BTC-DXY Correlation Turns Critical as Dollar Strengthens Again

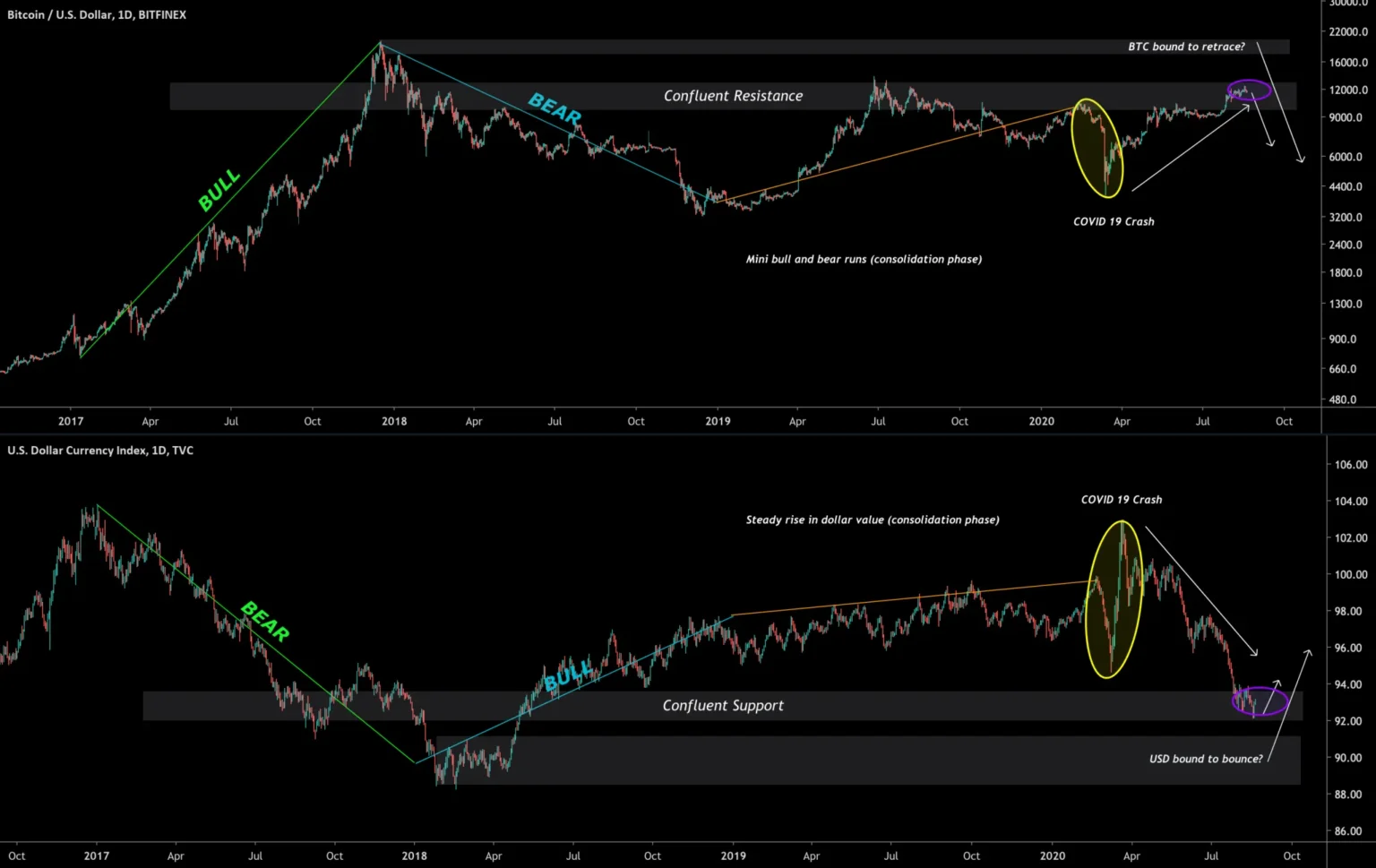

In the complex world of financial markets, the correlation between different asset classes can provide essential insights for investors. One of the most intriguing correlations that traders have been observing in recent years is that between Bitcoin (BTC) and the U.S. Dollar Index (DXY), which has entered a critical phase as the dollar strengthens once more.

Understanding the DXY

The U.S. Dollar Index measures the strength of the dollar against a basket of major currencies, including the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). A rising DXY usually indicates that the dollar is strengthening compared to these currencies, often reflecting a shift in international investor sentiment towards safety, typically at the expense of riskier assets including equities and crypto-currencies like Bitcoin.

The Changing Correlation

Historically, the correlation between BTC and DXY has been somewhat inconsistent, fluctuating between positive and negative states. In times of global uncertainty, such as during the onset of the coronavirus pandemic, both Bitcoin and the U.S. dollar saw gains, as both are considered ‘safe haven’ assets by different investor segments. Generally, however, the traditional view sees a strong dollar correlating negatively with Bitcoin and other commodity classes. This is because a stronger dollar makes these assets more expensive for holders of other currencies, potentially reducing demand.

Recently, this dynamic has evidenced significant strain as the DXY’s value has started to rise sharply once again. Several factors contribute to this resurgence, such as higher interest rate expectations from the Federal Reserve to combat inflation, which is at a multi-decade high. This has different implications for assets globally, including Bitcoin.

BTC and its Reaction to a Strong Dollar

Bitcoin, which has often been referred to as “digital gold” due to its proposed properties as a store of value, tends to react sensitively to changes in monetary policy and macroeconomic indicators just like traditional safe-havens. The recent increase in the DXY has been accompanied by a noticeable drop in BTC prices, reviving discussions about the inverse correlation between the two.

However, the BTC-DXY correlation is not purely inverse. Both assets can also move in tandem, driven by broader macroeconomic shifts. For example, during sharp market uncertainties, like those witnessed in March 2020, assets across the board can gain as investors flock towards safety.

Market Implications

As the dollar strengthens, investors in Bitcoin and comparable assets should brace for potential volatility. Bitcoin’s response to a rising DXY could include price corrections, as traders potentially pull out of Bitcoin to redirect funds into dollar holdings and other less volatile assets.

However, the broader adoption of Bitcoin by institutional investors could also buffer significant downturns, given that Bitcoin is increasingly seen not just as an alternative investment, but as a genuine component of diversified investment portfolios. This institutional pull might help stabilize Bitcoin’s price, preventing drastic declines even in the face of a soaring dollar.

Looking Ahead

Investors need to monitor a range of factors that could influence the BTC-DXY correlation further, such as fiscal policies, geopolitical tensions, and shifts in the economic landscape post-pandemic recovery. The complexity of global markets ensures that no single rule holds unconditionally. Financial diversification remains a fundamental principle for risk management, and understanding how asset correlations evolve can provide a crucial edge in navigating the investment landscape.

As we proceed, the critical relationship between the dollar strength and Bitcoin will serve as a fascinating case study of modern financial dynamics, highlighting how new age assets intersect with traditional economic indicators.