The growing interest in digital yuan, also known as e-CNY, is set to transform the financial landscape in China as the People’s Bank of China (PBOC) prepares to allow interest payments on digital yuan holdings beginning in 2026. This significant development has the potential to enhance the appeal of e-CNY, positioning it as a major competitor in the realm of banking alongside traditional deposits and other digital payment methods. With the introduction of interest payments, the digital yuan could evolve from merely a cash substitute into a viable “digital deposit currency,” encouraging greater user adoption. Meanwhile, concerns about potential regulations on stablecoins, with the recent debate surrounding the GENIUS Act, highlight the contrasting approaches between China and the US in fostering innovation and competitiveness in the digital currency arena. As global skepticism regarding stablecoin regulation grows, the implications of China’s digital currency strategy warrant close attention from financial analysts and policymakers alike.

The emergence of the e-CNY marks a significant shift in China’s approach to digital currency, with the central bank planning to introduce interest on digital yuan holdings, which will radically alter its functionality. By redefining the digital yuan as a type of deposit currency, the People’s Bank of China aims to bridge the gap between traditional banking and emerging digital financial technologies. This move could potentially spur widespread acceptance of e-CNY within domestic markets and facilitate international transactions in the future. As the debate heats up over stablecoins regulation in the US, particularly related to the GENIUS Act, observers are keenly watching how such policies could affect the competitive landscape. Treasury officials and financial institutions continue to grapple with the dilemma of fostering innovation while ensuring financial stability, positioning China advantageously with its timely policy adaptations.

The Rise of e-CNY Interest Payments: A Game Changer for Digital Transactions

Starting in 2026, China will offer interest on its digital yuan (e-CNY), marking a significant shift in how central bank digital currencies (CBDCs) could impact the economy. The People’s Bank of China (PBOC) believes that this change will elevate the e-CNY to a status beyond just being a simple form of digital cash; it will transform it into what is known as a “digital deposit currency.” This new categorization is expected to entice users looking for attractive savings options, potentially leading to increased adoption across the nation.

As interest payments become available, analysts suggest that the e-CNY could compete more effectively against conventional bank deposits. By offering yields on holdings, the digital yuan could encourage users to shift their funds from private digital payment platforms into the e-CNY ecosystem. This competitive advantage may not only drive domestic adoption but also pave the way for the digital yuan’s use in international transactions.

Impact of the GENIUS Act on Stablecoins and Digital Assets

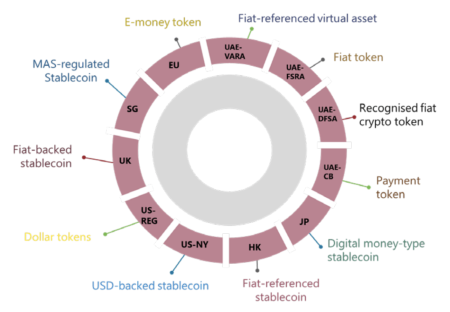

The GENIUS Act, which came into effect in July 2023, seeks to ensure that stablecoins remain strictly transactional and do not veer into interest-bearing investment products. This prohibition has spurred a contentious debate among US banks, legislators, and the crypto industry. Banking groups argue that allowing stablecoins to yield interest would confuse customers and undermine the integrity of traditional banking, potentially leading to financial instability.

Conversely, the crypto industry sees the GENIUS Act as a barrier to innovation. Major organizations like the Blockchain Association have urged Congress to reconsider strict enforcement of this act, suggesting that inhibiting the growth of interest-bearing stablecoins could drive technological innovation away from the US to countries with more favorable regulations. The ongoing discussions around this act illustrate the tension between fostering a proactive financial technology landscape and ensuring consumer protection within traditional banking norms.

China’s Advantage in Global Digital Finance through e-CNY

The introduction of interest payments on the digital yuan gives China a competitive edge in the global digital finance race. As the US grapples with the implications of the GENIUS Act, which restricts stablecoin rewards, Chinese policymakers have strategically positioned the e-CNY as an attractive option for consumers and businesses alike. The added interest incentive may not only enhance the domestic usage of the e-CNY but also attract international users seeking competitive yields on digital assets.

Faryar Shirzad, a senior executive at Coinbase, emphasized the potential ramifications for the US financial system. He noted that if American lawmakers maintain a strict stance against interest-bearing stablecoins, US dollar-backed digital assets could lose appeal in comparison to their Chinese counterparts. This competitive disadvantage could diminish the dollar’s status in global finance, a situation that could be detrimental as international players rapidly advance their digital finance capabilities.

The Debate Over Stablecoins Regulation: Balancing Innovation and Safety

The ongoing debate surrounding stablecoin regulation is a critical point of discussion in the context of financial innovation. With the GENIUS Act’s restrictions on interest-bearing stablecoins, there is concern that overly stringent regulations could stifle advancements in the cryptocurrency space. Industry advocates assert that rigid rules can mitigate consumer participation in emerging financial technologies, which may ultimately yield negative consequences for the future of innovation in the US market.

On the other hand, regulatory authorities emphasize the importance of consumer protection and financial stability. The clash between these two perspectives highlights the challenge of creating a regulatory framework that encourages innovation while ensuring that financial systems remain secure and trustworthy. As the global competition in digital currencies intensifies, finding a balance will be essential to maintaining US competitiveness in the evolving landscape of digital finance.

Potential Consequences of Restricting Yields on Stablecoins

Restricting yields on stablecoins could lead to serious implications for the United States’ position in the realm of digital finance. By enforcing strict regulations similar to those outlined in the GENIUS Act, US lawmakers risk creating an environment that is less favorable for technological advancements in the financial sector. As countries like China embrace features such as interest payments on CBDCs, US stablecoins may become less attractive to users looking for competitive financial products.

The potential downside of this situation is that it may cause a migration of interest-driven innovations abroad, where more lax regulations encourage development. As a result, the US could be left behind as other nations harness the momentum of technological progress, ultimately diminishing its role in the global economy. To avoid this outcome, US legislators may need to revisit their approach to stablecoin regulation, finding ways to encourage growth while ensuring consumer safety.

Adapting to Changing Financial Landscapes with Digital Innovations

As the financial landscape shifts with the advent of digital currencies, both consumers and businesses will need to adapt to new technologies. The anticipated introduction of interest payments on the e-CNY illustrates how central bank digital currencies are evolving beyond merely serving as digital cash. This evolution compels both traditional banks and financial tech companies to innovate and explore new opportunities within the digital payment space.

Moreover, the rise of digital currencies highlights the necessity for robust regulatory frameworks that keep pace with rapid technological advancements. Both regulators and market participants must work collaboratively to ensure that customer needs are met while safeguarding the integrity of the financial system. Adopting flexible regulations will be crucial to allow for the exploration of new financial products while maintaining consumer confidence in the traditional banking infrastructure.

The Future of Digital Currencies: Analyzing Global Trends

The future of digital currencies hinges on understanding global trends in finance and regulatory approaches to emerging technologies. China’s proactive stance on promoting interest-bearing digital currencies like the e-CNY signals an evolving landscape where traditional monetary systems may need to adapt to remain competitive. As other nations observe and possibly emulate this model, the implications for global finance could be profound.

In contrast, the US faces the challenge of navigating regulatory hurdles that may impede growth in the crypto and digital assets market. Addressing this tension between innovation and regulation will be pivotal in determining the success or failure of US-backed digital currencies. As the world increasingly leans towards digital ecosystems for financial transactions, establishing a progressive regulatory environment will be essential for ensuring the longevity and competitiveness of the US dollar in the digital economy.

Engaging Stakeholders in Crypto Regulation Discussions

To create an effective regulatory landscape for cryptocurrencies and stablecoins, engaging a diverse group of stakeholders is essential. The input from banking groups, crypto firms, industry associations, and lawmakers will be critical in shaping a framework that balances innovation with necessary safeguards. Collaborative discussions can lead to well-informed policies that meet the needs of various market participants while addressing the concerns associated with financial stability.

As the crypto industry continues to evolve and expand, stakeholders must prioritize open communication and dialogue to build trust among consumers and regulatory agencies. By doing so, they can create a more inclusive approach to regulating digital assets, thereby fostering a healthier ecosystem that supports sustainable growth. Ultimately, collaboration and transparency will be key in navigating the complexities of crypto regulation and ensuring a competitive financial future.

Lessons from China’s Digital Currency Strategy

China’s strategy in implementing the e-CNY serves as a valuable case study for other nations looking to develop their own digital currencies. By opting to include interest payments, China has not only incentivized the use of its digital currency but also paved the way for a transformation in how consumers interact with money. This shift from digital cash to digital deposit currency allows for a more robust use case that can potentially enhance consumer trust and adoption.

Other countries can learn from this approach as they seek to understand the implications of CBDCs on both domestic and international levels. As governments strive to stay relevant in a rapidly changing financial environment, adopting similar strategies may prove beneficial. Additionally, understanding consumer behavior in light of interest incentives could drive more significant participation in digital currency systems globally.

Frequently Asked Questions

What impact will digital yuan interest payments have on the e-CNY’s adoption in China?

The introduction of interest payments on the digital yuan (e-CNY) is expected to enhance its adoption significantly. By allowing commercial banks to pay interest on e-CNY holdings starting January 1, 2026, the People’s Bank of China hopes to transform the e-CNY into a ‘digital deposit currency.’ This change aims to make the e-CNY more competitive against traditional bank deposits and private digital payment platforms, potentially leading to increased usage both domestically and in cross-border transactions.

How does the GENIUS Act relate to digital yuan interest payments and stablecoins in the US?

The GENIUS Act, which has been in effect since July 2023, prohibits interest on stablecoins, ensuring they remain strictly transactional. This contrasts sharply with China’s digital yuan interest framework, as US banking groups argue that allowing yields on stablecoins could blur the lines between deposits and crypto assets, potentially impacting financial stability. The ongoing debate over the enforcement of this act could limit the US’s competitiveness in the evolving landscape of digital currencies, especially against the backdrop of China’s digital yuan.

Why are US lawmakers concerned about interest on stablecoins based on the GENIUS Act?

US lawmakers are concerned that allowing interest on stablecoins might undermine traditional banking practices, as outlined in the GENIUS Act. Observers argue that such allowances could divert funds from regulated banks and create confusion between crypto assets and traditional deposits, threatening financial stability. The debate highlights the need for regulation without stifling innovation in the digital finance sector.

What are the potential competitive advantages of China’s digital yuan due to interest payments?

China’s decision to allow interest payments on the digital yuan could provide significant competitive advantages, making its CBDC more attractive than US dollar stablecoins that are restricted from offering yields. This could accelerate user adoption in China and potentially enhance the digital yuan’s role in international transactions as it positions itself as a superior option compared to non-interest-bearing digital currencies.

How does the Coinbase warning about stablecoins relate to the global competitiveness of digital finance?

The Coinbase warning emphasizes that if the US enacts strict regulations against interest-bearing stablecoins under the GENIUS Act, it risks losing ground to foreign digital currency developments, particularly China’s digital yuan. Coinbase’s chief policy officer, Faryar Shirzad, argues that without incentives like interest payments, US dollar-backed stablecoins may diminish in appeal, allowing other countries to lead in the digital finance sector and risking the dollar’s position in global markets.

What challenges does the e-CNY face in terms of adoption despite interest payments?

Despite the potential benefits from allowing interest payments, the e-CNY faces challenges in adoption related to public trust and the transition from traditional payment methods to digital formats. Analysts suggest that while interest payments might enhance its appeal, broader consumer acceptance and usability will be essential for widespread adoption within China and in future cross-border transactions.

What is the relationship between stablecoins and the regulation of digital currencies in the context of China and the US?

Stablecoins, especially in relation to digital currencies like the e-CNY, highlight the regulatory challenges faced by policymakers in both China and the US. While China is actively positioning the e-CNY to compete with traditional financial systems by allowing interest, the US is focused on compliance and preventing stablecoins from functioning as interest-bearing instruments. This regulatory dichotomy could shape the future landscape of digital currencies and their roles in international finance.

| Topic | Details |

|---|---|

| Digital Yuan Interest | Starting in 2026, the People’s Bank of China (PBOC) will allow interest on digital yuan holdings, transitioning it to a ‘digital deposit currency’ to enhance competitiveness. |

| Adoption Challenges | Despite years of piloting the digital yuan for various payments and services, its adoption has been slower than expected. |

| Impact on US Stablecoins | The GENIUS Act in the US prohibits interest on stablecoins, sparking debate on its implications for competitiveness in digital finance. |

| Banking vs. Crypto Firms | US banking groups assert that interest-bearing stablecoins undermine financial stability, while crypto advocates argue it could spur innovation. |

Summary

Digital yuan interest is poised to reshape financial dynamics by enabling interest on e-CNY holdings starting in 2026. This strategic move by the People’s Bank of China could increase user adoption, directly competing with traditional banking and other digital payment platforms. As the global influence of digital currencies intensifies, the approach taken by China reinforces its central bank digital currency advantages, while the US debates over stablecoin regulations may hinder its position in the evolving digital finance landscape.