As the landscape of digital currency evolves, crypto winter predictions are once again coming to the forefront of financial discussions. Investors and analysts are closely monitoring the crypto market trends, grappling with the impacts on Bitcoin price forecasts and Ethereum updates. Recent insights from the Myriad prediction market have revealed a surprising decline in expectations for a prolonged downturn, with only 9% of respondents believing a crypto winter is imminent. This shift in sentiment comes despite a turbulent past few months for cryptocurrencies, which experienced significant fluctuations in value. As the cryptocurrency performance stabilizes, many are left wondering what factors will ultimately shape the next phase of this dynamic market.

In the ever-changing realm of digital assets, speculation surrounding the potential for a prolonged bear market—often referred to as a crypto winter—has gained renewed attention. With the fluctuating value of leading cryptocurrencies like Bitcoin and Ethereum, market participants are eager to decipher the latest signals indicating future price movements. The Myriad prediction market serves as an intriguing tool for gauging public sentiment, illustrating a noteworthy decrease in the fear of an impending downturn. Analysts are keen on tracking currency trends and the overall health of cryptocurrency investments as they seek to interpret recent developments in the space. As discussions continue about market resilience and volatility, the focus remains on how these dynamics will influence the broader cryptocurrency landscape.

Current State of the Cryptocurrency Market

As we analyze the current state of the cryptocurrency market, it’s important to note the recent fluctuations that have impacted investors’ sentiments. Following a challenging period, where Bitcoin reached significant lows, the market is showing signs of recovery. After recent price rallies, Bitcoin has shown resilience, trading above $91,500 and reflecting a 6% increase in just one day. This rebound indicates a shift in market dynamics, suggesting that traders may be regaining confidence, albeit cautiously.

In parallel, Ethereum’s price synergy with Bitcoin cannot be overlooked, especially with significant updates like the upcoming Fusaka upgrade. These developments are likely to enhance Ethereum’s network performance, encouraging investment as it recovers from recent performance dips. Thus, while the crypto market shows healing signs, it operates under a cloud of economic uncertainty that compels investors to be strategic.

The Impact of Economic Trends on Crypto Prices

Economic trends are playing a crucial role in shaping cryptocurrency price movements. Recently, analysts pointed towards hawkish sentiments from financial regulators, particularly the Bank of Japan, which created waves of volatility in the crypto market. Such macroeconomic pressures can lead to shifts in investor behavior, with Bitcoin experiencing a notable 31% correction from its recent peak. This kind of analysis highlights the intertwined relationship between traditional economies and digital assets, reaffirming that external factors have the power to influence investor sentiment significantly.

Moreover, as we navigate through potential interest rate hikes and inflationary pressures, investors in the cryptocurrency market remain vigilant. Any adverse economic signals could contribute to further fluctuations in asset values. This environment demands robust analyses and a nuanced understanding of how global economic trends correlate with cryptocurrency performance, setting up a narrative that every investor must pay attention to.

Navigating the Crypto Winter Predictions

Current predictions for a potential crypto winter are drastically changing among industry experts and traders. Initial projections at 30% of Myriad users anticipating a prolonged market downturn have sharply decreased to just 9%. This shift reflects a growing optimism that a crypto winter is not imminent, and many traders are banking on a more favorable climate for digital assets, particularly as Bitcoin and Ethereum show signs of recovery.

However, it’s essential to remain cautious. The definition of a crypto winter hinges on specific criteria that could still be met if market conditions don’t improve. These include significant drops in Bitcoin and Ethereum prices, as well as the market capitalization plummeting. Investors must recognize that while the immediate forecast appears promising, the market is inherently volatile, necessitating constant vigilance.

The Role of Prediction Markets in Shaping Expectations

Prediction markets, like Myriad, play a critical role in shaping the expectations surrounding cryptocurrency trends. They allow traders and investors to express their beliefs about future market conditions based on various indicators. This crowd-sourced intelligence can provide invaluable insights, influencing not just individual trading strategies, but also the overall market sentiment. The low expectation of a crypto winter, as reflected in current prediction trends, may drive more investment and trading activity.

Moreover, the interaction within these markets fosters a dynamic environment where information flows rapidly. Traders react to news and technical developments, which creates opportunities for sharp price movements. Consequently, prediction markets act as a barometer of investor confidence, with their outcomes often influencing wider cryptocurrency performance and market trends.

Bitcoin Price Forecast: What Lies Ahead?

Considering the recent price behaviors and trading volume, the outlook for Bitcoin remains a subject of intense discussion among analysts. While the recent uptrend to about $91,500 suggests recovery, the two areas of concern are overarching economic pressures and investor willingness to engage. If Bitcoin can maintain stability above critical levels, the forecast could pleasantly surprise traders as they eye a return toward previous all-time highs.

Yet, these forecasts should be taken with a grain of caution. The same macroeconomic conditions influencing Bitcoin’s price today could shift rapidly, introducing volatility. Therefore, prospective investors must appreciate the intricacies of both market sentiment and economic indicators when formulating their Bitcoin investment strategies.

Ethereum Updates: Future Outlook and Developments

As Ethereum rolls out significant updates, such as the Fusaka upgrade, the potential for positive impact on its price remains high. Developers intend for these enhancements to streamline data processing from layer-2 networks significantly, making the Ethereum blockchain more efficient and attractive for developers and users alike. This ongoing evolution is symbolic of Ethereum’s resilience and its position as a foundational pillar of the crypto ecosystem.

However, despite growth potential, Ethereum remains susceptible to market fluctuations, recently retreating over 20% from its prior month values. Investors may be eagerly watching these updates, yet they also must stay alert to wider market dynamics that can shape Ethereum’s trajectory. The combination of technological developments alongside strategic financial governance will be crucial in determining its future success.

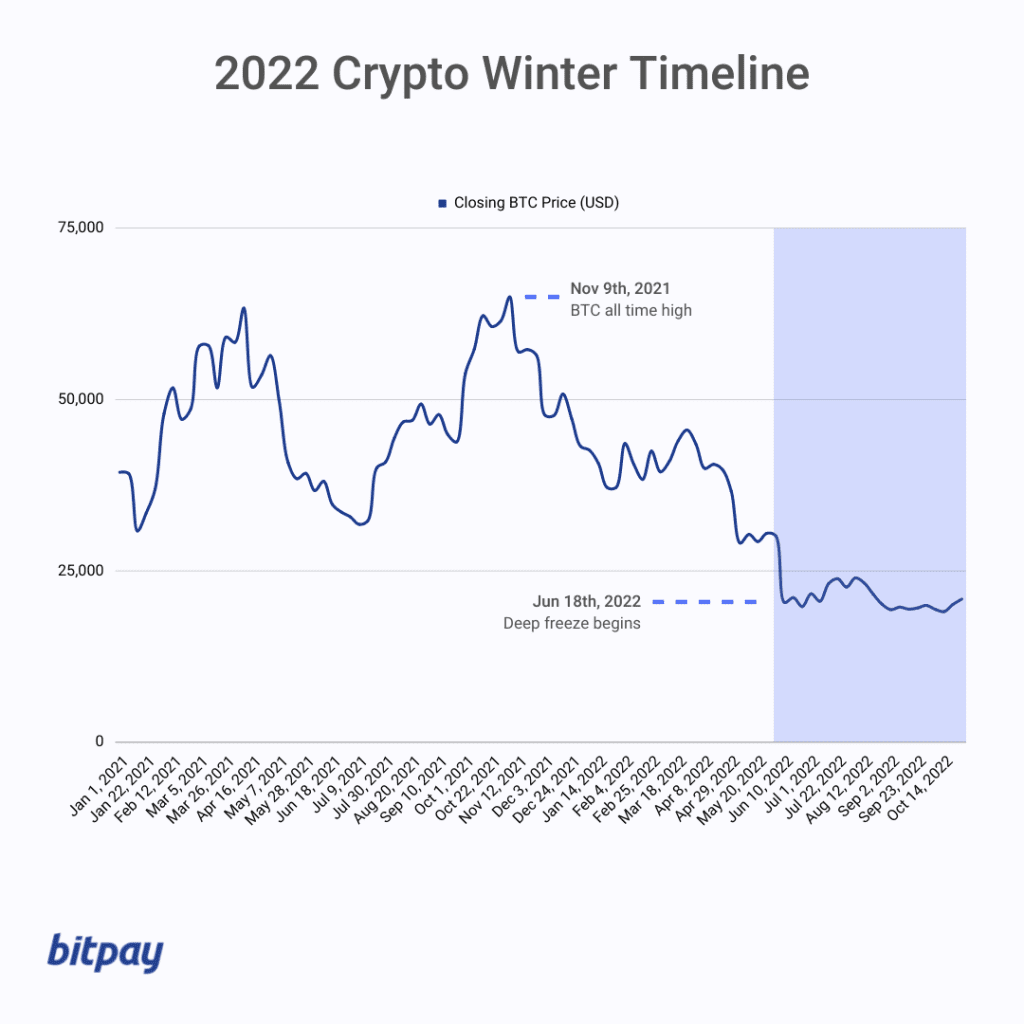

Historical Context: Lessons from Past Crypto Winters

Understanding historical contexts is pivotal when assessing potential future scenarios in the crypto market. The previous crypto winter spanned from late 2021 to 2023, marking a significant downturn that adversely affected Bitcoin and Ethereum, among other cryptocurrencies. This historical backdrop reminds investors that market cycles can be protracted, and complacency during bullish periods can lead to severe repercussions during downturns.

Within this context, us understanding the triggers of past crypto winters, including the explosive growth coupled with unsustainable speculative trading, is essential. These lessons underscore the importance of due diligence and a proactive approach to investing in cryptocurrencies. As market conditions fluctuate, the past serves as a guidepost for navigating the present and future landscape.

Investor Sentiment: The Pulse of the Market

Investor sentiment significantly influences cryptocurrency market movements and is captured effectively in prediction markets. The recent drastic shift from a majority fearing a crypto winter to an optimistic few suggests renewed confidence among traders. High levels of engagement indicate that many investors believe in the long-term viability of cryptocurrencies, suggesting that the current fluctuations may represent a mere correction rather than a precursor to a deeper decline.

However, measuring sentiment must be coupled with market realities; while optimism might suggest the market could stabilize, unforeseen events could easily shift sentiment. As demonstrated in past market cycles, maintaining a balanced perspective of expectations and realities is crucial for successful investing in the unpredictable world of cryptocurrencies.

Future Trends in Cryptocurrency Performance

Looking ahead, trends in cryptocurrency performance are poised to be influenced by myriad factors, including regulatory developments, technological innovations, and market sentiment shifts. As platforms like Myriad provide fresh insights into trader expectations, the shifting perspectives will be instrumental in shaping future price movements. Investors are likely to toggle between caution and ambition as they navigate these consequent trends.

Moreover, attention towards significant upcoming events, such as regulatory changes and technological upgrades, will be critical profile-moving moments in shaping the broader ecosystem. Hence, for investors, staying attuned to these dynamics, along with market performance analytics, will be key in making informed decisions as they cultivate a viable investment strategy in the cryptocurrency landscape.

Frequently Asked Questions

What are the latest crypto winter predictions based on market trends?

Recent crypto winter predictions suggest that the likelihood of a severe downturn is low, with only 9% of Myriad prediction market users anticipating a crypto winter. This is a significant decrease from the previous 30%, indicating a more optimistic outlook for crypto market trends.

How do Bitcoin price forecasts relate to crypto winter predictions?

Bitcoin price forecasts are crucial for determining the potential for a crypto winter. Currently, analysts believe that if Bitcoin were to drop to $35,000, it could indicate the onset of a crypto winter. However, recent rallies in Bitcoin prices suggest that the conditions for a crypto winter may not be imminent.

What impact do Ethereum updates have on crypto winter predictions?

Ethereum updates, like the recent Fusaka upgrade, are expected to enhance performance and stability, contributing positively to crypto winter predictions. Enhancements in how the Ethereum mainnet collects data could bolster confidence in long-term market recovery.

Can the Myriad prediction market accurately forecast a crypto winter?

The Myriad prediction market provides insights into market sentiment, with only 9% of users expecting a crypto winter. This suggests a prevailing optimism about cryptocurrency performance, as users adjust their forecasts based on recent price movements and market trends.

What defines a cryptocurrency winter, and what are the indicators based on current predictions?

A cryptocurrency winter is typically marked by prolonged declines in prices, trading activity, and investor interest. For a crypto winter to be confirmed, indicators such as Bitcoin dropping to $35,000 or Ethereum falling to $1,000 must occur, but current trends suggest we may avoid such declines in the near future.

| Key Points |

|---|

| Only 9% of Myriad users expect a crypto winter, down from 30% last week. |

| Bitcoin is currently trading around $91,500, down 27% from an all-time high of $126,000. |

| Ethereum is trading at $2,990, showing a 7.3% increase. |

| For a crypto winter, Bitcoin must drop to $35,000, Ethereum to $1,000, or the market cap to fall to $350 billion. |

| The last crypto winter occurred from late 2021 to most of 2023, marked by significant market downturns. |

| Current market concerns are driven by macroeconomic factors and recent hawkish sentiments from the Bank of Japan. |

| Recent increases in trading activity and price rebounds suggest a potentially stabilizing market. |

Summary

Crypto winter predictions indicate a cautiously optimistic outlook among users, with only 9% expecting a prolonged market downturn. This is a significant shift from previous expectations, highlighting some resilience in the market despite recent fluctuations in prices. Investors are still advised to stay alert to macroeconomic factors that could influence the crypto market.

Related: More from Market Analysis | Crypto Worries Over Iranian Oil Supply: Is It Overhyped? in Crypto Market | Insider Traders Profit $1.2M Before US Iran Strike in Crypto Market