Understanding the dynamics of ERC-20 stablecoin supply is crucial for grasping the current trends in the cryptocurrency market. At an astounding record of $185 billion, the robust supply of ERC-20 stablecoins is perceived as a pivotal indicator of bull market signals. Recent analysis by CryptoQuant reveals that even amidst market fluctuations, the stablecoin growth remains resilient, showcasing a stable inflow of capital into digital assets. With Ethereum stablecoins leading the charge, this surge in supply is more indicative of wider market trends than traditional metrics, such as the global money supply. Therefore, tracking ERC-20 stablecoin supply offers invaluable insights into impending shifts in cryptocurrency market trends, potentially forecasting the next wave of market excitement for investors and traders alike.

Exploring the realm of Ethereum-based stablecoins unveils a fascinating perspective on digital currency dynamics. The abundance of these assets, identified as ERC-20 stablecoins, signifies a growing confidence among market participants, underpinning forecasts for significant bullish activity. Analysts, including those from CryptoQuant, have highlighted how this specific type of cryptocurrency plays a critical role in enhancing market liquidity and stability. With a notable escalation in reserves, particularly on major exchanges like Binance, the implications for price movements and market sentiment become evident. By examining these developments, one can better understand the interplay between stablecoin supply and overall crypto investment strategies.

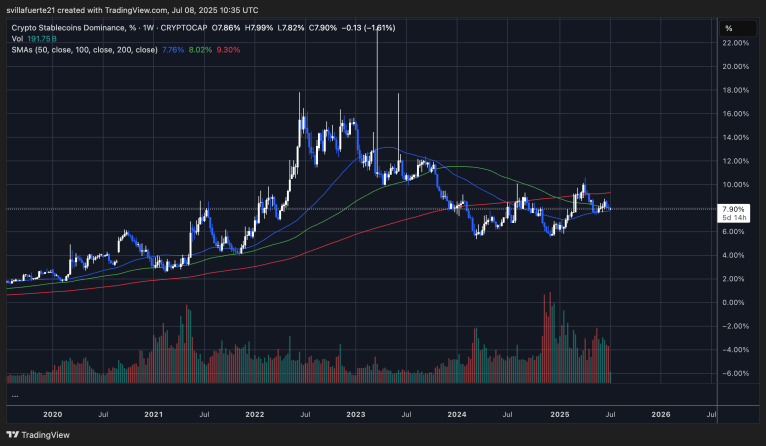

The Significance of ERC-20 Stablecoin Supply in Market Trends

The ERC-20 stablecoin supply plays a critical role in analyzing cryptocurrency market trends, as its continued growth often indicates investor confidence and increased market participation. Currently reaching a record high of $185 billion, this stablecoin supply serves as a barometer for the overall health of the crypto ecosystem. As traditional financial metrics like M2 aggregates don’t correlate as well with the highly volatile cryptocurrency sector, stablecoins have emerged as a more reliable gauge of market activity and capital flow. This strengthens the argument that as the ERC-20 supply grows, it could signal impending bullish movements in the market, setting the stage for robust bull market signals.

Moreover, the consistency in the supply of ERC-20 stablecoins, as highlighted in recent CryptoQuant analyses, suggests that the influx of capital towards these assets reflects a more stable and reliable investment behavior among traders. This is particularly true in contrast to the more erratic price movements of cryptocurrencies like Bitcoin and Ethereum. As traders increasingly convert their gains into stablecoins to manage risk, this stable asset class provides a cushion against market volatility, indicating that traders might be anticipating future price corrections or stability before re-entering the market. This accumulation of ERC-20 stablecoins, especially during market dips, hints at a strategic preparation for potential upward surges.

Bull Market Signals and Cryptocurrency Trends

The recent trends in the cryptocurrency market reveal several bull market signals that investors and analysts are closely monitoring. Despite a temporary decline in the prices of key assets such as Bitcoin and Ethereum, the buoyancy of ERC-20 stablecoin supply indicates underlying strength in investor sentiment. As stablecoins offer liquidity and a safe harbor during volatility, their increasing availability serves as a bullish indicator of upcoming market movements. Such trends are consistent with historical patterns where stablecoin growth precedes significant rallies in major cryptocurrencies, reinforcing the idea that traders are positioning themselves for future profits.

In addition to stablecoin supply growth, market sentiment driven by positive news cycles, regulatory advancements, and technological innovations also contributes to bullish trends. As the crypto community rallies around Ethereum advancements and new applications of blockchain technology, investor confidence is further reinforced. These factors, combined with an increase in stablecoin reserves, suggest a potent mix that could propel the market into a new bull phase. Keeping an eye on these developments, alongside ongoing analysis from platforms like CryptoQuant, is essential for any investor looking to navigate the complexities of the cryptocurrency landscape effectively.

Understanding Stablecoin Growth Dynamics

Stablecoin growth dynamics reveal much about the broader cryptocurrency market. With the ERC-20 stablecoin supply soaring to unprecedented levels, it signifies not only the growing adoption of these tokens but also highlights a shift in how investors manage their portfolios amidst volatility. Traditionally viewed as a safe haven, stablecoins are now integral to many trading strategies, allowing users to quickly enter and exit positions without converting back to fiat currencies. This growth in stablecoin supply is indicative of a more mature market, where participants are seeking ways to maintain liquidity while optimizing their risk-adjusted returns.

Moreover, the continuous growth of ERC-20 stablecoins aligns with the increasing use of decentralized finance (DeFi) platforms that leverage these stable assets for lending and trading. This dynamic growth leads to a more interconnected ecosystem where stablecoins are utilized not just for trading, but also as collateral for borrowing or yielding rewards in decentralized protocols. Therefore, stablecoin growth is pivotal for understanding market liquidity and capital flow, suggesting an evolution in user behavior that could further stimulate investment and innovation within the cryptocurrency space.

Ethereum Stablecoins: A Growing Economy

Ethereum stablecoins represent one of the fastest-growing segments in the cryptocurrency landscape, driven by the robust ERC-20 token standard that supports these assets. With the Ethereum network’s smart contract capabilities, stablecoins can be seamlessly integrated into various applications, enhancing usability and interactions across DeFi platforms. This growing economy based on Ethereum stablecoins not only increases their circulation but also highlights their critical role in fostering innovation within the ecosystem. As more users adopt Ethereum-based stablecoins, the implications for market liquidity, transaction volume, and overall network utilization are profound.

Furthermore, Ethereum stablecoins are increasingly being utilized in cross-border transactions, remittances, and everyday purchases, enhancing their practical utility. This shift is a testament to the evolving nature of digital currencies as they seek to fulfill roles traditionally held by fiat currencies. The heightened interest in Ethereum stablecoins can also be linked to broader trends in cryptocurrency acceptance by merchants and service providers, indicating a burgeoning infrastructure that supports their use. As cryptocurrency market trends evolve, the influence of Ethereum stablecoins will likely continue to grow, shaping the future of finance and the global economic landscape.

CryptoQuant Analysis on ERC-20 Stablecoins

Analyzing the latest insights from CryptoQuant provides valuable perspective on the state of the ERC-20 stablecoin market. Their research shows that the stablecoin supply remains resilient even in the face of broader market downturns, suggesting that investors are adopting a cautious approach amid volatility. This analysis indicates that traders are not simply holding assets; they are strategically reallocating capital into stablecoins, forming a buffer against potential losses and preparing for future market re-entries. Such behavior indicates a calculated response to market signals, where capital preservation strategies become paramount.

In addition, CryptoQuant’s emphasis on comparing stablecoin reserves against volatile assets helps underscore the narrative of stability versus speculation in the crypto sphere. Recent data revealing increased stablecoin reserves on exchanges like Binance further supports the idea that traders are anticipating future market movements, illustrating a proactive rather than reactive trading strategy. This accumulation hints at a mature investment landscape, where traders rely on analysis, data, and historical trends to plot their next moves in this dynamic environment. Therefore, the ongoing scrutiny from analytics platforms like CryptoQuant will be crucial in guiding trader behavior and predicting evolving market trends.

Frequently Asked Questions

What does the ERC-20 stablecoin supply indicate about cryptocurrency market trends?

The ERC-20 stablecoin supply is a crucial indicator of cryptocurrency market trends. A historic high supply, currently at $185 billion, signals bullish sentiment, as it reflects increased capital flowing into the crypto ecosystem. This stability in stablecoin supply, especially during market fluctuations, suggests that investors are preparing for potential growth phases.

How does the growth of ERC-20 stablecoins influence bull market signals?

The growth of ERC-20 stablecoins is seen as a positive bull market signal. With the supply reaching a record $185 billion, it indicates that traders are accumulating stablecoins as a buffer against market volatility, positioning themselves for future price increases. This trend often prefaces a resurgence in cryptocurrency prices.

How can CryptoQuant’s analysis of ERC-20 stablecoin supply impact investor strategies?

CryptoQuant’s analysis reveals that the ERC-20 stablecoin supply consistently correlates with capital inflows into the cryptocurrency market, making it a valuable tool for investors. By monitoring these supply levels, investors can gauge overall market health and adjust their strategies to capitalize on potential growth driven by increasing stablecoin liquidity.

Why is ERC-20 stablecoin supply considered more reliable than the global M2 money supply?

The ERC-20 stablecoin supply is viewed as a more reliable metric than the global M2 money supply because it directly reflects the liquidity available within the cryptocurrency market. Unlike traditional monetary indicators, stablecoin supply offers real-time insights into investor sentiment and the potential for capital movement, especially during key market phases.

What role do Ethereum stablecoins play in the overall growth of the cryptocurrency market?

Ethereum stablecoins play a significant role in the growth of the cryptocurrency market by providing a stable medium of exchange and value storage. The current ERC-20 stablecoin supply at $185 billion facilitates transactions and the movement of capital, which is critical for supporting market expansion and attracting new investors.

How do traders utilize ERC-20 stablecoins during times of market correction?

During market corrections, traders often convert volatile assets into ERC-20 stablecoins to preserve value. The substantial supply of stablecoins, noted to be around $185 billion, enables them to hold liquidity (‘dry powder’) while waiting for favorable market conditions to reinvest, fostering strategic trading decisions during uncertain times.

| Aspect | Details |

|---|---|

| ERC-20 Stablecoin Supply | Remains at a record high of $185 billion. |

| Market Signal | Considered a bullish signal for the growth of the cryptocurrency market. |

| Comparative Metric | Stablecoin supply is a better metric than global M2 for measuring industry performance. |

| Reserves Behavior | Binance’s stablecoin reserves surged, while Bitcoin and ETH reserves declined. |

| Investor Sentiment | Traders are holding substantial stablecoin reserves for potential market opportunities. |

Summary

ERC-20 stablecoin supply is experiencing a significant bullish trend. With the supply reaching an outstanding $185 billion, it provides insight into the growing capital flow into the cryptocurrency ecosystem. This consistent growth in stablecoin supply not only contrasts with volatile prices seen in Bitcoin but is also indicative of investor sentiment, as many traders are waiting for the right market conditions to re-enter after taking profits. Overall, the high levels of ERC-20 stablecoin supply suggest a vibrant and resilient crypto market, poised for potential future growth.