Dovey Wan Hong Kong hedge fund is making waves in the world of cryptocurrency trading amidst a backdrop of uncertainty and rumor. Recently, Dovey Wan, a well-respected figure and founding partner of Primitive Ventures, emphasized the robustness of Hong Kong’s hedge fund landscape in light of speculations about market turmoil originating from Bitcoin options trading. While concerns about Bitcoin fund performance and other Hong Kong hedge fund rumors circulate, Wan confidently asserts that the reality is more stable than the gossip would suggest. With no capital gains tax in Hong Kong, the landscape for Bitcoin trading hours and investment strategies differs significantly from other global markets. As the Hong Kong hedge fund community continues to navigate these dynamic waters, it is crucial to discern facts from fiction in the burgeoning crypto environment.

The Dovey Wan Hong Kong investment landscape is an intriguing arena where cryptocurrency trading intersects with traditional financial structures. In this unique ecosystem, hedge funds are adapting to changing narratives, particularly around Bitcoin options and their implications for market stability. Rumors about fund collapses can often overshadow consistent Bitcoin trading patterns and actual fund performance metrics. Investors and industry observers alike are keen to understand the intricacies of trading habits here, especially given the absence of capital gains tax, which sets Hong Kong apart from many other finance hubs. Delving deeper into this world reveals a rich tapestry of strategies and opportunities, where precision in navigating options can dictate the success or challenges faced by local hedge funds.

| Key Point | Details |

|---|---|

| Hong Kong Taxation | There is no capital gains tax in Hong Kong, making the idea of tax optimization irrelevant for local investors. |

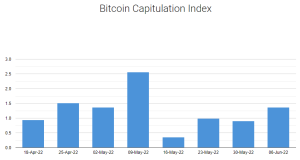

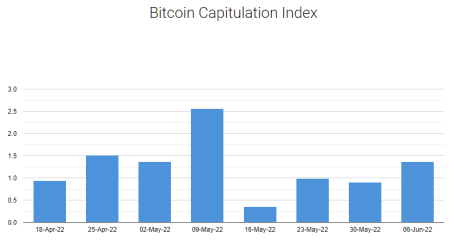

| Market Rumors | Dovey Wan is conducting due diligence on a major Bitcoin options fund, and there have been no incidents of concern reported since October 11. |

| Capital Flows | Bitcoin whales in Asia have shifted assets into compliant channels for easier custody and reduced risks long before new redemption mechanisms were introduced. |

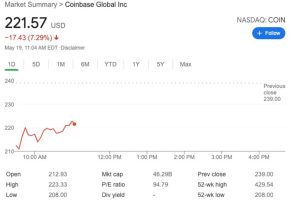

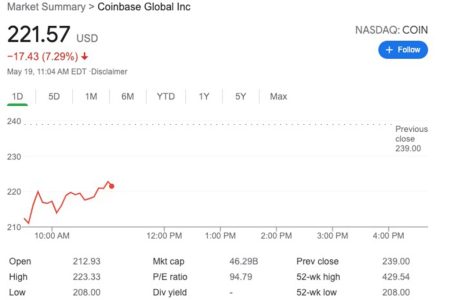

| Trading Trends | Bitcoin trading is increasingly aligned with U.S. stock market hours, reflecting a structural shift in trading habits. |

| Options Trading Hazards | A collapse of a Bitcoin fund due to options trading is unlikely unless engaging in risky activities such as naked shorting. |

Summary

Dovey Wan, a key figure in the Hong Kong hedge fund scene, has addressed recent rumors about potential turmoil within the Bitcoin market due to issues at certain funds. Her insights provided reassurance that the small, interconnected nature of the Hong Kong financial community would have resulted in swift news of any serious problems. Importantly, she clarified that Hong Kong’s lack of capital gains tax changes how local investors manage their assets, straying from practices typical in other markets. Furthermore, Wan highlighted the ongoing diligent monitoring of Bitcoin funds, suggesting that the region remains stable and devoid of significant trouble. Through this lens, she paints a picture of resilience and strategic evolution within the Hong Kong hedge fund landscape.

Understanding Dovey Wan’s Insight on Hong Kong Hedge Fund Stability

Dovey Wan, a prominent figure in the cryptocurrency investment space, recently addressed the prevailing rumors surrounding potential turmoil in the Hong Kong hedge fund sector. Her assessment comes amid circulating speculations that a particular fund might be teetering on the brink of collapse due to its IBIT options trading strategies. Wan passionately advocates for a nuanced perspective, highlighting that while the Hong Kong financial community is indeed small and rumors do spread rapidly, there appears to be no substantial basis for these alarms, especially based on her ongoing due diligence.

As a founding partner of Primitive Ventures, Wan emphasizes that many in the industry are closely monitoring fund performances, particularly the largest Bitcoin options strategy fund in Hong Kong. She asserts that since October 2023, this fund has shown resilience and stability. The tight-knit nature of the Hong Kong cryptocurrency scene makes it particularly difficult to conceal any significant issues, and Wan’s position allows her insight into the true state of affairs. This underlines the importance of relying on data over sensationalized gossip, especially in the highly volatile world of cryptocurrency investing.

Analyzing Capital Gains Tax Implications in Hong Kong for Hedge Funds

In her commentary, Dovey Wan also dissected the implications of capital gains taxes in Hong Kong, distinguishing the city’s financial environment from that of places like the United States. She pointed out that since Hong Kong imposes no capital gains tax, the concept of ‘tax optimization harvesting’ frequently discussed in Western markets, carries little weight in the local context. This creates a unique landscape for hedge funds operating in Hong Kong, as they are afforded greater flexibility in their trading strategies, particularly regarding high-stakes investments such as Bitcoin options.

The absence of capital gains tax cultivates an atmosphere in which hedge funds can operate freely, allowing for innovative financial products without the added burden of potential tax liabilities. This regulatory advantage may be a contributing factor to the heightened interest in Bitcoin investing among local institutions. Understanding these tax structures becomes crucial for hedge funds strategizing around Bitcoin trading or contemplating expansion into Asia, reinforcing Hong Kong’s position as a favorable hub for cryptocurrency and hedge fund activity.

The Current State of Bitcoin Trading in Hong Kong

Dovey Wan also shed light on the shifting dynamics of Bitcoin trading activities in Hong Kong, noting a distinct trend towards aligning trading hours with those of U.S. stock markets. This phenomenon, which gained momentum in the latter half of 2025, reflects broader trends in global investment patterns and showcases how local trading behaviors are adapting to international market influences. The noted increase in selling pressure during U.S. market opening hours indicates that Hong Kong-based traders are becoming more reactive to global events and stock market movements.

This adaptation in trading habits may suggest that Bitcoin investors in Hong Kong are increasingly viewing their investments through the lens of traditional financial instruments. With major exchanges like Binance facing increased spot selling during synchronized trading times, it becomes critical for traders and hedge funds to monitor these patterns closely. This trend highlights the necessity for firms in Hong Kong to consider not only the crypto-specific market signals but also the broader financial markets, reinforcing the interconnected nature of global finance.

Dovey Wan’s Perspective on Bitcoin Fund Performance

In her discussions about Bitcoin fund performance, Dovey Wan emphasized that sustained success is contingent upon robust strategies rather than speculative trades. Her insights bring to light the behaviors of established funds which rely heavily on well-researched options strategies. Given the high stakes associated with Bitcoin trading, Wan cautions against the dangers of excessive leverage and the risks of unexpected market fluctuations which can lead to liquidations.

Wan’s analysis underscores the importance for hedge funds to utilize sound risk management practices. Instead of engaging in risky behaviors such as naked shorting or excessive leverage, successful funds are likely to employ systematic trading methodologies that are resilient to market shifts. As the landscape evolves, the distinct challenges and opportunities posed by both traditional finance and cryptocurrency markets must guide strategies for optimizing fund performance.

Implications of IBIT and Options Trading for Hedge Funds

The ongoing discussions about hedge funds and their strategies for trading Bitcoin options touch upon critical elements of financial risk. According to Wan, many funds that utilize IBIT options trading mechanisms are not merely relying on speculative tactics. This is vital in maintaining stability within the volatile crypto markets where the risk of abrupt market changes could lead to significant losses. Wan mentions that a well-structured trading plan removes the necessity for excessive risk-taking, allowing funds the opportunity to thrive.

Furthermore, Dovey Wan’s insights suggest that these funds, regardless of whether they operate on traditional financial lines or Bitcoin-focused strategies, are inherently linked through the mechanisms they employ. As hedge funds manage their trading activities with a keen understanding of market conditions, this interconnectivity becomes prominent. By promoting transparent practices and adhering to structured trading methodologies, hedge funds can better navigate the complexities of the evolving financial landscape.

Navigating the Regulatory Landscape for Hedge Funds in Hong Kong

As the cryptocurrency market continues to flourish in Hong Kong, the regulatory landscape remains a pivotal consideration for hedge funds. Dovey Wan highlighted the importance of regulatory compliance, especially as institutions engage with cryptocurrencies like Bitcoin. With no capital gains tax in place, hedge funds can strategically position themselves to maximize investment opportunities while ensuring adherence to local regulations.

The unique regulatory environment in Hong Kong may offer hedge funds a competitive edge, allowing them to experiment with novel financial strategies without the same constraints experienced elsewhere. As the region becomes increasingly attractive to cryptocurrency investors, it will be vital for hedge funds to stay informed and adaptable to any changes in regulatory standards, ensuring that they can continue to operate effectively in a fast-paced financial environment.

Rumors and Reality: Addressing Hong Kong Hedge Fund Speculations

The speculative nature of the financial industry can sometimes overshadow the facts, particularly in the close-knit Hong Kong crypto community. Dovey Wan’s insights serve as a reminder of the necessity for investors to discern between rumors and reliable information. In light of the recent concerns about potential hedge fund collapses, Wan argues that it’s essential to engage in thorough diligence rather than feed into the hype fueled by gossip.

By staying grounded in verified data and operational transparency, hedge funds can not only enhance their credibility but also foster trust within the investment community. Wan’s position within the industry provides her with a unique vantage point, reinforcing the idea that real information often contrasts sharply with the rumors that circulate in the market. This highlights the importance of fostering an environment where factual reporting is prioritized.

Assessing Bitcoin Trading Hours Impact on Hedge Fund Strategies

In discussing the correlation between Bitcoin trading hours and hedge fund strategies, Dovey Wan indicated a pivotal shift towards aligning trading activities with the hours of traditional market operations, notably U.S. stock trading. This strategy may enhance responsiveness to market fluctuations, thereby optimizing trading outcomes for hedge funds operating in Hong Kong. With a significant portion of trading activity now occurring during these hours, funds must consider the implications on liquidity and market reactions.

This alignment could lead to more strategic decision-making processes for hedge funds as they navigate the nuances of both the cryptocurrency and traditional financial markets. Wan emphasizes that understanding these behavioral shifts is crucial for executing effective trading strategies, particularly as market dynamics evolve. Hedge funds that adapt to these changes are likely to stand out in the competitive landscape of cryptocurrency investment.

Dovey Wan’s View on the Future of Hedge Funds in Hong Kong

As the cryptocurrency sector continues to expand in Hong Kong, Dovey Wan offers a forward-looking perspective on the role of hedge funds in this evolving environment. She posits that hedge funds will increasingly adopt technology-driven strategies that cater to the demands of modern investors. By leveraging advanced analytics and robust trading algorithms, these funds can enhance their performance while mitigating risks associated with market volatility.

The intersection of technological innovation and financial strategy is set to redefine how hedge funds operate in Hong Kong. As investors seek more tailored investment solutions, hedge funds that prioritize agility and tech integration are destined to thrive. Wan’s insights signify a broader trend where traditional finance meets the innovative spirit of cryptocurrency, paving the way for a vibrant financial landscape.

Frequently Asked Questions

What are the recent rumors surrounding Dovey Wan and Hong Kong hedge funds?

Dovey Wan commented on potential market downturn rumors linked to a Hong Kong hedge fund collapsing due to Bitcoin options trading. She emphasized the importance of skepticism in the close-knit Hong Kong financial community, noting no verified troubles among institutions thus far.

How does capital gains tax in Hong Kong affect Dovey Wan’s hedge fund activities?

Dovey Wan mentions that Hong Kong has no capital gains tax, which fundamentally changes how hedge funds operate there. The traditional concept of tax optimization through capital gains harvesting commonly discussed in the U.S. does not apply in the Hong Kong hedge fund landscape.

What can be said about Dovey Wan’s perspective on Bitcoin fund performance in Hong Kong?

Dovey Wan is currently conducting due diligence on the largest Bitcoin options strategy fund in Hong Kong. She reports that its recent performance has been stable, and there have been no incidents in the fund since October, countering any negative rumors.

How have Bitcoin trading hours influenced hedge fund strategies according to Dovey Wan?

Dovey Wan notes a significant shift in Bitcoin trading activity towards U.S. stock trading hours since the second half of 2025. This aligns Bitcoin market dynamics with more traditional financial trading patterns, as evident from increased selling pressure during New York market hours.

What are the risks associated with Bitcoin options trading for hedge funds in Hong Kong?

Dovey Wan highlights that a potential collapse of a Bitcoin fund due to options trading would likely result from risky practices like naked shorting or leveraged trades, rather than standard trading strategies employed by established funds in Hong Kong.

What insights does Dovey Wan provide about capital flows in Hong Kong’s hedge fund market?

According to Dovey Wan, many traditional Bitcoin investors have shifted their assets to compliant channels like IBIT long before recent mechanisms were established. This movement was primarily for custody ease and to mitigate risks, demonstrating a strategic adaptation within the Hong Kong hedge fund market.