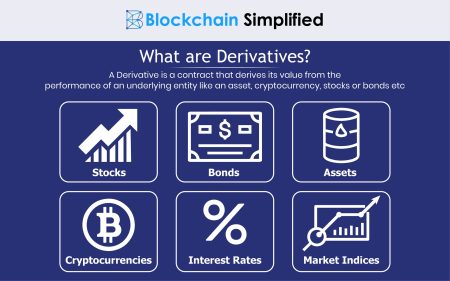

The crypto market volatility is an ever-present factor that shapes both investor sentiment and financial strategies within the ever-expanding digital asset landscape. Recently, we’ve observed significant fluctuations, with the Bitcoin price drop impacting countless investors and institutions alike, leaving them grappling with new challenges. Ethereum losses have compounded the agony, especially for companies heavily invested in digital assets, prompting a reevaluation of their balance sheets. Additionally, the rise of crypto ETFs has introduced a new wave of market participants, who are now experiencing firsthand the effects of this turbulent market. Amid these shifts, mining infrastructure challenges underscore how reliant the sector is on environmental factors, drawing in AI data centers as a beacon of technological evolution.

In the realm of cryptocurrencies, the unpredictable nature of digital assets has come to be referred to as market instability, a reality that has become increasingly evident to both seasoned traders and new investors. The recent descent in Bitcoin prices, often noted for its drastic swings, has created a ripple effect, affecting a variety of financial instruments including digital asset ETFs and corporate balance sheets. With substantial setbacks in Ethereum valuations, companies holding significant quantities of Ether are facing extensive unrealized losses, necessitating a reevaluation of their financial strategies. Moreover, the infrastructure that once solely supported cryptocurrency mining is being reimagined, as technological trends shift towards artificial intelligence and robust data centers. This transition illustrates not only the challenges of crypto’s inherent volatility but also the industry’s adaptability in the face of evolving market demands.

| Key Point | Details |

|---|---|

| Crypto Market Downturn | Digital asset volatility is impacting balance sheets, ETFs, and mining operations. |

| BitMine’s Losses | BitMine faces over $7 billion in unrealized losses on Ether as prices drop. |

| BlackRock ETF Impact | BlackRock’s Bitcoin ETF sees investors underwater as Bitcoin prices fall below $75,000. |

| US Winter Storm Effect | A winter storm disrupted Bitcoin mining, reducing output significantly due to energy grid strain. |

| Shift to AI Infrastructure | CoreWeave transitions from crypto mining to AI infrastructure, demonstrating market adaptability. |

Summary

Crypto market volatility continues to reshape the financial landscape, as evidenced by the recent downturn affecting various sectors. The decline in digital asset values, particularly Bitcoin and Ether, has resulted in substantial paper losses for firms heavily invested in these cryptocurrencies. This volatility is not only impacting balance sheets but is also revealing the interconnectedness of crypto markets with ETFs and mining infrastructure. As companies adapt to this instability, it becomes clear that maintaining a diversified strategy is crucial for navigating the turbulent waters of the crypto market.

Understanding Crypto Market Volatility

The crypto market is notoriously volatile, characterized by rapid price changes that can catch investors off guard. Recently, the decline in Bitcoin and Ethereum prices has highlighted this unpredictability. With Bitcoin dropping below $80,000 and Ether sliding dramatically, the impact on investments and balance sheets underscores the significant risks associated with digital assets. Market fluctuations not only affect individual investors but also ripple through financial products, such as ETFs, and the broader economic landscape.

This volatility has forced many companies, particularly those with heavy investments in cryptocurrencies, to reevaluate their treasury strategies. The recent sell-off has shown that unrealized losses can escalate quickly, leading to paper losses that stretch into the billions. Digital assets, while innovative, carry inherent risks that can reshape corporate financial strategies and operations, particularly in times of upheaval.

Impact of Bitcoin Price Drop on Investor Portfolios

As Bitcoin experiences significant price drops, investors are left to grapple with the uncomfortable reality of underwater investments. For instance, investors in BlackRock’s iShares Bitcoin Trust (IBIT) have seen their portfolios impacted severely. With the average dollar invested now below its purchase price, the downturn emphasizes the unpredictable nature of digital currency trading. More than just a price decline, these dynamics reveal the intricate connection between market sentiment and actual financial outcomes for investors.

The psychological effects of experiencing rapid devaluation can alter investment behaviors as well. Investors may become more risk-averse, triggering a sell-off in panic or a reevaluation of their investment strategies in an attempt to mitigate further losses. This situation illustrates the need for a well-informed, cautious approach to cryptocurrency investments, particularly in understanding market cycles and timing.

Ethereum Losses and Their Broader Implications

The recent slump in Ethereum prices has made waves across the financial world, particularly impacting companies like BitMine Immersion Technologies. With their significant holdings in Ether, they have faced paper losses exceeding $7 billion, leading them to reassess their risk exposure. These losses serve as a stark reminder of the unpredictable nature of cryptocurrencies, and how companies are often forced to adjust operations based on market performance.

Furthermore, the implications extend beyond individual companies. Such losses can influence market confidence, lead to a reevaluation of crypto ETFs, and affect investment in subsequent projects. The ongoing volatility underscores the need for improved risk management strategies among companies heavily invested in cryptocurrencies, particularly those that span various financial instruments and investment types.

Navigating Crypto ETFs Amidst Market Fluctuations

Exchange-traded funds (ETFs) centered around cryptocurrencies, such as the BlackRock Bitcoin ETF, provide investors an entry point into the crypto market without the need for direct ownership. However, recent volatility has showcased the drawbacks of this model, as several ETFs are reflecting negative returns. The rapid changes in Bitcoin’s value have left many ETFs struggling to maintain their value, revealing a critical vulnerability in these investment vehicles during a downturn.

Investors must now consider the holistic background of these funds and the underlying assets they hold. This situation serves as a pivotal lesson in understanding the correlation between market performance, ETF valuations, and individual investment strategies. The potential for further volatility lingers, signaling that investors should remain vigilant and informed when engaging with crypto-based ETFs.

Challenges Facing Mining Infrastructure During Volatility

The volatility in the crypto market also significantly affects mining infrastructure, particularly during extreme weather events. The recent US winter storm revealed how susceptible Bitcoin production is to energy grid stress, leading to drastic declines in output during adverse conditions. Such interruptions not only affect miners’ immediate output but also highlight the pressing operational challenges that arise from reliance on external power sources.

As the market experiences ongoing fluctuations, mining operations are compelled to adapt to changing conditions, rethinking their strategies and infrastructure use. The need for resilient energy solutions and efficient resource allocation becomes clearer, as miners strive to maintain production while managing the impacts of market swings and environmental factors. This interplay between production challenges and market conditions illustrates just how interconnected these elements are within the crypto ecosystem.

AI Data Centers and Their Relationship with Crypto Infrastructure

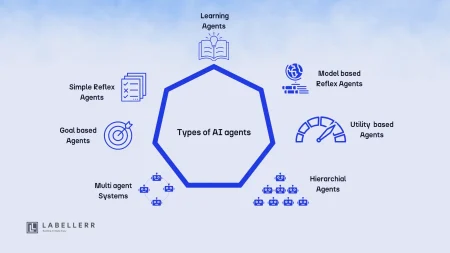

The evolution of mining infrastructure has paved the way for new opportunities, particularly in the realm of AI data centers. Companies like CoreWeave have successfully transitioned from crypto mining to providing high-performance computing for AI applications, demonstrating the versatility of mining hardware in adapting to technological shifts. This pivot not only reflects the changing landscape of digital assets but also shows how previously crypto-focused infrastructure can be repurposed to meet current demands.

This trend suggests a broader narrative within the technology sector, where cross-pollination between industries allows for innovative solutions. The transition from cryptocurrency mining to AI applications exemplifies how businesses can harness existing resources to explore new revenue streams effectively. As the crypto market continues to fluctuate, businesses with adaptable infrastructures may better weather the storms of volatility while capitalizing on emerging opportunities.

The Interconnected Ecosystem of Crypto and Traditional Markets

The relationship between cryptocurrency markets and traditional financial systems has never been more pronounced. As digital assets experience price corrections, the repercussions ripple through treasury management, ETFs, and investor confidence alike. Financial institutions are witnessing firsthand how intertwined these ecosystems are, as crypto volatility can drastically shift traditional investment strategies.

This interconnectedness has pushed many traditional investors to reassess their portfolios, leading to increased scrutiny over digital asset investments. Understanding these dynamics is crucial for investors looking to effectively navigate the crypto landscape while minimizing exposure to sudden market shifts. As regulators pay more attention to this convergence, future implications for market stability could lead to new frameworks for managing risk in both environments.

Exploring Resilience in Crypto Investments

In light of recent market volatility, resilience has become a buzzword in the crypto investment landscape. Investors are now prioritizing strategies that demonstrate flexibility and adaptability in the face of fluctuating prices. This shift in mindset reflects a broader trend where investors seek to fortify their holdings against the unpredictable nature of cryptocurrencies, embracing diversified portfolios that mitigate risk.

As businesses and individual investors grapple with the consequences of volatility, developing robust risk management techniques becomes imperative. These strategies not only encompass financial diversification but also technological investments that allow for quick adjustments in response to market conditions. The focus on resilience may ultimately pave the way for a more sustainable approach to engaging with the digital asset market.

The Future of Crypto Balances in Corporate Balance Sheets

Corporate treasury strategies are evolving as businesses reevaluate their exposure to cryptocurrencies amid ongoing market volatility. With companies like BitMine experiencing significant paper losses, the need for sound financial management practices has gained urgency. The future of how firms approach crypto holdings will likely involve a more cautious stance, balancing potential returns with the inherent risks of digital assets.

This evolution suggests firms may seek to integrate digital assets more cautiously into their balance sheets, potentially focusing on hedging strategies or limiting exposure during uncertain times. As the landscape continues to shift, corporate treasurers must remain agile and informed, ensuring their strategies align with both current market conditions and anticipated future trends in the crypto ecosystem.

Frequently Asked Questions

How does crypto market volatility affect Bitcoin price drops?

Crypto market volatility has a significant impact on Bitcoin price drops. For instance, when there are sharp declines in demand or economic uncertainty, investors tend to sell off their Bitcoin holdings, leading to drastic price falls. This was evident when Bitcoin dropped below $80,000, affecting both individual investors and funds like BlackRock’s Bitcoin ETF, exposing them to substantial losses.

What are the implications of Ethereum losses during periods of high crypto market volatility?

Ethereum losses often highlight the risks of volatility in the crypto market. Companies like BitMine Immersion Technologies experienced massive unrealized losses on their Ether-heavy treasury as ETH prices fell below $2,200. Such losses stress the fragility of cryptocurrencies and how they can substantially affect balance sheets, especially for organizations heavily invested in digital assets.

How do crypto ETFs manage risks associated with market volatility?

Crypto ETFs, such as the BlackRock Bitcoin ETF, are designed to provide exposure to cryptocurrencies while attempting to manage risks associated with market volatility. However, when market conditions sour, as they did with Bitcoin’s crash, even these financial vehicles can reflect significant losses as aggregate returns turn negative for investors. This illustrates that while ETFs can provide diversification, they are not immune to the inherent volatility of the crypto market.

What challenges do miners face due to crypto market volatility and environmental factors?

Miners face unique challenges due to crypto market volatility combined with environmental factors. A recent winter storm in the US significantly reduced Bitcoin production, showing how external conditions like weather can impact mining operations. When energy prices increase or availability decreases during severe weather, miners may halt production to conserve resources, directly affecting their revenue and operational output.

How is mining infrastructure adapting in response to crypto market volatility?

Mining infrastructure is adapting to crypto market volatility by pivoting towards alternative technologies, such as AI data centers. CoreWeave’s transition from a crypto miner to an AI infrastructure provider exemplifies this shift, showcasing how hardware originally used for crypto mining is now servicing the growing demands of AI. This strategic realignment allows mining companies to mitigate the risks associated with fluctuating crypto markets.