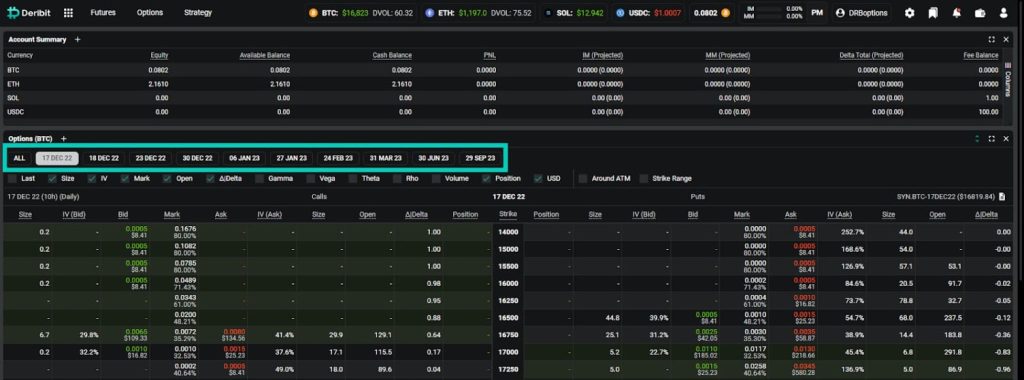

Deribit options trade is gaining traction in the crypto community as traders increasingly turn to derivatives for strategic market plays. Recently, a notable transaction on this popular exchange involved a trader purchasing 660 BTC call options at a strike price of $120,000 and an equal number of BTC put options at $80,000. This trading activity, flagged by on-chain analyst Ai Yi, highlights the intensifying crypto trading trends as we approach the options expiration date of March 27, 2026. With a hefty investment of approximately $860,000 in call options and about $1.5 million in put options, this move illustrates a keen anticipation of future Bitcoin price movements. As more investors flock to Deribit BTC options, the landscape of digital asset derivatives continues to evolve, inviting further exploration and discussion among market participants.

In the realm of cryptocurrency trading, derivatives play a pivotal role, especially on platforms like Deribit. Options trading, particularly with BTC call and put options, allows traders to hedge against volatility while speculating on price movements. Recent market developments have shown an increased interest in these instruments, as demonstrated by a significant buy order involving numerous call and put options. As traders look to navigate the complexities of the crypto market, understanding the implications of options expiration dates becomes crucial for making informed decisions. With the rise of crypto trading trends, platforms specializing in BTC options are becoming essential tools for both new and experienced traders.

Understanding BTC Call and Put Options

BTC call options give traders the right to buy Bitcoin at a specified price before an expiration date, while BTC put options provide the right to sell Bitcoin at the given strike price. In our case, a specific trader on Deribit made a notable transaction, purchasing 660 BTC call options and 660 BTC put options, demonstrating a strategy that captures potential market movements in both bullish and bearish scenarios. This dual approach is particularly crucial for savvy traders looking to hedge against volatility in crypto trading trends.

By acquiring call options with a strike price of 120,000 USD and put options at 80,000 USD, the trader is effectively betting on the future price of Bitcoin, anticipating significant price movements. The options expiration date of March 27, 2026, allows ample time for market conditions to evolve, hence, the strategy can be closely monitored for profitability. Such strategic trades on Deribit BTC options indicate a sophisticated understanding of market behavior and projected price volatility, which is vital for success in the ever-changing crypto landscape.

The Impact of Options Expiration on Market Volatility

Options expiration dates can have a substantial impact on market volatility, especially in the cryptocurrency sector. When large amounts of options are set to expire, traders often adjust their positions leading up to this date, creating significant price movements. In the case of the aforementioned Deribit trade, the expiration date on March 27, 2026, may lead to fluctuations in Bitcoin’s price as traders anticipate whether the market will move above the 120,000 USD strike for calls or below the 80,000 USD strike for puts.

Furthermore, after options expiration dates, there can be a repricing of BTC call and put options as traders reassess their positions and market conditions. This is particularly relevant for traders and investors who are keenly following crypto trading trends, as any movement in Bitcoin’s price could lead to substantial gains or losses, depending on the options contracts held. Therefore, understanding the implications of options expiration helps traders have a clearer strategy while navigating potential market dynamics.

Analyzing Market Sentiment Through Deribit Options Trade

The recent Deribit options trade of 660 BTC call options and 660 BTC put options showcases how traders are positioning themselves based on market sentiment. Usually, high volumes in both put and call options can indicate that a trader expects significant volatility or is hedging against unexpected market movements. This trade reflects confidence in market fluctuations for the near future, embodying a strategic balance between risk and reward based on anticipated developments within the crypto market.

On-chain analysts, such as Ai Yi, provide insights into such transactions, giving context to market behavior and investor sentiment. The 1.5 million USD allocated for put options signifies a protective stance against downward price movements, while the 860,000 USD spent on call options indicates an optimistic outlook for Bitcoin’s price appreciation. Monitoring these trades offers critical insights into how traders are reacting to market conditions and helps anticipate future price trends, making it essential for crypto enthusiasts and traders alike.

The Significance of Strike Prices in Options Trading

The strike price of an options contract is pivotal to options trading, as it determines the point at which the option becomes profitable. In our example, the defined strike prices of 120,000 USD for BTC call options and 80,000 USD for BTC put options are critical metrics for assessing the trader’s expectations and market outlook. These levels play a fundamental role in signaling potential resistance and support levels in Bitcoin’s price, particularly as the options expiration date approaches.

The choice of strike prices reflects the trader’s belief in the future movements of Bitcoin’s price, signaling confidence in substantial price movements within the specified timeframe. Such strategic strike price selections contribute to the larger narrative of market dynamics, helping other traders gauge the sentiment and potential trading strategies based on prevailing crypto trading trends. Analyzing these decisions yields insights into market expectations and the likely behavior leading up to and following the options expiration.

Key Considerations for Crypto Traders in 2026

As we progress through 2026, traders need to consider several factors affecting the crypto landscape, including regulatory changes, technological advancements, and shifting market sentiment. The transaction details involving BTC options on Deribit hint at larger trends that could shape trading strategies in the coming months, particularly concerning Bitcoin’s price action and external market forces. The prospect of regulatory scrutiny or impactful news events could lead traders to adopt more conservative or aggressive trading positions.

Another consideration lies in the fundamental analysis of Bitcoin’s underlying factors, including its supply-demand dynamics and macroeconomic trends that may influence price movements. Traders who engage in crypto trading must stay abreast of these developments to adapt their strategies effectively. Additionally, monitoring the upcoming options expiration date provides clarity and allows traders to assess their risk exposure and potential profitability associated with their investments.

Exploring the Role of On-Chain Analysis

On-chain analysis has become an invaluable tool in the cryptocurrency realm, providing deeper insights into market dynamics. Analysts like Ai Yi monitor specific transactions, like the sizeable Deribit options trade discussed earlier, to gauge market trends and trader sentiment. By assessing historical data, transaction volumes, and trader behaviors, on-chain analysts can predict potential outcomes based on past behaviors, allowing traders to make more informed decisions.

In this context, on-chain analysis serves not just as a tool for understanding past trends but also for predicting future price movements and market dynamics. The insights gleaned from such analysis can be critical for traders, especially those engaged in BTC call and put options. Recognizing the implications of major trades can help traders align their strategies with potential market shifts, fostering more efficient trading practices in the crypto market.

Strategic Implications of Large Options Trades

Large options trades, like the one executed on Deribit, can significantly influence market dynamics and trader psychology. When a trader takes a substantial position in BTC call and put options, it can signal confidence or fear in the market, often prompting others to take similar actions. This ripple effect can lead to increased market volatility, especially as the expiration date approaches and traders adjust their positions accordingly.

Additionally, the strategic implications of such high-stakes trades extend beyond immediate profits. They reflect a deeper understanding of the market and can influence how other traders perceive potential future price movements. As traders analyze the motivations behind these large options transactions, they can better position themselves in anticipation of price fluctuations, making it a vital aspect of trading strategies in the rapidly evolving crypto ecosystem.

Navigating Uncertainty in Crypto Trading

The crypto market is renowned for its unpredictability, making it essential for traders to adopt strategies that mitigate risk. Understanding the intricacies of options trading—including the balance between BTC call and put options, and the analysis of upcoming expiration dates—is crucial. As evidenced by the recent Deribit transactions, traders must be well-prepared to navigate through cycles of bullish optimism and bearish corrections to safeguard their investments.

Moreover, recognizing the signals provided by major trades and market sentiment can further bolster a trader’s ability to navigate uncertainty. With tools like on-chain analysis and historical data insights, traders can develop informed trading strategies that adapt to new information and evolving market conditions. This adaptability is key to surviving and thriving in a volatile market, as traders seek to capitalize on the opportunities presented by rapid price changes.

Future Trends in Bitcoin Options Trading

The future of Bitcoin options trading is poised for growth, driven by increasing participation from institutional investors and evolving market strategies. As more traders flock to platforms like Deribit to execute their options trades, the market is likely to see a rise in the sophistication of trading strategies. With innovations in trading tools and greater access to data analytics, traders can develop more precise and personalized approaches tailored to their risk appetites.

Furthermore, as regulatory frameworks around cryptocurrencies continue to develop, the legitimacy and acceptance of Bitcoin and other digital assets in mainstream finance will enhance participation in options trading. The potential for advanced trading strategies, including complex derivatives involving BTC call options and BTC put options, could provide opportunities for diversification and hedging in trader portfolios. An awareness of these future trends will be critical for traders aiming to stay ahead in the competitive world of crypto trading.

Frequently Asked Questions

What are BTC call options on Deribit and how do they work?

BTC call options on Deribit give traders the right, but not the obligation, to purchase Bitcoin at a predetermined strike price before the options expiration date. In this case, a trader recently bought 660 BTC call options with a strike price of 120,000 USD, indicating a bullish outlook on Bitcoin’s price.

What are BTC put options on Deribit?

BTC put options on Deribit provide the holder with the right to sell Bitcoin at a specified strike price prior to the options expiration date. A trader recently executed a transaction for 660 BTC put options at a strike price of 80,000 USD, reflecting expectations of downside risk in the market.

How do the options expiration dates impact Deribit options trades?

Options expiration dates are crucial in Deribit options trades, as they determine the time frame in which the options can be exercised. In this instance, the options purchased have an expiration date of March 27, 2026, indicating that the trader anticipates significant price movement before this date.

What indicators can signify crypto trading trends on Deribit?

Crypto trading trends on Deribit can often be identified through large transactions, such as the recent purchase of BTC call and put options. This transaction, along with its notable volume of approximately 860,000 USD for call options and 1.5 million USD for put options, indicates potential shifts in market sentiment.

What is the significance of a trader buying both call and put options on Deribit?

When a trader buys both call and put options like this trader on Deribit, it can indicate a strategy to hedge against volatility or to capitalize on anticipated price fluctuations within a specified range. The dual purchase reflects the trader’s outlook on future market uncertainty, especially with the options expiration date approaching.

| Key Point | Details |

|---|---|

| Trader’s Action | Bought 660 BTC call options and 660 BTC put options. |

| Call Options Strike Price | 120,000 USD. |

| Put Options Strike Price | 80,000 USD. |

| Transaction Date | January 7, 2026. |

| Expiration Date | March 27, 2026. |

| Cost of Call Options | Approximately 860,000 USD. |

| Cost of Put Options | Around 1.5 million USD. |

| Market Impact | Transaction has attracted market attention, indicating trader’s outlook on future trends. |

Summary

Deribit options trade highlights a significant position taken by a trader who purchased both call and put options, showing confidence in anticipated market movements. This strategic approach, focused on potential volatility, illustrates how traders seek to manage risk and capitalize on future price fluctuations.