Crypto Market Decline Might Boost Pi Coin Value

In the tumultuous world of cryptocurrencies, where high volatility is commonplace, patterns of rises and crashes dictate the pulse of the digital currency universe. Amidst a broader crypto market downturn, an intriguing scenario has been unfolding that could potentially favor emerging cryptocurrencies like Pi Coin. This period of decline might paradoxically serve as a launching pad for Pi Coin’s value and relevance in the crypto market.

Understanding the Dynamics of the Crypto Market Decline

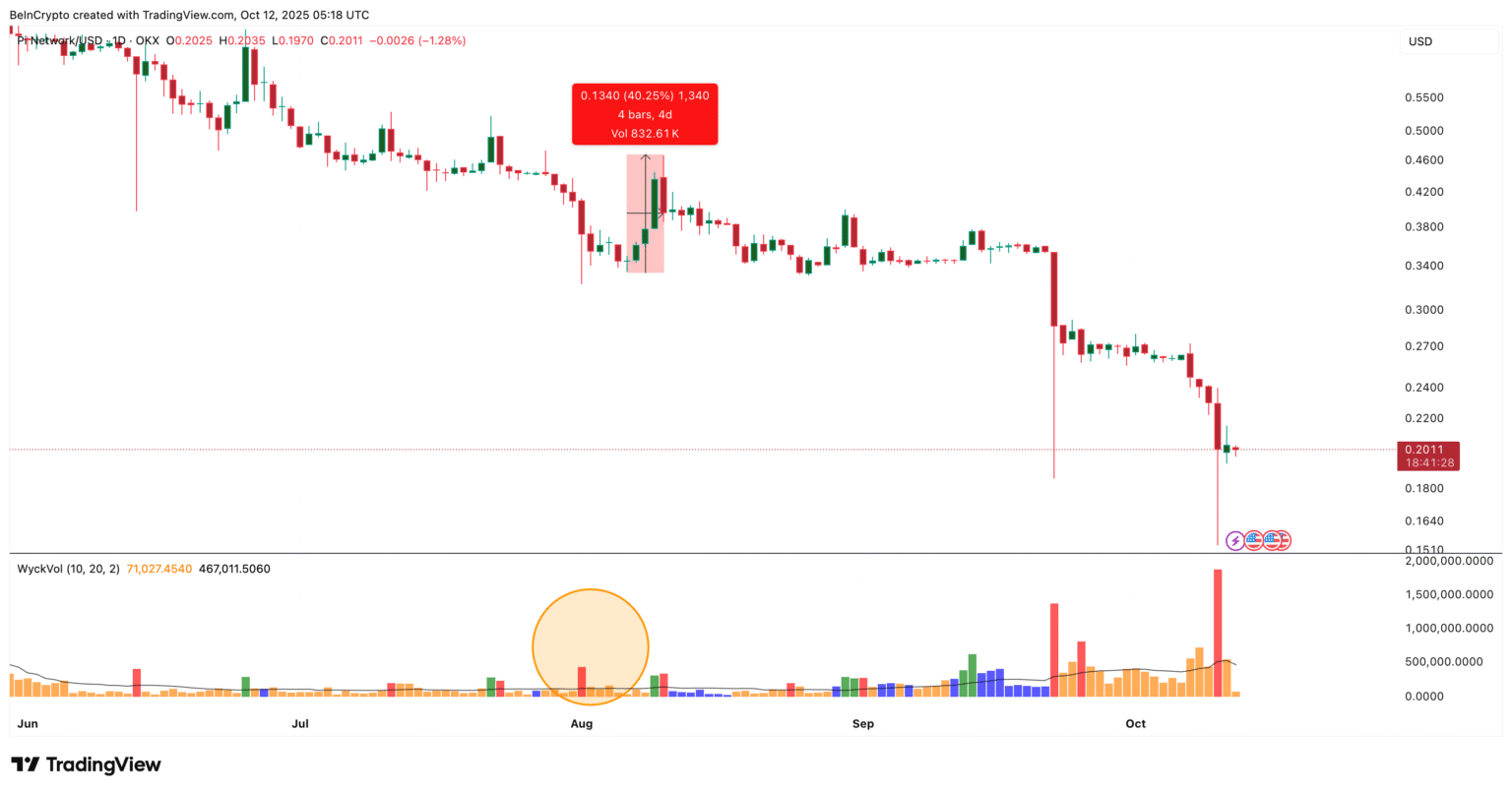

The crypto market is known for its swift gains and equally rapid declines, often prompted by global economic factors, changes in regulations, or shifts in investor sentiment. Recently, factors such as increased regulatory scrutiny, hikes in interest rates by major central banks, and broader economic uncertainties have contributed to a sharp downturn in the market values of established cryptocurrencies like Bitcoin and Ethereum.

During these periods, investors often search for alternative options to safeguard their investments from the mainstream market volatility, and new or less-known cryptocurrencies can become attractive for their perceived fresh opportunities and untapped potential.

The Emergence of Pi Coin

Unlike mainstream cryptocurrencies, Pi Coin is part of a novel project developed by a group of Stanford graduates that aims to make cryptocurrency mining accessible to everyday users via mobile phones. The Pi Network, which facilitates mining Pi Coin, emphasizes ease of use without the need for sophisticated hardware and extensive power consumption typically associated with such processes.

The potential of Pi Coin hinges on its unique proposition and its ability to develop an inclusive financial ecosystem. As the Pi Network moves out of its nascent stages and gears toward broader adoption and utility, it presents an attractive blend of novelty and utility to potential investors.

Why a Market Decline Might Favor Pi Coin

-

Search for Stability: In times of market decline, investors might look towards newer or developing coins like Pi Coin as they might not be as tied to the broader economic movements that affect established coins.

-

Diversification: As traditional crypto assets suffer, diversifying into different cryptocurrencies such as Pi Coin can seem a prudent strategy for reducing risk and potential losses.

-

Increased Attention to Innovations: During downturns, there is a potential shift in focus towards technological innovations offering solutions to existing problems in the crypto market, such as accessibility and energy consumption, which are areas where Pi Coin is positioned strongly.

- Community Engagement: Pi Coin’s model promotes community involvement and network growth which can lead to increased resilience against market downtrends. The more engaged and larger the network, the more stable the cryptocurrency can potentially become.

Challenges and Considerations

Despite the promising outlook, Pi Coin faces its set of challenges. It is yet unlisted on major cryptocurrency exchanges and still in the phase of building its ecosystem and proving its utility in real-world applications. Also, the value preposition could be heavily influenced by the network’s ability to achieve wide adoption and not merely the speculative trading that characterizes much of the cryptocurrency movements.

Conclusion

As the crypto market goes through another phase of correction and re-evaluation, it might be a boon for nascent projects like Pi Coin that offer a different value proposition from the established players. For investors worn by the recent volatilities, Pi Coin offers an intriguing mix of innovation, community engagement, and potential for growth.

Only time will tell how Pi Coin will carve its niche in the complex tapestry of the cryptocurrency market. Yet, as the broader market dynamics play out, emerging cryptocurrencies like Pi Coin could possibly emerge stronger and more relevant to a broader user base, looking for viable alternatives in a fluctuating economic landscape.