Crypto Whales Target Three Altcoins Post-Market Crash: Analysis and Insights

In the wake of a dramatic cryptocurrency market crash, savvy investors and large-scale crypto holders, popularly known as “whales,” have seemingly shifted their focus to three specific altcoins. This strategic move underscores a broader pattern of behavior where whales often look for undervalued assets to accumulate during market downturns. The targeted altcoins this time are Solana (SOL), Polkadot (DOT), and Chainlink (LINK).

Understanding the Whale Moves

Crypto whales are individuals or entities that hold a significant amount of cryptocurrency. Their massive trades can have a substantial impact on the market. Tracking where these whales allocate their funds can provide insights into emerging trends and recovery tokens post-crash.

-

Solana (SOL): Known for its high throughput and low transaction costs, Solana has been a favorite among institutional investors and developers alike. The blockchain’s focus on scalability makes it an attractive investment post-crash. Whales might be accumulating SOL due to its potential to host scalable decentralized applications (dApps) crucial for the next wave of crypto adoption.

-

Polkadot (DOT): With its unique interoperability features and parachain architecture, Polkadot stands out as a facilitator of a multi-chain future. Post-crash, DOT presents a bargain for whales looking to invest in infrastructure that could support a more interconnected blockchain ecosystem. The recent increase in development activity around Polkadot also signals a positive rebound, making it a prime target for whale investments.

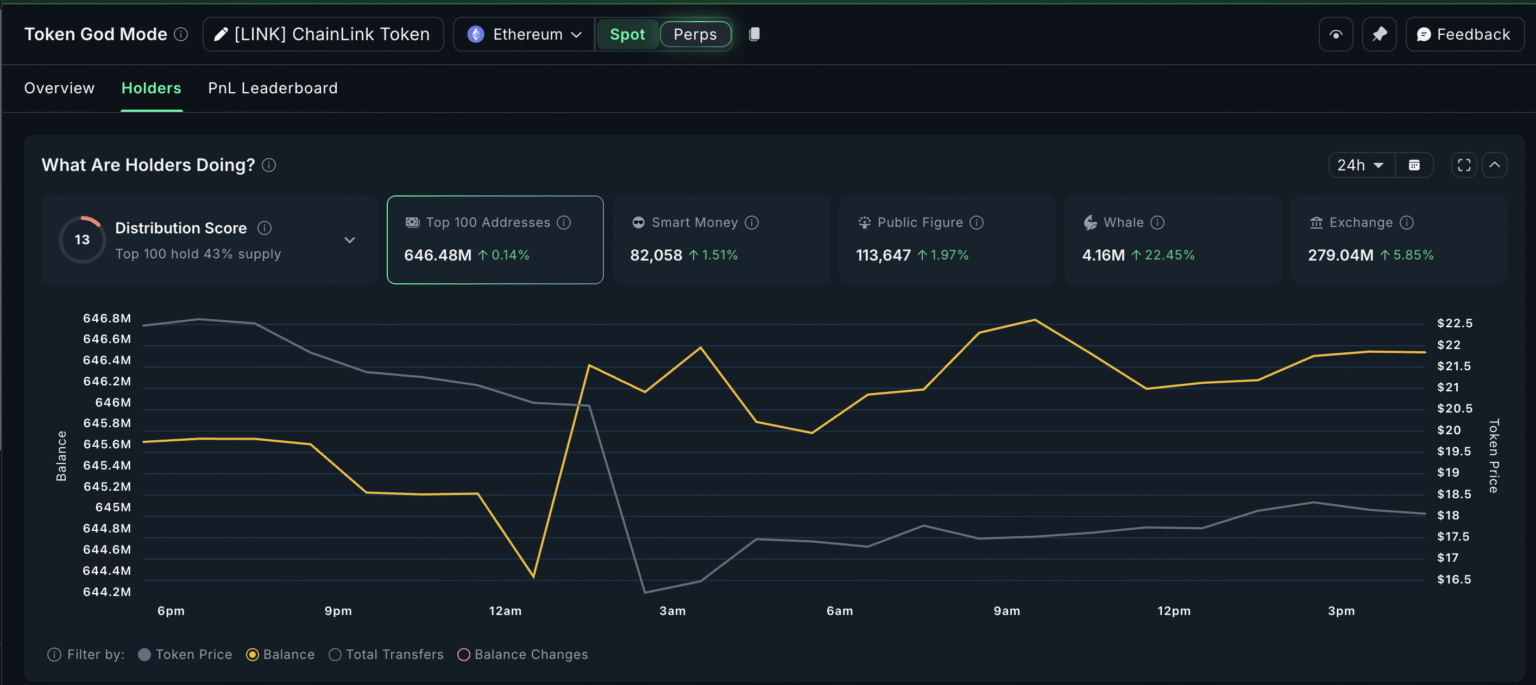

- Chainlink (LINK): As a decentralized oracle network that provides real-world data to blockchains, Chainlink is pivotal in the expansion of smart contracts and decentralized finance (DeFi) applications. Its utility is a key driver for whale interest, especially when considering its role in the broader context of blockchain adoption and the need for reliable data inputs.

Analysis Following the Market Crash

The market crash stripped considerable value from numerous digital assets, creating a buyer’s market for interested whales. Historically, these market players have demonstrated an ability to anticipate recoveries and support levels, making their movements particularly noteworthy.

Market Sentiment and Recovery Potential: The attention whales accord to specific altcoins like SOL, DOT, and LINK can also help in gauging market sentiment. Their investments might indicate a belief in a robust recovery and long-term viability of these projects. For smaller investors, keeping an eye on such trends could yield valuable strategy insights.

Strategic Accumulation: Post crash dynamics show that whales tend to accumulate coins silently before any significant recovery becomes apparent to the retail investor. This strategic accumulation often preempts major bullish trends in the tokens they choose to back.

Impact on the Broader Crypto Market

The investments by whales are not without consequences for the ordinary investor. Significant buying activity can drive prices up, while selling can lead to price declines. In cases where whales accumulate a substantial portion of available supply, it can lead to reduced volatility in the altcoin, potentially making it a less risky investment.

Conclusion

The recent targeting of SOL, DOT, and LINK by crypto whales suggests a strategy geared towards high utility and foundational blockchain projects post-market crash. For retail investors, understanding these movements can provide not just insights into potential investment opportunities, but also a broader perspective on the recovery patterns in the crypto ecosystem. As always, investors are advised to perform their own research (DYOR), considering the significant influence and unpredictability associated with whale movements in the cryptocurrency markets.