whales employ to avoid liquidation?

To avoid liquidation, ETH lending whales can reduce their leveraged positions by selling ETH to lower their liquidation price or by repaying debts in DAI to stabilize their positions.

How can understanding crypto liquidation risks help investors?

By understanding crypto liquidation risks, investors can better evaluate their exposure and make informed decisions, especially in volatile markets like Ethereum.

What is the relationship between ETH lending whale activities and liquidation patterns?

ETH lending whale activities often dictate liquidation patterns; as they approach liquidation prices, their market actions can influence Ethereum’s price volatility.

How critical is the liquidation price in lending whale strategies for Ethereum?

The liquidation price is critical in lending whale strategies as it determines the threshold at which collateral is sold, making proactive management crucial to avoid forced liquidation.

What recent actions have ETH lending whales taken in light of liquidation risks?

Recent actions include selling portions of their ETH holdings, such as the sale of 238 ETH for 488,000 DAI, to reduce debt and diminish the risk of hitting liquidation thresholds.