The cryptocurrency market is currently experiencing a significant surge, drawing the attention of investors looking to capitalize on shifting assets amid fluctuations in gold and silver prices. Despite a tumultuous start to the day, with sell-offs noted in the stock market, the value of cryptocurrencies is on the rise, sparking interest among analysts. This fresh influx of capital into the cryptocurrency space might not only sustain its upward trend but could also catalyze a potential short squeeze, emphasizing the volatile nature of digital assets. As Garrett Jin of ‘1011 Insider Whale’ noted, the financial landscape is rapidly changing, and those who analyze stock market dynamics closely are adjusting their strategies accordingly. The sustained rise in cryptocurrencies, alongside Jin’s notable profits nearing $68 million, illustrates the complex interplay between traditional markets and emerging digital currencies.

The realm of digital currencies, often referred to as the cryptocurrency ecosystem, is witnessing an unprecedented boom as investors redirect funds from traditional markets into these high-potential assets. With the recent volatility in precious metals such as gold and silver, the shift towards cryptocurrencies is becoming increasingly evident. Analysts are closely monitoring this trend, as further price gains could ignite a flurry of activity, including dramatic short squeezes. As the stock market navigates its recent challenges, individuals like Garrett Jin are capitalizing on the evolving landscape, showcasing significant profits that underscore the financial opportunities present within this innovative market. The burgeoning value of cryptocurrencies highlights a broader shift in investment strategies and a growing acceptance of digital assets as viable financial instruments.

The Impact of Gold and Silver Prices on Investment Trends

Recent analysis by Garrett Jin from ‘1011 Insider Whale’ indicates that gold and silver prices have reached their peak, prompting investors to reconsider their allocation strategies. As gold and silver often serve as safe havens, their current price trends are pivotal in influencing market sentiment. Understanding how precious metals play a role in overall investment strategies is critical; with the peaks of these metals leading to an exodus towards more volatile markets like cryptocurrencies, investors are looking to capitalize on rising trends elsewhere.

In the face of high gold and silver prices, many traders are evaluating their assets and considering diversifying into other opportunities. The surge in these precious metals has historically attracted short-term liquidity, which often results in a shift to riskier assets. This dynamic creates a landscape where cryptocurrencies could thrive, especially as new avenues for profit emerge. Vigilant investors are taking note of these potential shifts, using stock market analysis to safeguard their gains while exploring the cryptocurrency market for promising returns.

Navigating the Current Cryptocurrency Market

With a noticeable shift of funds into the cryptocurrency market, investors appear to be betting on the rise of digital assets amidst volatility in traditional stocks. The cryptocurrency market, once perceived as speculative, is increasingly viewed as a viable alternative for wealth preservation and growth, especially when traditional markets face sell-offs. Following Garrett Jin’s insights, even as investors feel the pressure of fluctuating stock prices, cryptocurrencies seem to be gaining traction, indicating a robust interest in digital investing strategies.

The ongoing movement towards cryptocurrencies is not just a fleeting trend; rather, it indicates a fundamental shift in how investors perceive risk and reward. With many turning to assets like Bitcoin and Ethereum amidst the backdrop of sticky gold and silver prices, the rise in cryptocurrency values is likely to continue if this momentum sustains. As more capital flows into this sector, the potential for a short squeeze could emerge, with prices spiking dramatically as traders react to new market signals. It’s crucial for investors to leverage stock market analysis while remaining aware of the intricacies involved in navigating this burgeoning marketplace.

Profiting from Market Movements: Garrett Jin’s Insight

Garrett Jin’s reported profits of approximately $68 million signal a successful navigation through turbulent market conditions. His foresight in entering the cryptocurrency market at opportune moments has placed him in a favorable position to capitalize on upward trends. Understanding his approach offers valuable lessons for investors about market timing and the importance of analytical insights in achieving financial gains, especially in fast-paced environments like cryptocurrency trading.

In the grand scheme of investment strategies, Jin’s methods highlight the significance of recognizing patterns in various markets. With just $6 million remaining to break even on his substantial $800 million long position, his gains reflect a mastery of both timing and market fundamentals. For those on the sidelines, Jin’s success serves as an example of how calculated risks in the right markets—such as cryptocurrencies—can yield impressive returns, especially when stock market analysis points towards instability.

The Role of Short Squeezes in Modern Trading

A short squeeze is a phenomenon that occurs when a stock’s price rises sharply, forcing short sellers to close their positions, which can further drive the price up. In the context of the current cryptocurrency market, many analysts speculate that with the influx of renewed interest and capital, a similar situation could arise, especially if traditional markets continue their downturn. Investors should keep an eye on potential short squeezes as they imply a rapidly changing landscape where quick, strategic trading can lead to substantial profits.

Given the volatility of cryptocurrencies, short squeezes in this sector can present both risks and rewards for investors. The psychology of market sentiment plays a crucial role; when traders sense an upward momentum, they may scramble to cover their shorts, propelling prices even higher. As this occurs, those who position themselves early can reap significant rewards. Understanding how to identify and react to these opportunities is vital for anyone looking to navigate the cryptocurrency market effectively.

Analyzing Stock Market Trends: A Path to Cryptocurrency Investment

Stock market analysis is an essential tool for investors looking to optimize their portfolios, particularly when venturing into newer markets like cryptocurrencies. By studying the trends in traditional financial markets, investors can glean insights into investor sentiment and capitalize on shifting dynamics. As fintech continues to blend traditional finance with cryptocurrencies, savvy investors are using these analyses to inform decisions about where to allocate their resources.

One pivotal aspect of stock market analysis is the correlation between assets. As gold and silver have peaked, observing the subsequent behavior of these commodities can provide clues about where funds may flow next. When traditional market participants start reallocating their resources, the signs may indicate a ripe opportunity for investment in cryptocurrencies. Having a robust analytical framework allows investors to make informed predictions about market shifts, maximizing their potential for profits.

Investing in Cryptocurrency: A Strategic Perspective

Investing in cryptocurrency necessitates a strategic approach that integrates data analysis, market understanding, and risk assessment. As Garrett Jin demonstrated with his significant profits following a thorough evaluation of market conditions, having a well-founded strategy is crucial. Investors must comprehend the multi-faceted nature of cryptocurrency trading, acknowledging both its volatility and potential rewards.

Furthermore, constructing an investment portfolio that includes cryptocurrencies requires a balance of risk tolerance and the ability to adapt to fast-changing market dynamics. Utilizing insights from stock market analysis, traders can better navigate cryptocurrency investments by determining optimal entry and exit points. The journey into digital assets may be complex, but with the right knowledge and strategies, investors can position themselves for significant gains.

Long-term Wealth Strategies in a Digital Age

As markets evolve, the strategies for achieving long-term wealth must also adapt, particularly in the face of the increasing relevance of cryptocurrencies. Embracing a diversified portfolio, which includes digital currencies alongside traditional assets like gold and silver, is becoming a common approach among seasoned investors. This strategy not only mitigates risks but also positions portfolios to benefit from different market scenarios.

The key to successful long-term wealth strategies lies in understanding the nature of each asset class. While gold and silver provide security, cryptocurrencies offer growth potential that can lead to substantial profits, as Garrett Jin’s experience illustrates. As industries continue to shift and new technologies emerge, investors who continuously educate themselves and analyze market conditions will more effectively navigate and secure their wealth in the digital age.

Emerging Trends in Cryptocurrency: What Investors Should Know

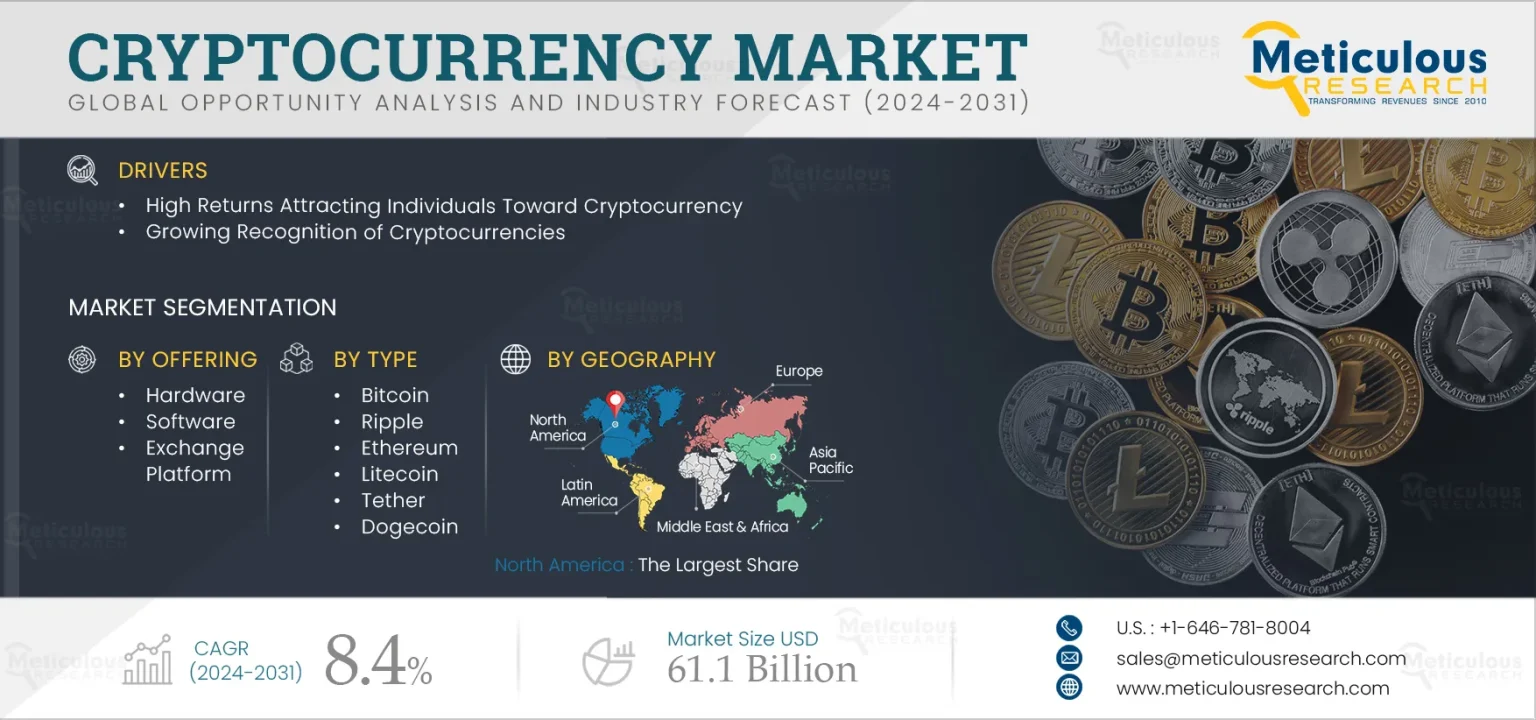

As the cryptocurrency market continues to mature, several emerging trends warrant attention from investors. Amid the backdrop of rising gold and silver prices and market instability, many are turning to cryptocurrencies as viable alternatives that promise high returns. This shift is indicative of a broader acceptance of digital currencies and a growing recognition of their potential role in the financial ecosystem.

Moreover, technological advancements and innovations within the blockchain space are continually reshaping the investment landscape. Investors must stay informed about these developments, as they can provide both opportunities and challenges. By keeping an eye on the factors driving cryptocurrency adoption, such as regulatory changes and institutional interest, traders can position themselves strategically to leverage the benefits these trends present.

Understanding Cryptocurrency Volatility: A Trader’s Guide

Cryptocurrency volatility is one of the defining characteristics of this asset class, presenting both challenges and opportunities for traders. Many investors, as reflected in Garrett Jin’s strategies, are learning to navigate these fluctuations skillfully to identify profitable moments to enter or exit the market. By understanding the drivers of volatility—from market sentiment to macroeconomic factors—traders can better prepare for unexpected price movements that can either yield substantial profits or potential losses.

Additionally, managing risk is paramount in trading volatile assets like cryptocurrencies. Effective strategies often combine technical analysis with an understanding of market psychology, helping traders make informed decisions. Investors should develop a plan that outlines their risk tolerance and defines their approach to trading in volatile conditions, taking lessons from seasoned traders to maximize their success while mitigating potential downsides.

Frequently Asked Questions

What factors influence the cryptocurrency market compared to gold and silver prices?

The cryptocurrency market is influenced by various factors, including investor sentiment, regulatory news, and market trends. Unlike gold and silver prices, which are affected by physical demand and macroeconomic conditions, the cryptocurrency market reacts more dynamically to technological developments and speculative trading. As noted by Garrett Jin, the recent shift of funds from traditional assets like gold and silver into cryptocurrencies indicates a growing preference for digital assets during market volatility.

How does the cryptocurrency rise relate to stock market analysis?

The cryptocurrency rise often contrasts with stock market analysis, especially during sell-offs. As observed, even when the stock market experiences declines, investments can funnel into the cryptocurrency market as an alternative. This movement highlights a trend where investors seek higher potential returns in digital currencies during uncertain economic times.

Can a short squeeze occur in the cryptocurrency market?

Yes, a short squeeze can occur in the cryptocurrency market. This situation arises when the price of a cryptocurrency rises rapidly, forcing short sellers to cover their positions quickly, which can further propel the price increase. The recent influx of funds into cryptocurrencies without significant pullbacks may create conditions favorable for a short squeeze, potentially accelerating the market’s upward momentum.

How have Garrett Jin’s profits impacted the perception of the cryptocurrency market?

Garrett Jin’s reported profits of approximately $68 million since the market bottom highlight the lucrative opportunities available in the cryptocurrency market. His success, gained through a long position amidst shifting investment trends, underscores the appeal of cryptocurrencies as investors increasingly choose digital assets over traditional investments like gold and silver.

What should investors consider when shifting funds into the cryptocurrency market?

Investors should consider market volatility and historical performance when shifting funds into the cryptocurrency market. As Garrett Jin’s analysis suggests, the current environment favors cryptocurrencies amid a broader market sell-off. It’s essential to conduct thorough stock market analysis and understand the risks associated with such a transition to capitalize on potential gains effectively.

| Key Point | Details |

|---|---|

| Agent Statement | Garrett Jin from ‘1011 Insider Whale’ stated that gold and silver prices have peaked. |

| Market Trends | Funds are shifting into the cryptocurrency market after the U.S. market opened. |

| Stock Market Impact | Despite stock market sell-offs, cryptocurrencies are experiencing growth. |

| Potential Outcomes | Increased influx of funds may lead to a short squeeze without any pullback. |

| Profit Analysis | Since December 17, Jin has made approximately $68 million in profits, nearing breakeven on his long position of $800 million. |

Summary

The cryptocurrency market is gaining traction as funds transition from the stock market, which has shown recent downturns. With key insights from Garrett Jin of ‘1011 Insider Whale’, it is clear that the momentum in cryptocurrencies may continue to accelerate, leading to significant profit potential for investors. As the market evolves, those engaged in cryptocurrency can expect dynamic shifts, with opportunities for profitable trading strategies amidst ongoing market fluctuations.