Cryptocurrency Payment Solutions are revolutionizing the way businesses handle transactions in the digital age. Recently, industry news highlighted how Alchemy, a prominent name in crypto payment infrastructure, secured a substantial investment from C1 Fund, a major player in cryptocurrency finance. This partnership underscores the increasing importance of robust crypto trading support systems as more companies transition to blockchain technology. With Alchemy providing vital services for leading firms like Robinhood and JPMorgan Chase, the move signals a shift toward Web3 payment providers shaping the future of e-commerce. As digital currencies gain traction, understanding and implementing these solutions becomes crucial for business growth in a competitive market.

The emergence of digital currency transaction systems is fundamentally altering financial operations across various sectors. Companies like Alchemy are paving the way as essential players in this transformation, thanks to strategic investments from firms such as C1 Fund. With a focus on facilitating user-friendly and secure payment methods within the cryptocurrency landscape, these Web3 solutions are not just a trend but a critical evolution in payment processing. Enhanced by technological advancements, the infrastructure behind cryptocurrency transactions is becoming more sophisticated, offering businesses the crypto trading support necessary to thrive in today’s economy. As organizations increasingly embrace this new economic paradigm, understanding alternative digital payment mechanisms is key to leveraging their full potential.

Overview of Alchemy’s Investment from C1 Fund

In a significant move for the cryptocurrency landscape, Alchemy has garnered attention by securing a noteworthy investment from the C1 Fund. This investment underscores C1 Fund’s commitment to propelling innovation within the burgeoning Web3 ecosystem. Although the financial details remain undisclosed, the backing from such a prolific cryptocurrency fund indicates strong confidence in Alchemy’s capabilities to sustain its role as a leading cryptocurrency payment solution provider.

Alchemy’s infrastructure is rapidly becoming essential for many prominent players in the financial sector, including Robinhood, Stripe, JPMorgan Chase, and Coinbase. This caliber of support indicates that Alchemy is not just a startup but a vital component of modern crypto payment infrastructure. The confidence shown by C1 Fund, known for its prior investments in major blockchain companies like Chainalysis and Ripple, highlights the growing importance and acceptance of cryptocurrency payment solutions in mainstream finance.

The Role of Cryptocurrency Payment Solutions in Web3

Cryptocurrency payment solutions are at the forefront of the Web3 revolution, enabling seamless transactions in a decentralized digital economy. As digital currencies become increasingly integrated into daily transactions, the need for robust crypto payment infrastructure is paramount. Alchemy’s position as a core provider in this space empowers businesses to leverage the unique advantages of blockchain technology, such as transparency, speed, and security.

Furthermore, as consumers and merchants alike show growing interest in digital currencies, the demand for reliable crypto trading support services is essential. Alchemy’s capabilities facilitate this transition, allowing users to engage with cryptocurrencies effortlessly. With more traditional financial institutions entering the cryptocurrency arena, providers like Alchemy are poised to lead the charge, offering services that cater to both innovations in payment processing and the expanding market of digital assets.

Investment Trends in Cryptocurrency Infrastructure

The influx of investments in cryptocurrency infrastructures, such as Alchemy, highlights a burgeoning trend in the financial sector. As more institutions recognize the potential for profit within the blockchain space, investments from funds like C1 Fund become increasingly prevalent. These investments not only fuel the growth of companies like Alchemy but also signify a transformative shift towards decentralized finance and digital payment solutions.

Investors are keenly aware that the future of finance is heavily tied to technological advancements, particularly in payment solutions that leverage cryptocurrencies. By channeling funds into proven entities within the crypto landscape, investors aim to capitalize on the ongoing trends of digital transformation. The relationship between investment firms and cryptocurrency payment solutions is indicative of a shifting paradigm, where traditional finance meets new age technology in the realm of Web3.

Alchemy’s Influence on the Future of Digital Payments

As the cryptocurrency landscape evolves, Alchemy’s influence on the future of digital payments is becoming more pronounced. With support from notable firms like C1 Fund, Alchemy is positioned to push the envelope in how financial transactions are conducted. Their innovative solutions enable a more inclusive, accessible financial network, catering to both individual users and larger enterprises seeking to adopt cryptocurrency payment systems.

Moreover, Alchemy’s technology underpins essential trading capabilities and solutions for established platforms, paving the way for increased adoption of cryptocurrency as a viable payment method. As traditional banking systems start to integrate these technologies, Alchemy’s role as a Web3 payment provider ensures that it remains at the cutting edge of payment processing innovations, thereby helping to shape a future where seamless cryptocurrency transactions become commonplace.

Challenges Facing the Cryptocurrency Payment Sector

Despite the optimism surrounding cryptocurrency payment solutions like Alchemy, there are significant challenges facing the sector. Regulatory uncertainty continues to pose a substantial barrier, particularly as countries around the world develop their policies regarding cryptocurrencies. Alchemy must navigate this complex landscape while maintaining compliance and fostering trust among users and stakeholders in the financial services sector.

Furthermore, the volatility of cryptocurrencies presents ongoing risks for payment processors. While Alchemy provides crypto trading support, the unpredictability in value can deter potential users or merchants from fully committing to cryptocurrency as a primary payment method. Addressing these challenges will require innovative strategies and collaborations across the industry to bolster confidence and encourage widespread adoption.

The Future of Investments in Cryptocurrency Solutions

Investment in cryptocurrency solutions is expected to surge as demand for digital payment options grows. With C1 Fund’s recent backing of Alchemy, a new wave of interest in established cryptocurrency payment providers may emerge, drawing attention from other investors aiming to capitalize on the shift towards digital currency. As businesses increasingly recognize the importance of integrating crypto solutions, the potential for investment in this space is immense.

Furthermore, as the technology supporting these payment systems matures, investors are encouraged by the prospect of significant returns. Alchemy’s success in providing a robust crypto payment infrastructure not only solidifies its standing but also attracts further investments from venture funds and institutional investors. The outcome of these investments could dramatically reshape the future landscape of the financial industry, with cryptocurrencies playing an essential role.

The Impact of Alchemy on Cryptocurrency Adoption

Alchemy’s influence extends far beyond mere technological provision; it plays a pivotal role in promoting broader cryptocurrency adoption. By enabling popular platforms to integrate easily with cryptocurrency systems, Alchemy removes many barriers that may hinder users from exploring digital currencies. This initiative not only fosters greater consumer engagement but also encourages merchants to adopt crypto payment solutions more readily.

As more users become comfortable with cryptocurrency, facilitated by Alchemy’s robust payment infrastructures, the likelihood of widespread adoption increases. This push towards acceptance can significantly enhance the overall market for cryptocurrencies and drive innovation in financial services, creating an ecosystem that is both user-friendly and forward-thinking.

Navigating the Competitive Landscape of Crypto Payment Providers

The competition among cryptocurrency payment providers is intensifying. With innovative companies like Alchemy leading the charge, there is immense pressure on rival firms to enhance their offerings. The entry of C1 Fund into the picture by investing in Alchemy illustrates the increasing need for companies to evolve continually, optimizing their services to stay relevant in a fast-paced market.

In addition to innovation, cryptocurrency payment providers must also focus on establishing trust and reliability among users. The competitive landscape necessitates that firms like Alchemy not only improve transaction speeds and enhance user experience but also prioritize security measures that instill confidence in their platforms. As market dynamics shift, adaptability will be key to maintaining a competitive edge.

The Interplay Between Traditional Finance and Cryptocurrency

The intersection of traditional finance and cryptocurrency is becoming increasingly pronounced, particularly with investments from established financial entities into cryptocurrency payment solutions like Alchemy. As traditional institutions begin to embrace digital currencies, the demand for strong crypto payment infrastructures that can bridge these two worlds grows. Investing in companies like Alchemy signifies a recognition of the need for cooperation between the two sectors.

This interplay facilitates innovation and can also lead to a reimagination of financial services as we know them. By collaborating with established financial institutions, cryptocurrency payment providers can enhance their legitimacy and functionality. In turn, traditional finance can diversify its offerings and appeal to a broader audience interested in digital currency transactions.

Looking Ahead: The Future of Cryptocurrency Payment Solutions

As we look ahead, the future of cryptocurrency payment solutions appears bright, characterized by significant growth and innovation. Companies like Alchemy are poised to lead this charge, backed by investments from funds such as C1 Fund that recognize the immense potential of digital payment systems. This growth trajectory suggests that cryptocurrency will become an integral part of the financial ecosystem, reshaping how transactions are conducted on a global scale.

Moreover, as more users and businesses adopt cryptocurrency for daily transactions, the technology supporting these payment solutions will continue to improve. Innovations in blockchain technology, coupled with strong investor support, will likely propel the industry forward, establishing cryptocurrency as a mainstream payment option. Moving forward, the success of payment providers like Alchemy will hinge on their ability to adapt and respond to evolving market needs.

Frequently Asked Questions

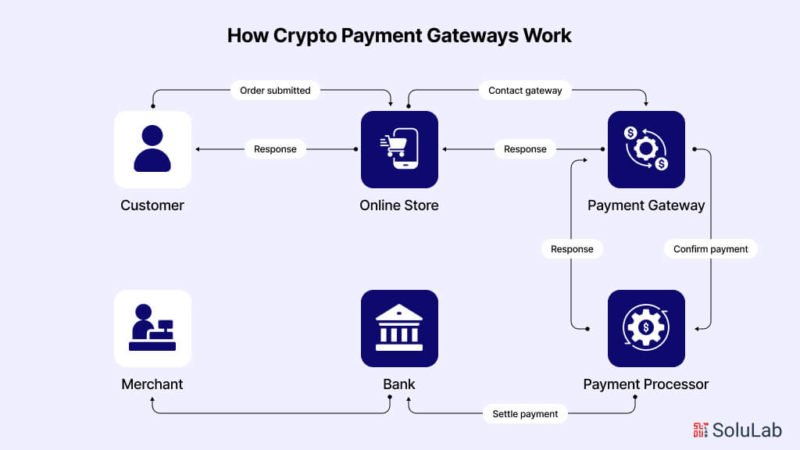

What is a Cryptocurrency Payment Solution and how does it work?

A Cryptocurrency Payment Solution enables businesses to accept and process payments in cryptocurrencies. These solutions often utilize advanced crypto payment infrastructure to facilitate secure and speedy transactions, leveraging blockchain technology. By integrating with Web3 payment providers like Alchemy, companies can streamline their payment processes and enhance the customer experience.

How does Alchemy improve Cryptocurrency Payment Solutions for businesses?

Alchemy enhances Cryptocurrency Payment Solutions by providing a robust crypto payment infrastructure that allows businesses to easily integrate cryptocurrency transactions into their platforms. With support from major companies like Robinhood and JPMorgan Chase, Alchemy offers reliable and scalable options for businesses looking to adopt crypto payments.

What role does C1 Fund play in the development of Cryptocurrency Payment Solutions?

C1 Fund plays a vital role in the development of Cryptocurrency Payment Solutions by investing in innovative companies like Alchemy. Their backing helps these solution providers expand their offerings and improve crypto trading support, making it easier for merchants to adopt cryptocurrency as a payment method.

Can small businesses benefit from using Cryptocurrency Payment Solutions?

Yes, small businesses can greatly benefit from Cryptocurrency Payment Solutions by accepting digital currencies, which can attract a new customer base. Utilizing services from established providers like Alchemy ensures that small businesses have access to reliable crypto payment infrastructure without requiring extensive technical knowledge.

How do Web3 payment providers like Alchemy differ from traditional payment processors?

Web3 payment providers like Alchemy differ from traditional payment processors by specializing in cryptocurrency transactions. They leverage decentralized technology and provide crypto payment infrastructure that is more aligned with the principles of blockchain and digital currencies, offering unique advantages such as lower fees and enhanced privacy in transactions.

What are the advantages of using Cryptocurrency Payment Solutions for online retailers?

The advantages of using Cryptocurrency Payment Solutions for online retailers include reduced transaction fees, faster settlement times, and access to a global market. By integrating solutions from providers like Alchemy, retailers can provide crypto trading support, catering to a growing demographic of crypto-savvy consumers.

| Aspect | Details |

|---|---|

| Investment | C1 Fund has invested in Alchemy, a cryptocurrency payment solution provider. |

| Amount | The specific amount of investment has not been disclosed. |

| Alchemy’s Role | Alchemy serves as a core infrastructure layer in the Web3 market. |

| Client Support | Provides trading support for major companies like Robinhood, Stripe, JPMorgan Chase, and Coinbase. |

| C1 Fund’s Background | C1 Fund has previously invested in notable companies like Chainalysis and Ripple. |

Summary

Cryptocurrency Payment Solutions are essential to the evolving financial landscape, as exemplified by Alchemy’s recent investment by C1 Fund. Alchemy plays a significant role in the Web3 market by providing vital infrastructure and trading support to leading financial entities. As the demand for cryptocurrency transactions increases, solutions like those offered by Alchemy will become increasingly important for businesses looking to integrate efficient payment systems.

Related: More from Regulation & Policy | Anthropic Founder Critiques Pentagons Choice as Unprecedented in Crypto Regulation | UK Gambling Regulator Examines Cryptocurrencies for Licensed Bettors in Crypto Regulation