| Key Points |

|---|

| Crypto mortgages face valuation risks and regulatory uncertainty; however, some lenders are beginning to accept cryptocurrencies like Bitcoin for mortgage applications. |

| Newrez, a Pennsylvania-based lender, plans to accept certain cryptocurrencies from February 2024 for home loans, refinancing, and investment properties. |

| The FHFA is pushing for the recognition of crypto in mortgages, giving it partial acknowledgment from major mortgage enterprises, Fannie Mae and Freddie Mac. |

| Homeownership rates in the US are stable but the average homeowner age is increasing, highlighting the need for alternatives like crypto mortgages. |

| Borrowers might retain ownership of their crypto assets while securing 30-year loans through fintech companies like Milo. |

| There are restrictions on the acceptance of crypto, including the requirement of being held on US-regulated exchanges to mitigate risk. |

| Political factors influence the direction of crypto mortgages, with ongoing debates about risks versus affordability. |

Summary

Crypto mortgages are emerging as a viable option for home ownership in the US, particularly amidst rising housing costs and a changing financial landscape. While the acceptance of cryptocurrencies by lenders could offer young Americans a pathway to secure loans, the market is still fraught with challenges due to regulatory uncertainties and valuation risks. As lenders cautiously navigate this new territory, the potential for crypto to become a staple in mortgage financing remains to be fully realized.

Crypto mortgages are revolutionizing the landscape of homeownership, making it feasible for tech-savvy individuals to leverage digital assets for traditional real estate transactions. As the US mortgage market adapts, lenders are beginning to embrace crypto mortgage options, allowing buyers to utilize cryptocurrencies like Bitcoin in the purchasing process. This shift signifies a changing attitude towards buying a home with crypto, driven by both innovation and increasing investor interest. With partners like Newrez stepping forward as crypto mortgage lenders, the potential for using digital currencies to finance homes is becoming more tangible. However, despite the excitement surrounding bitcoin mortgages, challenges surrounding valuation risks and regulatory uncertainty persist, making it essential for prospective homeowners to navigate this evolving landscape with caution.

When discussing the concept of cryptocurrency-based home financing, one might think of alternative terms like digital asset mortgages or blockchain home loans. The rise of this innovative financing method reflects a broader trend in the real estate industry, where traditional lending practices are being supplemented with newer technologies and assets. As younger generations look for ways to enter the housing market, utilizing their crypto holdings as leverage offers a compelling alternative to conventional mortgage solutions. Moreover, as industries adapt to include options for crypto and homeownership, it’s crucial to understand the varying degrees of acceptance and regulation affecting both lenders and borrowers. This evolution highlights a potential shift in homebuying paradigms, allowing more individuals to secure their future properties in an increasingly digital economy.

Understanding Crypto Mortgages and Their Potential

Crypto mortgages represent a transformative shift in how home financing can occur, especially within the evolving landscape of the US mortgage market. Traditional lenders are now starting to accept cryptocurrency assets like Bitcoin as viable forms of collateral for home loans. This innovative approach facilitates an intersection between emerging digital asset ownership and longstanding financial practices, aiming to democratize the pathway to homeownership for younger generations who may hold significant crypto investments. As more lenders, such as Newrez, begin to embrace this concept, it’s crucial to understand how crypto mortgages can revolutionize the homebuying experience.

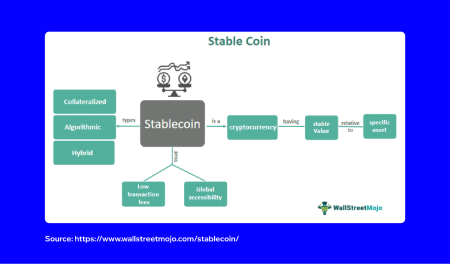

However, the adoption of crypto mortgages involves navigating a web of valuation risks and regulatory uncertainty. There are inherent risks in relying on volatile cryptocurrencies as collateral, which could fluctuate dramatically in value during the loan period. Regulators like the Federal Housing Finance Agency (FHFA) are still determining how to integrate cryptocurrencies into the mortgage application processes effectively, leading to cautious acceptance by lenders. This evolving scenario poses both opportunities and challenges for potential homeowners looking to capitalize on their crypto assets.

The Role of Crypto Mortgage Lenders in Home Buying

Crypto mortgage lenders play a pivotal role in bridging the gap between innovative digital finance and traditional homeownership. By accepting cryptocurrencies, these lenders are catering to a niche market where crypto holders seek to leverage their digital assets for significant financial undertakings, such as purchasing real estate. The rise of crypto mortgage lenders reflects broader trends in the US mortgage market, showing a willingness to adapt to changing economic dynamics and consumer preferences. This adaptation could create new pathways for individuals who previously struggled to qualify for conventional financing.

In addition to allowing Bitcoin and other cryptocurrencies as collateral, lenders provide unique solutions and products tailored to meet the needs of this new demographic. For instance, some crypto mortgage lenders enable customers to retain ownership of their digital assets while securing long-term loans. This can create a scenario where borrowers can benefit from potential appreciation in crypto valuations, while simultaneously investing in their real estate futures. Nevertheless, with such innovations come further discussions regarding risk management and the need for clear regulatory frameworks.

Navigating Risks and Challenges with Crypto Mortgages

Despite the promising emergence of crypto mortgages, several key risks and challenges must be analyzed. First and foremost is the volatility of cryptocurrencies, which can significantly impact a borrower’s ability to maintain collateral value throughout the mortgage term. As pointed out by industry experts, this volatility poses a dilemma for lenders who must devise strategies to ensure adequate risk mitigation without discouraging potential borrowers. The requirement for crypto to be held on regulated exchanges further complicates matters, as not all cryptocurrencies may qualify, limiting options for borrowers.

Another challenge is the limited market acceptance for crypto mortgages among traditional lenders, many of whom are still cautious due to the lack of comprehensive regulatory guidance. While some lenders are leading the way in integrating crypto assets into their mortgage products, others remain hesitant, citing potential financial pitfalls from entering a market still viewed as speculative. As homeowners increasingly explore the intersections of crypto and homeownership, understanding these risks becomes crucial for those considering leveraging their digital assets for mortgage financing.

Opportunities for First-Time Homebuyers with Crypto Assets

The introduction of crypto mortgages presents several unique opportunities for first-time homebuyers, particularly younger generations who have invested in cryptocurrency. This demographic, primarily composed of tech-savvy individuals under 44 years old, represents a growing segment of the population that is financially leveraging digital assets for traditional goals such as homeownership. As organizations like the FHFA encourage the acceptance of crypto in loan applications, first-time buyers can find ways to realize the long-term American dream of owning a home.

Moreover, by integrating cryptocurrencies into the mortgage process, lenders can significantly lower barriers to entry for these first-time buyers. Traditional income verification methods and credit score assessments could become more flexible, allowing individuals who may not qualify for standard loans to access home financing through innovative crypto solutions. This could greatly enhance homeownership rates, contributing to economic growth and stability, as more individuals transition from renting to owning.

The Impact of Regulatory Environment on Crypto Mortgages

The regulatory environment plays a critical role in shaping the future of crypto mortgages within the US market. Guidance from the FHFA and other government entities is essential for establishing a framework in which lenders can operate confidently while integrating cryptocurrencies into their loan offerings. As seen with the shift in policy direction, regulators are beginning to acknowledge the legitimacy of crypto assets in the context of real estate financing, though they proceed with caution due to concerns surrounding volatility and fraud.

Future regulatory developments will likely dictate the pace and scale at which the crypto mortgage market expands. Lenders and potential homebuyers alike are anxiously awaiting clearer guidelines and mechanisms for integrating crypto into the lending process. As political acceptance grows, so too might borrowing opportunities for crypto holders, suggesting that the coming years could usher in significant changes in the landscape of home financing.

Bitcoin Mortgages: A New Frontier in Real Estate Financing

Bitcoin mortgages are emerging as a significant trend within the broader crypto mortgage sector, as more lenders start to accept Bitcoin as a basis for loan applications. By capitalizing on the increasing prevalence of Bitcoin ownership, these mortgage products cater to a specific audience eager to utilize their digital wealth to invest in traditional assets such as real estate. The liquidity offered by Bitcoin allows lenders to create innovative loan structures, thus broadening the options available to homebuyers.

These Bitcoin mortgages not only provide individuals a means to secure funding for home purchases but can also help foster a sense of connection between modern digital finance and traditional real estate. As lenders enhance their understanding of cryptocurrency and move toward more adaptable lending models, the potential for Bitcoin mortgages to change the homebuying landscape becomes ever more likely. For first-time buyers especially, this new frontier could present a viable path to achieving their homeownership goals.

The Future of Crypto and Homeownership in America

As the integration of cryptocurrencies into the home purchasing process becomes increasingly normalized, the future of crypto and homeownership in America appears promising. With organizations and lenders embracing innovative solutions, and entities like the FHFA endorsing the consideration of crypto assets, the potential for a more inclusive mortgage market is aligning with societal trends toward digital finance adoption. This progress could help invigorate homeownership among younger populations who are seeking ways to leverage technology for their financial futures.

Looking ahead, we are likely to see an evolution in the type of mortgage products and services available that cater specifically to crypto holders and their unique financial profiles. Lenders may experiment with dynamic lending structures tailored to the unique nuances of the crypto market while ensuring compliance with evolving regulatory standards. With ongoing discussions around affordability and access to homeownership, harnessing the potential of crypto assets might serve as a catalyst for a more equitable real estate market.

Using Crypto to Counter Rising Homeownership Challenges

As housing costs continue to soar, integrating crypto assets into mortgage applications presents a strategic solution for addressing the affordability crisis affecting many potential homebuyers. Younger generations with significant crypto holdings can now look towards leveraging these digital assets as a tool for securing mortgages, thus directly confronting the barriers imposed by rising property prices. This paradigm shift encourages financial inclusion and democratizes access to homeownership in a turbulent housing market.

Lenders’ willingness to innovate around the inclusion of cryptocurrencies reflects broader economic trends and growing demands among consumers. By finding novel ways to incorporate crypto into financing, lenders may not only foster a more competitive environment but can also contribute to stabilizing homeownership rates. As the market adapts to these evolving dynamics, the way forward for home ownership in America may increasingly rely on recognizing the intrinsic value of crypto assets.

The Influence of Political Will on Crypto Mortgage Acceptance

Political factors play a significant role in the acceptance and development of crypto mortgages within the US. The recent move by the FHFA signals a shift that could have long-lasting effects on how mortgage lenders view cryptocurrencies. Enthusiastic policy changes at the federal level can pave the way for broader adoption, reducing the friction currently faced by lenders when considering crypto in their assessments. This political backing serves to instill confidence in the mortgage market as it navigates these uncharted waters.

Continued political advocacy in favor of crypto will also be pivotal for ensuring that regulatory environments evolve in tandem with market demands. Key legislative efforts aimed at facilitating the growth of the crypto mortgage sector will likely focus on establishing clearer guidelines for both lenders and borrowers. As influential lawmakers recognize the potential of cryptocurrencies to reshape homeownership in America, a concerted effort to bolster acceptance could lead to a more favorable landscape for all participants involved.

Frequently Asked Questions

What are crypto mortgages and how do they work?

Crypto mortgages refer to loans that allow borrowers to use their cryptocurrency holdings, such as Bitcoin, as collateral when securing a mortgage. By leveraging digital assets, borrowers can enter the homeownership market, despite potential volatility in crypto valuations. Some lenders in the US recognize crypto holdings when evaluating mortgage applications, providing a new avenue for financing a home purchase.

How are crypto mortgage lenders evaluating applications?

Crypto mortgage lenders assess applications by considering the value of the crypto assets alongside traditional metrics, such as credit scores and income. For instance, Pennsylvania-based lender Newrez announced plans to accept certain cryptocurrencies when evaluating mortgage applications, following guidance from the Federal Housing Finance Agency (FHFA). These lenders are careful about risk and may require crypto to be held on regulated exchanges.

Can you buy a home with crypto?

Yes, buying a home with crypto is becoming increasingly possible as more lenders accept digital currencies for mortgage applications. Crypto mortgages allow potential homeowners to leverage their Bitcoin or other cryptocurrencies as collateral, aiding in the home-buying process while navigating traditional loan requirements.

What are the benefits of crypto and homeownership?

Crypto and homeownership offer numerous benefits, especially for younger buyers who may struggle to secure traditional mortgages. By utilizing crypto assets, borrowers can bypass some financial barriers, potentially increasing homeownership rates. Additionally, this approach reflects an evolving real estate market adapting to new financial technologies.

What are the risks associated with Bitcoin mortgages?

Bitcoin mortgages carry inherent risks, primarily due to the volatility of cryptocurrency values. Lenders may require that crypto be held on regulated exchanges and will factor in market fluctuations when evaluating collateral for mortgage applications. Borrowers should be prepared to accept potential losses on their crypto assets as part of the mortgage process.

How is the US mortgage market adapting to crypto mortgages?

The US mortgage market is gradually adjusting to the concept of crypto mortgages, as seen with lenders like Newrez embracing this new asset class. Government entities like Fannie Mae and Freddie Mac are developing guidelines for incorporating crypto into mortgage applications, suggesting a shift towards recognizing cryptocurrencies in traditional financing.

What do potential borrowers need to know about crypto mortgages?

Potential borrowers interested in crypto mortgages should be aware of regulatory uncertainties and the specific requirements set by lenders, such as the need for crypto to be on regulated platforms. Understanding the financial implications, including the potential for valuation loss, is crucial when considering leveraging digital assets for homeownership.

Will crypto mortgages become mainstream in the future?

While the future of crypto mortgages looks promising, their mainstream adoption will depend on regulatory clarity and lender acceptance. Political momentum exists to embrace crypto in the mortgage sector, but factors like market volatility and institutional concerns will play significant roles in shaping its viability.

What challenges do lenders face with accepting crypto for mortgages?

Lenders face various challenges when accepting crypto for mortgages, including regulatory ambiguity and the volatility of digital currencies. Concerns about market fluctuations affecting collateral value hinder widespread acceptance. Lenders also need to develop risk mitigation strategies that comply with existing mortgage guidelines while navigating the evolving landscape of crypto.