Cryptocurrency’s Wild Ride: The Resurgence of the ‘Trump Trade’

In the volatile world of cryptocurrency, every geopolitical or economic shift can send shockwaves through the market. Recent observations indicate a reemergence of what financial analysts are calling the ‘Trump Trade’, a term that gained prominence during Donald Trump’s presidency. This article explores the resurgence of this trend and its implications for cryptocurrency.

The Origins of the ‘Trump Trade’

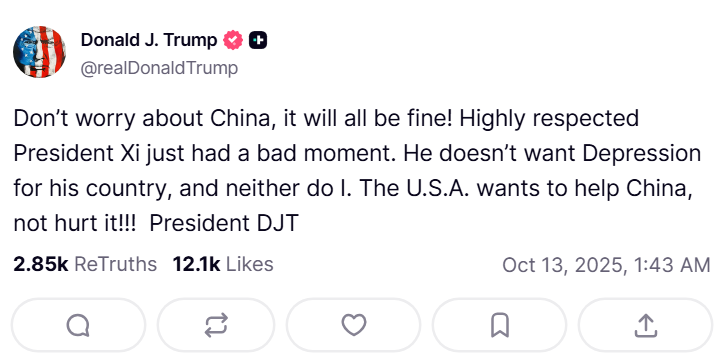

The ‘Trump Trade’ originally referred to market movements triggered by the policies and tweets of former U.S. President Donald Trump. His tenure was marked by aggressive economic policies, including tax cuts and deregulation, which had a profound impact on various sectors, including technology and finance. Notably, Trump’s approach to trade policies, particularly with China, created waves that ricocheted through the cryptocurrency markets, affecting values and investor behavior.

Cryptocurrency’s Initial Response

During Trump’s presidency, cryptocurrency markets saw significant volatility. For instance, his comments and policies on trade often led to a weaker dollar, which, conversely, strengthened Bitcoin’s appeal as a ‘digital gold’ or hedge against currency devaluation. This established an inverse relationship between Trump’s economic policies and the performance of crypto markets.

Current Trends: The Return of the ‘Trump Trade’

What’s intriguing now is the noticeable resurgence of this ‘Trump Trade’ dynamic in the cryptocurrency sphere, even as Trump himself is no longer in office. Several factors contribute to this phenomenon:

-

Speculation on Political Comeback: With speculations about Donald Trump possibly running for office again, investors are preemptively reacting to a potential repeat of his market-influencing policies.

-

Regulatory Landscape: Trump’s presidency had a complicated relationship with regulatory frameworks around technology and finance, including cryptocurrency. The current regulatory uncertainty recalls the Trump-era approaches, prompting investors to reconsider their strategies.

-

Economic Policies: Trump’s preference for protectionist policies could influence current economic strategies, especially those related to trade. Cryptocurrencies, used as alternative or parallel financial systems, become particularly appealing during such shifts.

- Market Sentiment: The cryptocurrency market is significantly influenced by investor sentiment, which can be swayed by political developments. The mere speculation of ‘Trump-style’ policies is enough to trigger market movements.

Implications for the Cryptocurrency Market

The implications of a revived ‘Trump Trade’ are profound. Firstly, if Trump were to return to a significant political role, it could increase market volatility. Investors might see this as an opportunity to hedge against potential market disruptions caused by aggressive national and trade policies.

Secondly, a political climate that mirrors the Trump era could cause shifts in the regulatory landscape, affecting how cryptocurrencies operate globally. For crypto investors and stakeholders, staying informed about political developments is as crucial as monitoring market fundamentals.

Conclusion

The ‘Trump Trade’ serves as a reminder of the intricate connections between politics, economics, and technological markets like cryptocurrency. As global geopolitical landscapes evolve, the agility to adapt to these changes remains a vital skill for investors. Whether or not Trump returns to the political arena, the movements his past presidency initiated offer valuable insights into the potential future trajectory of cryptocurrency markets.

In conclusion, as the world braces for more political, economic, and regulatory shifts, the cryptocurrency market continues to ride the extraordinary rollercoaster, influenced by factors well beyond conventional market predictors. The return of the ‘Trump Trade’ is just one facet of this complex mosaic, guiding investors through the choppy waters of financial speculation.