The crypto sector performance displayed a kaleidoscope of movements, particularly as BitMine soared by an impressive 7.9% on the latest trading day. In the backdrop of this dynamic environment, the U.S. stock market closed mostly steady, with traditional indices offering a mixed signal to investors. Crypto market trends indicate that while some assets surged, others like Coinbase faced declines, emphasizing the volatility inherent in cryptocurrency investments. As investors seek the latest cryptocurrency updates, platforms like msx.com provide essential tools for navigating these shifts, especially with their decentralized RWA trading platform. Overall, the interplay between digital currencies and the traditional stock market creates a captivating landscape for both seasoned traders and new entrants alike.

In the realm of digital assets, recent fluctuations in the cryptocurrency market have caught the attention of traders and investors. The varied results among major coins echo the diverse performances seen in traditional financial markets, particularly following the U.S. stock market’s mixed outcomes. Notably, BitMine’s remarkable rise amidst this environment illustrates the unpredictable nature of today’s crypto landscape. Moreover, with platforms like msx.com pioneering RWA token trading, the future of investment may very well hinge on the intricate connections between digital currencies and conventional assets. As enthusiasts follow the evolving trends, understanding the nuances of crypto and its relationship with broader market forces will become increasingly vital.

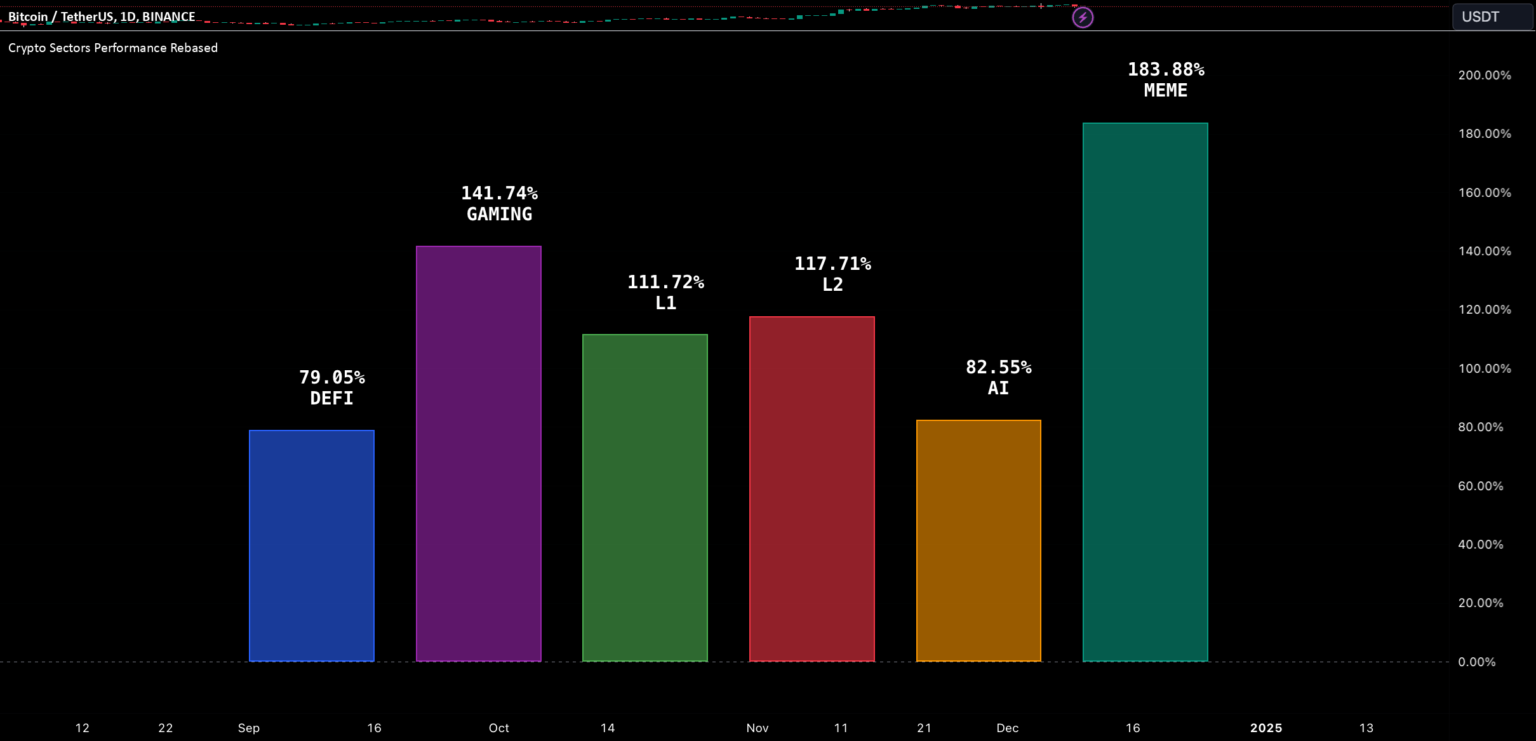

Crypto Sector Performance Overview

On the closing of the U.S. stock market, the cryptocurrency sector exhibited a mixed performance, showcasing its volatility and the varying responses of individual assets to the market environment. Notably, BitMine (BMNR) experienced a significant surge of 7.9%, illustrating the potential for notable gains within this digital financial landscape. While some altcoins like Circle (CRCL) demonstrated a respectable increase of 1.36%, others, including Coinbase (COIN), faced declines. This mix of performance underscores the importance of understanding the underlying trends and forces influencing the crypto market.

The overall crypto market trends reveal much about investor sentiment and market dynamics. The rise of specific cryptocurrencies, such as BitMine, can often be attributed to broader market forces or particular developments within the projects themselves, including innovative product launches or strong community engagement. Additionally, while the crypto sector may not always move in lockstep with the U.S. stock market, it often reflects similar sentiments, particularly during times of economic uncertainty, making it essential for investors to keep an eye on both markets.

Analyzing the BitMine Rise

BitMine’s impressive rise of 7.9% is more than just a number; it symbolizes a growing interest in innovative cryptocurrency projects that leverage unique technology and market strategies. As investors increasingly seek out alternatives to traditional assets, BitMine stands out with its propositions and potential for high returns. The project has been gaining traction on social media platforms and among crypto enthusiasts, likely driving the rally further. Understanding these dynamics can offer insights into future movements within the cryptocurrency space.

Additionally, BitMine’s ascent can be interpreted as a response to recent cryptocurrency updates and trends that highlight technological advancements or regulatory shifts. When investors perceive potential growth and stability in particular coins or platforms, they may flock to those assets, pushing their prices upward. The balance of risk and reward in the crypto sector continues to attract participants looking for opportunities amid the fluctuations seen in the U.S. stock market.

Impact of U.S. Stock Market on Crypto Trends

The performance of the U.S. stock market has a substantial influence on crypto market trends. As traditional markets like the Dow Jones and S&P 500 closed with mixed performances, the ripple effects were felt across the cryptocurrency landscape. For instance, while major indices showed stability, the varied performance of digital assets indicates a clear divergence. Some cryptocurrencies thrive in bullish stock market conditions, while others, like Coinbase, may struggle under geopolitical or economic pressures.

Investors often look toward traditional financial metrics to gauge the viability of their crypto investments, creating a symbiotic relationship between both markets. When stock indices perform poorly, investors may diversify their portfolio into cryptocurrencies, seeing them as a hedge against inflation or market stagnation. Conversely, confidence in stocks can lead investors to pull back on crypto investments, illustrating the need for a comprehensive approach when trading across these intertwined finance sectors.

Understanding Cryptocurrency Updates and Innovations

Recent cryptocurrency updates reflect revolutionary changes in the way digital assets are perceived and utilized within the financial landscape. Platforms like msx.com are leading the charge by introducing new Real World Asset (RWA) trading options that include an array of U.S. stocks and ETFs. This integration serves to bridge the gap between traditional finance and cryptocurrencies, fostering a broader acceptance and potential regulatory framework for digital assets.

As the landscape evolves with these updates, it becomes crucial for investors to stay informed about emerging technologies and platforms making advances in the cryptocurrency sector. Innovations in trading mechanisms, such as those offered by decentralized platforms like msx.com, present opportunities for users to engage in markets previously dominated by traditional exchanges. Keeping abreast of these developments can inform investment decisions and strategy adaptations as the crypto environment continues to shift.

Future of the Crypto Market amidst Economic Conditions

As the global economy navigates fluctuating conditions, the future of the crypto market remains an area of keen interest. The crypto sector often resonates with broader economic trends, and as traditional markets fluctuate, we can expect similar volatility within the cryptocurrency marketplace. The performance metrics of companies like BitMine and others will be closely monitored, indicating how external factors can create both opportunities and risks for investors.

Additionally, economic conditions such as inflation rates or changes in U.S. monetary policy can impact sentiment towards risk assets, including cryptocurrencies. Factors such as these lead to varied responses within the market; for instance, an unexpected rise in inflation could spur interest in cryptocurrencies as alternative stores of value. Investors must consider these elements and how they interplay with crypto market dynamics as they navigate the future.

Key Trends in Cryptocurrency Investments

In the wake of growing digital asset adoption, understanding the key trends in cryptocurrency investments is more vital than ever. As asset classes like BitMine gain notoriety for their returns, investors are increasingly flocking to cryptocurrencies for diversification. This trend reflects an overarching shift where both retail and institutional investors are recognizing the potential of cryptocurrencies as legitimate financial assets amidst global market uncertainties.

Furthermore, the rise of decentralized applications and novel trading platforms like msx.com contribute to the changing landscape of investment strategies in cryptocurrency. As more platforms enable easier access to varied investment options, investors are becoming more sophisticated, leading to a greater focus on substantial gains rather than mere speculative trading. Keeping an eye on these trends will guide better investment decisions moving forward.

The Role of RWA Trading Platforms in Crypto Growth

The launch of Real World Asset (RWA) trading platforms signifies an essential evolution within the cryptocurrency sector. Platforms like msx.com play a pivotal role in this growth by combining traditional assets with the dynamism of crypto, allowing users to trade U.S. stocks alongside cryptocurrencies seamlessly. This integration opens doors for new investment strategies and attracts a broader audience towards digital assets.

As more investors become aware of the benefits of RWAs, we can expect increased participation in cryptocurrency markets, driven by the stability offered by familiar assets. This shift will likely pave the way for innovative trading habits, allowing investors to explore various asset classes throughout fluctuating market environments. Emphasizing the importance of RWAs can further solidify cryptocurrency’s position as a substantial player in global finance.

Monitoring Cryptocurrency and Traditional Market Correlations

Monitoring the correlations between cryptocurrencies and traditional markets can provide valuable insights for investors looking to optimize their portfolios. As the U.S. stock market fluctuates, understanding how Bitcoin and altcoins respond to those changes can inform strategic trading decisions. For instance, periods of stability in stocks may correlate with increased investor confidence in cryptocurrencies, leading to surges in prices for certain coins like BitMine.

Analyzing these correlations not only aids in timing investment entries and exits but also helps mitigate risk by informing diversification strategies. As cryptocurrency continues to mature as an asset class, the importance of examining these relationships will become increasingly essential for investors aiming to navigate the complexities of both the crypto and traditional markets.

Investing in Cryptocurrency: Key Considerations

Investing in cryptocurrency requires a strategic approach, considering the unique characteristics of the digital asset environment. Unlike traditional stocks, crypto markets are notorious for their volatility, as evidenced by the mixed performance recently observed across various cryptocurrencies like BitMine and Circle. Investors must be prepared for rapid fluctuations and understand their risk tolerance when entering this dynamic market.

Moreover, staying informed on the latest cryptocurrency updates, economic factors, and market trends is critical for making educated investment choices. Engaging with various analytical tools and resources can provide insights into which cryptocurrencies might perform better in changing conditions, particularly those linked closely with promising platforms such as msx.com that bridge gaps between digital and traditional assets.

Frequently Asked Questions

How did the crypto sector perform compared to the U.S. stock market this week?

This week, the crypto sector displayed mixed performance as the U.S. stock market exhibited stability. While the Dow Jones dropped slightly by 0.07%, the S&P 500 and Nasdaq Composite had moderate gains. Notably, the crypto market saw BitMine rise by 7.9%, alongside Circle’s 1.36% increase, even amidst some declines in major cryptocurrencies like Coinbase.

What factors influenced the recent cryptocurrency updates regarding BitMine’s rise?

BitMine’s rise of 7.9% can be attributed to several factors including increased trading activity and overall interest in newer crypto projects. With the mixing market conditions in the U.S. stock market, investors might be shifting their focus to cryptocurrencies, especially those showing promising growth, like BitMine.

What are the latest crypto market trends following the U.S. stock market closures?

Following the closure of the U.S. stock market, the latest crypto market trends reflect a divergence, with some cryptocurrencies experiencing gains, such as BitMine and SharpLink, while others like Coinbase faced declines. This mixed performance suggests a selective investment approach among traders in response to broader market cues.

How do cryptocurrency performances correlate with movements in the U.S. stock market?

The performance of cryptocurrencies often reflects broader market trends, including those of the U.S. stock market. For instance, with the stabilizing indices such as the S&P 500, the crypto sector, including assets like BitMine, may attract increased investor interest, showcasing potential for higher returns during periods of stock market fluctuations.

What is the connection between RWA trading platforms and crypto sector performance?

RWA trading platforms, like msx.com, facilitate investment in real-world assets through tokenization, which can enhance crypto sector performance by integrating traditional financial instruments, such as U.S. stocks and ETFs, within the digital asset ecosystem. This integration can drive interest and improve liquidity within the crypto market.

| Crypto Asset | Performance (%) |

|---|---|

| BitMine (BMNR) | 7.9 |

| SharpLink (SBET) | 5.38 |

| Circle (CRCL) | 1.36 |

| Coinbase (COIN) | -1.04 |

| Strategy (MSTR) | -1.26 |

| CEA Industries (BNC) | -5.05 |

Summary

The crypto sector performance exhibited a mixed trend following the U.S. stock market closing, showcasing significant gains and losses among various assets. BitMine led the charge with a remarkable rise of 7.9%, while others like Coinbase and CEA Industries faced declines. This demonstrates the volatility and diverse trends present in the crypto market, reflecting a broader sentiment in financial trading.