The recent ETH deposit MetaAlpha has caught the attention of crypto enthusiasts and analysts alike, as a staggering 3,500 ETH was transferred from the MetaAlpha wallet to Binance, valued at an impressive $10.39 million. This significant transaction showcases the active ETH wallet activity linked to MetaAlpha, which has consistently demonstrated its capacity for high-value transfers. In just three months, this particular wallet has engaged in numerous crypto deposits, contributing to a cumulative total of 20,050 ETH or approximately $66.66 million into Binance. Such Ethereum transactions highlight the thriving ecosystem of digital assets and the importance of secure wallets like MetaAlpha. The implications of these transfers are vast, potentially influencing market trends and investor decisions in an ever-evolving cryptocurrency landscape.

Recently, a notable Ethereum deposit has emerged from the MetaAlpha digital wallet, drawing interest within the cryptocurrency community. The transaction, consisting of 3,500 ETH, equivalent to over $10 million, was executed from MetaAlpha to the Binance exchange, signaling increased engagement in crypto transfer activities. This development underlines the wallet’s pivotal role in the broader crypto market, as it has transacted a remarkable 20,050 ETH in the last quarter alone. Such high volumes in ETH wallet operations not only affect trading dynamics but also highlight the ongoing surge in demand for secure and efficient crypto deposit solutions. As transactions like these unfold, they continue to shape the landscape for Ethereum enthusiasts and investors.

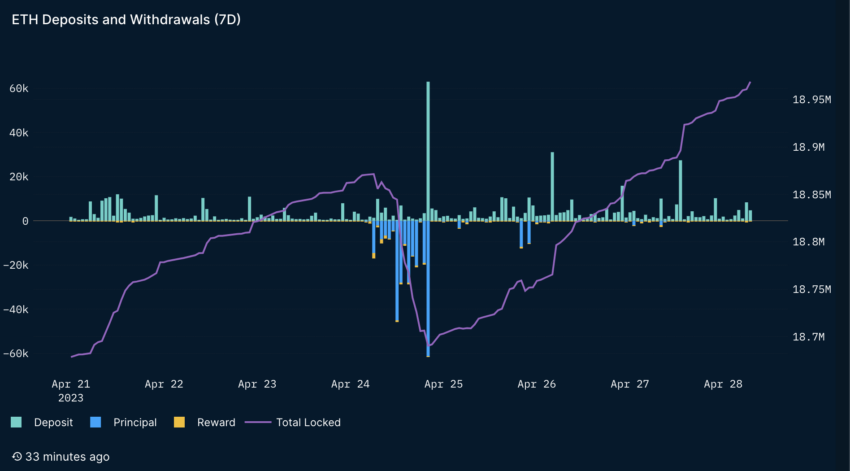

Recent ETH Transactions from the MetaAlpha Wallet

The recent transfer of 3,500 ETH from the MetaAlpha wallet to Binance has caught the attention of cryptocurrency enthusiasts and investors alike. Valued at approximately $10.39 million, this transaction highlights the increasing activity and importance of the MetaAlpha wallet in the crypto ecosystem. With the ongoing rise of decentralized finance (DeFi), transfers such as these shape the market dynamics, encouraging other users to explore their own ETH wallet activity.

Monitoring tools like The Data Nerd provide valuable insights into such transactions, allowing investors to track significant movements in the Ethereum network. Over the past three months, the MetaAlpha wallet demonstrates a strong presence in the market with a total of 20,050 ETH deposits to Binance, equivalent to about $66.66 million. This trend suggests that the MetaAlpha wallet is becoming a key player in Ethereum transactions, highlighting the need for effective tracking and analysis tools in the burgeoning crypto landscape.

Understanding ETH Deposits and Transfers

Depositing ETH into exchanges like Binance is a common practice among crypto traders and investors. Such transfers allow individuals and institutions to leverage the volatility of Ethereum for trading profit or to manage their investment strategies effectively. The recent deposit from the MetaAlpha wallet emphasizes the ease of making a Binance ETH transfer, which incorporates both security and speed—critical factors for users in the fast-paced crypto world.

With the rise of digital currencies, understanding the mechanics surrounding crypto deposits becomes vital. Each Ethereum transaction impacts market liquidity and can influence the overall price movement. The MetaAlpha wallet’s consistent activity in depositing ETH into Binance suggests a strategy that aims to capitalize on market fluctuations, hence reinforcing the necessity for crypto enthusiasts to stay informed about wallet activities and trends.

The Role of Monitoring Tools in Crypto Transactions

Tools like The Data Nerd play a significant role in monitoring crypto transactions, providing insights that traders can leverage to make informed decisions. By tracking movements from prominent wallets such as MetaAlpha, users can gauge market sentiment and the flow of assets, particularly in the context of trading on platforms like Binance. This kind of monitoring helps demystify the behaviors of large holders or whales in the cryptocurrency market, influencing strategies for both individual and institutional investors.

Utilizing monitoring tools enhances the understanding of ETH wallet activity and the broader implications of significant transactions. For example, the deposit of 3,500 ETH from MetaAlpha not only reflects the wallet’s investment strategy but also serves as a signal for traders to assess market conditions. By analyzing such data, stakeholders can better predict trends and adjust their own strategies accordingly, ultimately contributing to a more dynamic and informed cryptocurrency marketplace.

Analyzing the Impact of Significant ETH Deposits

Significant deposits, like the recent transfer of 3,500 ETH from the MetaAlpha wallet, can have both immediate and long-term impacts on the Ethereum market. Traders often react to these large movements by adjusting their buy and sell orders, resulting in fluctuating prices on exchanges. When a considerable amount of ETH is deposited into Binance, it could indicate that the depositor is preparing to capitalize on expected price changes or liquidity opportunities.

Moreover, tracking these large deposits adds to the overall understanding of market psychology among traders. If the market perceives the MetaAlpha wallet’s activity as bullish, it might encourage more investors to enter the fray, driving prices up and enhancing trading volumes. Conversely, if such deposits are interpreted as signs of potential sell-offs, it could lead to panic selling. Hence, analyzing these trends becomes essential for anyone involved in Ethereum transactions.

Security Considerations for ETH Deposits

While facilitating ETH deposits is crucial for trading, the security surrounding these transactions is paramount. Users should be aware of the security measures necessary to protect their funds, especially when utilizing wallets like MetaAlpha for transfers to exchanges such as Binance. Adopting best practices—such as enabling two-factor authentication and using strong passwords—can help protect against potential vulnerabilities that could impact crypto deposit safety.

Additionally, understanding the protocols involved in an Ethereum transaction can provide further security insights. Users should remain vigilant about the network’s status and any emerging threats that could compromise their ETH wallet activity. Continuous education on the best practices for securing digital assets is essential for sustaining investor confidence and ensuring a safe trading environment.

Understanding Ethereum Wallets and Their Functions

Ethereum wallets, like MetaAlpha, serve as essential tools for storing and managing digital assets. They provide users with the capability to conduct transactions, track their ETH balance, and interact with decentralized applications (dApps). Wallets not only facilitate secure transactions but also enable users to engage with the broader Ethereum ecosystem, making them integral to the overall functioning of the cryptocurrency market.

Moreover, the choice of wallet can affect how effectively users can perform ETH transfers. Some wallets are optimized for trading on exchanges such as Binance, while others may be better suited for long-term storage. Understanding the functions and features of different types of Ethereum wallets can empower users to make informed decisions that align with their trading objectives and investment strategies.

The Future of ETH Activity with MetaAlpha

As the digital currency market continues to evolve, the role of wallets like MetaAlpha in ETH activity will likely grow. The recent transfer trends not only showcase the potential of such wallets but also indicate the future of crypto trading practices. Analysts predict that as more users begin to grasp the importance of monitoring wallet activities, the demand for enhanced tracking tools will rise, potentially leading to a more informed investing environment.

The ongoing developments in blockchain technology and the expansion of secure trading avenues present exciting opportunities for ETH transactions. As MetaAlpha continues to facilitate significant deposits and transfers, it will remain a focal point for discussions surrounding innovations in Ethereum trading and investment strategies. This evolution could redefine how users interact with their crypto assets, promoting a more engaged and knowledgeable trading community.

Concluding Thoughts on ETH Transactions and Wallet Dynamics

In conclusion, the dynamics surrounding ETH transactions, particularly from significant wallets like MetaAlpha, highlight the intricate relationship between wallet activity and market behavior. Traders must remain vigilant and informed about these transactions to successfully navigate the complexities of the cryptocurrency landscape. This understanding will contribute to a more strategic approach to maximizing the potential of ETH trading.

As more investors embrace the power of tools for monitoring crypto deposits and transactions, the overall health of the Ethereum ecosystem is likely to improve. By evaluating deposit trends and analyzing the movements of large wallets, users can better predict market fluctuations, positioning themselves for success in the dynamic world of cryptocurrency trading.

Frequently Asked Questions

What is the recent ETH deposit from the MetaAlpha wallet to Binance?

The recent ETH deposit from the MetaAlpha wallet to Binance involved a transfer of 3,500 ETH, valued at approximately $10.39 million. This transaction was noted by The Data Nerd just an hour ago.

How much ETH has the MetaAlpha wallet deposited into Binance recently?

In the past three months, the MetaAlpha wallet has deposited a total of 20,050 ETH into Binance, which is equivalent to around $66.66 million.

What does the ETH wallet activity of MetaAlpha indicate about its trading operations?

The significant ETH wallet activity from MetaAlpha suggests active trading operations, including recent large deposits to Binance, which may indicate their strategy in the crypto market.

How can I safely transfer ETH from my MetaAlpha wallet?

To safely transfer ETH from your MetaAlpha wallet, ensure that you are sending it to a verified Binance ETH transfer address, double-check transaction details, and monitor the Ethereum transaction status once initiated.

What are the potential risks of depositing ETH into exchanges like Binance?

Depositing ETH into exchanges such as Binance carries risks including potential withdrawal delays, security issues, and market volatility. Always ensure that your ETH wallet is secure before initiating any crypto deposit.

Can I track my ETH wallet activity after depositing to Binance?

Yes, you can track your ETH wallet activity through blockchain explorers by entering your MetaAlpha wallet address. This will allow you to monitor all Ethereum transactions, including those sent to Binance.

Why should I consider using the MetaAlpha wallet for my ETH deposits?

The MetaAlpha wallet is designed to facilitate smooth ETH deposits and transactions, offering enhanced security features and compatibility with various exchanges like Binance, making it a reliable option for crypto users.

What are the benefits of using Binance for ETH deposits?

Using Binance for ETH deposits offers benefits such as competitive trading fees, a wide range of trading pairs, and robust security measures, making it one of the preferred platforms for Ethereum transactions.

| Key Points |

|---|

| Suspected deposit of 3,500 ETH from MetaAlpha wallet to Binance, valued at $10.39 million |

| The transaction was monitored by The Data Nerd and occurred on December 29, 2025 at 12:08 PM. |

| In the last three months, the MetaAlpha wallet has deposited a total of 20,050 ETH into Binance. |

| The overall value of these deposits amounts to $66.66 million. |

Summary

ETH deposit MetaAlpha saw a significant transfer of 3,500 ETH to Binance, showcasing the wallet’s active trading strategies. This transaction highlights the growing trend of cryptocurrency liquidity flowing into exchanges, where the MetaAlpha wallet has contributed an impressive total of 20,050 ETH over the last three months. As concern and interest in crypto investments continue to rise, monitoring such movements like the ETH deposit MetaAlpha helps investors stay informed about market trends.