DeepBook Margin has officially launched, marking a significant advancement in on-chain trading within the Sui ecosystem. This innovative platform introduces fully composable leveraged trading functionality, allowing traders to maximize their investment potential through Sui trading. With the ability to execute trades using leverage, users are positioned to benefit from market fluctuations while minimizing risk. Additionally, DeepBook Margin empowers developers with an SDK and API, enabling seamless integration of leveraged trading into decentralized applications without the need for complex infrastructure. As a unique opportunity for asset holders, it also opens pathways for earning passive income in the crypto space by contributing liquidity to leveraged trading pools.

The recent debut of DeepBook Margin unveils a new era for the realm of leveraged trading in the Sui network. This platform sets itself apart by offering a fully on-chain framework that enables users to engage in sophisticated trading strategies with ease. By harnessing composable trading technologies, DeepBook Margin invites developers to incorporate advanced trading mechanics into their applications effortlessly. As traders utilize this innovative tool for maximizing their profits, the potential for passive earnings through liquidity provision becomes increasingly attractive. For anyone interested in expanding their crypto portfolio, this leveraged trading solution stands as a remarkable opportunity.

| Key Feature | Description |

|---|---|

| Launch of DeepBook Margin | DeepBook Margin introduces leveraged trading functionality on Sui, live from January 23, 2026. |

| On-chain Trading | All trading activities are conducted entirely on-chain, enhancing transparency and security. |

| Composable Functionality | Allows developers to integrate leveraged trading seamlessly into their DApps using provided SDK and API. |

| No Need for Risk Engine | Developers do not have to create a risk engine or manage liquidity, simplifying the process. |

| Passive Income Opportunities | Asset holders can earn passive income by staking dbUSDe and providing liquidity to the trading pool. |

Summary

DeepBook Margin is a groundbreaking feature that significantly enhances the trading capabilities on Sui. This innovative introduction facilitates fully on-chain and composable leveraged trading, empowering developers and asset holders alike. With seamless integration options available via SDK and API, there’s no need for a complex risk management setup, making it easier than ever to engage in leveraged trading while offering passive income opportunities for liquidity providers. The launch marks a significant step forward for decentralized finance within the Sui ecosystem.

Introducing DeepBook Margin: Revolutionizing Leveraged Trading

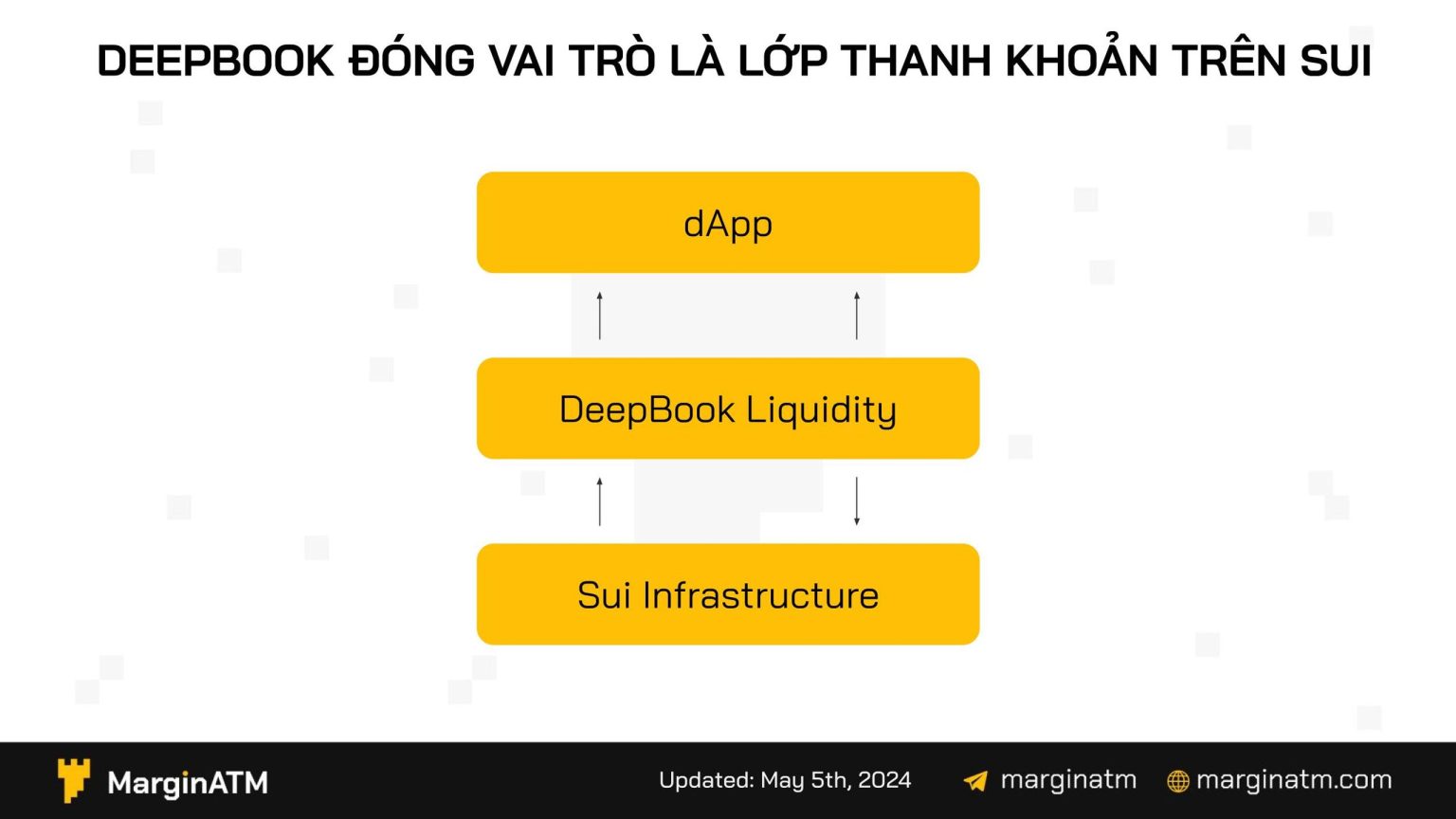

The launch of DeepBook Margin marks a significant milestone in the landscape of Sui trading by offering fully on-chain and composable leveraged trading functionalities. Unlike traditional trading platforms, DeepBook enables developers to seamlessly integrate advanced trading features directly into their decentralized applications (DApps) using an easy-to-navigate SDK and API. This not only enhances trading efficiency but also allows developers to focus on innovation without the burden of creating complex risk engines or sourcing liquidity independently.

By leveraging DeepBook Margin, users can experience a new level of trading flexibility. The platform’s composable design allows for the creation of tailored trading experiences, suitable for both novice traders and seasoned professionals. With integral features such as risk management being managed on-chain, traders can operate with confidence, knowing all transactions are secure and transparent. As the demand for sophisticated trading solutions continues to rise in the crypto market, DeepBook Margin stands poised to redefine the trading experience for Sui users.

Enhancing Liquidity and Passive Income Opportunities

One of the standout features of DeepBook Margin is its potential to enhance liquidity in the Sui ecosystem. Asset holders now have the opportunity to earn passive income by contributing to the liquidity pool used in leveraged trading. By staking dbUSDe, users not only provide crucial liquidity support but also benefit from trading fees and other associated earnings, making it a win-win situation. This model empowers users to efficiently allocate their assets while generating continuous returns without actively participating in the market.

The passive income aspect is particularly appealing to those exploring cryptocurrency investments, as it allows asset holders to engage in Sui trading without the need for active trading strategies. As the cryptocurrency market evolves, methods to earn without direct market involvement become invaluable. DeepBook Margin facilitates this with a streamlined process for staking, which makes it easier than ever for users to maximize their holdings and enjoy the benefits of on-chain trading while maintaining a hands-off investment approach.

The Impact of Composable Trading on the Sui Ecosystem

Composable trading, as introduced by DeepBook Margin, signifies a transformative approach to decentralized finance. By enabling various components of the trading process to interact fluidly, users can create more complex and tailored strategies that suit their specific financial goals. This flexibility is essential in maximizing the advantages of on-chain trading, allowing users to react swiftly to market changes and manage their risk more effectively than traditional trading methodologies.

Furthermore, the composability of trading features means that developers can build upon each other’s innovations, fostering a collaborative environment for growth within the Sui ecosystem. As tools and functionalities become increasingly integrated, the potential for creating comprehensive trading protocols expands, paving the way for more sophisticated investment strategies and products. This collaboration not only enhances user experience but also drives the adoption of on-chain trading within the broader crypto community.

Leveraged Trading: A Risk-Reward Strategy

Leveraged trading, while offering the potential for greater profits, also comes with its inherent risks. With DeepBook Margin’s on-chain capabilities, users can engage in leveraged trading with more transparency and control. Understanding the mechanics of leverage is crucial for traders, as it allows them to amplify their exposure to market movements—both upward and downward. This characteristic makes it essential for traders to implement solid risk management practices to mitigate potential losses.

To leverage effectively, users need to stay informed about market trends and strategies that can influence their trading decisions. DeepBook Margin provides users the tools necessary for informed trading, including actionable insights and real-time data analytics. This strategic approach promotes a balanced perspective on risk-taking, empowering traders to navigate the complexities of leveraged trading confidently.

Building a Sustainable Crypto Ecosystem with DeepBook Margin

The launch of DeepBook Margin goes beyond just introducing leveraged trading; it signifies a commitment to building a sustainable crypto ecosystem. By enabling liquidity provisioning and passive income opportunities for users, the platform encourages a more engaged and participative community. As liquidity providers contribute to the trading pool, they play a crucial role in ensuring that traders have access to the resources they need for successful transactions, thereby fostering a self-sustaining cycle of trading.

Moreover, sustainability is critical in the rapidly evolving crypto space, where projects often come and go. DeepBook’s focus on creating a robust infrastructure where developers and traders can thrive contributes to a steady growth in trust and user adoption. Insightful features and a reliable framework created by DeepBook Margin could not only attract new users but also retain existing ones, thereby solidifying the project’s place in the Sui trading ecosystem.

The Future of Sui Trading: Innovations Ahead

The launch of DeepBook Margin positions Sui at the forefront of trading innovation. As the demand for sophisticated trading solutions grows, the integration of fully on-chain and composable trading functionalities is expected to set new standards within the space. Innovations in trading technology, user experience, and risk management will likely emerge as developers harness DeepBook Margin’s capabilities, leading to more streamlined operations across the Sui network.

With continuous updates and improvements on the horizon, users can look forward to an expansive array of trading options. Future innovations may include enhanced algorithms for automated trading strategies, improved liquidity incentives, and advanced data analysis tools designed to optimize trading efficiency. As the Sui ecosystem evolves with these advancements, it is poised to become a leading platform for traders seeking both flexibility and opportunity.

Understanding On-Chain Trading Mechanics

On-chain trading represents a paradigm shift in how transactions are executed and recorded in the cryptocurrency space. With DeepBook Margin, users enjoy unparalleled transparency and security, as each transaction is logged directly on the blockchain, providing an immutable record of trading activities. This not only fosters trust among participants but also allows for increased accountability within the trading process.

Moreover, the ability to execute trades on-chain means that users can benefit from reduced reliance on centralized exchanges, which often come with limitations and vulnerabilities. By participating in on-chain trading via DeepBook Margin, users can maintain greater control over their trading activities and assets, enabling a more decentralized approach to financial transactions that resonates with the ethos of the cryptocurrency community.

Engaging with Sui’s Community: Leveraged Trading and Beyond

Community engagement is essential for the success of any trading platform, and DeepBook Margin places significant emphasis on fostering a vibrant trading community. By encouraging users to take part in discussions and share insights, DeepBook cultivates an environment where knowledge and strategies can be exchanged freely. This collaborative approach not only aids individual traders but also strengthens the Sui ecosystem as a whole.

Furthermore, the integration of educational resources and community-driven initiatives into the DeepBook Margin platform can empower users to navigate leveraged trading with greater confidence. Offering tutorials, webinars, and interactive content can help demystify the complexities of trading, ensuring that both novices and experienced traders can partake in Sui trading effectively. By cultivating an informed community, the platform is set to increase overall user satisfaction and engagement.

Navigating the Risks of Leveraged Trading on DeepBook Margin

While leveraged trading provides promising opportunities to amplify profits, it also entails significant risk. Users engaging in leveraged trading on DeepBook Margin must exercise caution and establish robust strategies to manage potential downsides effectively. Risk management techniques, such as stop-loss orders and careful leverage selection, are crucial for trading success, especially in a volatile environment like cryptocurrency.

Users should also familiarize themselves with the mechanics of leveraged trading offered by DeepBook Margin to understand its implications fully. Educational resources embedded within the platform can guide users on best practices and help them cultivate a responsible trading mindset, ultimately reducing the likelihood of incurring substantial losses while maximizing the potential for returns.

Frequently Asked Questions

What is DeepBook Margin and how does it relate to Sui trading?

DeepBook Margin is a newly launched feature that provides fully on-chain and composable leveraged trading capabilities specifically for Sui. It allows traders to engage in Sui trading with enhanced leverage, making it possible to amplify their positions while managing risk directly on the blockchain.

How does DeepBook Margin facilitate leveraged trading?

DeepBook Margin facilitates leveraged trading by allowing developers to integrate its functionalities directly into their decentralized applications (DApps) using its Software Development Kit (SDK) and Application Programming Interface (API). This means developers do not need to build their own risk engine or manage liquidity, streamlining the process for Sui trading.

Can I earn passive income using DeepBook Margin?

Yes, you can earn passive income through DeepBook Margin by providing liquidity to the leveraged trading pool. By staking dbUSDe, asset holders can contribute to the liquidity necessary for leveraged trades while earning rewards over time.

What advantages does composable trading offer with DeepBook Margin?

Composable trading with DeepBook Margin offers significant advantages, including seamless integration into existing DApps, allowing for customizable trading experiences. This feature enhances the efficiency and functionality of leveraged trading for Sui users, making it an appealing choice for developers and traders alike.

What is the significance of on-chain trading in the context of DeepBook Margin?

On-chain trading, as implemented by DeepBook Margin, ensures that all trading activities are recorded directly on the blockchain. This transparency enhances security and trust, allowing users to engage in leveraged trading with confidence while benefiting from the decentralized nature of the Sui platform.

How does DeepBook Margin improve the user experience for leveraged trading?

DeepBook Margin improves the user experience for leveraged trading by providing an easy-to-use interface that integrates with DApps, offering immediate access to leveraged trades. The composable nature of the system allows for tailored trading solutions, catering to the diverse needs of traders in the Sui ecosystem.

What are the risks associated with using DeepBook Margin for leveraged trading?

While DeepBook Margin offers enhanced trading opportunities, leveraged trading also comes with inherent risks, including the potential for amplified losses. Users should approach leveraged trading with caution, utilizing risk management strategies and fully understanding the Sui trading environment.

How can developers leverage the SDK and API of DeepBook Margin?

Developers can utilize the SDK and API of DeepBook Margin to easily integrate leveraged trading functionalities into their DApps. This powerful toolset allows for seamless deployment of trading features without the overhead of building foundational risk management and liquidity structures.