Digital Asset Trusts (DATs) are emerging as a significant player in the realm of digital asset management, particularly in terms of revenue generation and market value. As Upexi’s Chief Strategy Officer Rudick highlighted, these trusts can create value by exploring new income sources and making selective acquisitions, although he remains skeptical about the potential for widespread consolidation in this space. The concept of mNAV, or market Net Asset Value, becomes crucial here, as it establishes a baseline for negotiations among stakeholders. With sellers disinclined to part with their assets for less than 1.0 times mNAV, and buyers finding little incentive to pay more, the dynamics of acquisitions in digital assets remain complex. In this evolving landscape, understanding the strategies behind DATs is essential for investors looking to navigate the digital asset market effectively.

Digital Asset Trusts, often referred to as DATs, represent a new frontier in asset management within the digital domain. These trusts hold unique promise for generating income and diversifying revenue streams, all while operating within the framework of mNAV for market valuations. As emphasized by industry experts, the interplay between acquisition strategies and market dynamics is pivotal for stakeholders involved in digital assets. The intricacies of trust consolidation and the motivations behind seller and buyer behavior reflect a nuanced understanding of market forces at work. Hence, exploring the terminology and principles surrounding digital asset management can shed light on the evolving nature of value creation in this sector.

Understanding Digital Asset Trusts (DATs) Revenue Generation

Digital Asset Trusts (DATs) are increasingly becoming a vital component of the financial landscape, primarily due to their potential for revenue generation. These entities manage diverse digital assets, allowing for more streamlined investment opportunities. As Rudick pointed out, DATs may explore various avenues for value creation, including attracting new income sources through the management and strategic deployment of their assets. Furthermore, innovative financial instruments and diversified portfolios within DATs could make them attractive options for investors seeking stability in the volatile digital asset market.

However, the challenge lies in the competitive nature of asset valuation. Rudick suggested that sellers are unlikely to entertain offers below 1.0 times mNAV, meaning that they see retention of their assets as more profitable than selling. This perception creates a scenario where while buyers are interested in acquisitions, they remain reluctant to value DATs above this threshold without understanding the intrinsic worth and future revenue potential of the underlying digital assets.

The Role of Acquisitions in Digital Assets

Acquisitions play a crucial role in the evolution of Digital Asset Trusts (DATs), yet the current market sentiment indicates caution among potential buyers. As highlighted by Upexi’s strategy Chief Officer, there is a prevalent hesitance to engage in significant mergers, as the acquisition of DATs at high valuations might not yield the expected financial returns. This reluctance stems from market behavior trends where investors can directly acquire individual digital assets, bypassing potential overhead costs associated with acquiring established DATs.

Despite this cautious approach, strategic acquisitions could provide pathways for scalability and expanded market potential for DATs. By targeting specific, undervalued segments of the digital asset space, DATs could enhance their portfolios—something that remains essential in driving overall market value. However, any acquisition strategy must be substantiated by thorough due diligence assessing not just market trends but also the potential yield and operational synergies that could result from integration.

Exploring mNAV and Market Value Implications for DATs

The concept of market Net Asset Value (mNAV) is a critical benchmark for assessing the valuation of Digital Asset Trusts (DATs). Rudick mentioned that deviations in perceived market value from the mNAV metric could impede potential transactions in the digital asset space. When sellers opt not to sell below this threshold, it suggests that there may be a lack of consensus on the actual performance and growth potential of their holdings, leading to potential volatility as market dynamics shift.

Investors and analysts alike use mNAV to gauge the health of a DAT, weighing its assets against current market conditions. Hence, understanding how mNAV interplays with broader market sentiments gives stakeholders insight not only into current valuations but also into future potential. Thus, savvy investors need to remain aware of the mNAV implications when engaging in transactions involving DATs, particularly in a landscape where the separation of underlying asset values and market perceptions is especially pronounced.

Rudick’s Upexi Statement on the Future of DATs

Rudick’s statement regarding the future trajectory of Digital Asset Trusts highlights a complex interplay between valuation and acquisition potential. His assertion that many DATs are unlikely to see significant consolidation raises questions about the long-term strategy of these entities. Investors must carefully navigate this landscape, considering the implications of valuation metrics like mNAV and how they impact decision-making in acquisitions.

Moreover, Rudick emphasizes a vital consideration: the motivations behind sellers and buyers within this ecosystem. For sellers, asset retention at or above the established mNAV seems preferable, while buyers are hesitant to invest in DATs that do not present clear and compelling valuations. This dynamic could mean that the digital asset market may see more organic growth strategies evolving among DATs instead of traditional acquisition models, pushing firms to innovate within their existing frameworks.

Consolidation Trends Among Digital Asset Trusts (DATs)

While the concept of consolidation usually draws attention in the finance and investment sectors, Rudick’s views on Digital Asset Trusts (DATs) provide a unique perspective on this trend. He suggests that significant consolidations are not likely due to the lack of incentive among sellers. This viewpoint indicates that DATs may instead focus on strengthening their current positions rather than merging or acquiring others, as maintaining asset value is prioritized.

The reluctance towards consolidation may also reflect broader trends in the digital assets market, where individual asset performance can significantly outweigh potential benefits from joining forces. Consequently, DATs might increasingly concentrate on honing their revenue streams and performance metrics instead of pursuing mergers, thereby redefining how success can be achieved in the digital asset sector.

Future Directions for Digital Asset Trusts

Looking ahead, the future of Digital Asset Trusts (DATs) appears poised for interesting developments as they adapt to evolving market conditions. Peering into strategies driven by revenue generation and asset management diversification can provide insights into how DATs will shape the financial landscape. Such adaptations may include creating specialized funds tailored to emerging digital assets or targeting unique niches within established assets, thereby setting themselves apart in a competitive market.

Moreover, as the infrastructure for digital assets continues to mature, DATs can find innovative pathways to foster sustainability and growth. A clear understanding of market vulnerabilities and investment trends enables them to pivot swiftly, ensuring they remain relevant. Through these approaches, DATs can remain resilient in a shifting landscape while still pursuing their goals of value creation and asset maximization.

Navigating the Digital Asset Market: Key Considerations

For investors and strategists in the realm of Digital Asset Trusts (DATs), understanding the dynamics of the current market landscape is paramount. The context provided by Rudick regarding mNAV highlights the necessity of maintaining a robust approach to valuation. Investors must be prepared to assess the true worth of DATs against market alternatives and make informed decisions on when to hold or divest their positions.

Moreover, as DATs navigate fluctuating sentiments and valuation challenges, the importance of thorough market research and asset performance analysis becomes exceedingly clear. The ability to determine which assets promise the most significant returns and how to pivot strategies accordingly will be crucial for success. Maintaining this focus not only supports DATs in generating revenue but also establishes confidence among investors, driving more substantial commitment to digital asset initiatives.

Digital Asset Trusts and the Innovation Agenda

Digital Asset Trusts (DATs) are at a crossroads where innovation can either propel them forward or hinder their growth trajectory. Companies like Upexi are leading the charge by exploring new concepts of asset management and value creation. As Rudick’s insights shed light on the cautious approach towards acquisitions, it becomes apparent that DATs must seek innovation through internal development rather than relying solely on external mergers and acquisitions.

Moreover, innovation in the digital assets sector can take many forms, from new technological implementations to novel financial products designed for better asset utilization. As competition increases and the need for differentiation becomes evident, DATs that leverage fresh ideas and technologies will likely experience robust growth and enhanced market positions. Thus, an innovation-driven agenda is essential for modern DATs aiming to thrive in an increasingly sophisticated financial landscape.

Evaluating the Potential of Digital Asset Acquisitions

In the world of Digital Assets, evaluating potential acquisitions necessitates a careful balance between risk and reward. According to Rudick, a cautious outlook prevails among potential buyers regarding the true value of DATs. Concentrating solely on direct market purchases rather than taking a chance on DATs at above-mNAV values, buyers highlight the struggles in creating a viable acquisition strategy in this sphere.

To be successful, DATs must demonstrate their value proposition clearly and effectively communicate how their acquisitions would lead to enhanced revenues or asset growth. This means engaging in thorough market analysis to understand not just the fundamental value of their assets, but also possible synergies that can be created from potential acquisitions. Such strategic insights will aid DATs in positioning themselves more favorably in negotiations, ultimately changing the narrative around acquisitions in the digital asset space.

Frequently Asked Questions

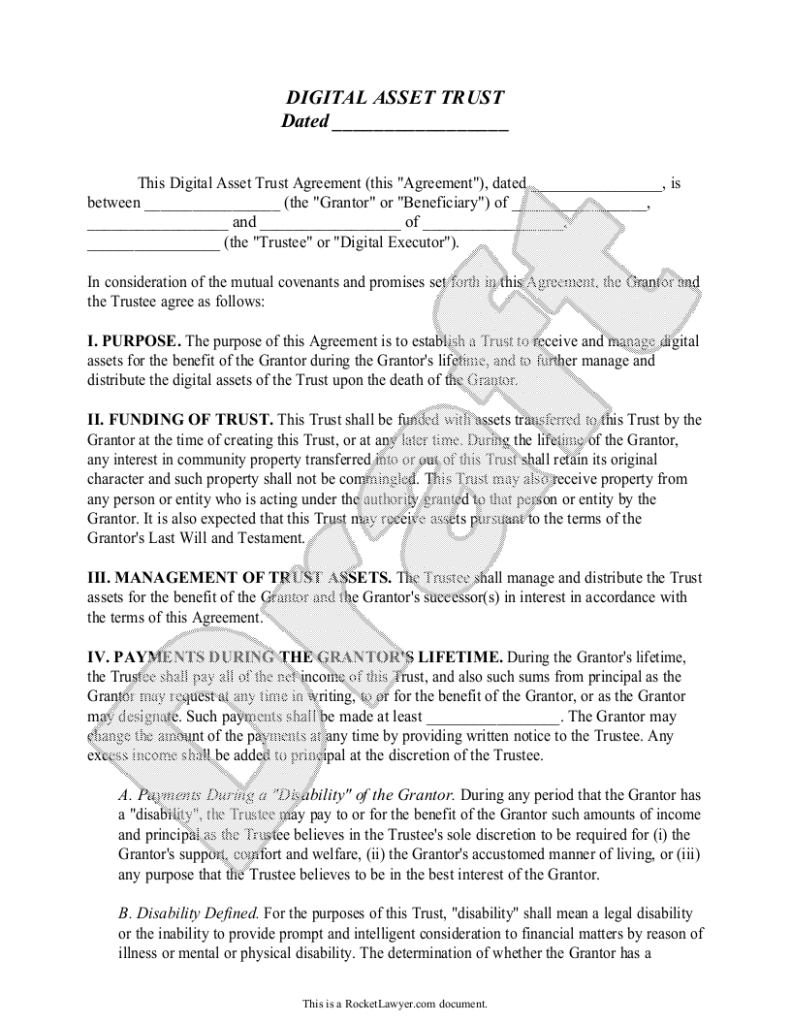

What are Digital Asset Trusts and how do they operate?

Digital Asset Trusts (DATs) are investment vehicles designed to hold digital assets such as cryptocurrencies. They operate by pooling investor funds to acquire and manage these assets, aiming to generate revenue through capital appreciation and income from asset holdings.

What is the significance of mNAV (market Net Asset Value) in Digital Asset Trusts?

mNAV, or market Net Asset Value, is crucial for Digital Asset Trusts as it represents the valuation metric that defines the worth of the assets held by the trust. Rudick highlights that this metric influences both the motivations of sellers and buyers in the digital asset market.

Why is there skepticism about consolidation among Digital Asset Trusts?

Rudick’s statement indicates skepticism regarding consolidation among Digital Asset Trusts due to the reluctance of sellers to sell below 1.0 times mNAV. Sellers can achieve better value by selling assets directly in the market, reducing the incentive for mergers and acquisitions.

How do Digital Asset Trusts generate revenue?

Digital Asset Trusts can generate revenue through various avenues such as capital gains from asset appreciation, income from staking or lending digital assets, and selective acquisitions that enhance their portfolio’s value.

What role do acquisitions play in the growth of Digital Asset Trusts?

Acquisitions in digital assets can enhance the value proposition of Digital Asset Trusts by allowing them to expand their asset base. However, according to Rudick, the current market conditions may limit these acquisitions due to the constraints of mNAV valuations.

What challenges do Digital Asset Trusts face regarding market transactions?

Digital Asset Trusts face challenges in market transactions primarily due to the valuation threshold of 1.0 times mNAV, which discourages both buyers from overpaying for trusts and sellers from selling at a loss, thus impacting potential consolidation.

Are Digital Asset Trusts likely to undergo major transformations in the near future?

While Digital Asset Trusts are positioned for growth through new revenue sources and selective acquisitions, Rudick suggests that significant transformations through consolidation are unlikely due to the current market dynamics surrounding mNAV.

| Key Point | Details |

|---|---|

| Value Creation via DATs | DATs may generate revenue and new income sources, alongside selective acquisitions. |

| Lack of Expected Consolidation | Significant mergers and acquisitions among DATs are not anticipated by Rudick. |

| Seller Motivation | Sellers are unlikely to sell below 1.0 times mNAV as they can sell assets at face value. |

| Buyer Justification | Buyers have no justification for paying more than 1.0 times mNAV; they can buy assets directly. |

Summary

Digital Asset Trusts (DATs) represent a growing segment in the financial landscape, with a focus on value creation through revenue generation and acquisitions. However, the market dynamics suggest a hesitance towards significant consolidation, as both sellers and buyers are constrained by mNAV valuations. This indicates that while DATs aim for growth, the current market conditions may limit transformative mergers and acquisitions.