Cryptocurrency payroll investing is revolutionizing how employees can engage with digital assets by allowing them to invest directly through payroll deductions. The innovative offering from companies like CoinFlip enhances access to crypto investing benefits, making it easier for workers to acquire digital currencies such as Bitcoin and Ether without the need for a hefty upfront investment. This program not only appeals to younger generations looking for modern workplace benefits but also supports a gradual investing strategy aligned with traditional retirement plans like 401(k) options. As interest in portfolio diversification continues to rise, the integration of cryptocurrency into employer-sponsored investing models opens up a new frontier for workforce financial growth. With minimum contributions starting as low as $25 per pay period, this emerging workplace trend signifies a major shift towards embracing digital assets in personal finance strategies and enhancing employee engagement in their financial futures.

The landscape of employee investing is evolving with the introduction of payroll cryptocurrency contributions, providing a fresh avenue for workers to build their wealth. This innovative approach allows individuals to allocate a portion of their salary into cryptocurrencies, thus integrating digital currencies into their long-term financial planning. As organizations enhance their payroll options, engaging employees with investment opportunities in digital assets becomes a substantial workplace benefit. Notably, as traditional retirement plans adapt with flexible 401(k) cryptocurrency options, the desire for diversification among newer employees is being met through accessible, employer-sponsored initiatives. Consequently, payroll deductions for cryptocurrencies not only facilitate the adoption of digital investing but also align with the shift towards modern financial practices in the workplace.

Understanding Cryptocurrency Payroll Investing

Cryptocurrency payroll investing is a revolutionary concept that allows employees to allocate a portion of their salary towards investing in cryptocurrencies. This process is facilitated through automatic payroll deductions, making it an accessible option for workers who want to incorporate digital assets into their financial portfolio. With the advent of such innovative approaches, employees can gradually build their cryptocurrency holdings without needing to make large, one-time investments. This method aligns perfectly with the trend of dollar-cost averaging, where investments are made in small amounts over time, reducing the impact of market volatility on the overall investment.

Companies like CoinFlip are pioneering this trend by providing a seamless way for workers to invest in popular cryptocurrencies such as Bitcoin and Ether. The initiative highlights the growing popularity of digital assets among younger workers who increasingly desire flexible and modern investment options. As more employees explore cryptocurrency payroll investing, it’s expected that the overall understanding and acceptance of digital assets in the workplace will increase, further pushing traditional institutions to adapt their financial products.

The Benefits of Payroll Deductions for Crypto Investing

One of the primary benefits of payroll deductions for cryptocurrency investing is the ease of integration into employees’ financial routines. By allowing workers to invest directly from their paychecks, the decision to invest becomes automatic, which helps to cultivate a culture of saving and investing among employees. This approach not only simplifies the investment process but also encourages regular participation, which is critical in the volatile market of cryptocurrencies.

Moreover, many employees are leveraging payroll deductions as a strategy to gradually enter the cryptocurrency market. This initiative provides a significant advantage in terms of cost management, allowing them to benefit from dollar-cost averaging. With a starting minimum of just $25 per pay period, it’s an approachable option for individuals with diverse financial backgrounds, thus broadening access to investing in digital assets as a workplace benefit.

Digital Assets: A Modern Workplace Benefit

The integration of digital assets into workplace benefits represents a significant shift in how companies view employee compensation and financial wellness. By offering cryptocurrency investing options, companies can attract a tech-savvy workforce that is keen on modern financial solutions. This type of innovation not only enhances employee satisfaction but also positions firms as forward-thinking entities in a competitive job market.

Additionally, introducing such benefits can lead to increased employee engagement, as individuals become more invested in the company’s growth alongside their financial future. Digital assets, being relatively new on the financial landscape, offer a unique talking point and potential for employers to engage in meaningful discussions about financial literacy and investment strategies with their employees.

Exploring 401(k) Cryptocurrency Options

With the growing interest in digital assets, integrating cryptocurrency options within traditional 401(k) plans is gaining traction among employers. This shift represents a significant evolution in retirement planning, allowing employees to diversify their investment portfolios with alternative assets. Companies are beginning to recognize that offering crypto options can serve as a tool for employee retention and attraction, as a more diverse investment strategy aligns with the preferences of a younger workforce.

As services like Fidelity begin to introduce cryptocurrency-centric IRA options, the potential for 401(k) plans to include digital assets becomes more tangible. This development could lead to substantial increases in the adoption of cryptocurrencies among working individuals, as it merges the appeal of traditional retirement savings with the innovative potential of digital investments.

The Impact of Employer-Sponsored Crypto Investing

Employer-sponsored crypto investing provides a platform for employees to engage with digital assets within a structured framework. This new financial offering can enhance the overall morale of employees, as they see their employers investing in innovative payment solutions. By facilitating access to cryptocurrencies through payroll settings, companies empower workers to experience financial growth, thus enhancing financial wellness in the workplace.

Furthermore, as the regulatory landscape evolves, employer-sponsored investing can potentially open up new avenues for financial growth and security. Companies that proactively adapt to include alternative investments like cryptocurrencies in their benefits packages not only differentiate themselves but also contribute to a broader acceptance of digital assets in corporate finance.

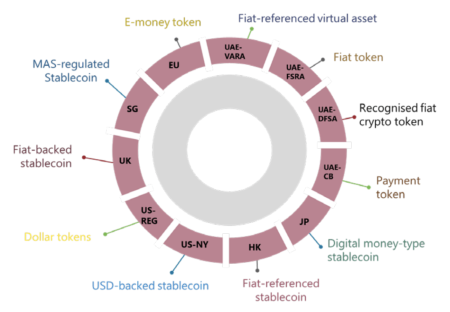

Regulatory Environment Surrounding Cryptocurrency in Retirement Planning

The regulatory environment surrounding the incorporation of cryptocurrencies into retirement planning is constantly evolving. Recent actions, such as the executive order signed by US President Trump, indicate a recognition of the necessity to examine how alternative assets can be integrated into retirement plans. Such regulatory insights could pave the way for significant changes that favor the inclusion of digital assets within the retirement portfolios of millions.

The collaboration of federal agencies like the SEC and the Department of Labor reflects the importance of establishing guidelines that ensure both investor protection and market integrity. As new regulations emerge, employers who offer cryptocurrency options within their retirement plans stand to benefit from a more structured and secure investing environment, thus enhancing employee confidence in incorporating digital assets into their long-term financial strategies.

The Growing Appeal of Digital Assets in Financial Education

As more companies adopt cryptocurrency payroll options, there is an increasing need for financial education centered around digital assets. Educating employees about investing in cryptocurrencies and understanding how these assets fit into their overall financial goals is essential for making informed decisions. This growing awareness can empower employees to actively participate in their investment programs, leading to more fruitful financial outcomes.

Financial literacy programs that include modules on cryptocurrencies and their benefits can help demystify these digital assets. Providing employees with the tools and knowledge necessary to navigate the evolving landscape of investing will not only bolster their confidence but also enhance their overall investment experience within employer-sponsored programs.

Future Prospects of Cryptocurrency in the Workplace

The future of cryptocurrency in the workplace looks promising, with organizations increasingly recognizing the importance of incorporating digital assets into their benefits offerings. The growing acceptance of cryptocurrencies is poised to change the landscape of employee compensation and investment options, creating an environment that embraces innovation and diversity in financial products. As companies compete for top talent, those that offer cutting-edge benefits like crypto investing are likely to stand out in attracting a dynamic workforce.

Additionally, as technology evolves and regulatory frameworks become more established, we can expect to see an expansion in the types of cryptocurrencies available for employee investment. This evolution will enable companies to provide more inclusive and diverse investment strategies, ultimately enhancing the workplace financial ecosystem and allowing employees to achieve their financial goals more effectively.

The Role of Financial Institutions in Promoting Crypto Benefits

Financial institutions play a crucial role in facilitating the adoption of cryptocurrencies within employee benefits. As the market matures, banks and investment firms are becoming more active in offering services that allow employers to integrate crypto options seamlessly into their existing payroll and retirement offerings. These traditional financial entities can provide the regulatory guidance and technological solutions needed to ensure a secure and efficient adoption of cryptocurrency investments.

By actively supporting employers in implementing cryptocurrency payroll investing, financial institutions can also promote greater acceptance and understanding of digital assets among the general populace. This partnership can catalyze a broader embrace of cryptocurrencies as viable investment options, contributing to a more dynamic and inclusive financial landscape.

Frequently Asked Questions

What are the benefits of cryptocurrency payroll investing?

Cryptocurrency payroll investing offers various benefits, including the ability to invest in digital assets like Bitcoin and Ether directly from your paycheck. This system facilitates dollar-cost averaging, helping employees manage the market’s volatility by spreading out their investments over time. Additionally, it enhances accessibility to crypto investing, allowing individuals to build wealth through employer-sponsored plans.

How do payroll deductions for cryptocurrency work?

Payroll deductions for cryptocurrency allow employees to automatically allocate a portion of their salary towards purchasing digital assets. Companies like CoinFlip facilitate this process by enabling employees to invest in cryptocurrencies directly from their paycheck, with contributions starting as low as $25 per pay period, making crypto investing more manageable.

Can I include cryptocurrencies in my 401(k) through employer-sponsored crypto investing?

Yes, employer-sponsored crypto investing may soon allow for the inclusion of cryptocurrencies in 401(k) plans. Companies are exploring options to incorporate digital assets into traditional retirement accounts, enabling employees to invest in cryptocurrencies alongside other investment vehicles, thus modernizing retirement planning.

What types of cryptocurrencies can I invest in through payroll deductions?

Through payroll-based cryptocurrency investing, employees can typically invest in a variety of cryptocurrencies, including popular options like Bitcoin, Ether, Solana, and stablecoins. Employers offering this benefit can curate a selection, providing employees with diverse investment opportunities in the digital asset space.

How does cryptocurrency payroll investing fit into long-term financial planning?

Cryptocurrency payroll investing aligns with long-term financial planning by allowing individuals to build wealth through consistent investment in digital assets. This method supports strategies like dollar-cost averaging, helping employees gradually increase their investments in cryptocurrencies as part of a diversified portfolio.

What is the role of employer-sponsored crypto investing in enhancing employee benefits?

Employer-sponsored crypto investing serves as a vital workplace benefit by providing employees access to alternative investment options in the form of digital assets. This modern benefit can attract and retain talent, cater to the evolving preferences of the workforce, and improve overall employee satisfaction by aligning with their financial goals.

Will regulations affect cryptocurrency payroll investing in the future?

Yes, potential regulatory changes could significantly impact cryptocurrency payroll investing. With federal agencies examining how alternative assets, including cryptocurrencies, can be incorporated into defined contribution plans, the landscape for digital asset investing in the workplace may evolve, enhancing security and consumer protections.

Are there any risks associated with payroll deductions for cryptocurrency investing?

Certainly, risks exist with payroll deductions for cryptocurrency investing, primarily due to the volatility of digital assets. Employees should consider the potential for significant price fluctuations and ensure they understand their risk tolerance before committing a portion of their salary to crypto investments.

What is the minimum contribution needed for cryptocurrency payroll investing with CoinFlip?

With CoinFlip’s payroll-based cryptocurrency investing, the minimum contribution starts at just $25 per pay period. This entry-level investment strategy allows employees to gradually build their crypto portfolios while managing their budgets.

How does automatic cryptocurrency investing work through payroll deductions?

Automatic cryptocurrency investing through payroll deductions works by allowing employees to pre-allocate a percentage or a set amount of their salary towards the purchase of digital assets. This automated process streamlines investing, letting employees benefit from consistent contributions and the advantages of dollar-cost averaging in a fluctuating market.

| Key Points |

|---|

| CoinFlip has launched a payroll-based cryptocurrency investing benefit for US employees, allowing investment through payroll deductions. |

| Employees can invest in cryptocurrencies like Bitcoin and Ether, with contributions starting at $25 per pay period. |

| The program is aimed at workers who prefer dollar-cost averaging for gradual investment. |

| There is a growing demand for regulated and accessible crypto investment options among US adults. |

| The initiative is gaining traction as a significant alternative in retirement planning alongside employer-sponsored 401(k) plans. |

| Policymakers are exploring ways to incorporate alternative assets, including cryptocurrencies, into retirement plans. |

| Regulatory changes could pave the way for cryptocurrencies to be part of the $12.5 trillion US retirement market. |

Summary

Cryptocurrency payroll investing is revolutionizing how employees engage with digital assets by allowing them to invest directly from their paychecks. This innovative benefit offered by CoinFlip caters to the increasing interest in portfolio diversification and enables workers to gradually accumulate cryptocurrencies like Bitcoin and Ether. As more employers integrate cryptocurrency options into their benefit packages, the landscape of retirement planning is rapidly evolving, making it essential for individuals to consider these options for their financial futures.