In the ongoing debate of Digital Renminbi vs WeChat and Alipay, understanding the nuances of China’s evolving digital currency landscape is crucial. The Digital Renminbi, as China’s official digital currency, aims to replace cash and enhance transaction efficiency, providing users with a direct way to pay merchants. In contrast, WeChat Pay and Alipay operate as digital wallets that facilitate mobile payments, allowing users to withdraw funds from their accounts to settle transactions. With digital wallets dominating the market, the upcoming features of Digital Renminbi promise to bring about significant changes in how consumers approach payments. As more citizens engage with these platforms, the impact of Digital Renminbi on traditional mobile payment giants is a topic heating up on platforms like Baidu.

When exploring the competition between China’s sovereign digital currency and popular payment platforms, one cannot ignore the significant impact of mobile financial systems. As the country pivots towards a digitized economy, the interplay between the Digital RMB and services such as WeChat and Alipay becomes increasingly relevant for consumers and businesses alike. These platforms, often referred to as mobile payment solutions, have revolutionized the shopping experience by providing convenience and speed. As the Digital Renminbi rolls out, its advantages and functionalities will likely redefine how transactions are conducted across various sectors. Understanding these distinctions will be essential for navigating the future of finance in China.

Understanding Digital Renminbi: A New Era of Currency in China

Digital Renminbi, China’s state-backed digital currency, marks a significant evolution in the way transactions are conducted in the nation. Unlike traditional currencies or existing mobile payment platforms, the digital renminbi is viewed as legal tender with unique characteristics that set it apart. It is designed to provide a safe, efficient, and convenient framework for financial transactions, minimizing the reliance on physical cash while enhancing monetary policy control. As a product of the People’s Bank of China, the currency aims to integrate seamlessly with everyday transaction systems, offering users a digital alternative that embodies the security and stability normally associated with government-issued money.

The full potential of Digital Renminbi extends beyond mere functionality as a payment method; it will also bolster economic sovereignty and improve financial inclusion across a rapidly digitizing economy. This innovative form of currency will help streamline processes for both consumers and merchants alike. In the context of the growing adoption of mobile payments, the digital renminbi could redefine how everyday transactions are executed in China, setting a benchmark that could influence the global digital currency landscape.

WeChat Pay and Alipay: The Titans of Mobile Payments

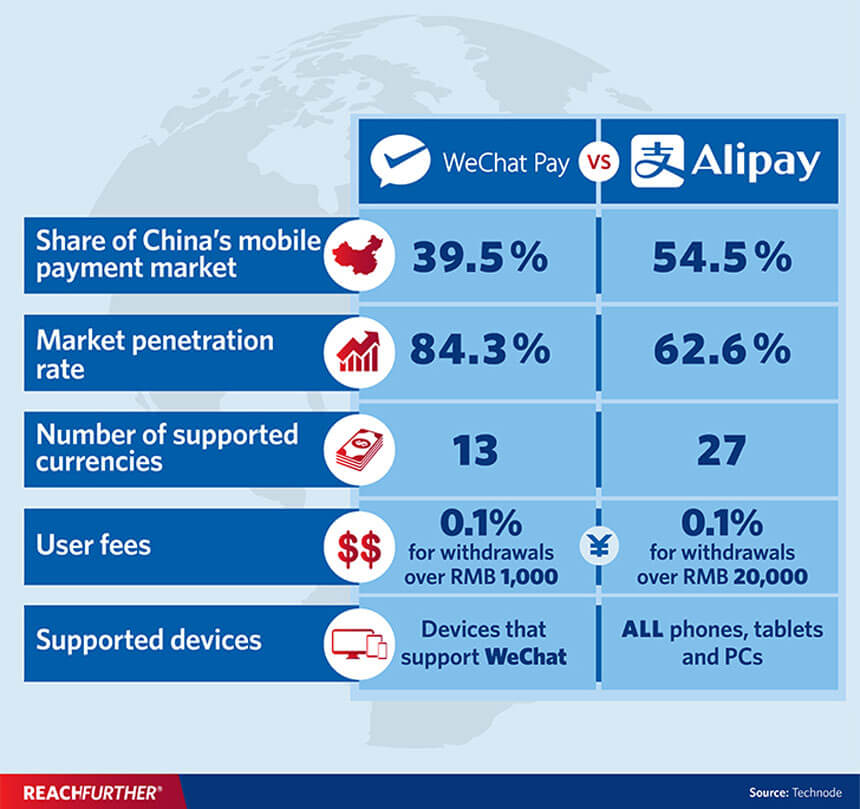

WeChat Pay and Alipay have revolutionized mobile payments in China by providing users with a convenient way to conduct transactions using their smartphones. Both platforms have integrated several features that allow for seamless payments, peer-to-peer transactions, and even bill splitting. However, they fundamentally differ from Digital Renminbi in terms of their operational frameworks. While WeChat and Alipay act as digital wallets that require linking to bank accounts or other funding sources, the digital renminbi is a direct form of currency issued by the state, meaning users transact directly in money rather than through a payment intermediary.

These mobile payment giants have managed to leverage their respective ecosystems—WeChat’s social media platform and Alipay’s extensive e-commerce partnerships—to dominate the financial transaction landscape. WeChat Pay facilitates payments within conversations and social interactions, while Alipay offers comprehensive shopping experiences, including credit services. As these systems become further embedded in the fabric of daily life in China, they will inevitably face challenges and competition from the state-enabled digital renminbi, which may transform user preferences and redefine the competitive dynamics of the mobile payments market.

Comparing Digital Renminbi and WeChat/Alipay: Key Differences in Functionality and Design

The primary distinction between Digital Renminbi and mobile wallets like WeChat and Alipay lies in the nature of how users access their funds. Digital Renminbi functions as actual currency, allowing consumers to make payments directly by transferring electronic cash to merchants, while WeChat Pay and Alipay operate by withdrawing funds from a digital wallet that is linked to a bank account. This structural difference means that, with the digital renminbi, users are holding a form of currency that benefits from the stability and backing of the Chinese government, as opposed to the indirect access afforded by third-party wallets.

Moreover, the digital renminbi is anticipated to come with advantages that impact user experience negatively associated with current mobile payment systems. As transactions using digital renminbi are likely to experience faster processing times and reduced transaction fees compared to WeChat Pay and Alipay, consumers can expect a more efficient payment experience. The integration of micro-payment functionalities in digital renminbi may also cater to a broader range of transactions that currently rely on traditional mobile wallets in the market.

Implications of Digital Currency Adoption in China

The introduction of Digital Renminbi signifies a pivotal moment in China’s approach to financial technology and currency management. As the government rolls out this new digital currency, the implications for both local and international markets are profound. For consumers and businesses, digital currency promises to make transactions quicker, safer, and more transparent. The government’s ability to track transactions could enhance efforts to reduce fraud and financial crime, instilling greater confidence in the financial system among users.

On a broader economic scale, the digital renminbi is expected to bolster China’s position in the global economy, potentially challenging the dominance of existing payment solutions like WeChat Pay and Alipay. It is also seen as a strategic move to increase the renminbi’s international usage and acceptance in global trade, creating opportunities for China to expand its influence in the digital currency arena. The transition to a state-backed digital currency has the potential to reshape financial flows and encourage a shift towards more innovative payment methods not just domestically, but around the globe.

The Future of Payments: How Digital Renminbi Will Reshape Consumer Behavior

As consumers in China become accustomed to Digital Renminbi, a shift in payment behaviors is likely to occur. With its state-backed features, such as interest-earning wallet balances, users might prefer utilizing digital renminbi over mobile wallets like WeChat Pay and Alipay, which do not offer the same incentives or benefits. This transformation could challenge the existing norms and push businesses to adapt quickly to emerging consumer preferences, creating a ripple effect in the way payment services are structured and promoted.

Additionally, as Digital Renminbi begins to see adoption in everyday transactions, it could lead to increased negotiations around payment technologies among businesses and platforms. Promoting a competitive environment can result in better terms for consumers and more robust service offerings. As financial education about digital currencies grows, it opens up conversations around the advantages of using a government-backed currency over existing mobile payments, further encouraging a shift towards adopting Digital Renminbi at retail points and beyond.

Digital Renminbi vs WeChat and Alipay: A Comparative Overview

When assessing Digital Renminbi against WeChat and Alipay, the critical takeaway is that while they serve the same fundamental purpose of enabling money transfer and payments, their operational frameworks are inherently distinct. The digital renminbi is designed to function on its own as money, directly connecting consumers to merchants without the typical reliance on third-party wallets. In contrast, WeChat and Alipay provide additional services, positioning themselves more as platforms that facilitate transactions through linked accounts and pre-loaded funds.

Essentially, this creates different user experiences and expectations. Consumers might find the digital renminbi appealing due to its direct essence as a form of money, which could lead to changes in habitual spending patterns as users become more comfortable with its benefits. As the competitive landscape evolves, the coexistence of these digital payment mechanisms will shape how businesses and consumers alike approach payment solutions in their daily lives.

Navigating the Digital Currency Landscape Globally

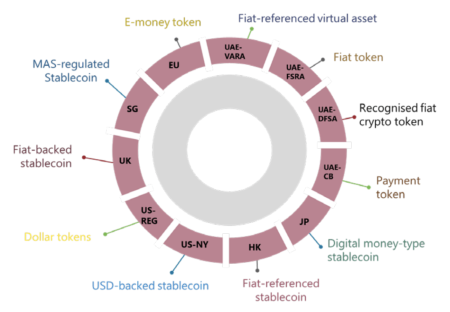

The rise of digital currencies, such as the digital renminbi, is not only a Chinese phenomenon but part of a broader global trend where many countries are exploring their own state-backed digital currencies. The implications of these developments can be significant, especially for cross-border transactions and the future of mobile payments. As more nations consider their digital currency frameworks, it is likely to become a critical aspect of the global financial ecosystem that requires attention from investors and consumers.

Furthermore, the advancement of technologies like blockchain is setting the stage for how digital currencies will authenticate transactions securely and efficiently. Digital Renminbi and similar currencies can benefit from such technological innovations, paving the way for smoother transactions, lower fees, and wider accessibility. As China positions itself as a pioneer in digital currency deployment, it could strongly influence global payment systems, prompting discussions about the implications for privacy, security, and monetary policy on a worldwide scale.

Strategies for Businesses to Adapt to Digital Renminbi Adoption

Businesses must prepare for the rise of Digital Renminbi by re-evaluating their payment acceptance strategies and technological infrastructures. As digital currency adoption increases, understanding this new landscape becomes integral for remaining competitive. Retailers can enhance customer experiences by integrating systems that accept digital renminbi alongside existing payment methods. Given that consumers may start expecting more convenience, companies should also consider what incentives can be implemented to encourage the transition towards digital currency usage.

Moreover, training staff on the nuances of Digital Renminbi and promoting its benefits can lead to better implementation and customer engagement. Understanding how to leverage digital currency effectively is not just about technology, but about aligning it with consumer preferences and expectations. Companies that proactively adapt to these changes may find themselves at the forefront of a rapidly evolving market, capturing the interest of digital-savvy consumers looking for efficient payment solutions.

The Role of Regulation in the Digital Currency Landscape

Regulatory frameworks will play a vital role in guiding the development and implementation of Digital Renminbi in China and influencing its acceptance in global markets. Policies established by the People’s Bank of China will need to address a broad range of issues, including privacy, cybersecurity, and the impact on the financial ecosystem, especially concerning established entities such as WeChat and Alipay. Regulatory clarity will also be essential for consumers and businesses to gain the confidence necessary to adopt new payment methods without fear of volatility or security vulnerabilities.

Additionally, the responses from other jurisdictions will create a ripple effect that could shape international regulatory standards for digital currencies. As countries continue to grapple with the balance of innovation, financial stability, and consumer protection, collaboration between governments will be crucial in developing frameworks that promote the adoption of digital currencies worldwide. Understanding regulatory landscapes will therefore not only be a necessity for local stakeholders but also for businesses operating in the global market.

The Consumer Sentiment Towards Digital Currency in China

Consumer sentiment towards Digital Renminbi is gradually shifting as users become more educated about state-backed digital currencies. With growing awareness of the benefits, such as interest-earning wallets and direct merchant transactions, users are starting to recognize the convenience of utilizing digital renminbi over existing mobile payments like WeChat Pay and Alipay. This shift in attitude suggests that as consumers understand the security and efficiency that come with Digital Renminbi, it could lead them to prefer it for everyday transactions.

Surveys and market research indicate a positive uptake among younger demographics, who are already accustomed to digital interactions in their financial activities. As early adopters share experiences and become advocates for digital renminbi, it’s likely to catalyze a wider acceptance among different consumer groups. Understanding these sentiments will be critical for businesses looking to strategize effectively for the coming changes in the payment landscape.

Frequently Asked Questions

What are the main differences between Digital Renminbi and WeChat Pay or Alipay?

The primary difference between Digital Renminbi, WeChat Pay, and Alipay lies in their structure and functionality. Digital Renminbi is a government-backed digital currency equivalent to cash, while WeChat Pay and Alipay are mobile wallet applications that allow users to make payments by withdrawing money from their balance. Essentially, Digital Renminbi functions as electronic cash for direct transactions, while WeChat and Alipay serve as payment platforms.

How does the Digital Renminbi earn interest compared to WeChat Pay and Alipay?

Starting January 1, balances in digital renminbi wallets will earn interest, classified as demand deposits. In contrast, funds held in WeChat Pay and Alipay do not earn interest as they are not considered formal bank accounts but rather mobile wallets for payments. This feature of the Digital Renminbi may encourage users to adopt it for greater financial benefits.

Can Digital Renminbi be used on WeChat or Alipay?

Currently, Digital Renminbi cannot be used directly through WeChat Pay or Alipay. Each serves a different purpose; Digital Renminbi functions as a digital currency, while WeChat and Alipay operate as payment wallets. However, future integrations may occur as China’s payment ecosystem evolves and adapts to the emerging digital currency landscape.

Is Digital Renminbi safer than using WeChat Pay or Alipay for transactions?

Digital Renminbi is considered to be a safer option since it is issued and regulated by the People’s Bank of China, offering government backing. WeChat Pay and Alipay, while secure, are third-party platforms that rely on additional security measures for protection. Users might find peace of mind knowing their digital currency is supported by the state.

What are the user benefits of Digital Renminbi over WeChat Pay and Alipay?

The benefits of using Digital Renminbi include earning interest on wallet balances, government support, and potential increased privacy since transactions may not rely on third-party data collection. Meanwhile, WeChat and Alipay provide extensive services like social networking and shopping features, but do not offer interest on user balances.

How will Digital Renminbi affect the future of mobile payments compared to WeChat and Alipay?

Digital Renminbi is poised to impact the future of mobile payments by introducing a state-backed alternative that enhances transaction efficiency and security. While WeChat Pay and Alipay dominate the current market, the integration of Digital Renminbi could shift user preferences towards a more formal digital currency model, encouraging diversification in payment methods.

What should consumers consider when choosing between Digital Renminbi, WeChat Pay, and Alipay?

Consumers should consider factors such as ease of use, security, interest benefits, and transaction flexibility. Digital Renminbi offers direct payment options with interest accumulation, while WeChat Pay and Alipay provide more lifestyle integration. Users should weigh their priorities to find the solution that best fits their financial habits.

| Key Points |

|---|

| Digital Renminbi is classified as money and allows direct payments to merchants like cash. |

| WeChat and Alipay function as digital wallets where users withdraw money to make payments. |

| Starting January 1, digital renminbi wallet balances will earn interest as demand deposits. |

Summary

Digital Renminbi vs WeChat and Alipay highlights the significant differences in how these payment systems operate. Digital Renminbi acts as direct cash, allowing users to pay merchants seamlessly, while WeChat and Alipay serve as wallets, facilitating payments through funds withdrawn from user accounts. With the added benefit of interest on digital renminbi balances starting January 1, understanding these differences is essential for consumers and businesses navigating the future of digital transactions.