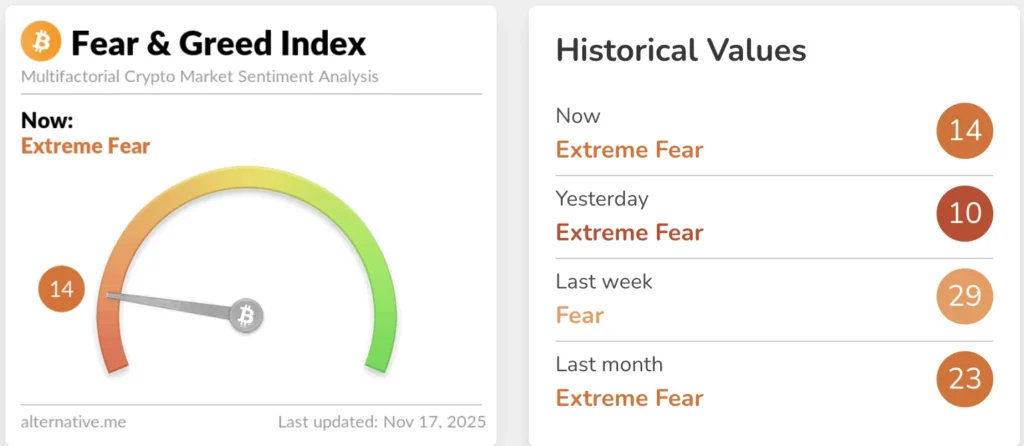

Crypto Market Sentiment Hits 6-Month Low: Time to Buy the Dip?

As the crypto market sentiment plunges to its lowest point in six months, both seasoned investors and curious onlookers are confronted with the perennial question: is now a good time to buy the dip? The recent turbulence in cryptocurrency prices has cast a shadow of doubt over what was once viewed as a relentlessly optimistic market. This dip presents a crucial juncture, potentially laden with opportunities for those who choose to act judiciously.

Understanding the Sentiment Dip

Several factors contribute to the declining market sentiment. Regulatory pressure from countries like the United States and China has historically introduced significant volatility in the crypto markets. Likewise, macroeconomic issues, including inflation rates and interest rate hikes by the Federal Reserve, also cast long shadows over the inherently sensitive cryptocurrency market environment.

Moreover, incidents of security breaches and fraud continue to undermine the trust in decentralized systems. High-profile collapses in cryptocurrency exchanges and lending platforms have prompted a cautious approach among potential investors.

Historical Context and Market Recoveries

Historically, the cryptocurrency market has been characterized by its rapid price fluctuations and dramatic recoveries. Notable downturns, such as those followed by rapid recoveries in late 2017, mid-2019, and the infamous pandemic-triggered crash of March 2020, have all tested investor resolve. Each dip presented a unique set of risks and rewards, with many investors capitalizing on the lower prices.

Analyzing Risk Versus Reward

The crucial aspect of “buying the dip” entails recognizing the volatility and inherent risks of the crypto market. While purchasing assets at a lower price can potentially lead to high returns, the investment could also face further depreciation. As such, each investment should be accompanied by a thorough risk assessment, ideally tailored to individual financial capacity and tolerance for risk.

One should consider diversification — not just among cryptocurrencies but across different asset classes. This strategy helps mitigate risk by spreading potential losses, particularly during periods of significant downturns in one sector.

The Blockchain and Technology Perspective

Beyond mere speculation, the underlying value in many cryptocurrencies and tokens is their association with innovative blockchain technology. Developments in areas such as decentralized finance (DeFi), smart contracts, and non-fungible tokens (NFTs) point to continuing innovation and utility in this space, which could stabilize and drive future growth.

Expert Opinions and Market Analyses

Prominent voices in finance, like CNBC’s Jim Cramer, and major crypto advocates such as Elon Musk, have sometimes pointed to the pitfalls and opportunities in crypto investing. Monitoring expert analyses and staying updated with reliable cryptocurrency news outlets can offer useful insights and help temper overly emotional decisions.

Final Thoughts: To Buy or Not to Buy?

Each potential investor must weigh their decision to invest during a market low carefully. Education is key—understanding blockchain technology’s potential, keeping abreast with market trends, and carefully assessing one’s financial situation are all crucial steps.

In conclusion, while the sentiment in the crypto market is currently bearish, and the landscape looks uncertain, the decision to buy the dip should not rely solely on market sentiment. Prospective buyers should consider long-term potential, broader market conditions, and personal investment goals. As always, in the high stakes game of cryptocurrencies, it’s wise to hope for the best but prepare for the worst.