The recent takedown of Cryptomixer marks a significant blow to the illicit crypto landscape, disrupting a notorious laundering operation that has facilitated $1.4 billion in money laundering activities since its inception. The service, known for its role in aiding ransomware groups and dark web markets, was dismantled by European authorities, led by teams from Germany and Switzerland in a coordinated action supported by Europol. This operation not only seized crucial servers and vast amounts of data but also underscores the intensified efforts against crypto crime across the region. In doing so, it highlights a growing concern over the use of crypto mixers in dark web laundering and their connection to an array of criminal undertakings, including ransomware attacks and large-scale fraud. As the dust settles on this significant crypto mixer shutdown, experts predict that while there will be immediate disruption, many of these criminal enterprises will quickly seek out alternative money laundering operations.

In a sweeping initiative against digital currency crime, authorities have successfully dismantled a major crypto laundering service that had been in operation for nearly a decade. This shut down follows a comprehensive investigation into the practices of illicit money movement through various channels, particularly those linked to underground forums and ransomware syndicates. Leveraging cross-border cooperation, law enforcement agencies targeted the intricate web of transactions often obscured by such mixers, which play a vital role in concealing the origins of illicit funds. The recent actions against this crypto mixer not only disrupt existing criminal networks but also shed light on the broader challenges of tackling money laundering operations that exploit blockchain technologies. As we navigate through an era increasingly dominated by digital currencies, the relevance of addressing dark web laundering and the threats posed by crypto-enabled crime only intensifies.

The Impact of the Cryptomixer Takedown on Ransomware Groups

The recent takedown of Cryptomixer marks a significant disruption in the operational capabilities of ransomware groups that have long relied on this crypto mixing service. For nearly a decade, cryptocurrencies like Bitcoin flowed through Cryptomixer, totaling an astounding $1.4 billion in laundered funds. By blocking the traceability of these transactions on the blockchain, Cryptomixer facilitated various illicit activities, allowing ransomware groups and other criminal organizations to obscure their financial trails. With its closure, these groups are now facing immediate challenges as they scramble to find alternative laundering options, which is likely to hinder their operations temporarily.

While the takedown may bring short-term disruptions, experts anticipate that many of these ransomware crews will adapt quickly to this setback. History shows that when such high-scale services are dismantled, criminal enterprise often evolves, migrating to other available mixing services or even creating their own. The reliance on mixers highlights the dark side of cryptocurrency, as these tools are intertwined with the funding of cybercrime, making it clear that cutting off these financial lifelines is essential in the ongoing fight against digital crime.

Europol’s Crackdown on Crypto Crime: A Wider Strategy

The dismantling of Cryptomixer underscores Europol’s commitment to cracking down on cryptocurrency-related crime across Europe. This operation was supported by intelligence sharing and collaboration between law enforcement agencies from Germany and Switzerland, demonstrating an integrated approach against cybercrime. The complex web of money laundering operations, especially in connection with ransomware and dark web activities, necessitates such coordinated efforts. Furthermore, the seizure of significant data and financial resources from Cryptomixer illustrates the scale and seriousness of this laundering hub.

In recent months, Europol has intensified its focus on tackling crypto-enabled crimes, as illustrated by concurrent arrests in Cyprus, Spain, and Germany targeting individuals involved in expansive money laundering networks. These coordinated raids and takedowns are essential components of a broader strategy to disrupt the financial infrastructure supporting cybercriminals. By addressing the underlying money laundering operations, authorities aim not only to dismantle existing frameworks but also to deter future investments in crypto crime ventures.

The Role of Crypto Mixers in Money Laundering Operations

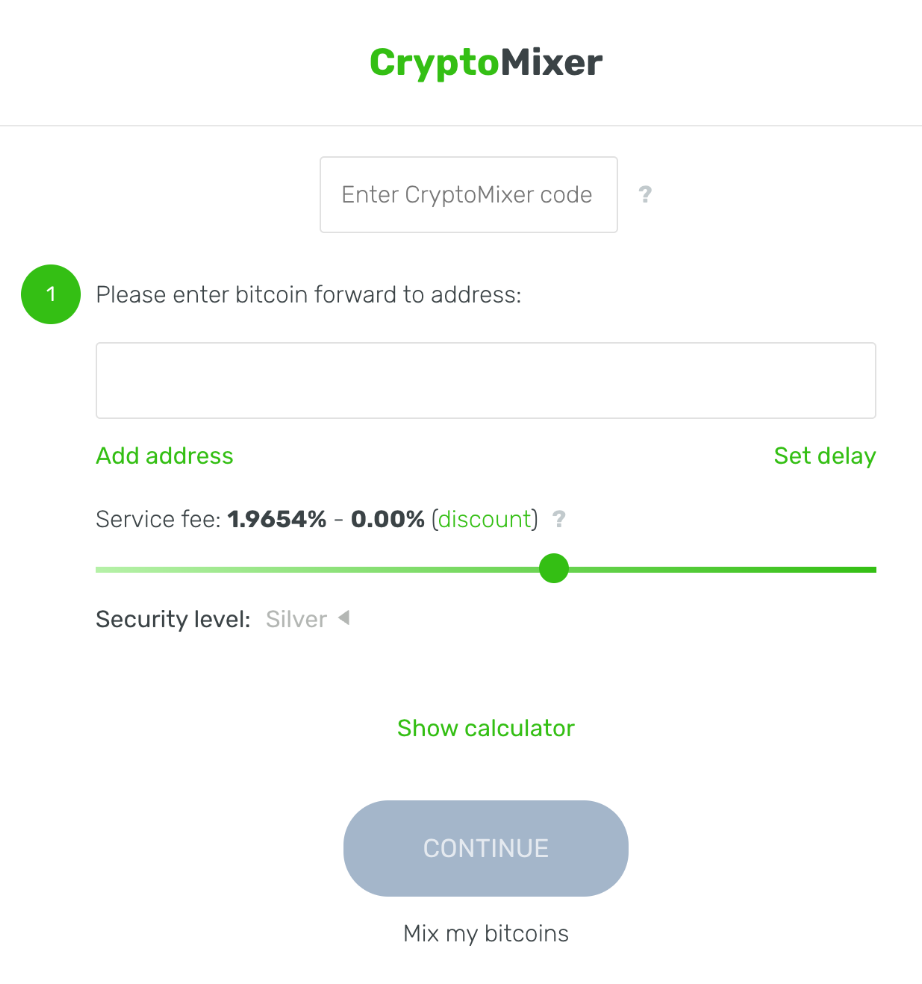

Crypto mixers like Cryptomixer play a pivotal role in facilitating money laundering operations within the cryptocurrency ecosystem. By pooling funds from multiple users and redistributing them, mixers effectively obfuscate the origins and destinations of crypto transactions, making it extremely challenging for law enforcement to track illicit funds. This operational model has been particularly beneficial for ransomware groups and other criminals, allowing them to legitimize their incomes while evading scrutiny from regulatory bodies.

The implications of this functionality are vast, as mixers have become integral to the operational success of dark web laundering. Law enforcement’s takedown of Cryptomixer not only disrupts a significant service but also sends a potent message to other mixers that their operations could be at risk. As authorities ramp up their investigations and enforcement in this domain, it’s crucial for these organizations to reassess their risk management strategies and seek compliance with legal frameworks if they wish to avoid similar fates.

Dark Web Laundering: The Challenges Faced Post-Cryptomixer Takedown

Following the seizure of Cryptomixer, dark web laundering operations face a critical junction. Many criminals who utilized this mixer are now urgently searching for new avenues to launder their proceeds from illicit activities. The impact of such a major disruption is compounded by the intricate connections these mixers have with dark web markets and ransomware operations, forcing criminals to reconsider their strategies. In the short term, this situation may create vulnerabilities and opportunities for law enforcement to intervene further.

However, the adaptability of cybercriminals must not be underestimated. Ransomware groups are known for their resilience, often leveraging underground forums to share information and create new laundering solutions quickly. As a result, while Cryptomixer’s closure is a significant milestone in combating money laundering on the dark web, it is critical for law enforcement agencies to remain vigilant and proactive in dismantling successor services that may emerge in its place.

The Future of Cryptocurrency Regulation Post-Cryptomixer

The closure of Cryptomixer may signal a turning point in cryptocurrency regulation. As authorities increasingly target mixers that enable money laundering operations, the development of comprehensive regulatory frameworks is essential for curtailing the use of cryptocurrencies for illicit activities. Law enforcement agencies are realizing the need for more robust regulations that govern the use of cryptocurrencies, similar to those in traditional financial systems, thereby heightening the scrutiny of crypto mixing services.

Moreover, this regulatory push could pave the way for a more secure and transparent cryptocurrency environment. As the industry matures and adapts to these changes, legitimate businesses operating within the crypto space may benefit from clearer guidelines and regulations. This balance between effectively combating crime while fostering innovation in the sector is critical as stakeholders work together to shape the future of cryptocurrency regulation.

Challenges of Tracking Laundered Funds in the Crypto Space

Tracking laundered funds within the cryptocurrency space presents unique challenges, particularly in light of sophisticated services like Cryptomixer that obscured transaction trails. The complexity of blockchain technology, combined with the anonymous nature of many cryptocurrencies, complicates traditional law enforcement efforts. As criminal enterprises utilize advanced techniques to mask their activities, digital forensic analysts must innovate continually to improve tracking methods and identify suspect transactions.

The fallout from Cryptomixer’s takedown illustrates the urgency of these challenges in the crypto space. Authorities are investing in advanced analytical tools and technologies aimed at demystifying blockchain activities, yet the rapid evolution of laundering techniques employed by criminal organizations remains a formidable obstacle. Enhanced collaboration between governments, financial institutions, and cybersecurity experts will be essential to fortify defenses against this ever-growing tactic employed by cybercriminals.

Europol’s Role in the Fight Against Crypto Crime

Europol has emerged as a key player in combating crypto crime across Europe, showcasing its powerful capabilities in coordinating complex operations like that of Cryptomixer’s takedown. By leveraging intelligence sharing and developing task forces within the cybersecurity domain, Europol provides essential support to member states dealing with the rising tide of cybercrime. The agency’s strategic focus on crypto crime highlights the urgent need for enhanced international cooperation to tackle challenges presented by crime networks that operate across borders.

In addition to direct enforcement actions, Europol’s role involves increasing awareness of the risks associated with cryptocurrencies and mixtures such as Cryptomixer. Through initiatives aimed at educating law enforcement and the public, Europol is not only advancing its operational goals but also fostering a more informed society regarding the implications of digital currencies. As crypto crime continues to evolve, Europol’s proactive stance will be instrumental in crafting a safer digital financial landscape.

The Response of Financial Institutions to Crypto Mixers

In light of the recent takedown of Cryptomixer, financial institutions are reevaluating their approaches to cryptocurrencies, especially in relation to money laundering concerns. As awareness of the risks associated with crypto mixers grows, banks and financial service providers are compelled to implement stricter monitoring and compliance measures. This shift reflects an industry-wide recognition of the need to safeguard against potential connections to illicit activities that mixers may facilitate.

Furthermore, the incident prompts discussions around the integration of blockchain technology and cryptocurrencies within traditional financial systems. Financial institutions are exploring how they can incorporate innovative practices while ensuring that they comply with regulations. This dual obligation serves as a foundation for building resilient systems that can withstand the turbulence created by criminal elements seeking to exploit the financial landscape.

Evaluating the Long-term Effects of the Cryptomixer Shutdown

The long-term effects of the Cryptomixer shutdown will likely resonate across the cryptocurrency ecosystem for years to come. As criminal organizations seek to recover from this disruption, they will be forced to adapt their laundering strategies, possibly leading to the emergence of new services. The evolution of these services might also prompt further legal and regulatory action, ultimately shaping the future landscape for cryptocurrencies and their associated risks.

Moreover, the shutdown serves as a crucial reminder of the ongoing battle between law enforcement and cybercriminals. The more resources and strategies law enforcement agencies deploy to combat crypto-enabled crimes, the more sophisticated criminal organizations tend to become. This cyclical nature of technological advancement in the world of cybercrime indicates that sustained vigilance and adaptation on both sides will be essential in the battle against illicit activities in the crypto space.

Frequently Asked Questions

What led to the Cryptomixer takedown by Europol?

The Cryptomixer takedown was prompted by its role in laundering over $1.4 billion in Bitcoin for criminal activities including ransomware attacks and dark web laundering. European authorities, supported by Europol, dismantled this nine-year-old operation to disrupt money laundering operations linked to serious cybercrimes.

How did the Cryptomixer shutdown impact ransomware groups?

The Cryptomixer shutdown significantly disrupts ransomware groups that relied on its services for laundering illicit proceeds. Although this takedown will have immediate effects, experts believe that criminals may quickly shift to alternative crypto mixers to continue their money laundering operations.

What were the outcomes of the Cryptomixer operation in Switzerland?

During the Cryptomixer operation in Switzerland, authorities seized three servers, confiscated 12 terabytes of data, and recovered over $27 million in cryptocurrency. This coordinated effort also involved the shutdown of the cryptomixer.io domain and the placement of a seizure banner on its website.

What is the significance of Europol in the Cryptomixer takedown?

Europol played a crucial role in the Cryptomixer takedown by coordinating the cross-border operation, providing forensic support, and facilitating information exchange among law enforcement from Germany and Switzerland. This operation forms part of Europol’s ongoing efforts to combat crypto-enabled crime.

How can a crypto mixer like Cryptomixer facilitate money laundering?

Crypto mixers like Cryptomixer enable money laundering by obscuring the traceability of funds on the blockchain, making it easier for criminals involved in activities such as drug trafficking, weapons trade, and ransomware to launder their earnings without detection.

What are the future implications of the Cryptomixer takedown for dark web laundering?

The Cryptomixer takedown is expected to cause a temporary disruption in dark web laundering activities, but experts anticipate that criminals will eventually adapt by migrating to other crypto mixers. This means that while immediate operations are hindered, money laundering remains a persistent issue.

What role did Europol’s Joint Cybercrime Action Taskforce (J-CAT) play in the takedown?

Europol’s Joint Cybercrime Action Taskforce (J-CAT) was instrumental in the takedown of Cryptomixer by coordinating efforts between law enforcement agencies, providing real-time forensic support, and facilitating a smooth operation to dismantle the laundering hub.

| Key Point | Details |

|---|---|

| Takedown Location | Conducted in Switzerland with collaboration from Germany, Europol, and Eurojust. |

| Amount Laundered | Over $1.4 billion in Bitcoin since 2016. |

| Seizures | Three servers, 12 terabytes of data, and over $27 million in cryptocurrency were seized. |

| Duration of Operation | Cryptomixer operated for nearly nine years, showing operational maturity and reliability among criminal networks. |

| Impact on Criminals | Temporary disruption expected for ransomware groups; likely migration to alternative mixers within weeks. |

| Broader Context | Part of a wider European crackdown on crypto-related crime, with recent arrests related to a $689 million money laundering network. |

Summary

The Cryptomixer takedown marks a significant blow against cryptocurrency laundering operations that have supported illegal activities across Europe. This operation highlights the ongoing efforts by law enforcement to combat crypto-enabled crimes and disrupt major criminal enterprises. Despite the immediate impact of this takedown, experts anticipate that criminal networks will adapt quickly, migrating to alternative services. This incident not only underscores the scale of laundering activities facilitated by mixing services but also emphasizes the need for continued vigilance and collaboration among European authorities to address the evolving landscape of cybercrime.

Related: More from Regulation & Policy | Anthropic Founder Critiques Pentagons Choice as Unprecedented in Crypto Regulation | UK Gambling Regulator Examines Cryptocurrencies for Licensed Bettors in Crypto Regulation