Cryptocurrency liquidation has emerged as a significant concern for traders navigating the volatile landscape of digital assets. In the past 24 hours alone, the cryptocurrency market has faced a staggering $67.6237 million in total liquidations, driven predominantly by long positions which accounted for $38.9888 million. This phenomenon, characterized by forced asset sales due to margin calls, has affected over 58,633 individuals worldwide, highlighting the urgency of market analysis in understanding crypto market trends. Notably, the largest liquidation event occurred on the Hyperliquid platform involving the FARTCOIN-USD pair, which was valued at an impressive $1.4637 million. As cryptocurrency trading continues to attract both novice and expert investors, grasping the implications of liquidation is crucial for mitigating potential losses and capitalizing on market movements.

In the realm of digital currencies, forced asset sales—commonly referred to as liquidation events in crypto—can significantly impact investors and the overall market dynamics. Recently, the cryptocurrency market witnessed a substantial wave of liquidations, reflecting the volatile nature of trading and the importance of prudent investment strategies. With countless traders subject to liquidation risks, understanding these events is essential for anyone keen on thriving in the world of cryptocurrency. Additionally, the occurrences related to specific trading pairs, such as FARTCOIN liquidations, underline the necessity for comprehensive market analysis to navigate this ever-evolving digital asset landscape. By exploring alternative terms and concepts associated with these events, investors can better equip themselves to manage both risks and opportunities.

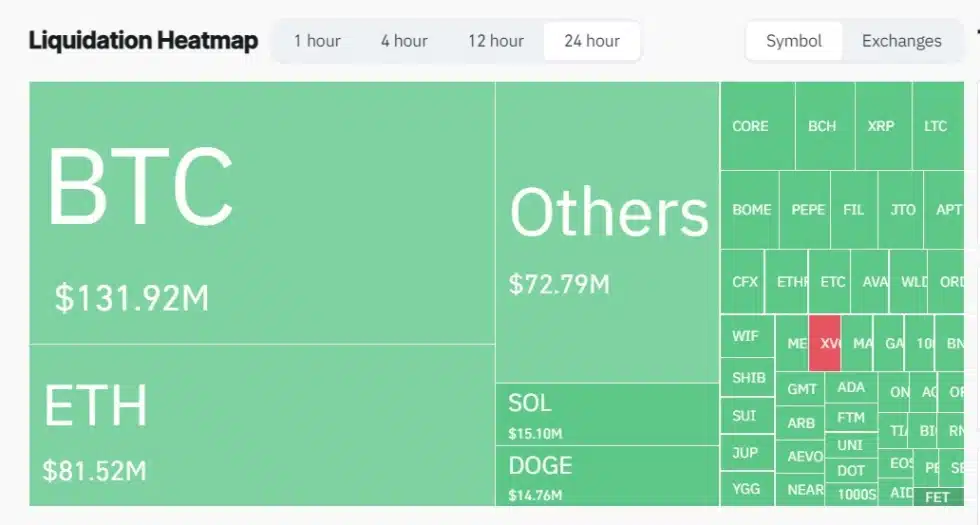

Current Cryptocurrency Liquidation Trends

In the last 24 hours, the cryptocurrency market has experienced significant liquidation activity, totaling an astonishing $67.6237 million. This figure highlights the volatile nature of cryptocurrency trading and the risks traders face in the ever-changing crypto market trends. Particularly, long positions suffered the majority of the liquidation, accounting for $38.9888 million. Such drastic moves in liquidation events in crypto are critical for traders to understand, as they reflect not only the market’s sentiment but also potential future price movements.

The liquidation data, sourced from Coinglass and reported by Odaily Planet Daily, illustrates that 58,633 traders globally faced liquidation. This serves as a stark reminder of the risks associated with leveraging positions in cryptocurrency trading. The analysis of these events indicates a need for robust risk management strategies, especially in a market so prone to rapid changes. Observing these liquidation patterns can provide valuable insights into future market behavior.

Frequently Asked Questions

What are recent trends in cryptocurrency liquidation?

Recent trends in cryptocurrency liquidation indicate significant market volatility, with a total of $67.6237 million liquidated in the last 24 hours. This includes $38.9888 million from long positions, reflecting the heightened risk and unpredictability in crypto market trends.

How do liquidation events in crypto affect trading strategies?

Liquidation events in crypto significantly affect trading strategies as they can trigger rapid price movements. Investors often adjust their approaches to mitigate risks associated with potential liquidations, such as setting tighter stop-loss orders or avoiding highly leveraged trades.

What is the impact of cryptocurrency trading on liquidation occurrences?

Cryptocurrency trading directly impacts liquidation occurrences, as traders’ decisions to enter long or short positions can lead to significant liquidations during market dips. For example, the recent $67.6237 million liquidation indicates both heavy long and short positions were affected by market shifts.

How can market analysis help prevent cryptocurrency liquidation?

Market analysis can help prevent cryptocurrency liquidation by providing traders with insights into price movements, identifying trends, and suggesting optimal entry and exit points. By analyzing market data, traders can better manage risk and avoid being caught in liquidation scenarios.

What was the role of FARTCOIN liquidation in recent market events?

The FARTCOIN liquidation played a notable role in recent market events, as the largest single liquidation of $1.4637 million occurred on the FARTCOIN-USD trading pair. This case highlights how specific cryptocurrencies can experience rapid liquidation events that influence overall market sentiment.

| Metric | Value |

|---|---|

| Total Liquidation in Last 24 Hours | $67.6237 million |

| Liquidated Long Positions | $38.9888 million |

| Liquidated Short Positions | $28.6394 million |

| Total Number of Liquidated Individuals | 58,633 |

| Largest Single Liquidation | $1.4637 million (FARTCOIN-USD on Hyperliquid) |

Summary

Cryptocurrency liquidation has become a prevalent issue in the market, highlighted by the staggering total of $67.6237 million liquidated in the last 24 hours. This method of trade closure often leads to significant losses for investors, marking an essential aspect of cryptocurrency trading dynamics.

Related: More from Market Analysis | Barclays Looks at Blockchain for Payments, Deposits | PayPal USD Powers New PYUSDx App