Crypto PACs are at the forefront of a seismic shift in political influence as the U.S. midterm elections approach. These political action committees dedicated to the cryptocurrency sector are mobilizing significant resources to back candidates who champion their interests in Washington. The influx of donations to Crypto PACs has raised eyebrows among election reform advocates, who warn of the potential for money to overshadow the voices of everyday Americans. With a keen focus on advancing favorable crypto legislation, these committees are reshaping the landscape of political action in the crypto industry. By leveraging their war chests, they aim to secure a lasting legacy that may influence the trajectory of Washington lobbying efforts for years to come.

The rise of cryptocurrency-centric political action committees reflects a broader trend where digital currencies seek to carve out a substantial presence in the political arena. As 2024’s midterm elections draw near, these financial entities are strategically positioning themselves to support candidates aligned with their deregulatory goals. Such organizations are increasingly viewed as the new power players in U.S. politics, channeling funds to promote pro-cryptocurrency stances during crucial legislative discussions. This concerted effort underscores the crypto sector’s desire to gain traction in government, ultimately aiming to shape pivotal policies that impact the entire financial landscape. By bolstering their engagement in the political process, they are not only securing their interests but also redefining the future of Washington’s political dynamics.

| Key Points | Details |

|---|---|

| Crypto PACs | Crypto PACs are raising millions to support candidates aligned with their policies. |

| Impact on Democracy | Critics argue that the influence of crypto PACs undermines democratic processes. |

| Legislative Goals | The industry is focusing on the CLARITY Act to create a regulatory framework. |

| Bipartisan Strategy | While some are supporting specific parties, there’s a push for bipartisan strategies. |

| Historical Spending | In 2024, crypto firms contributed nearly a quarter billion dollars to various campaigns. |

| Political Influence | Crypto PACs are changing how political influence is exercised, advocating for favorable legislation. |

| Future Challenges | Concerns over money in politics and the integrity of elections persist as the midterms approach. |

Summary

Crypto PACs have become a significant player in the political landscape as they secure substantial funding to influence elections and shape policies. With mounting contributions and a clear agenda focused on legislative advancements like the CLARITY Act, these PACs signify a heightened interest from the crypto industry in U.S. politics. However, their involvement raises critical questions about the implications for democratic processes and election integrity. As we move closer to the midterms, the effectiveness and impact of Crypto PACs on political outcomes will be closely observed, revealing the intricate relationship between money and politics.

The Rise of Crypto PACs in Political Funding

In recent years, the emergence of Crypto PACs has significantly altered the landscape of political funding in the United States. These Political Action Committees (PACs) have been instrumental in channeling funds from the lucrative crypto sector to politicians who align with their vision for crypto legislation. As the midterm elections of 2024 draw closer, these Crypto PACs have amassed war chests of unprecedented sizes, showcasing the growing influence of the crypto industry within Washington’s corridors of power. With millions of dollars at their disposal, these PACs aim to underwrite the campaigns of candidates who promise to advocate for less regulatory oversight and more favorable policies for digital currencies, thus amplifying their voice in a traditionally partisan arena.

This influx of financial support has garnered scrutiny from various groups advocating for transparent campaign financing and voter representation. Critics assert that the increasing role of Crypto PACs in elections risks drowning out the opinions of average citizens, effectively marginalizing the democratic process. Saurav Ghosh’s statement reflects the underlying concern that unchecked funding from crypto entities may skew political outcomes in favor of industry-heavy interests at the expense of broader electorate concerns. As such, the battle for public favor intensifies, turning the spotlight on how effectively these PACs can leverage their resources to advance the interests of crypto stakeholders.

Bipartisan Support: A Strategy for Crypto’s Legislative Success

Gaining bipartisan support stands as a crucial strategy for the crypto industry’s legislative ambitions, especially in light of the upcoming midterm elections. Despite existing tensions and the stalling of significant bills like the CLARITY Act, crypto advocates understand that a unified front may be essential to secure transformative legislation. Recent investments by crypto magnates such as the Winklevoss twins highlight this strategic pivot; their contributions to conservative PACs underscore a willingness to hedge bets on various political factions. This move suggests that the crypto community is open to collaborating with whichever party can facilitate the passage of progressive crypto legislation, indicating a pragmatic approach driven by necessity.

Furthermore, the willingness of organizations like Fairshake to extend support to Democratic candidates who endorse pro-crypto policies illustrates a significant shift in the industry’s political strategy. Such bipartisan endorsements not only help to counteract potential backlash from losing one party’s favor but also diversify the political risk associated with investments in PACs. As the midterms approach, the crypto industry’s ability to navigate these political waters while maintaining broad support across party lines may determine its legislative future and influence the trajectory of crypto regulation in the United States.

Historical Context: How Crypto Influenced Past Elections

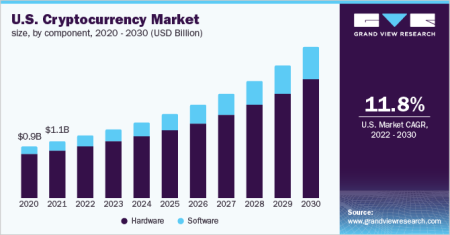

Understanding the historical context of crypto’s political involvement sheds light on the industry’s burgeoning influence on elections. In 2024, the crypto sector reportedly contributed nearly a quarter of a billion dollars to political campaigns, marking itself as a formidable force within the landscape of campaign finance. Previous election cycles had already paved the way for this financial crescendo, particularly during the 2020-2021 bull run, when major crypto firms ramped up their lobbying activities and advertising efforts to position themselves favorably in the political arena. The increased financial clout of companies like Coinbase and Ripple has not only bolstered their political strategies but has also expanded the boundaries of accepted campaign contributions.

Key figures such as Sam Bankman-Fried also played pivotal roles in bridging the gap between politics and finance within the crypto realm. His ability to garner bipartisan support was eclipsed by the subsequent collapses and scandals that rocked the industry, leaving a timely disruption in the political fabric. As the 2023 presidential election cycle evolved, crypto’s potent influence resurged, especially with candidates like Donald Trump championing deregulatory promises. As the stakes magnify, the lessons learned from previous contributions lay the groundwork for how crypto PACs can engage in shaping future political landscapes, demonstrating an evolving engagement with funding mechanisms in political discourse.

The Role of Crypto Lobbying in Shaping Legislation

The increasing involvement of crypto lobbying efforts has become a pivotal element in crafting legislation that aligns with the interests of the digital currency ecosystem. High-profile lobbying campaigns have mobilized around critical legislation, such as the CLARITY Act, which aims to establish clear regulatory parameters for the crypto industry. The heightened stakes surrounding this legislation highlight the intricate relationship between lobbying entities and regulatory outcomes in Washington. By investing significantly in lobbying efforts, Crypto PACs are striving to ensure that their perspectives are adequately represented in policy discussions that directly affect their operational landscape.

However, this scenario presents a dual-edged sword. While the advocacy for pro-crypto legislation can lead to beneficial outcomes for the industry, it also raises ethical concerns about the extent to which financial influence can distort democratic processes. The proactive engagement by Crypto PACs signifies not just a push for favorable regulations; it also embodies the industry’s broader ambition to cultivate a favorable business climate amidst growing scrutiny from regulators and policymakers. As the discussions surrounding crucial bills continue to evolve, the role of organized lobbying will be essential in navigating the complex relationship between governance and the burgeoning crypto ecosystem.

Potential Threats to Democracy from Crypto Donations

As the crypto industry gains ground through substantial donations to political campaigns, concerns about the implications for democracy have surged. Activist groups warn that the overwhelming financial power of Crypto PACs may lead to a distortion of priorities in governance, favoring the interests of affluent stakeholders over the common public. The fear is that such financial influence diminishes citizen engagement, as their voices could be overshadowed by well-heeled interests that can afford to contribute significantly to electoral campaigns. Observers remain vigilant about how this increasing role of money in politics can directly affect voter representation and election integrity.

Moreover, as discussions around nationalizing elections surface, the ethical dilemmas surrounding the influence of big money come increasingly into focus. The potential for corruption or the erosion of democratic principles poses a real threat when vast resources are concentrated in the hands of few, particularly in a rapidly evolving sector like crypto. This necessitates ongoing discourse regarding regulation around campaign financing, emphasizing the importance of maintaining a balanced system where all citizens feel their voices matter, despite the escalating influence of Crypto PACs on the political stage.

The Future of Crypto Legislation and Political Engagement

Looking forward, the trajectory of crypto legislation will likely hinge on the ability of Crypto PACs to maintain strong political engagement and adaptability in response to shifting political dynamics. With the midterm elections approaching, it is apparent that the strategies employed by these PACs will either bolster or hinder the progress towards more favorable legislation for the crypto industry. As both parties weigh their positions on crypto regulations, the possibility of regulatory frameworks emerging is tantalizing, yet fraught with challenges, particularly as legislators are often divided along party lines.

Furthermore, the ongoing dialogue around crypto’s impact on national elections raises important questions about transparency and the potential for abuse within political funding structures. The industry’s ability to navigate these challenges will be instrumental in ensuring that the next phase of crypto legislation reflects both the innovative spirit driving this sector and the democratic values that underpin American politics. As Crypto PACs continue to evolve, their influence will shape not just the industry’s future, but also the integrity of the political process they seek to engage with.

Key Players in the Crypto PAC Landscape

The crypto PAC landscape includes several notable players who have emerged as influencing forces within political financing. High-profile investors and entrepreneurs, such as the Winklevoss twins and figures like Sam Bankman-Fried, have played decisive roles in shaping the PAC contributions funneling towards candidates who support crypto-friendly policies. Their participation underscores a growing trend of cryptocurrency enthusiasts translating their financial success into political power, with contributions aimed at fostering a system that promotes financial innovation and less constrictive regulations.

As the industry evolves, these key players face the dual challenge of effectively mobilizing resources to support candidates while also confronting the ethical implications of their financial involvement. The spotlight will persist on how their actions, along with the strategies of broader Crypto PACs, can harmonize the goal of advancing cryptocurrency interests with the necessity of maintaining democratic integrity. Their prominence in political fundraising reveals the crucial nexus between finance and governance in an increasingly digital age.

The Impact of Crypto Super PACs on 2024 Elections

As we approach the 2024 elections, the influence of Crypto Super PACs is poised to reshape electoral outcomes significantly. These super PACs operate with fewer restrictions than traditional PACs, allowing them to mobilize vast resources in supporting pro-crypto candidates and initiatives. Their ability to raise and spend unlimited amounts underscores a shift in how political campaigns are financed, particularly as candidates seek endorsements and financial backing from these influential groups. Such leverage can dramatically alter the competitive landscape of elections, making it essential for both candidates and constituents to comprehend the dynamics at play.

Moreover, the strategic deployment of funds by Crypto Super PACs will likely reflect a calculated approach to galvanize support for legislative proposals that align with the industry’s interests. As key stakeholders from the crypto realm bolster their political contributions, the ramifications are set to extend beyond campaign victories; they could potentially redefine the regulatory framework governing digital currencies in the long run. Observers will be closely monitoring how these developments interplay with traditional political ideologies, as the outcome may well influence broader electoral trends and public perceptions of the evolving cryptocurrency industry.

Challenges Facing Crypto PACs Post-Election

Despite their significant capabilities to influence elections, Crypto PACs will likely face numerous challenges in the aftermath of the 2024 elections. One major concern is the potential backlash against the political establishment fueled by the perception of political cash overwhelming democratic processes. As consumer awareness regarding the intersections of finance and politics rises, there may be increasing demands for transparency and regulatory oversight on how PAC funds are utilized. This backlash could force Crypto PACs to adopt more robust accountability measures to satisfy a skeptical electorate.

Additionally, any subsequent shifts in political power can significantly affect the operational environment for Crypto PACs. Should newfound authorities favor stricter crypto regulations, PACs could find their investments rendered ineffective, highlighting the risks involved in aligning closely with political candidates. Adaptability will be key for these organizations moving forward, requiring them to balance the enforcement of their interests with the evolving political landscape that could impact the very foundations of their funding strategies.

Frequently Asked Questions

What role do Crypto PACs play in influencing the political landscape ahead of the midterm elections 2024?

Crypto PACs play a significant role in shaping the political landscape by amassing large contributions to support candidates who advocate for favorable crypto legislation. With millions received ahead of the midterm elections 2024, these Political Action Committees are positioned to exert influence on policy-making in Washington, especially concerning the regulatory environment of the crypto industry.

How are Crypto PACs impacting Washington lobbying efforts?

Crypto PACs are increasing the scale and influence of Washington lobbying efforts by providing substantial funding for candidates who support pro-crypto initiatives. These PACs, particularly super PACs, enable the crypto industry to engage effectively with lawmakers, ensuring that their interests are prioritized in political discussions and legislation.

What is the significance of bipartisan support for Crypto PACs during midterm elections?

Bipartisan support is crucial for the success of Crypto PACs, especially as they aim to pass important legislative frameworks like the CLARITY Act. By appealing to both sides of the political spectrum, these PACs can enhance their influence and secure endorsements from a wider array of candidates, which is vital in the potentially tumultuous midterm elections 2024.

What are the concerns regarding the influence of Crypto PACs on democracy?

Concerns about the influence of Crypto PACs on democracy center around the potential for money to undermine the democratic process. Critics argue that the substantial contributions from the crypto industry may marginalize the voices of everyday Americans, posing risks to election integrity and the ethical considerations of campaign finance.

How much money have Crypto PACs contributed to political campaigns in the run-up to the midterms?

In the run-up to the midterms, Crypto PACs have contributed nearly a quarter of a billion dollars to various political campaigns and super PACs, marking the largest donations from a single industry. This influx of funding highlights the crypto industry’s significant financial clout and its commitment to influencing political outcomes.

What challenges do Crypto PACs face with regard to obtaining pro-crypto legislation?

Crypto PACs face challenges in securing pro-crypto legislation due to differing political priorities and concerns about ethics and oversight. While they have gained bipartisan support, there are still significant hurdles to passing comprehensive legislation like the CLARITY Act, particularly as key stakeholders within the industry express ongoing dissatisfaction.

How do future elections shape the strategies of Crypto PACs?

Future elections heavily influence the strategies of Crypto PACs, as they must adapt to the shifting political landscape and public sentiment. With midterm elections approaching, these PACs are recalibrating their funding strategies to support candidates who align with their interests, focusing on those favorable to the crypto industry.

Why are super PACs considered fashionable for the crypto industry?

Super PACs are seen as fashionable for the crypto industry because they allow for unlimited contributions, enabling the powerful interests behind crypto to make their presence felt in Washington. These PACs facilitate advocacy not only for individual candidates but also for broader policy changes that favor deregulation and the growth of the crypto market.

What are the implications of the large contributions from Crypto PACs for future legislation?

The large contributions from Crypto PACs have significant implications for future legislation, as they can dictate which candidates gain power and shift the legislative focus towards pro-crypto policies. This financial backing can lead to the enactment of laws that may undermine consumer protections or disrupt existing regulations in favor of the crypto industry.

How do Crypto PACs plan to approach the 2026 midterm elections?

As the 2026 midterm elections approach, Crypto PACs plan to focus on building bipartisan support to secure favorable outcomes. They may reassess their funding strategies to ensure they back candidates across party lines who can effectively advocate for the regulatory needs and interests of the crypto industry.