The crypto market growth has captured the attention of investors and analysts alike, as predictions indicate it might expand by an astounding 10-20 times over the next decade. This remarkable forecast, highlighted by Bitwise CIO, suggests a promising future driven by increasing adoption and evolving technologies. One key player in this landscape, Solana, continues to dominate with its impressive DApp revenue, showcasing the potential for innovative platforms to attract market share expansion. Meanwhile, the Bitcoin supply dynamics contribute to its allure, as publicly traded companies now hold over 5% of the total circulating supply. As the market evolves, understanding these trends and their implications will be crucial for capitalizing on forthcoming opportunities in the crypto arena.

The growth trajectory of the cryptocurrency sector is drawing an increasingly enthusiastic following, with experts hinting at monumental increases in value in the coming years. Leading voices, such as the CIO from Bitwise, emphasize that the digital asset domain could experience a substantial surge, fostering innovations that drive user engagement. Furthermore, the ongoing developments in decentralized applications and the financial maneuvering by key stakeholders indicate a shifting landscape that beckons for exploration. Notably, the burgeoning participation of institutional players and the heightened trading volumes in established networks like Solana reflect the eagerness for market penetration. As digital currencies gain foothold, emerging trends will redefine investor strategies and shape the future of finance.

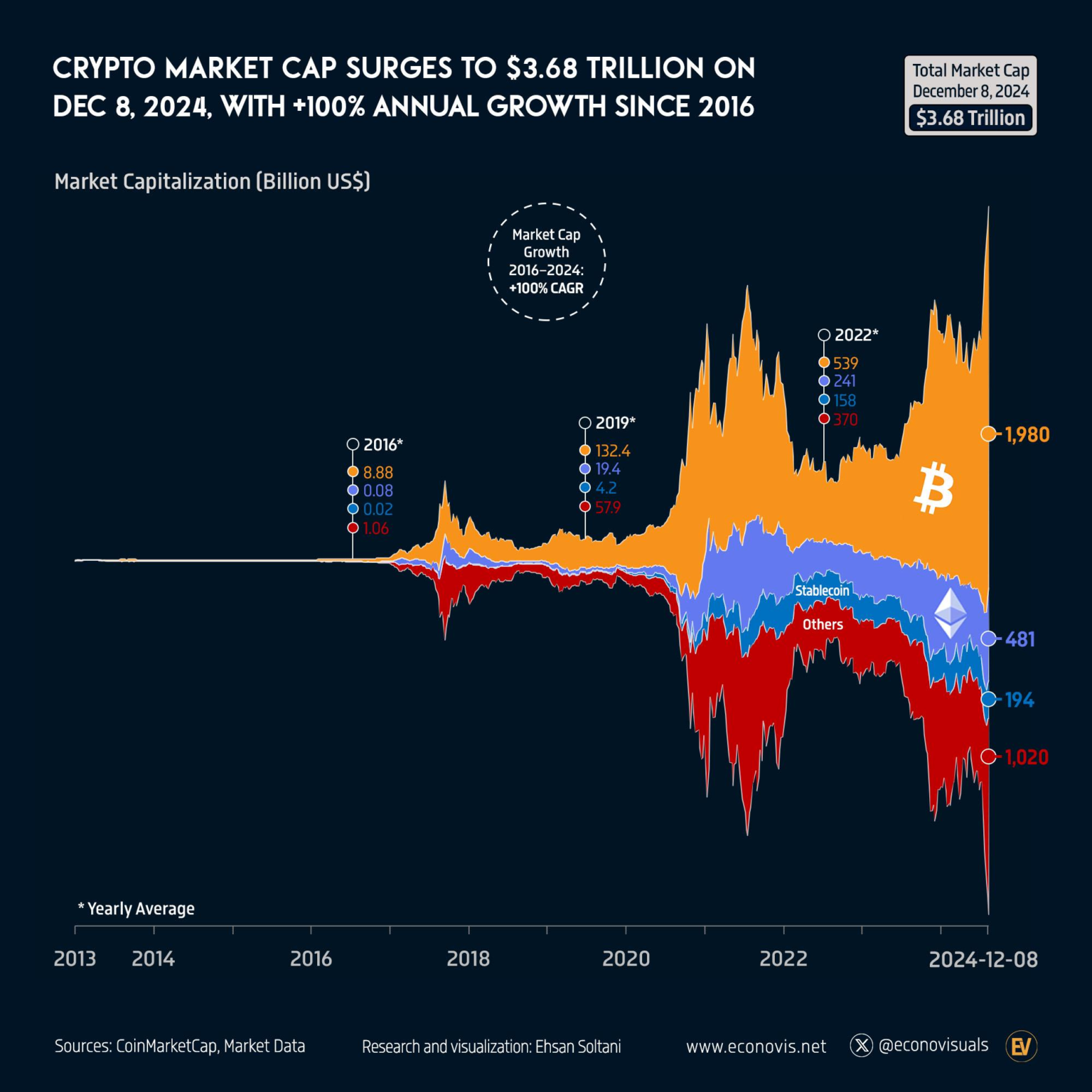

Significant Growth in the Crypto Market: A Decade of Predictions

The crypto market has been a topic of discussion for economists and investors alike, particularly with the recent predictions made by prominent figures. Bitwise CIO forecasts that the crypto market will grow 10 to 20 times in the next decade, reflecting an optimistic outlook fueled by technological advancements and broader adoption. Such growth may be attributed to the increasing number of applications built on blockchain technology, especially within the realm of decentralized finance (DeFi), as well as assets like Bitcoin and Ethereum reaching new heights in value and integration into mainstream financial systems.

This projected surge in the crypto market could rest on several emerging factors, including enhanced regulatory clarity and institutional investment appetite. As large financial entities begin to recognize the potential of cryptocurrencies, market predictions lean towards an expanding ecosystem where digital assets gain a significant share of the overall investment landscape. Furthermore, innovations in the crypto space, such as improvements in transaction speeds and scalability, are expected to facilitate widespread acceptance and utilization, thus paving the way for remarkable market growth.

As the crypto market continues to thrive, analysts are closely monitoring projects like Solana, which has emerged as a leader in DApp revenue and trading volumes. Such performance indicates that specific blockchains are gaining traction within the investment community, further supporting the overall growth narrative. By prioritizing user-friendly features and ecosystem advantages, platforms that harness blockchain technology could very well drive the upward trajectory of the crypto market, solidifying their place in investment portfolios worldwide.

In summary, the future trajectory of the crypto market holds exciting possibilities, reinforced by substantial predictions and the arrival of new and more resilient financial technologies. As industry leaders advocate for greater investment and innovation in this space, the potential for explosive growth appears more plausible than ever.

Market Share Expansion: The Competitive Landscape of Cryptocurrency

Polymarket’s CEO has indicated that the company is currently operating at a loss but remains committed to expanding its market share. This strategic decision highlights an underlying competitive tension in the crypto market, where companies are continuously vying for dominance. The business models are shifting as new players enter the sector and established ones double down on their development and marketing initiatives. A critical aspect of this expansion strategy is the need to attract user engagement and facilitate seamless transactions, which can significantly impact revenue streams.

In light of such competitive dynamics, it’s evident that many crypto companies are adopting innovative tactics to retain and grow their user bases. Solutions that prioritize user experiences, such as lowering transaction fees for DApps or providing attractive liquidity incentives, can incentivize users to engage with a platform over its competitors. Such strategies can lead to meaningful highs in market share expansion and confer precedence in revenue generation, particularly as the industry evolves and matures in terms of infrastructure and offerings.

As companies like Polymarket strive to improve their market positions, it’s important to acknowledge the broader implications for the cryptocurrency ecosystem. Specifically, competition ultimately benefits consumers, who enjoy enhanced services and improved functionalities in their transactions. As the dynamics of market share expansion unfold, keeping an eye on successful strategies and ongoing trends will be essential for understanding the broader implications for financial models in the crypto space.

Thus, it is clear that market share expansion is not merely about growing revenues but requires a comprehensive approach that includes enhancing user experience, robust marketing campaigns, and facilitating partnerships that align with the evolving digital finance landscape.

The Role of Bitcoin in the Current Financial Environment

As highlighted by recent analyses, publicly listed companies hold over 5% of the total Bitcoin supply, indicating a significant institutional interest in this cryptocurrency. Notably, firms like Strategy hold a substantial 3% of this supply, showcasing their elevated positions within the crypto landscape. This growing institutional adoption of Bitcoin suggests that many mainstream investors are considering digital assets as part of their diversification strategies, particularly in an unpredictable economic environment where traditional asset classes may falter.

Bitcoin’s role as a digital asset is further solidified when analyzing the increasing uncertainty represented by traditional market fluctuations. As hedge funds and investment firms diversify into cryptocurrencies, Bitcoin often emerges as a primary asset due to its first-mover advantage and widespread recognition. This growing trend reveals investor sentiment shifting towards viewing Bitcoin not just as a speculative asset but as a potential safe haven during financial turmoil.

In summary, Bitcoin continues to act as a beacon within the financial landscape, drawing significant investment from specialized crypto avenues and traditional benchmarks alike. As its supply dynamic shifts with institutional involvement, the landscape for cryptocurrencies will evolve, potentially deepening Bitcoin’s market influence and affirming its value proposition as a financial asset.

Thus, understanding Bitcoin’s unique position within both the crypto ecosystem and the broader investment community is essential for any stakeholder looking to navigate the complex financial implications of today’s markets.

Solana’s Dominance in DApp Revenue and Trading Volumes

In recent months, Solana has emerged as a leading force in the blockchain marketplace, surpassing all other Layer 1 (L1) and Layer 2 (L2) chains in terms of DApp revenue and decentralized exchange (DEX) trading volume. This remarkable achievement stems from Solana’s high throughput, low transaction costs, and ability to support a myriad of applications. Investors and developers alike are turning their attention towards Solana’s ecosystem, which is proving to be a robust platform for building and executing decentralized applications.

The continuous rise in DApp revenue on Solana suggests a growing user base engaging with its decentralized applications, which translates to increased transaction volume and liquidity in its trading platforms. As more developers tap into Solana’s infrastructure for their projects, it is likely that we will witness further growth in revenue and market engagement, solidifying its position in the crypto market. Moreover, as other blockchains strive to compete with Solana’s efficiency and user experience, this competition can lead to innovations that ultimately benefit the entire sector.

Given the momentum behind Solana, its performance can be indicative of broader trends within the blockchain industry. Projects built on efficient networks tend to draw significant attention from users and investors, which can create using effects for surrounding markets. Analysts and enthusiasts of cryptocurrency will undoubtedly keep a close eye on Solana as it continues to set precedents in terms of user engagement and financial success.

Overall, Solana’s leading position in DApp revenue and trading volumes highlights the importance of technological advancements in the evolving cryptocurrency landscape. This trend is not only central to Solana’s sustainability but also significant for the overall market growth as investors seek out platforms that offer utility and performance.

Bitcoin Supply Dynamics and Institutional Adoption Trends

With increased institutional purchases, the dynamics of Bitcoin supply have undergone significant changes in recent years. Publicly traded companies now collectively hold a notable percentage of the total Bitcoin supply, as mentioned, reflecting a major shift in how traditional finance is beginning to view and engage with cryptocurrencies. Such adoption suggests a movement away from Bitcoin as a mere speculative vehicle toward its recognition as a digital asset of real value amid global financial volatility.

The impacts of this institutional interest in Bitcoin’s supply are multifaceted; for example, it may lead to increased price stability as institutional holders tend to view their investments with a longer-term horizon compared to retail investors. Additionally, large holders are often more reluctant to engage in selling their assets during market fluctuations, thereby reducing sell pressure on Bitcoin. This scenario indicates a potential for a healthier market environment, where price manipulation by peripheral actors could be minimized.

Over time, as institutional interest grows and Bitcoin supply dynamics adjust, the role of Bitcoin within the broader investment landscape is expected to evolve. Stakeholders must consider how these trends influence market dynamics, particularly as institutions increasingly seek out secure and efficient ways to invest in digital assets.

In essence, monitoring Bitcoin supply alongside institutional adoption patterns will provide critical insights into the future of cryptocurrency investments and the overall health of the digital asset ecosystem.

The Future of Crypto Regulation: Balancing Innovation and Security

As cryptocurrencies continue to gain popularity, the conversation surrounding regulation has amplified. Industry leaders and regulators are engaging in discussions aimed at striking the right balance between fostering innovation and ensuring the security of investors and markets. The rapid evolution of the financial landscape driven by cryptocurrencies calls for tailored regulatory approaches that can help facilitate growth without stifling the technological progress that comes with blockchain innovations.

Proponents of light-touch regulation argue that imposing stringent rules could hinder the versatility and rapid advancement of crypto technologies. On the other hand, supporters of regulatory frameworks emphasize the importance of protecting consumers from inherent risks associated with new financial products. Finding common ground is crucial for the future of the crypto market, as regulatory uncertainty can lead to hesitancy among potential investors and hinder broader adoption.

Navigating this complex regulatory environment will be paramount for crypto firms looking to sustainably scale their operations. As jurisdictions worldwide explore their regulatory stances, it will be important for businesses to remain proactive and compliant to stay ahead of evolving requirements.

Ultimately, the establishment of effective regulations can support the credibility and viability of the cryptocurrency ecosystem while ensuring that innovations can thrive, thus setting the stage for a more stable and mature market.

Impact of Whale Activity on Crypto Prices and Market Trends

The actions of large cryptocurrency holders, or whales, have a significant influence on market prices and trends. A recent example involved a whale accumulating nearly 99 million RLS from Coinbase, showcasing the potential for sizeable investments to sway market conditions. Such activities highlight the intricate relationship between whale movements and cryptocurrency price stability, as large trades can create sudden fluctuations that smaller investors find difficult to predict.

Additionally, understanding whale behavior is crucial for developing a market strategy. The fact that whales can leverage their assets to take bold positions – such as going long on HYPE, as one whale did with significant unrealized losses – speaks to the complexities of trading in this arena. As retail traders attempt to navigate the crypto market, knowledge of these dynamics can offer insights into price movements and expected trends, ultimately leading to more informed investment decisions.

Consequently, awareness of whale activity is invaluable not only for predicting short-term price movements but also for understanding longer-term trends within the cryptocurrency market. Stakeholders must continuously monitor these large holders’ actions to fully grasp the potential implications of their trades on overall market conditions.

To summarize, whale dynamics shape the crypto market in significant ways, influencing investor behavior and price stability. As the market matures, recognizing these factors will be essential for anyone looking to navigate the evolving landscape of digital assets.

Innovations Driving Change: The Future of Blockchain Technology

The rapid development of blockchain technology has paved the way for numerous innovations that are transforming various sectors. As decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain applications gain traction, the potential for disruption in traditional industries becomes markedly evident. These innovations are not only catalyzing growth in the crypto market but are also fostering new business models that leverage the unique features of digital assets, such as scarcity and programmability.

Tech advancements, such as layer two scaling solutions and interoperability protocols, are redefining what is possible within the blockchain ecosystem. For instance, Solana has distinguished itself by enabling high-speed transactions at a fraction of the cost compared to its competitors. This adaptability is key to sustaining continued engagement and growth within the crypto landscape, consequently positioning blockchain technologies at the forefront of financial evolution.

As innovations drive change, it is vital to remain aware of how evolving technologies will impact not only the cryptocurrency market but also the broader economic landscape. By embracing these advancements, stakeholders can harness the power of blockchain to develop new financial products and services that enhance efficiency, security, and user experience.

In essence, the future of blockchain technology promises to bring about significant transformations that will shape the next generation of digital assets and finance as a whole.

Frequently Asked Questions

What are the crypto market predictions for growth in the next decade?

According to Bitwise CIO, the crypto market is expected to grow 10-20 times over the next decade. This substantial growth signals increasing adoption and potential for higher market valuations in cryptocurrencies.

How does Bitcoin supply affect the overall crypto market growth?

The total Bitcoin supply is capped at 21 million coins, which creates scarcity. Limited supply combined with growing demand contributes significantly to the overall crypto market growth, driving prices and investor interest.

What factors contribute to Solana’s leading position in DApp revenue within the crypto market?

Solana continues to lead all Layer 1 and Layer 2 chains in decentralized application (DApp) revenue and DEX trading volume due to its high throughput, low transaction costs, and supportive developer community, positioning itself as a significant player in the crypto market growth.

How is market share expansion impacting the growth of the crypto market?

Companies like Polymarket are focusing on market share expansion despite operating at a loss, signaling that strategic investments in technology and partnerships are critical for long-term growth in the competitive crypto market.

What does the high percentage of Bitcoin supply held by publicly traded companies mean for the crypto market?

With over 5% of the total Bitcoin supply held by publicly listed companies, this indicates institutional interest in cryptocurrencies, which is a strong driver for crypto market growth and stability.

| Key Point | Details |

|---|---|

| Missing Government Data | This situation places a spotlight on the need for transparency and accurate economic indicators. |

| Hawkish Rate Cuts | Former Fed Vice Chairman supports more aggressive rate cuts to combat inflation. |

| Crypto Market Prediction | Bitwise CIO forecasts the crypto market could grow 10-20 times over the next decade. |

| Polymarket CEO’s Strategy | Despite operating at a loss, Polymarket is focusing on expanding its market share. |

| Spot Gold Price Rise | Gold prices rise short term to over $4200 per ounce, indicating a shift to safe-haven assets. |

| Fed’s Balance Sheet Signals | Economic signals regarding balance sheet expansion may outweigh the importance of rate cuts. |

| Whale Activity | A major investor has accumulated nearly 99 million RLS from Coinbase, valued at $1.51 million. |

| Bitcoin Ownership by Companies | Data shows that publicly listed companies hold more than 5% of the total Bitcoin supply. |

| Solana Performance | Solana leads all L1 and L2 chains in DApp revenue and DEX trading volume. |

| HYPE Whale Position | A whale has leveraged 5 times to invest long on HYPE but faces a significant unrealized loss. |

| Flash Crash Reactions | Following a recent market crash, the whale’s strategy included opening a short position in ETH. |

Summary

The crypto market growth is expected to outpace many other sectors in the coming years. As highlighted in recent developments, industry leaders are optimistic about the future, with projections indicating a potential increase of 10-20 times within the next decade. With significant investments from companies and evolving market dynamics, the crypto landscape is poised for a transformational era that could redefine financial systems.