The remarkable growth of cryptocurrency wallets is reshaping the financial landscape as we approach 2025. Recent insights from Bitget Wallet reveal that these digital wallets are transitioning beyond just trading platforms, increasingly facilitating stablecoin payments and on-chain yield management. This evolution is particularly intriguing as stablecoin usage expands, reflecting a shift towards practical applications of blockchain technology that stand resilient against market sentiment fluctuations. In addition, crypto card spending via the Bitget Wallet has surged, showcasing a user-friendly approach to integrating cryptocurrencies into everyday financial transactions. As decentralized finance (DeFi) continues to flourish, the growth of cryptocurrency wallets is set to accelerate, allowing users to navigate a dynamic ecosystem of digital assets with ease and confidence.

The evolution of digital asset management is becoming a focal point in today’s financial world, particularly as cryptocurrency wallets are rapidly gaining traction. With the ability to handle stablecoin transactions, manage yields through on-chain strategies, and facilitate seamless crypto card payments, these wallets are revolutionizing how users interact with their assets. The increasing adoption of decentralized finance (DeFi) principles is further driving innovation in wallet capabilities, enabling easier access to various financial services. As the ecosystem develops, tools like the Bitget Wallet exemplify the shift towards a more integrated and user-centric approach to cryptocurrency storage and transactions. This multifaceted growth showcases the adaptability of wallets in meeting the diverse needs of the evolving digital economy.

The Rise of Stablecoin Payments in Cryptocurrency Wallets

Stablecoin payments are revolutionizing the way people interact with cryptocurrencies. As the market matures, users are increasingly turning to stablecoins for transactions, thanks to their ability to provide a more consistent value compared to traditional cryptocurrencies. The Bitget Wallet has been at the forefront of this trend, demonstrating significant growth in stablecoin-related transactions. Reports indicate that stablecoin payments are not only expanding the scope of cryptocurrency usage but also providing a reliable means of conducting business in a fluctuating market. With stablecoins now integrated into various payment scenarios, users can leverage their advantages without worrying about volatility.

Moreover, the surge in stablecoin payments has paved the way for innovations in the cryptocurrency wallet sector. With annual global stablecoin transaction volumes hitting approximately $46 trillion, it’s evident that users are seeking stability in their financial dealings. Bitget Wallet’s adoption of diverse payment features, including national-level QR code payments and local bank transfers, underscores this trend and caters to the growing demand for secure and convenient payment solutions. This shift towards stablecoin payments not only enhances user engagement but also positions cryptocurrency wallets as essential tools in financial ecosystems.

Expanding Use Cases of Cryptocurrency Wallets: From Trading to Payments

Cryptocurrency wallets have evolved significantly beyond their initial purpose of facilitating trading. The latest data from the Bitget Wallet illustrates this transformation, highlighting an expansive range of applications. One of the most notable developments is the remarkable rise in payment functionalities, which are helping to bridge the gap between digital assets and everyday transactions. With features like crypto card spending introduced earlier this year, users can now seamlessly integrate cryptocurrencies into their daily financial activities, making the process not only easier but also more appealing.

Furthermore, this evolution is reflected in the impressive trading volumes reported by Bitget Wallet. In 2025, the wallet saw a trading volume exceeding $900 million, signaling a strong demand for both trading and payment options. The shift in focus from merely trading cryptocurrency to incorporating payment solutions demonstrates how users are adapting to a more holistic financial ecosystem. As the landscape continues to change, wallets are poised to remain at the center of cryptocurrency adoption, enabling users to utilize their assets for various purposes, including on-chain yield management and stablecoin payments.

On-Chain Yield Management: A New Frontier for Crypto Investors

On-chain yield management represents a rapidly growing facet of decentralized finance that is attracting attention from both novice and experienced investors. As users increasingly look for ways to maximize their returns, products offered by platforms like Bitget Wallet are becoming essential. The subscription volume for their Earn offerings soared to nearly $200 million in the latest quarter, reflecting a tenfold increase since the year began. This surge is largely driven by stablecoin wealth management strategies and collaborations with leading DeFi protocols, indicating the importance of stablecoins in generating predictable yields.

The interest in on-chain yield management can be attributed to the need for reliability in an otherwise unpredictable market. Even as traditional trading volumes fluctuate, users are seeking refuge in stablecoin-based yield management solutions that offer consistent returns. This indicates a growing understanding among investors about the power of decentralized finance to provide alternate avenues for profit without being overly exposed to market volatility. As decentralized finance matures, it’s expected that on-chain yield offerings will become a staple within cryptocurrency wallets, further reinforcing their relevance in the financial landscape.

Bitget Wallet: Leading the Charge in Crypto Innovations

Bitget Wallet has emerged as a frontrunner in the evolution of cryptocurrency wallets, continuously innovating to meet the demands of its users. With cutting-edge features and user-friendly interfaces, the wallet simplifies the complexities of trading, payments, and yield management. The year 2025 marks a significant milestone for Bitget as it achieved unprecedented trading volumes and revenue growth, demonstrating the wallet’s pivotal role in shaping cryptocurrency usage behaviors. This innovation drive is likely to attract a broader audience, including those who are just starting their journeys into cryptocurrency.

In addition to its impressive trading capabilities, Bitget Wallet’s commitment to enhancing user experience is evident through its array of functionalities. From supporting various payment methods like cryptocurrency cards to optimizing on-chain yield management strategies, the wallet is adapting to the changing landscape of digital finance. The emphasis on user-centric design ensures that both seasoned traders and newcomers can engage confidently with cryptocurrencies. As the platform continues to evolve, Bitget Wallet is well-positioned to lead the charge in driving the growth of cryptocurrency wallet adoption.

Decentralized Finance and Its Impact on Cryptocurrency Wallets

Decentralized finance (DeFi) has transformed the cryptocurrency landscape, presenting innovative financial solutions that eliminate intermediaries. The emergence of DeFi protocols has directly influenced the functionality of cryptocurrency wallets, like Bitget Wallet, which now offer users access to a multitude of yield-generating opportunities. DeFi’s impact is evident in the growing number of users engaging with on-chain yield management products and platforms, highlighting a cultural shift towards a more democratic approach to finance.

As DeFi continues to mature, cryptocurrency wallets are being designed to provide seamless integration with various protocols, allowing users to navigate this new financial ecosystem effortlessly. The significant growth of on-chain yield activities, particularly among stablecoin holders, showcases how decentralized finance is reshaping investment strategies. Integrating DeFi features into wallets not only enhances user experience and engagement but also positions wallets as critical tools in the broader cryptocurrency market, further solidifying their vital role in users’ financial strategies.

Crypto Card Spending: Bridging Traditional Finance and Cryptocurrencies

Crypto card spending is revolutionizing the way consumers use cryptocurrencies in their everyday lives. The introduction of the Bitget Wallet crypto card has catalyzed this shift, allowing users to spend their digital assets as easily as traditional currencies. Since its launch, the spending through the card has increased more than sixfold, indicating a growing acceptance of cryptocurrencies as viable payment methods. This trend aligns perfectly with the increasing demand for payment solutions within the cryptocurrency ecosystem.

By integrating traditional payment systems with crypto functionalities, Bitget Wallet is effectively bridging the gap between conventional finance and the digital asset world. As users become more familiar with crypto card spending, the potential for further adoption increases, pushing the boundaries of how cryptocurrencies are utilized. This paradigm shift emphasizes the importance of developing user-centric solutions that cater to the evolving needs of consumers, making cryptocurrency wallets indispensable tools for future financial transactions.

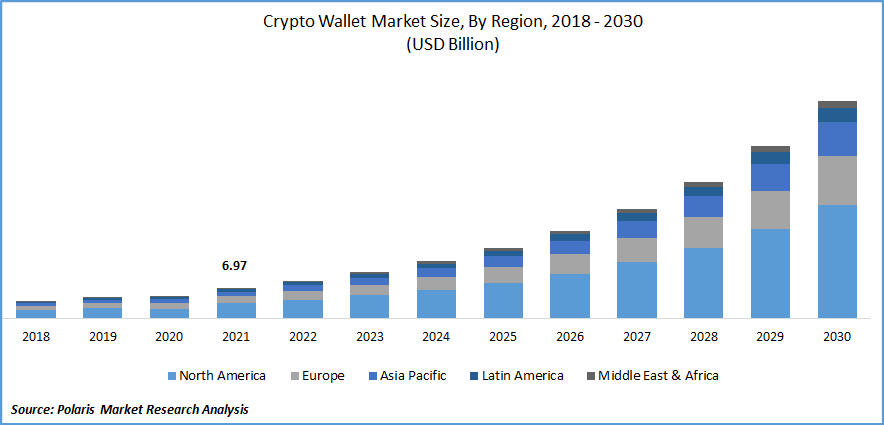

The Future of Cryptocurrency Wallets: Trends and Predictions

The future of cryptocurrency wallets looks bright as adoption trends reveal a growing reliance on digital assets for various financial activities. With the accelerating interest in stablecoin payments, decentralized finance solutions, and on-chain yield management opportunities, users are increasingly utilizing wallets for more than just trading. The integration of advanced payment features, such as crypto card spending, suggests that these wallets will play a central role in shaping how individuals manage their finances going forward.

Predictions indicate that cryptocurrency wallets will continue to evolve, incorporating more sophisticated financial tools that allow users to maximize returns while minimizing risks. As global stablecoin transaction volumes scale higher, it is expected that the demand for crypto-related financial products will surge. The Bitget Wallet is well-positioned to capitalize on these trends, catering to a consumer base that seeks both stability and innovation in their financial dealings. As the sector advances, education around cryptocurrency use will also grow, further influencing wallet growth and acceptance.

Exploring the Security Features of Modern Cryptocurrency Wallets

Security remains a top concern for cryptocurrency users, making it a critical aspect of wallet development. Modern cryptocurrency wallets, including Bitget Wallet, have prioritized the implementation of robust security measures to protect users’ assets. Features such as two-factor authentication, encryption protocols, and hardware wallet integration are becoming standard practices that instill confidence among users. With regulatory standards tightening globally, having a secure cryptocurrency wallet will be essential for maintaining user trust and ensuring continued adoption.

The evolving landscape of cybersecurity threats necessitates a proactive approach to wallet security. Developers are constantly innovating to stay ahead of potential vulnerabilities that could compromise user funds. As cryptocurrency wallets incorporate advanced technologies like biometric security and multi-signature authentication, users can expect higher levels of protection. As the market matures, ensuring the security of digital assets will remain a foundational pillar in the growth and development of cryptocurrency wallets, driving more individuals to participate in the crypto economy.

The Role of User Experience in Cryptocurrency Wallet Adoption

User experience is a vital component of cryptocurrency wallet adoption, influencing how individuals interact with digital assets. Wallets like Bitget Wallet are designed with an intuitive interface that simplifies navigation, making it easier for both novice and experienced users to manage their holdings. Enhancing user experience involves not only design aspects but also the integration of features that cater to users’ various needs, such as easy access to stablecoin payments and yield management options. A positive user experience is crucial for driving engagement and retention in an increasingly competitive market.

As the cryptocurrency landscape grows, wallets that prioritize user experience will likely stand out from the competition. Streamlined processes for transactions, including crypto card spending and swaps, can significantly improve the overall satisfaction of users, encouraging them to utilize wallet features more frequently. With continuous feedback and refinement based on user interactions, cryptocurrency wallets can adapt and evolve, ensuring they meet the demands of a diverse user base. Ultimately, a focus on user experience will be instrumental in fostering growth for cryptocurrency wallets in the years to come.

Frequently Asked Questions

How is cryptocurrency wallet growth impacting stablecoin payments?

Cryptocurrency wallet growth is significantly enhancing stablecoin payments. The rise of platforms like Bitget Wallet shows a shift in usage behavior as stablecoin transaction volumes increase, aligning with the overall global transition towards more stable payment methods. With the introduction of the Bitget Wallet crypto card, users are adopting stablecoin payments at an unprecedented rate, indicating a strong market demand.

What role does on-chain yield management play in cryptocurrency wallet growth?

On-chain yield management is a crucial factor driving cryptocurrency wallet growth. As seen with Bitget Wallet, the subscription volume for yield products has surged, reflecting an increasing interest among users to seek predictable returns through stablecoin investments and DeFi collaborations. This trend in yield management contributes to the overall utility and adoption of cryptocurrency wallets.

How has Bitget Wallet contributed to the growth of decentralized finance (DeFi)?

Bitget Wallet has been a key player in boosting decentralized finance (DeFi) by facilitating increased access to on-chain derivatives and yield management products. The wallet’s support for innovative payment methods and its growing user base have expanded the DeFi ecosystem, encouraging more users to participate in decentralized financial activities.

What features are driving crypto card spending growth in cryptocurrency wallets?

The impressive growth in crypto card spending is largely driven by features such as diverse payment options, including national-level QR code payments and local bank transfers, offered by wallets like Bitget Wallet. The seamless integration of these features has resulted in a sixfold increase in monthly spending, highlighting the wallet’s adaptability to modern financial needs.

What recent trends indicate the future of cryptocurrency wallet growth?

Recent trends indicate that cryptocurrency wallet growth is poised for further expansion. The strong performance in stablecoin payments, the surge in on-chain yield activities, and the increased usage of products linked to decentralized finance showcase a robust and evolving market. As more users shift from traditional trading to innovative payment and yield options, we can expect continued growth within the cryptocurrency wallet sector.

| Aspect | Key Points |

|---|---|

| Application Scenarios | Expansion from trading to include payments, stablecoin usage, and on-chain yield management. |

| Trading Growth | Monthly swap trading volume exceeded $900 million (232% increase); perpetual contract trading volume reached $5 billion (291% increase). Decentralized perpetual contracts now account for 18.7% of trading. |

| Payments | Following the launch of the Bitget Wallet crypto card in July, monthly spending increased over sixfold. Supports various payment methods including card and QR code payments. |

| Yield Management | Subscription volume for Earn products reached nearly $200 million; a tenfold increase driven by stablecoin wealth management and DeFi collaboration. |

| Overall Market Sentiment | Despite a decline in market sentiment, stablecoin payments and yield management activities are growing and becoming less affected by market fluctuations. |

Summary

Cryptocurrency wallet growth is witnessing significant transformation as highlighted by the 2025 data review from Bitget Wallet. The application of these wallets is diversifying from merely trading functionalities to embrace payments and yield management effectively. The notable increase in stablecoin transactions and the continuous rise in on-chain yield management showcase the wallet’s expanding role in the evolving cryptocurrency landscape. Overall, while market sentiment may fluctuate, the foundational uses of cryptocurrency wallets are proving resilient and increasingly integral to daily transactions.