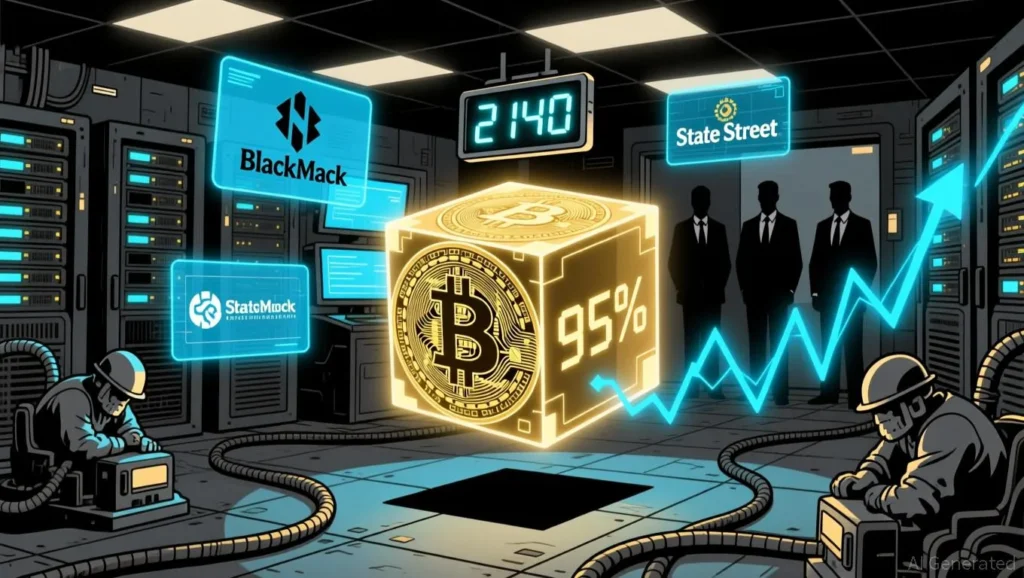

Institutions Are Backing Off Crypto as Inflows Plunge 95%

Cryptocurrencies once hailed as the future of finance are facing a stark reality check in 2023. Institutional investors, who were critical in bolstering crypto markets and legitimizing the asset class, are now pulling back significantly, fleeing from the turbulent and uncertain landscape that characterizes the sector today. The shift has been drastic, with investment inflows plummeting by an astonishing 95%, signaling a loss of faith that could reshape the terrain of digital currencies.

The Crypto Boom and its Dark Turn

Over the past few years, cryptocurrencies have surged in prominence and valuation, driven by a frenzy of retail and institutional investment. Blockchain technology promised unparalleled security and transparency, aspects that drew in not just individual speculators but also heavyweight financial institutions. Giants in banking and investment poured billions into the sector, buoyed by a mix of FOMO (fear of missing out) and genuine belief in crypto’s disruptive potential.

However, the tide began to turn as stories of hacks, fraud, and market volatility dominated headlines. Regulatory crackdowns began in earnest with various governments expressing concern over crypto’s role in money laundering, terrorism financing, and destabilizing financial systems. The fatal blow to investor confidence appears to have come in a series of high-profile collapses and bankruptcies in the crypto arena, most notably, entities like FTX, which declared bankruptcy following a liquidity crisis.

Drastic Drop in Inflows

Recent data from industry analysts highlights the scale of the exodus. A report observing investment patterns over the last year noted a 95% decrease in net inflows to crypto-related funds and projects. This figure starkly contrasts with the massive inflows seen in the previous year, marking one of the most dramatic downturns in the industry’s investments.

“Financial institutions are not merely cautious; they are actively withdrawing from what they perceive as an excessively risky and unstable environment,” said a senior analyst from a leading financial think tank. “The regulatory uncertainties and frequent market turmoils have created a hostile environment for institutions that prefer stability and predictable legal frameworks to operate within.”

Implications for the Crypto Market

This pullback by institutional investors might have serious repercussions for the crypto market. Institutional involvement not only brought in funds but also stability and credibility to the market. With their exit, the market loses not only financial support but also the legitimizing presence that can attract larger public and corporate participants.

It’s also likely to affect innovation and development within the sector. Many blockchain projects relied on institutional funding to fuel their research, development, and scaling operations. Without this support, projects might slow down, pivot, or cease entirely, potentially stifolding innovation in an industry that thrives on rapid technological advancements.

Future Outlook

While the immediate outlook might seem grim, the crypto market is no stranger to cycles of boom and bust. Enthusiasts and experts within the field argue that this could be a necessary purge, eliminating weaker projects and scams, thereby setting the stage for a more mature and robust market infrastructure. Moreover, the underlying technologies such as blockchain and decentralized finance (DeFi) continue to hold significant potential for transforming aspects of global finance.

However, for now, the task at hand for crypto advocates and businesses is to address the concerns of regulators and rebuild investor confidence. This might mean increased transparency, better security measures, and more robust compliance practices. As the market navigates this complex terrain, the comeback of institutional investors remains a critical uncertainty.

In conclusion, the dramatic withdrawal of institutional funds from the cryptocurrency market reflects broader economic, regulatory, and market-specific challenges. While the future of crypto remains uncertain, it’s clear that the journey towards mainstream adoption and acceptability is far more complicated and fraught with hurdles than previously anticipated.