The concept of a crypto super cycle is gaining traction among investors and enthusiasts alike, as excitement builds around the future of digital currencies. Recently, CZ’s insightful tweet has sparked discussions, suggesting that a period of unprecedented growth in the cryptocurrency market may be on the horizon. This belief is further bolstered by emerging trends and developments, especially in light of the SEC’s latest announcements regarding cryptocurrency regulation. As we navigate through the evolving landscape, crypto market predictions are more crucial than ever in shaping our investment strategies. With a focused outlook towards 2026 and beyond, the cryptocurrency community is eagerly assessing these trends to maximize their potential returns.

The anticipated emergence of a crypto super cycle has become a hot topic in recent months, with many crypto analysts forecasting significant upward movement in the value of various digital assets. Influenced by influential figures like CZ, the discourse surrounding future cryptocurrency trends emphasizes the importance of staying informed about market indicators and regulatory shifts. Notably, the SEC’s decision to deprioritize cryptocurrency risks marks a pivotal moment in the industry, potentially paving the way for wider adoption and innovation. As we explore what lies ahead, understanding the broader landscape of cryptocurrency—including market predictions and expert analyses—will empower investors to make educated decisions. Ultimately, the possibilities for growth and advancement in the crypto arena are more promising than ever, especially as we approach the critical year of 2026.

Understanding the Crypto Super Cycle

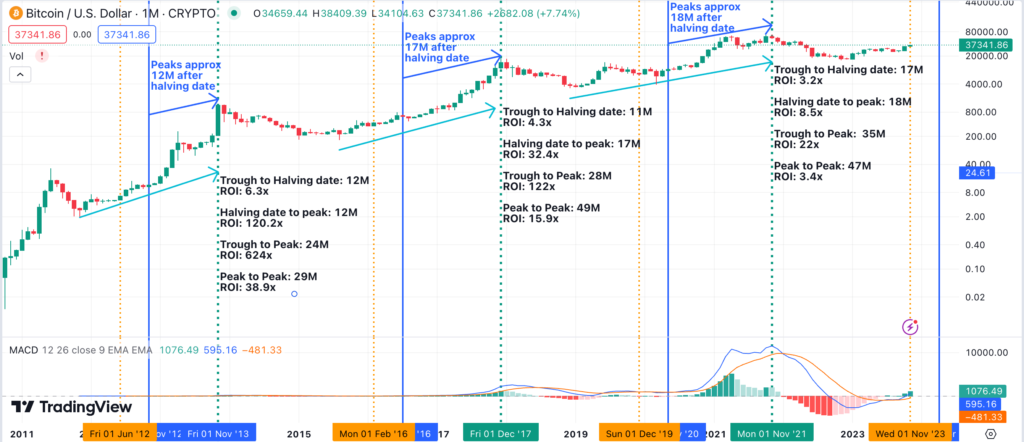

The term ‘crypto super cycle’ refers to an extended period of bullish activity in the cryptocurrency market, where prices steadily rise, and investor interest spikes significantly. Prominent figures in the cryptocurrency community, such as Changpeng Zhao (CZ), have suggested that we might be on the cusp of this phenomenon. A super cycle could lead to widespread adoption and a surge in cryptocurrency values, making it a pivotal point for investors and enthusiasts alike.

With the increasing market penetration of cryptocurrencies and their growing acceptance among mainstream financial systems, the conditions for a super cycle may be more favorable than ever. Factors such as regulatory clarity and institutional investment play a crucial role in driving this cycle. CZ’s tweet epitomizes this optimism, hinting at potential market movements that could shape the future of cryptocurrency investment.

Impact of SEC Cryptocurrency News on Market Dynamics

The U.S. Securities and Exchange Commission (SEC) plays a vital role in determining the regulatory framework surrounding cryptocurrencies. Recently, the SEC’s decision to remove cryptocurrency from its priority risk list starting in 2026 has sparked significant discussions among investors. This shift indicates a more lenient regulatory approach that could foster a conducive environment for cryptocurrency trading and investment.

Market players are especially optimistic about this development as it suggests a clearer path for the establishment of cryptocurrency as a legitimate asset class. With regulatory tensions easing, the crypto community anticipates increased participation from both retail and institutional investors. This could be a key driver for not just a recovery phase but potential growth phases leading into and beyond 2026.

Analyzing Cryptocurrency Trends Leading to 2026

As we analyze current cryptocurrency trends, several indicators suggest that the market is gearing up for significant changes by 2026. Factors such as technological advancements, increased adoption of digital currencies, and macroeconomic shifts all contribute to this evolving landscape. For instance, the rise of decentralized finance (DeFi) has transformed how users interact with financial platforms, paving the way for broader acceptance of cryptocurrencies.

In addition, social media influencers and crypto thought leaders, like CZ, shape public perception and trends in the market. Their insights often lead to heightened interest and speculation, which can drive prices and market sentiments dramatically. Understanding these trends is crucial for investors looking to position themselves favorably in anticipation of the potential super cycle.

CZ Tweet Analysis: Insights from a Key Industry Figure

Changpeng Zhao, often referred to as CZ, has established himself as a significant voice in the cryptocurrency space. His recent tweet regarding the impending super cycle and the SEC’s stance reflects his insights into market sentiment and future predictions. Analyzing CZ’s tweets provides a window into the thoughts of an industry leader who has a pulse on market developments and investor psychology.

Investigating the implications of CZ’s statements can reveal how they might affect trading strategies and market behavior. As followers and investors react to his insights, understanding these dynamics is crucial for making informed decisions in the rapidly evolving world of cryptocurrencies. These insights not only guide expectations but also help gauge confidence levels within the market.

Crypto Market Prediction: What Lies Ahead?

With more analysts predicting a bullish wave in cryptocurrency markets, market prediction for the next few years becomes a pivotal topic. Analysts closely monitoring trends and indicators, alongside significant announcements, are leveraging this information to forecast potential price movements. Speculations about the influence of broader economic changes, such as inflation or technology adoption, will also play a crucial role in forming these predictions.

Furthermore, the involvement of major financial institutions could tip the scales, either bolstering the market or causing fluctuations. Upcoming regulations and developments, especially concerning SEC policies and other global regulatory frameworks, will significantly inform these predictions. Investors must keep abreast of these factors to strategize effectively as we approach the end of 2026.

2026 Cryptocurrency Outlook: Expectations and Strategies

Looking ahead to 2026, the cryptocurrency landscape is expected to undergo dramatic changes that could redefine investment strategies. With the removal of cryptocurrencies from the SEC’s priority risk list, predictions point towards an era of stability and legitimacy for the crypto market. Many analysts suggest that innovations such as blockchain scalability solutions and enhanced security protocols will play pivotal roles in this transformation.

Investors are advised to remain vigilant and flexible in their strategies as the market evolves. Holding diverse portfolios that include a range of cryptocurrencies—alongside established alternatives—could mitigate risks associated with volatility. As the crypto super cycle potentially looms, adopting a long-term outlook while keeping abreast of regulatory developments and market movements will be vital.

The Future of Cryptocurrency Investments

The future of cryptocurrency investments appears increasingly promising as major players in the financial market recognize the potential of digital currencies. Factors such as a global shift toward digital assets and advances in blockchain technology are paving the way for a new era of financial sovereignty. Investors who adapt to these changing dynamics and embrace new models will likely find opportunities in this evolving landscape.

Moreover, with more educational resources and platforms becoming available for new investors, the market’s entry barrier is lowering, opening up the space for retail investors. Engaging in continuous learning about market trends and regulatory news is essential for anyone looking to navigate this complex arena successfully. As we approach the anticipated super cycle and tackle emerging challenges, preparatory measures will set informed investors apart.

Trends in Decentralized Finance (DeFi) and Their Implications

Decentralized finance (DeFi) has emerged as one of the most significant trends in the cryptocurrency space, impacting how traditional financial services function. By removing intermediaries and enabling peer-to-peer transactions, DeFi promises greater accessibility and efficiency for users looking to engage with their assets directly. This trend is anticipated to strengthen as innovative applications and user-friendly platforms continue to proliferate.

As DeFi continues to evolve, regulatory frameworks will need to adapt. Regulatory bodies, such as the SEC, are expected to increase their focus on DeFi platforms, leading to potential new guidelines and compliance requirements. Understanding these developments will be essential for investors looking to navigate the DeFi landscape effectively while capitalizing on the opportunities it presents.

Key Takeaways for Crypto Investors

In conclusion, the cryptocurrency landscape is filled with opportunities and challenges that investors need to understand. The insights from CZ’s tweet indicate a hopeful future, while the SEC’s changing stance adds to this optimism. Investors should focus on key indicators, market predictions, and trends to devise strategies that align with their investment goals.

As we move forward, staying informed about the evolving regulatory landscape and engaging with emerging technologies will be crucial for investors. Building a robust and versatile portfolio, remaining adaptable to changes, and continuously learning about market developments are essential components for success in the world of cryptocurrencies.

Frequently Asked Questions

What is a crypto super cycle and how does it relate to cryptocurrency trends?

A crypto super cycle refers to an extended bullish market period for cryptocurrencies, driven by sustained demand and adoption. It often follows significant technological advancements and regulatory clarifications, similar to what we might see in cryptocurrency trends that lead up to major price increases.

How might CZ’s tweet impact the crypto super cycle predictions?

CZ’s tweet about the upcoming crypto super cycle suggests that industry leaders are confident in a potential market resurgence. However, he also notes the possibility of error, which highlights the importance of cautious optimism in crypto market predictions.

What role does SEC cryptocurrency news play in forecasting the crypto super cycle?

The SEC’s removal of cryptocurrency from its priority risk list signals a more favorable regulatory environment, which can enhance investor confidence and potentially initiate a crypto super cycle. This regulatory clarity is crucial for the market’s long-term outlook.

Why is the 2026 cryptocurrency outlook significant for the crypto super cycle?

The 2026 cryptocurrency outlook is significant because it aligns with the SEC’s anticipated regulatory changes, which could foster a more robust investment climate for cryptocurrencies. This environment may facilitate the emergence of a crypto super cycle, driven by increased institutional interest.

Can we expect a crypto super cycle based on current cryptocurrency trends?

Current cryptocurrency trends indicate increasing adoption and investment in digital assets, suggesting a foundation for a potential crypto super cycle. Market dynamics and regulatory developments will heavily influence this trajectory.

What indicators should investors watch for in relation to the crypto super cycle?

Investors should monitor key indicators such as comprehensive SEC cryptocurrency news, emerging market trends, and statements from influential figures like CZ. These factors can provide insights into the possibilities of a crypto super cycle.

| Key Point | Details |

|---|---|

| CZ’s Announcement | CZ stated on X that a crypto super cycle is approaching, though he admits he could be mistaken in his assessment. |

| SEC Update | The U.S. Securities and Exchange Commission will remove cryptocurrencies from its priority risk list starting in 2026, indicating positive sentiment for the industry. |

Summary

The crypto super cycle is an anticipated phase in the cryptocurrency market that suggests a significant upward trend in crypto assets. As indicated by CZ’s comments and the SEC’s recent updates, the conditions for a super cycle appear to be forming, highlighted by reduced regulatory risk. This development could lead to renewed investor confidence and market momentum.