As discussions around the crypto market bottom intensify, investors are eager to identify the signs of a potential rebound. Understanding this critical phase in the cryptocurrency landscape can unlock opportunities for savvy investment strategies. Historical data suggests that entering during market lows can yield impressive returns, as demonstrated by past trends in crypto market analysis. The maturation of blockchain technology and the rise of stablecoins indicate a developing ecosystem that may soon reverse current trends. With the integration of AI in crypto advancing, the future appears bright for those prepared to navigate the complexities of the crypto market bottom.

In exploring the depths of cryptocurrency fluctuations, the term “market low” is often used interchangeably with the concept of the crypto market bottom. This pivotal phase represents a crucial turning point where investor sentiment may shift from despair to hope. By analyzing market trends and utilizing various investment strategies, such as holding stable digital assets, traders can position themselves advantageously. The evolution of decentralized finance and blockchain innovation points toward a robust infrastructure capable of supporting future growth. Ultimately, understanding these dynamics is essential for anyone looking to thrive in the volatile world of digital currencies.

| Key Point | Details |

|---|---|

| Investor Returns | Investors who bought at the 2018 market bottom saw about 2000% returns, while those entering at the 2022 low experienced approximately 300% returns. |

| Current Market Observation | There is a notable disconnection between crypto prices and technological advancements, reminiscent of previous market cycles. |

| Growth of Non-Sovereign Currencies | The rise of stablecoins and the development of tokenization indicate a maturing cryptocurrency ecosystem. |

| Future Catalysts for Recovery | Potential recovery drivers include the CLARITY Act, a shift in market risk appetite, expectations for interest rate cuts, and breakthroughs in AI and crypto technologies. |

| Market Behavior Expectations | Bitwise predicts that without sudden positive shifts, the market is likely to slowly find its bottom. |

Summary

The concept of the Crypto Market Bottom indicates a significant phase where prices may have bottomed out, leading to a potential recovery. As highlighted by Bitwise’s observations and analysis from Matt Hougan, current extreme anxiety in the crypto market suggests we may be approaching a bottom. Historical data shows strong returns for those who invested during previous lows, and maturity in the crypto ecosystem through stablecoins and technological advances indicates future growth. With several catalysts on the horizon, such as legislative changes and market sentiment shifts, the outlook for the crypto market becomes increasingly optimistic.

Understanding the Crypto Market Bottom

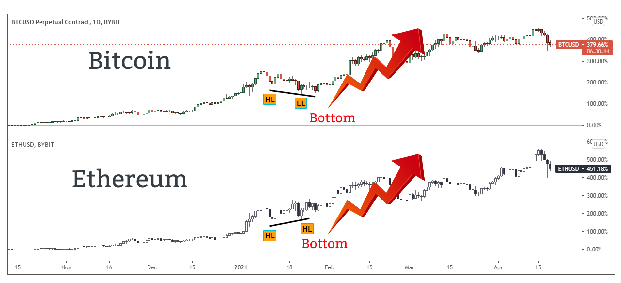

The term “crypto market bottom” refers to a phase in the market cycle where prices reach their lowest point before beginning an upward trend. Investors often look for indicators that suggest the market is nearing this bottom, such as extreme anxiety among market participants. According to Matt Hougan from Bitwise, current sentiments echo those seen at previous bottoms, particularly in 2018 and 2022, when patient investors eventually saw returns exceeding 2000% and 300%, respectively. This pattern suggests that despite the current market turmoil, a turnaround may be on the horizon as fundamental indicators improve.

Several factors could signal the crypto market bottom, including heightened volatility and investor sentiment. The ongoing development of blockchain technology and the adoption of stablecoins indicate systemic growth that usually precedes a market recovery. Market analysts are keeping an eye on various catalysts such as regulatory clarity through legislation like the CLARITY Act, which could foster a more favorable investment environment for both retail and institutional investors. As sentiment shifts towards a willingness to take on more risk, the crypto space might just be gearing up for a rebound, making it an opportune time for long-term investment strategies.

Investment Strategies During Market Downturns

Developing sound investment strategies during crypto market downturns involves a disciplined approach focusing on long-term gains. While many trading strategies thrive in bull markets, constructing a robust portfolio with a mix of stablecoins and established cryptocurrencies can help mitigate risks. By diversifying investments and including non-sovereign currencies, investors can better weather market fluctuations. Furthermore, employing dollar-cost averaging can be effective when buying assets over time, reducing the impact of short-term volatility.

Long-term investors often capitalize on downturns by seeking undervalued assets that can yield high returns once the market rebounds. A deep understanding of market cycles is essential; therefore, investors should closely monitor crypto market analysis to identify emerging trends, especially at the intersection of AI and blockchain technology. Innovations in these areas could lead to new opportunities and enhance the ecosystem’s resilience, ultimately aiding recovery as demand for digital assets rises.

The Role of Stablecoins in Cryptocurrency Recovery

Stablecoins play a crucial role in providing stability during periods of high volatility in the crypto market. These digital assets, pegged to stable currencies such as the US dollar, offer a refuge for investors looking to minimize their exposure to risk while maintaining liquidity. According to industry experts, the rise of stablecoins indicates a maturing market that embraces both innovation and security, a sentiment echoed by Matt Hougan of Bitwise. As these coins gain traction, they could serve as a bridge between traditional finance and the crypto space, enhancing mainstream adoption.

Moreover, the expanding use of stablecoins in decentralized finance (DeFi) applications highlights their importance during market downturns. Investors can leverage stablecoins for lending and liquidity provision, allowing them to earn yield while waiting for the market to stabilize. This unique capability not only enhances market depth but also encourages institutional players to enter the crypto ecosystem. The interplay between stablecoins and traditional currencies is projected to define the next phase of crypto market evolution, particularly as they gain regulatory recognition.

Blockchain Technology: Key to Future Market Resilience

Blockchain technology represents the backbone of the cryptocurrency ecosystem, providing transparency, security, and decentralization. Despite current market anxieties, the rapid advancement of blockchain applications indicates a promising future. As Matt Hougan points out, developments such as tokenization of real-world assets and AI-driven financial solutions are paving the way for broader adoption. This integration not only showcases the practical utility of blockchain technology but also reassures investors about the underlying health of the crypto market.

Moreover, the convergence of blockchain with other technological innovations, particularly artificial intelligence, is set to revolutionize the financial landscape. AI technologies in crypto can streamline operations, enhance security measures, and provide data-driven insights for better decision-making. As these technologies mature, they are likely to attract more institutional investments, further boosting market confidence. Consequently, blockchain technology remains a pivotal factor driving the crypto market towards recovery, even in the face of current challenges.

Market Sentiment and Its Impact on Cryptocurrency Prices

Market sentiment is a powerful motivator in the cryptocurrency space, influencing investor behavior and, consequently, price movements. Understanding the emotional state of market participants—ranging from fear to euphoria—can provide essential insights into potential market bottoms. According to research, extreme anxiety signals that investors may be reaching a tipping point, historically leading to opportunistic buying. This psychological aspect remains critical, as it reflects the broader dynamics of supply and demand within the crypto market.

In times of distress, like those currently seen in the crypto market, traders often respond by liquidating positions, which can exacerbate price declines. However, as sentiments shift and confidence begins to recover, it can form a foundation for renewed investor interest. Observing key indicators of market sentiment, such as trading volume and social media sentiment analysis, can help investors navigate these cycles. Fostering a risk appetite through improving market sentiment could be the turning point needed for a bullish reversal.

Anticipating Regulatory Changes in the Crypto Space

One of the significant catalysts for a potential crypto market recovery could be upcoming regulatory changes. For instance, legislation such as the CLARITY Act aims to provide regulatory clarity surrounding cryptocurrencies and digital assets, fostering an environment conducive to growth. By addressing the current legal ambiguities, governments can enhance investor confidence, facilitating an influx of capital from both retail and institutional investors. This regulatory equilibrium is crucial for long-term stability in the crypto market.

Moreover, as regulations evolve, they could contribute to the development of a more structured framework for stablecoins and other digital assets. This would not only protect investors but also encourage innovation within the space. Regulatory clarity is expected to facilitate the integration of more advanced investment strategies and tools into the crypto ecosystem, aligning them with existing financial markets. Ultimately, sensible regulations may not only set the stage for recovery but also position the crypto market as a legitimate player in the global financial landscape.

The Influence of Interest Rate Cuts on Crypto Investments

Interest rates significantly influence the investment landscape, including cryptocurrencies. As central banks consider interest rate cuts to stimulate economic growth, asset classes like cryptocurrencies often become more appealing due to their potential for higher returns. Lower interest rates can lead to increased borrowing and consumer spending, ultimately impacting demand for digital assets. This macroeconomic environment can create favorable conditions for crypto prices to rebound, particularly for long-term investors.

Additionally, as investors seek alternatives to traditional savings accounts that offer minimal returns, cryptocurrencies provide an attractive option for portfolio diversification. The introduction of financial instruments linked to crypto assets, coupled with decreasing interest rates, can further enhance their appeal. Thus, interest rate trends and monetary policies will continue to be critical factors in shaping the future of cryptocurrency investments and could catalyze recovery in the face of current market anxieties.

AI’s Integration into the Cryptocurrency Ecosystem

The integration of artificial intelligence (AI) into the cryptocurrency ecosystem offers exciting possibilities for improving market dynamics. AI can assist in analyzing vast amounts of data, providing real-time insights into market trends and investor behavior. For instance, algorithmic trading powered by AI can optimize trading strategies, making them more efficient and potentially more profitable, even during downturns. This advancement aligns with the growing interest in blending cutting-edge technologies with finance, enhancing the overall appeal of cryptocurrencies.

Moreover, AI’s predictive capabilities can play a pivotal role in anticipating market movements and identifying profitable opportunities. As the cryptocurrency market evolves and becomes more data-driven, the incorporation of AI technology will likely attract additional investors seeking to leverage sophisticated tools for better decision-making. This synergy between AI and blockchain technology not only showcases the innovative aspects of the crypto market but also strengthens its fundamental viability as an investment class.

Future Trends in the Cryptocurrency Market

As the cryptocurrency market continues to mature, several trends are likely to shape its future trajectory. For instance, the rise of decentralized finance (DeFi) applications is expected to redefine traditional financial transactions, empowering users through greater autonomy and reduced reliance on intermediaries. This transition signifies a broader shift toward digital economies, which may further bolster the demand for cryptocurrencies and stablecoins. Industry leaders like Bitwise view this trend as a catalyst for the market’s potential recovery.

Additionally, upcoming innovations at the convergence of AI, blockchain technology, and fintech are set to redefine investment strategies within the crypto market. Predictive analytics could guide strategic decisions, while automated trading systems enhance market engagement. As these trends unfold, they are likely to attract a more diverse range of investors, ranging from retail to institutional players. The integration of emerging technologies will play a paramount role in fortifying the foundation of the crypto market, ensuring resilience against future economic fluctuations.

Frequently Asked Questions

What does the term ‘crypto market bottom’ mean in the context of crypto market analysis?

The ‘crypto market bottom’ refers to the lowest price point that cryptocurrencies reach during a market downturn. It signals a potential reversal point where prices start to rise again. In crypto market analysis, recognizing this bottom helps investors identify optimal buying opportunities, similar to historical trends seen in 2018 and 2022.

How can I identify a potential crypto market bottom using investment strategies?

Identifying a potential crypto market bottom involves analyzing market sentiment, price trends, and fundamental developments. Investment strategies may include monitoring the Fear & Greed Index, using technical analysis tools, and keeping an eye on market catalysts like regulations, advancements in blockchain technology, or the rise of stablecoins that can stabilize prices.

What role do stablecoins play in establishing a crypto market bottom?

Stablecoins can significantly influence the crypto market bottom by providing a stable value amidst volatility. They serve as a safe haven for investors during downturns, allowing them to exit more volatile assets and re-enter at a more favorable price when the market shows signs of recovery. As adoption increases, stablecoins can help stabilize the entire crypto ecosystem.

How does blockchain technology impact the prediction of a crypto market bottom?

Blockchain technology impacts the prediction of a crypto market bottom by enabling more transparent and efficient market transactions. It allows for better tracking of market trends and investor behavior, which can signal when the market is bottoming out. Additionally, ongoing innovations within the blockchain space can drive renewed investor interest and activity, aiding in recovery.

Is AI in crypto helping to predict market bottoms more accurately?

Yes, AI in crypto is enhancing the accuracy of predicting market bottoms by analyzing vast amounts of data to identify trends and patterns that may not be evident through traditional analysis. AI algorithms can evaluate sentiment, transaction volumes, and external factors, providing insights that help investors make informed decisions about when to enter the market as it approaches a bottom.

What indicators should I watch for to know the crypto market is near a bottom?

Indicators to watch for when assessing if the crypto market is near a bottom include increased trading volume in stablecoins, rising interest rates in the broader economic landscape, significant drops in market sentiment leading to excessive pessimism, and major technological advancements in blockchain technology or AI that may reinvigorate the market.

What catalysts could signal a recovery from the crypto market bottom?

Catalysts signaling recovery from a crypto market bottom may include legislative changes like the passage of the CLARITY Act, improvements in market sentiment towards risk appetite, speculation regarding interest rate cuts, and critical technological breakthroughs that enhance the integration of AI in the crypto space, leading to renewed investor confidence.