Dogecoin Value May Decline as NASDAQ Excitism Faces Intense Sell-Off

In recent times, the cryptocurrency sphere has been remarkably volatile, subject to soaring highs and sudden lows. One of the tokens often at the heart of this volatility is Dogecoin, a cryptocurrency that started as a meme but has since garnered a massive following and significant financial backing. However, recent trends and market dynamics suggest we might be seeing Dogecoin’s value face potential decline, particularly influenced by investor behavior on platforms like NASDAQ.

The Connection Between NASDAQ and Dogecoin

While Dogecoin is traded primarily on crypto exchanges, its performance often mirrors the sentiment observable on stock exchanges like NASDAQ. This is largely due to the interconnected nature of investment environments: what happens in one often impacts the other. In recent times, NASDAQ, a benchmark for tech stocks, has experienced a level of excitement leading to higher valuations of tech companies. However, this heightened enthusiasm is not always sustainable, leading to sharp corrections or intense sell-offs.

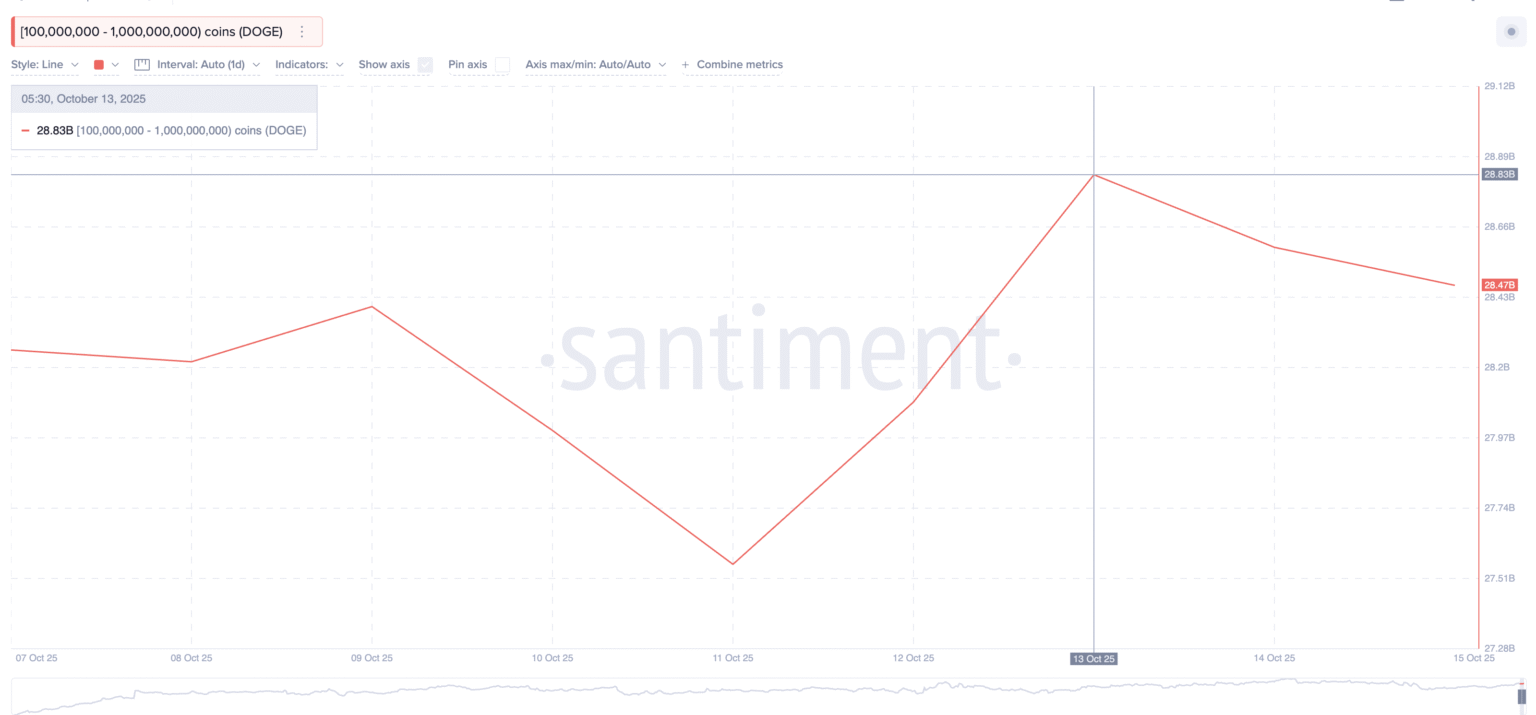

Indicators of a Potential Decline

Market analysts have pointed out several indicators that suggest a potential downturn in Dogecoin’s valuation. First, the correlation between Dogecoin and NASDAQ has shown that spikes in tech stock valuations often lead to increased speculative trading in cryptocurrencies. However, when these stocks face sell-offs due to profit-taking or market corrections, cryptocurrencies like Dogecoin invariably face a decline.

Moreover, the overall excitement around cryptocurrencies has cooled off somewhat from its peak in recent years, leading to decreased trading volume and less media coverage. This normalization could translate into lower speculative interest in Dogecoin.

Investor Psychology and Market Dynamics

One of the critical aspects of cryptocurrency trading is investor psychology. The “fear of missing out” (FOMO) can quickly drive up prices, but the opposite effect, “fear, uncertainty, and doubt” (FUD), can cause equally swift declines. As NASDAQ faces a sell-off, the ripple effect can trigger FUD among cryptocurrency investors, leading to rapid sell-offs in markets like those for Dogecoin.

Impact of Regulatory News

Regulatory news also plays a significant role in shaping the cryptocurrency market landscape. Recent murmurs in the United States about tightening regulations around digital currencies could add to the bearish sentiment surrounding tokens like Dogecoin. Investors, particularly institutional ones, tend to pull back their investments in uncertain regulatory environments, leading to declines in crypto values.

Future Outlook

The future of Dogecoin’s value remains uncertain and largely dependent on broader market trends and investor sentiment. While the cryptocurrency could potentially rebound with positive market news or renewed investor interest, the current indicators suggest a cautious approach.

Conclusion

Investors in Dogecoin and other cryptocurrencies should remain vigilant and informed about changes in both the crypto market and traditional stock exchanges like NASDAQ. As the excitement around tech stocks faces corrections, it might be prudent for crypto investors to brace for potential declines and manage their investments accordingly. As always in the realm of investment, diversification and careful analysis are key to navigating such unpredictable waters.