Cryptocurrency liquidations have become a focal point in the volatile world of digital assets, impacting traders and investors alike. Recently, the entire crypto market experienced a staggering $106 million in liquidations, with a significant portion attributed to BTC liquidations, totaling around $76.85 million. This surge in liquidations highlights the importance of understanding market movements, particularly amid fluctuating prices and sentiments. Tracking liquidation events, such as those seen with ETH and BTC, can provide crucial insights into cryptocurrency trends and the overall health of the market. By staying informed about crypto market news and liquidation analysis, traders can better navigate these turbulent waters and adjust their strategies accordingly.

In the fast-evolving arena of digital currencies, the phenomenon of forced sell-offs, often referred to as liquidations, has significant consequences on market dynamics. Recent trends reveal that a considerable amount of capital, including BTC and ETH liquidations, has recently been impacted amid unpredictable fluctuations. Keeping abreast of these liquidation events not only informs risk management strategies but also sheds light on broader cryptocurrency dynamics. Observers of the crypto landscape are increasingly relying on liquidation analytics to gauge market sentiment and make informed decisions. As digital asset traders seek to understand the implications of these market forces, shedding light on liquidation occurrences is essential for navigating the complexities of cryptocurrency investments.

Understanding Cryptocurrency Liquidations

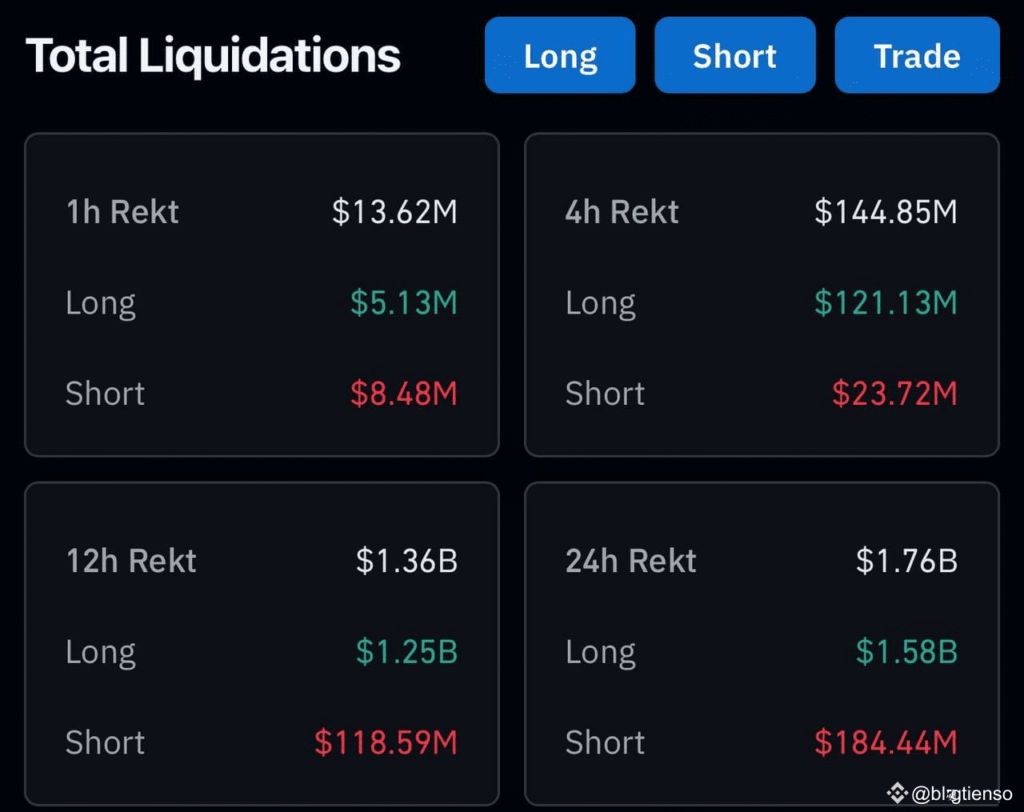

Cryptocurrency liquidations occur when a trader’s position is forcibly closed as a result of reaching the margin call or liquidation price. In the past hour alone, the crypto market witnessed a staggering $106 million in total liquidations. This indicates a volatile trading environment where substantial market movements can quickly lead to significant losses for traders, especially those holding leveraged positions. Liquidations are crucial for market participants to understand, as they often provide insight into the overall sentiment and potential shifts within the cryptocurrency landscape.

Recently, data from Coinglass revealed that long positions were predominantly affected, accounting for $104 million of the total liquidations. This situation showcases the increasing risks associated with maintaining long-term bullish positions during market turbulence. In contrast, short positions saw a comparatively minor liquidation amount of $1.3111 million, highlighting a prevailing bullish sentiment among traders, even amidst broader market uncertainty. Such events can lead to cascading liquidations, further amplifying price swings and indicating persistent volatility in cryptocurrency trends.

Analyzing BTC and ETH Liquidations

In the recent data analysis, BTC liquidations stood out significantly, with approximately $76.85 million liquidated. This substantial figure underscores Bitcoin‘s influence on the overall crypto market dynamics. As BTC often sets the trend for other cryptocurrencies, such as Ethereum (ETH), these liquidation events can have ripple effects across numerous altcoins and the broader market. Investors closely monitor BTC liquidations for signs of trend reversals or momentum shifts, making this data critical for effective trading strategies.

Comparatively, ETH liquidations totaled about $7.4077 million, showing a less pronounced impact from immediate market fluctuations than Bitcoin. However, this does not diminish Ethereum’s importance in the crypto ecosystem, where shifts in ETH prices can directly correlate with changes in DeFi activity and NFT markets. Understanding Ethereum’s liquidations helps investors gauge the sentiment towards the overall blockchain technology space and its continuous evolution in response to market demands.

Current Crypto Market News and Trends

Recent crypto market news has been dominated by significant liquidations, with traders reacting to rapid price movements and shifts in sentiment. Staying abreast of these developments is crucial, particularly for investors actively trading in the space. The recent hourly liquidation figures emphasize a broader trend of increased volatility in cryptocurrencies, where large buy or sell orders can easily sway market dynamics, leading to substantial financial repercussions.

Notably, the context of liquidation trends informs traders’ perceptions of market health. With continuous developments in blockchain technology, regulatory changes, and economic factors influencing investor behaviors, both traders and analysts must adapt to shifting conditions. The balance between maintaining risk management strategies and seizing potential gains is essential in navigating current and future cryptocurrency trends effectively.

The Importance of Liquidation Analysis

Liquidation analysis is a critical tool for traders looking to understand market movements and prepare for potential risks. By examining the patterns in BTC and ETH liquidations, participants can better predict future price actions and market trends. Current data indicates that $76.85 million in BTC liquidations and $7.4077 million in ETH liquidations are a clear signal of substantial market activity, allowing traders to adjust their strategies accordingly. Understanding how to analyze these liquidations can significantly improve a trader’s ability to respond to volatility.

Moreover, liquidation analysis provides insights into the psychology of the market. When large positions are liquidated, it can lead to herd behavior where other traders react by selling off their holdings, which can provoke further liquidations and market drops. By staying informed about these dynamics, traders can better position themselves to capitalize on market corrections or avoid substantial losses during turbulent periods.

Strategies to Mitigate Risk During Liquidation Events

In the cryptosphere, strategies to mitigate risk during liquidation events are essential for traders. Maintaining appropriate leverage ratios, employing stop-loss orders, and setting realistic profit targets are crucial components of a sound trading strategy. For example, with the recent BTC liquidations amounting to approximately $76.85 million, traders with higher leverage may have faced quicker liquidation due to price volatility. Therefore, implementing a conservative approach to leverage can significantly reduce the likelihood of forced liquidation.

Additionally, diversifying trading strategies can also help to mitigate risks. By varying positions across multiple cryptocurrencies—rather than concentrating solely on BTC or ETH—traders can spread their exposure and shield themselves from severe downturns in any single asset class. Keeping abreast of cryptocurrency trends and market news further enables traders to reassess their positions frequently, enhancing their preparedness for sudden liquidation events.

Market Impact of Recent Liquidations

The impact of recent liquidations on the cryptocurrency market cannot be overstated. The $106 million in liquidations, including a majority from BTC, reflects a phase of heightened uncertainty and speculative trading. Such large-scale liquidations can result in sharp price drops, creating both challenges and opportunities in the market. During these events, traders must navigate complex price dynamics and make strategic decisions quickly to capitalize on potential rebounds after liquidations.

Furthermore, recent market trends highlight how liquidation events, especially in leading cryptocurrencies like Bitcoin and Ethereum, considerably influence pricing across the crypto landscape. After significant liquidations, it is common for a recovery rally to occur as traders look to buy back at lower prices, creating a potential profit opportunity. Understanding these market cycles is key for participants looking to thrive in a highly volatile arena.

The Role of Traders in the Liquidation Cycle

Traders play a fundamental role in the liquidation cycle within the cryptocurrency market. Their decisions—whether to hold, sell, or liquidate positions—can trigger further liquidations, creating a cascading effect that impacts pricing. With the current market liquidity at $106 million, traders must be aware of how their trades can affect market stability. The interconnectedness of trader sentiment and market movements emphasizes the need for informed decision-making during periods of volatility.

Moreover, understanding the psychology behind traders’ actions during liquidation events can inform better trading strategies. Emotional responses to price changes, fear of missing out (FOMO), and panic selling can exacerbate volatility. Thus, successful traders cultivate emotional discipline, leveraging data such as BTC and ETH liquidation statistics to make rational decisions. By mastering these aspects, traders can navigate the complexities of the market while minimizing risks associated with liquidation events.

Future Outlook for Cryptocurrency Liquidations

Looking ahead, the future outlook for cryptocurrency liquidations remains uncertain yet intriguing. As the cryptocurrency landscape evolves, factors such as regulatory developments, technological advancements, and macroeconomic conditions will continue to shape liquidations. With recent figures highlighting considerable liquidations in BTC and ETH, investors and analysts alike will monitor these patterns closely, seeking indicators of stability or further volatility in the market.

Additionally, as the crypto market matures, the nature of liquidations may change. With increasing institutional involvement and growing acceptance of cryptocurrencies, we may see shifts in trading behaviors that could alter liquidation dynamics. Investors must remain vigilant, adapting their strategies to embrace the continuous evolution of cryptocurrency trends and preparing adequately for potential liquidations in response to market developments.

Frequently Asked Questions

What caused the recent cryptocurrency liquidations?

Recent cryptocurrency liquidations, totaling approximately $106 million, were primarily driven by market volatility, particularly in Bitcoin (BTC) and Ethereum (ETH). BTC liquidations accounted for about $76.85 million, influenced by quick price movements that triggered margin calls on long positions.

How do BTC liquidations affect the crypto market?

BTC liquidations can significantly impact the crypto market by increasing volatility. When a substantial amount of long positions are liquidated, as seen with $76.85 million in recent BTC liquidations, it often leads to rapid price declines, affecting investor sentiment and leading to further liquidations.

What is the impact of ETH liquidations on cryptocurrency trends?

ETH liquidations contribute to cryptocurrency trends by reflecting investor behavior and market sentiment. With about $7.4077 million in recent ETH liquidations, such events indicate how traders respond to market shifts, potentially predicting future movements in cryptocurrency prices.

Can I find detailed liquidation analysis for the crypto market?

Yes, detailed liquidation analysis for the crypto market can be found on platforms like Coinglass. They provide insights into recent market activity, showing total liquidations, including BTC liquidations and ETH liquidations, which helps traders understand market dynamics better.

What are the key indicators of future cryptocurrency liquidations?

Key indicators of future cryptocurrency liquidations include market volatility, trading volume, and long vs. short position ratios. Monitoring these factors can provide insights into potential liquidation events, especially for BTC and ETH in the context of overall crypto market news.

Why is understanding cryptocurrency liquidations important for investors?

Understanding cryptocurrency liquidations is crucial for investors as it can help them navigate market fluctuations. By analyzing BTC and ETH liquidations, investors can better manage their risk and adapt their trading strategies in response to shifting cryptocurrency trends.

How can I protect my investments from cryptocurrency liquidations?

To protect your investments from cryptocurrency liquidations, consider using stop-loss orders, diversifying your portfolio, and avoiding high leverage trading. Being aware of the liquidation situations, especially for BTC and ETH, can also help in making informed decisions.

Where can I get the latest updates on crypto market news and liquidations?

The latest updates on crypto market news and liquidations can be found on various financial news websites and analytics platforms like Coinglass. These sources provide real-time information on BTC liquidations, ETH liquidations, and other significant market developments.

| Metric | Amount ($ Million) |

|---|---|

| Total Liquidations | 106 |

| BTC Liquidations | 76.85 |

| ETH Liquidations | 7.4077 |

| Long Positions Liquidated | 104 |

| Short Positions Liquidated | 1.3111 |

Summary

Cryptocurrency liquidations have escalated recently, with a staggering $106 million liquidated across the entire network within the past hour. The substantial amounts in BTC ($76.85 million) and ETH ($7.4077 million) highlight the significant market volatility. While long positions accounted for the majority of liquidations at $104 million, short positions remained minimal at just $1.3111 million. Despite these fluctuations, the overall fundamentals of cryptocurrencies are reported to remain strong, indicating resilience in this dynamic market.

Related: More from Market Analysis | Related Box Test | Crypto Worries Over Iranian Oil Supply: Is It Overhyped? in Crypto Market