Cryptocurrency tax in India has become a pivotal topic as the government refines its regulations on virtual digital assets. The Income Tax Department (ITD) has emphasized the complexities introduced by decentralized finance (DeFi) tools and offshore exchanges, which pose significant challenges for tax enforcement. With a flat tax rate of 30% on profits from cryptocurrency activities, the stakes are high for investors navigating these turbulent waters. Additionally, the government’s focus on monitoring transactions to prevent tax evasion reflects a growing awareness of the risks associated with private wallets and anonymous exchanges. As the landscape of India cryptocurrency regulations continues to evolve, stakeholders must adapt to ensure compliance while maximizing their investment potential.

The taxation of virtual assets in India is a pressing issue as regulatory frameworks evolve to match the rapid adoption of digital currencies. Concerns have been raised regarding the enforcement of tax laws amid the complexities of offshore trading platforms and the anonymity that comes with decentralized assets. Regulators are actively identifying ways to tackle the challenges posed by these innovations in finance, which not only complicate taxation but also expose users to varied decentralized finance risks. Recent discussions have highlighted the need for transparent policies that facilitate proper tax assessments without hindering the digital economy’s growth. As the government seeks to clarify its stance, understanding the implications of tax on virtual digital assets becomes essential for both new and experienced investors.

Understanding Cryptocurrency Tax in India

In India, the taxation of cryptocurrency assets has become a significant area of focus for financial regulators and taxpayers alike. With the implementation of a flat tax rate of 30% on profits derived from cryptocurrency trading, individuals engaging in this digital asset space are required to navigate a complex web of regulations. This tax regime reflects the government’s cautious yet evolving stance on cryptocurrencies, recognizing them as legal yet treating them as a separate class of assets for tax purposes. The necessity to remain compliant with the taxation framework prompts many to stay informed about their obligations when engaging in cryptocurrency transactions.

Furthermore, the introduction of a 1% tax deducted at source (TDS) on all cryptocurrency transactions adds another layer of complexity. This TDS applies regardless of whether a transaction results in a profit or a loss, which could potentially stifle growth within the burgeoning cryptocurrency market in India. The implications of these taxes on various stakeholders, from individual investors to larger trading firms, cannot be underestimated. As this asset class continues to evolve, the need for clear guidance on cryptocurrency tax enforcement becomes paramount to ensure compliance and foster a fair trading environment.

Challenges of Cryptocurrency Tax Enforcement

Tax enforcement in the cryptocurrency realm presents unique challenges, particularly with the rise of offshore exchanges and decentralized finance (DeFi) platforms. These entities often operate outside traditional regulatory frameworks, making it difficult for tax authorities to track income and enforce compliance. Financial officials in India have raised alarm over the anonymity and borderless nature of cryptocurrency transactions, which can facilitate tax evasion and complicate the detection of taxable events. The usage of private wallets and DeFi tools further obfuscates the trail of transactions, presenting significant hurdles to authorities tracking cryptocurrency income.

During recent discussions among key financial regulatory bodies, officials emphasized that these challenges are not simply technical but also jurisdictional. The international nature of these transactions often means multiple jurisdictions are involved, complicating the legal landscape for tax enforcement. Without clear identification of cryptocurrency holders and transparency in transaction tracking, tax officials face an uphill battle to successfully assess and collect taxes from cryptocurrency activities.

Decentralized Finance (DeFi) Risks in India

Decentralized finance (DeFi) has emerged as a revolutionary financial paradigm that allows users to engage in peer-to-peer transactions without the need for intermediaries. While it presents intriguing opportunities, the risks associated with DeFi in India are significant, particularly regarding user protection and tax compliance. The anonymity that DeFi offers can lead to financial transactions that escape tax regulations, thereby increasing potential losses for the government. Moreover, the complexities surrounding DeFi transactions often go beyond conventional financial regulations, leaving room for exploitation by opportunistic individuals.

Indian regulators are grappling with the DeFi landscape, understanding that measures must be taken to mitigate risks related to tax evasion and money laundering. Ensuring compliance within this sphere is crucial, as it can help stabilize the market and promote responsible innovation. The challenge lies in crafting a regulatory approach that allows innovation to flourish while safeguarding the interests of both individual investors and the financial system as a whole.

Implications of Cryptocurrency Tax Regulations in India

The tax regulations imposed on cryptocurrencies in India not only impact traders but also shape the overall landscape of the digital asset market. As more individuals and firms step into cryptocurrency trading, understanding these implications becomes essential. The lack of recognition of losses from cryptocurrency transactions in the current tax framework can create friction and discourage potential investors from participating fully. This harsh regulatory environment may lead to concerns about fairness in treatment compared to traditional investments and markets.

Moving forward, the Indian cryptocurrency market needs a more balanced regulatory approach that encourages growth while ensuring compliance. A potential recalibration of tax policies, including the consideration of losses and reassessments of TDS, could foster a more conducive environment for innovation. Stakeholders in the crypto space are advocating for clearer guidelines that could help demystify the regulatory landscape, ensuring that participants can make informed decisions without the fear of tax repercussions undermining their investments.

The Role of Offshore Exchanges in Cryptocurrency Taxation

Offshore exchanges continue to play a pivotal role in the cryptocurrency trading landscape in India and around the world. These platforms offer traders the ability to operate outside the jurisdiction of domestic laws, which poses a significant challenge for tax authorities. India’s Income Tax Department has expressed concerns that such exchanges can facilitate tax evasion by enabling traders to conduct transactions without sufficient oversight. This lack of regulatory control complicates the relationship between cryptocurrency trading and tax compliance, indicating the need for stronger enforcement mechanisms.

Furthermore, the anonymity and rapid transaction capabilities offered by offshore exchanges can lead to increased risks in tracking taxable income. With borderless transfers becoming the norm, questions arise regarding jurisdiction and the enforceability of tax regulations. To address these concerns, regulators in India may need to foster collaborative international efforts to create standardized frameworks that promote transparency and accountability among cryptocurrency exchanges operating in various jurisdictions.

Navigating Cryptocurrency Transactions: A Liability or an Asset?

For many investors, navigating the cryptocurrency landscape can lead to significant financial opportunities or substantial losses, depending on the strategy employed. The necessity of understanding one’s tax obligations is critical in determining whether these digital assets serve as a liability or an asset. With the current tax regime imposing rigorous rates on profits, plus the implications of TDS, individuals are incentivized to carefully evaluate their trading practices. Failure to account for potential taxation elements could result in unforeseen liabilities when profits are realized.

As the regulatory landscape continues to evolve, it is essential for traders and investors to remain informed of new developments that could affect their tax responsibilities. Seeking guidance from tax professionals with expertise in cryptocurrency can provide clarity and ensure that individuals are making informed decisions. This advisory role becomes increasingly important as the complexities surrounding taxation, especially concerning offshore exchanges, decentralized finance, and overall cryptocurrency regulations in India, become more pronounced.

The Future of Cryptocurrency Taxation in India

Looking ahead, the future of cryptocurrency taxation in India hinges on the ability of regulators to adapt swiftly to the rapidly changing digital landscape. With cryptocurrency adoption gaining traction in India, there is an urgent need for a regulatory framework that not only promotes growth but also ensures robust tax compliance. The officials have already acknowledged the complexities involved in tracking crypto transactions and enforcing tax legislation, hinting at possible reforms that could accommodate the uniqueness of digital assets.

As discussions around potential changes in cryptocurrency tax regulations continue, there is optimism that a more harmonized approach could emerge, favoring both the government’s revenue objectives and market development. Striking the right balance between regulation and innovation will be crucial, as it could ultimately shape the future of the cryptocurrency ecosystem in India and yield an environment conducive to sustainable growth.

Tax Guidelines for Virtual Digital Assets (VDAs) in India

The regulatory framework for virtual digital assets (VDAs) in India demands clarity as the government seeks to address the burgeoning market. Recently introduced tax guidelines indicate a rigorous approach toward VDA operations, with outlined responsibilities for both exchanges and users. Understanding these guidelines is crucial for compliance, as failure to adhere to the stipulations could lead to serious penalties. Investors must familiarize themselves with the tax obligations linked to VDAs to minimize risks associated with non-compliance, enabling a smoother trading experience.

Moreover, the financial implications of the ongoing regulations involve not only direct taxes but also the potential for future developments that could affect scalability and innovation in this space. As exchanges in India align themselves with these taxation rules, the emphasis on clear reporting, regulatory compliance, and diligent record-keeping becomes more pressing. The environment created by these tax guidelines will likely influence the structure and efficiency of cryptocurrency operations, determining India’s position within the global digital asset arena.

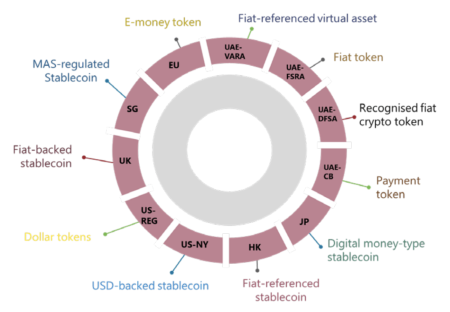

Adapting to the Global Cryptocurrency Regulatory Landscape

As the global cryptocurrency market matures, India’s approach to regulations and taxation plays a crucial role in shaping its future in the digital economy. With various countries adopting different strategies, from stringent regulations to progressive frameworks, India’s policymakers must consider these international trends when crafting their regulations. Engaging in dialogues with other nations and adopting best practices could lead to a more comprehensive and coherent regulatory framework that leverages India’s strengths while protecting its interests in the cryptocurrency ecosystem.

Furthermore, the international dimension of cryptocurrency trade and taxation highlights the importance of collaboration among regulatory bodies worldwide. Building alliances can facilitate information sharing, enhance enforcement capabilities, and ultimately lead to a more uniform set of standards to govern global cryptocurrency operations. India’s response to these global challenges will not only determine its own market stability but also set a precedent for developing nations navigating the complexities of cryptocurrency regulations and tax enforcement.

Frequently Asked Questions

What is the cryptocurrency tax structure in India?

In India, all profits from cryptocurrency activities are taxed at a flat rate of 30%. Additionally, there is a 1% tax deducted at source (TDS) on all cryptocurrency transfers, creating a rigorous tax structure under which individuals must report their earnings.

How does the Indian government enforce cryptocurrency tax regulations?

The Indian government, through the Income Tax Department (ITD) and the Central Board of Direct Taxes (CBDT), enforces cryptocurrency tax regulations by monitoring transactions and leveraging information-sharing mechanisms. However, challenges arise due to the anonymous nature of many cryptocurrency transactions, particularly those involving offshore exchanges and decentralized finance (DeFi) tools.

Are there risks associated with offshore exchanges regarding cryptocurrency tax in India?

Yes, offshore exchanges present significant risks for cryptocurrency taxation in India. They complicate the tracking of taxable income, given their borderless nature and potential for anonymity, making it difficult for tax authorities to identify and assess tax obligations effectively.

Do virtual digital asset (VDA) transactions fall under Indian tax regulations?

Yes, virtual digital asset (VDA) transactions are subject to Indian tax regulations. The government has mandated that profits from VDA activities, including cryptocurrency trades, are taxed at 30%, with specific reporting requirements to ensure compliance.

What is the stance of India on decentralized finance (DeFi) tools concerning tax enforcement?

India’s tax authorities view decentralized finance (DeFi) tools as a significant challenge for tax enforcement. Their anonymous and innovative features make it difficult to trace transactions and ensure they are properly reported for taxation purposes.

Can losses from cryptocurrency trading be deducted from taxable income in India?

No, under the current Indian tax framework, losses incurred from cryptocurrency trading cannot be offset against taxable income. This policy creates hurdles for traders, as they cannot mitigate their tax liabilities from previous losses.

What measures is India taking to improve cryptocurrency tax compliance?

To improve cryptocurrency tax compliance, India is actively engaging with financial intelligence units and other regulatory bodies to enhance transaction tracking. Despite these efforts, substantial challenges remain, especially with the rise of private wallets and offshore exchanges.

Will the recognition of cryptocurrency exchanges influence tax enforcement in India?

The recognition of cryptocurrency exchanges is expected to aid in tax enforcement in India. As more exchanges receive approval and comply with regulations, tax authorities will likely have improved access to transaction data, enhancing their ability to monitor and enforce tax obligations.

How does the Indian government view the growth of the cryptocurrency ecosystem?

The Indian government recognizes the growth of the cryptocurrency ecosystem, noting its increasing adoption. However, it maintains a cautious approach due to the potential risks associated with unregulated transactions and the complexities involved in enforcing cryptocurrency tax regulations.

What are future challenges for cryptocurrency tax in India?

Future challenges for cryptocurrency tax in India include addressing the obfuscation created by decentralized finance tools, enhancing tracking capabilities for transactions on offshore exchanges, and reforming the tax legislation to address the current limitations on loss deductions.

| Key Point | Details |

|---|---|

| Concerns Raised | India’s tax authorities are worried about risks from offshore exchanges, private wallets, and DeFi tools that complicate tracking cryptocurrency income. |

| Challenges in Enforcement | Cryptocurrency transactions complicate tax enforcement, with ITD highlighting the difficulties in monitoring such income during parliamentary discussions. |

| Risks Identified | The ITD pointed out that anonymous and borderless nature of cryptocurrencies makes it hard to track transactions for tax compliance. |

| Tax Policies | India imposes a flat 30% tax on profits from cryptocurrency activities and a 1% TDS on all transfers, regardless of profitability. |

| Current Ecosystem Status | Despite growing adoption, challenges remain due to the strict tax framework that doesn’t recognize losses from cryptocurrency trading. |

| Future Prospects | With 49 exchanges approved for FY 2024–2025, the Indian cryptocurrency market is poised for growth, albeit under cautious regulations. |

Summary

Cryptocurrency tax India is an evolving topic, with authorities emphasizing the need for robust regulations to manage the complexities associated with digital assets. The Indian government’s approach highlights significant challenges in tax enforcement, particularly with the rise of offshore exchanges and DeFi tools that complicate income tracking. As the ecosystem develops, understanding the implications of these regulations is crucial for investors.