Cryptocurrency regulation has emerged as a pivotal issue in the digital financial landscape, especially with the upcoming SEC cryptocurrency roundtable scheduled for December 15. This meeting will spotlight the intricate balance between regulatory oversight and the importance of cryptocurrency privacy, a topic that has sparked intense debate among industry stakeholders. Discussions will likely revolve around innovative concepts like zero-knowledge proofs, which could revolutionize how compliance is approached within digital asset markets. As the SEC evaluates cryptocurrency privacy and governance, the implications for digital asset compliance will be crucial in determining the future of privacy in cryptocurrency. The potential for regulatory polarization between privacy advocates and law enforcement perspectives could heavily influence forthcoming regulations.

The ever-evolving sphere of digital currencies and blockchain technology is at a crossroads, necessitating a comprehensive framework for cryptocurrency governance. As institutions like the SEC delve into the complexities of financial oversight, they will examine how to align beneficial privacy measures with the rigorous demands of compliance in the digital asset realm. With concepts such as zero-knowledge proofs gaining traction, the potential for harmonizing user privacy with regulatory needs is on the table. The future of cryptocurrency oversight hinges on how effectively these discussions can bridge the gap between safeguarding privacy rights and ensuring responsible financial practices. Ultimately, the conversations led by regulatory bodies will shape the landscape for crypto enthusiasts and market participants alike.

The Importance of Cryptocurrency Regulation

Cryptocurrency regulation has emerged as a critical theme in the evolving world of digital assets. With the explosive growth of cryptocurrencies, the need for established frameworks to govern these assets has become paramount. Regulators are grappling with how to implement these rules to ensure consumer protection while fostering innovation. A fundamental aspect of this regulatory landscape is the balance between enabling cryptocurrencies to contribute positively to the financial ecosystem and mitigating the risks associated with their use.

The approach taken by regulatory bodies like the U.S. Securities and Exchange Commission (SEC) reflects an understanding that without adequate regulation, the use of cryptocurrencies could facilitate illicit activities, such as money laundering and fraud. Consequently, the SEC’s roundtable discussions around cryptocurrency privacy are poised to set a precedent for how privacy measures are integrated into the regulatory framework, ensuring that technological advancements do not undermine compliance efforts.

Cryptocurrency Privacy: A Double-Edged Sword

The concept of cryptocurrency privacy has sparked significant debate within the financial and tech communities. On one hand, privacy technologies such as zero-knowledge proofs protect user identities and transaction details, allowing individuals to have greater control over their personal information. On the other hand, the same features can be exploited by bad actors for illicit activities. This duality raises important questions about how regulatory frameworks can accommodate privacy while preventing its misuse for criminal purposes.

As the SEC prepares for its roundtable, the discussion is likely to center on this tension between privacy as a fundamental right and the perception that it facilitates nefarious activities. Understanding this nuanced perspective will be vital for developing regulatory practices that do not stifle innovation. If privacy technologies can prove their utility in compliance—potentially through established methodologies like zero-knowledge proofs—it could pave the way for a more accommodating regulatory environment for privacy-focused cryptocurrency projects.

The Role of Zero-Knowledge Proofs in Compliance

Zero-knowledge proofs are increasingly being recognized as a significant advancement in ensuring compliance within the cryptocurrency space. These cryptographic protocols allow transactions to be verified without exposing the underlying data, thereby enabling a degree of privacy that traditional systems lack. With regulators looking for ways to monitor compliance without compromising user privacy, zero-knowledge proofs could provide a way forward that satisfies both parties’ concerns.

When implemented effectively, zero-knowledge proofs can facilitate the creation of compliant digital assets while maintaining the integrity of user privacy. By incorporating such technologies into their operations, cryptocurrency companies could demonstrate their commitment to regulatory compliance and simultaneously protect their customers’ identities. As the SEC explores these possibilities, there is potential for a groundbreaking shift in how digital assets are regulated, especially concerning privacy and transparency.

Digital Asset Compliance and Regulatory Challenges

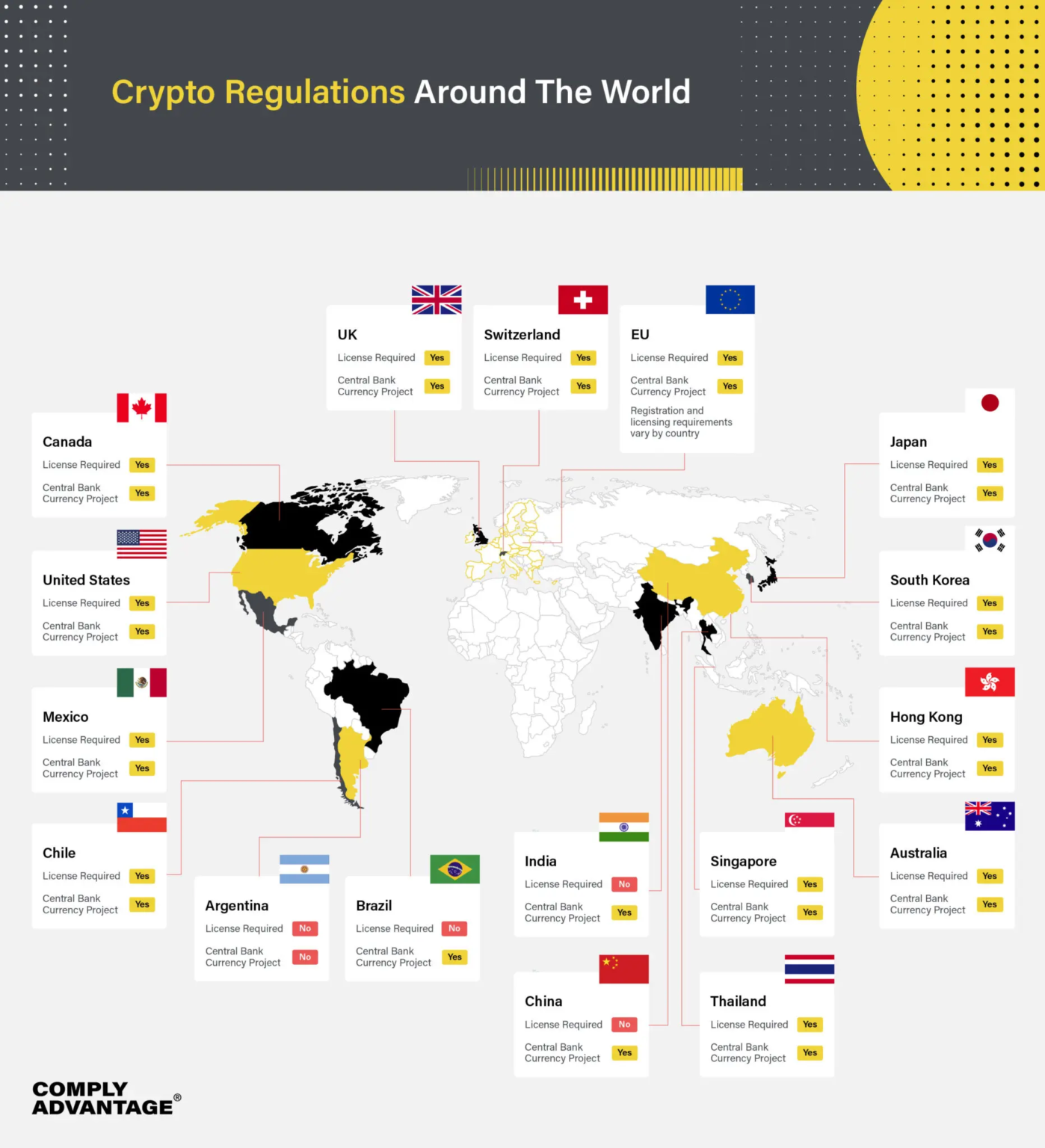

Compliance in the realm of digital assets presents unique challenges due to the decentralized nature of cryptocurrencies. Different jurisdictions have varied approaches to regulation, which can create confusion among users and operators. The SEC’s ongoing evaluation of cryptocurrency regulation aims to establish a more unified compliance framework that balances innovation with the need for oversight. Achieving this balance will be paramount for fostering a healthy digital asset ecosystem.

Regulatory challenges also become more pronounced as new technologies emerge. Tools designed to enhance privacy, while beneficial for users, can inadvertently conflict with compliance obligations. As the SEC and other regulatory bodies assess digital asset compliance frameworks, the outcomes of their deliberations will significantly impact how cryptocurrency firms operate going forward. Ensuring that digital assets are compliant while also respecting users’ rights to privacy will be a critical factor in shaping the future of cryptocurrency regulation.

The Intersection of Privacy and Financial Regulation

The discussion of privacy in cryptocurrency is vital as it intersects directly with financial regulation. As the SEC considers privacy issues during its roundtable, it faces the challenge of integrating privacy protections into existing regulations without compromising their intent. The financial regulatory landscape traditionally emphasizes transparency and oversight, which can clash with privacy advocates’ objectives. This intersection creates a complex regulatory environment that necessitates careful consideration.

Balancing the rights of users to maintain their privacy while ensuring that financial regulations serve their purpose is a delicate task. As privacy advocates assert their stance during these discussions, their outcomes could lead to significant changes in how privacy provisions are managed in the world of cryptocurrency. The SEC’s role in this dialogue will be crucial as it seeks to carve out a framework that respects privacy while fulfilling regulatory duties.

Litigation Risks for Privacy Advocates

If the SEC’s discussions on cryptocurrency privacy lead to polarization between those who advocate for user privacy and those who see privacy as a facilitator of crime, the implications could be serious for privacy-focused projects. Should the SEC lean towards the perspective that privacy features enable nefarious activities, we may see increased scrutiny and regulation that could stifle innovation in the field of privacy-enhancing technologies.

For privacy advocates, this presents a formidable challenge: they must contend with not only existing regulations but also the possibility of litigation stemming from adverse regulatory decisions. As the debate unfolds, these advocates may find themselves needing to take a firm stand, potentially resorting to litigation as a means to safeguard their interests and the future of privacy in cryptocurrency.

Future Trends in Cryptocurrency Regulation

As cryptocurrency continues to evolve, regulatory trends are likely to follow suit, adapting to emerging technologies and market needs. Anticipated developments may include more robust frameworks that integrate new privacy technologies while ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. The SEC’s proactive stance in addressing these issues can lead the way for more comprehensive regulations that protect the integrity of the financial system while respecting user privacy.

In the near future, we might witness an increasing trend toward regulation that encourages transparency and compliance but allows for privacy innovations to flourish. By recognizing the legitimacy of privacy as a characteristic of the digital landscape, regulators could help advance the dialogue on cryptocurrency in a way that is beneficial for both consumers and the broader financial ecosystem.

Educating Stakeholders on Cryptocurrency Regulation

One of the critical components of effective cryptocurrency regulation is education. Stakeholders—ranging from regulators to developers and investors—must understand the implications of both regulatory policies and privacy technologies. By fostering a culture of awareness and understanding, it is possible to develop a regulatory environment that is informed by the realities of the digital asset ecosystem.

Seminars, workshops, and roundtable discussions hosted by regulatory bodies like the SEC can play a pivotal role in this educational process. Such initiatives can encourage dialogue among all parties involved, allowing for constructive feedback that can guide the evolution of regulatory frameworks. Prioritizing education will be essential for ensuring that as regulations are developed, they are responsive to the needs of the users and empower them within the cryptocurrency space.

Potential Impacts of the SEC Roundtable

The upcoming SEC roundtable on cryptocurrency will likely shape the future landscape of digital asset regulation. With key participants, including privacy advocates and industry leaders, the dialogue will focus on the intersection of financial oversight and the rights of users to privacy. Outcomes from this roundtable could establish a critical benchmark for how privacy measures are integrated into the regulatory framework.

Depending on the direction of the discussions, the SEC may propose regulations that either support a healthier privacy ecosystem within cryptocurrency or reinforce a monitoring-centric regulatory stance. The choices and recommendations made by the SEC during this roundtable will resonate beyond its immediate impact, potentially influencing global cryptocurrency practices and regulations.

Frequently Asked Questions

What is the focus of the SEC cryptocurrency roundtable and its impact on cryptocurrency regulation?

The SEC cryptocurrency roundtable, scheduled for December 15, aims to discuss key issues surrounding cryptocurrency regulation, primarily focusing on financial monitoring and privacy concerns. Participation from industry figures, such as Zcash founder Zooko Wilcox, highlights the importance of cryptocurrency privacy in the regulatory landscape. The outcome could influence how much regulatory weight the SEC assigns to privacy projects, potentially affecting compliance regulations for digital assets.

How do zero-knowledge proofs relate to cryptocurrency regulation?

Zero-knowledge proofs are cryptographic technologies that allow one party to prove to another that a statement is true without revealing any information beyond the validity of the statement. In the context of cryptocurrency regulation, if the SEC recognizes zero-knowledge proofs as a viable method for achieving compliance, this could lead to more lenient regulations for cryptocurrency privacy projects, allowing for greater innovation while still meeting regulatory standards.

What role does cryptocurrency privacy play in digital asset compliance?

Cryptocurrency privacy is becoming a crucial aspect of digital asset compliance as regulators grapple with balancing user privacy rights and the need for financial transparency. The SEC’s discussions on this topic may shape future regulations, influencing how cryptocurrency firms implement privacy features while adhering to compliance obligations. A consensus on the importance of privacy could pave the way for more flexible regulatory approaches.

What are the potential outcomes of the SEC cryptocurrency roundtable regarding financial monitoring?

The SEC cryptocurrency roundtable could result in a range of outcomes depending on the discussions surrounding privacy in cryptocurrency. If the consensus leans toward viewing privacy as a fundamental right, the SEC may adjust its financial monitoring frameworks. Conversely, if the dialogue suggests that privacy could facilitate illicit activities, the current focus on oversight and monitoring may solidify, possibly prompting legal challenges from privacy advocates.

How might the SEC’s evaluation of cryptocurrency privacy affect future regulations?

The SEC’s evaluation of cryptocurrency privacy during the roundtable could greatly influence future regulations by determining how much flexibility can be integrated into compliance requirements. If the discussions favor integrating privacy technologies like zero-knowledge proofs, it may lead to a more supportive regulatory environment for innovators, whereas a focus on monitoring might solidify stringent regulations impacting privacy initiatives in the cryptocurrency sector.

| Key Points |

|---|

| The SEC is assessing cryptocurrency privacy and its implications for regulation. |

| A roundtable on December 15 includes key figures like Zooko Wilcox. |

| The meeting may evaluate compliance obligations for privacy projects. |

| Consensus on zero-knowledge proofs could influence digital asset regulations. |

| Polarization in opinions may lead to litigation between privacy advocates and regulatory frameworks. |

Summary

Cryptocurrency regulation is poised to evolve significantly as the SEC evaluates the role of privacy in the digital asset space. The upcoming roundtable aims to address the complexities surrounding privacy technologies, specifically how zero-knowledge proofs can align with compliance obligations. Depending on the discussions, we may see a shift towards accommodating privacy that balances regulatory needs, or an entrenched stance that prioritizes monitoring and oversight. This juncture highlights the potential for future disputes as the cryptocurrency landscape grapples with the dichotomy of privacy as a right versus a vehicle for crime.