Crypto lending is revolutionizing the way individuals and businesses approach borrowing and lending in the ever-evolving landscape of decentralized finance (DeFi). This innovative model allows users to leverage their digital assets, such as Bitcoin and stablecoins, to unlock liquidity without selling their holdings. The recent launch of World Liberty Financial’s crypto lending platform, centered around its USD1 stablecoin, exemplifies the resurgence of on-chain credit amid favorable regulatory clarity. As the market for cryptocurrency borrowing gains traction, users are increasingly drawn to the benefits of stablecoin lending and the diverse options for collateralization. With a robust infrastructure and improved transparency, crypto lending is poised to reshape the financial ecosystem by offering greater accessibility and flexibility in managing digital assets.

Crypto lending, often referred to as digital asset borrowing and lending, harnesses the power of blockchain technology to create a seamless, decentralized marketplace for financial transactions. This emerging trend within decentralized finance enables individuals to utilize their cryptocurrencies as collateral, effectively deriving loans or earning interest without needing to liquidate their holdings. Recent developments, such as the introduction of innovative platforms that focus on stablecoin lending, highlight a growing interest in on-chain credit solutions. The rise of alternative lending options reflects a shift towards more transparent and accessible financial tools, catering to the needs of modern investors who seek to maximize their asset utility. With the increasing integration of digital currencies into mainstream finance, the importance of cryptocurrency lending continues to gain momentum.

Understanding Crypto Lending and Its Importance

Crypto lending is an innovative solution within the decentralized finance (DeFi) sector, enabling users to leverage their digital assets to gain access to liquidity without having to liquidate their holdings. This approach allows individuals to earn interest on their idle cryptocurrencies while also providing opportunities for others to borrow against their digital assets. With the launch of platforms like World Liberty Markets, participants can engage in seamless transactions, borrowing and lending assets backed by stablecoins such as USD1, which is poised to enhance trust and usability in the crypto market.

The significance of crypto lending extends beyond simple transactional efficiency; it represents a shift towards a more inclusive financial ecosystem. Traditional banking systems often require extensive paperwork and credit checks, but crypto lending circumvents these barriers, allowing users to gain access to credit based on their asset holdings. This revolutionary method reflects a broader trend towards democratizing finance, where decentralized models empower users to take control over their financial future, utilizing on-chain credit to fulfill their diverse needs.

Frequently Asked Questions

What is crypto lending and how does it work within decentralized finance?

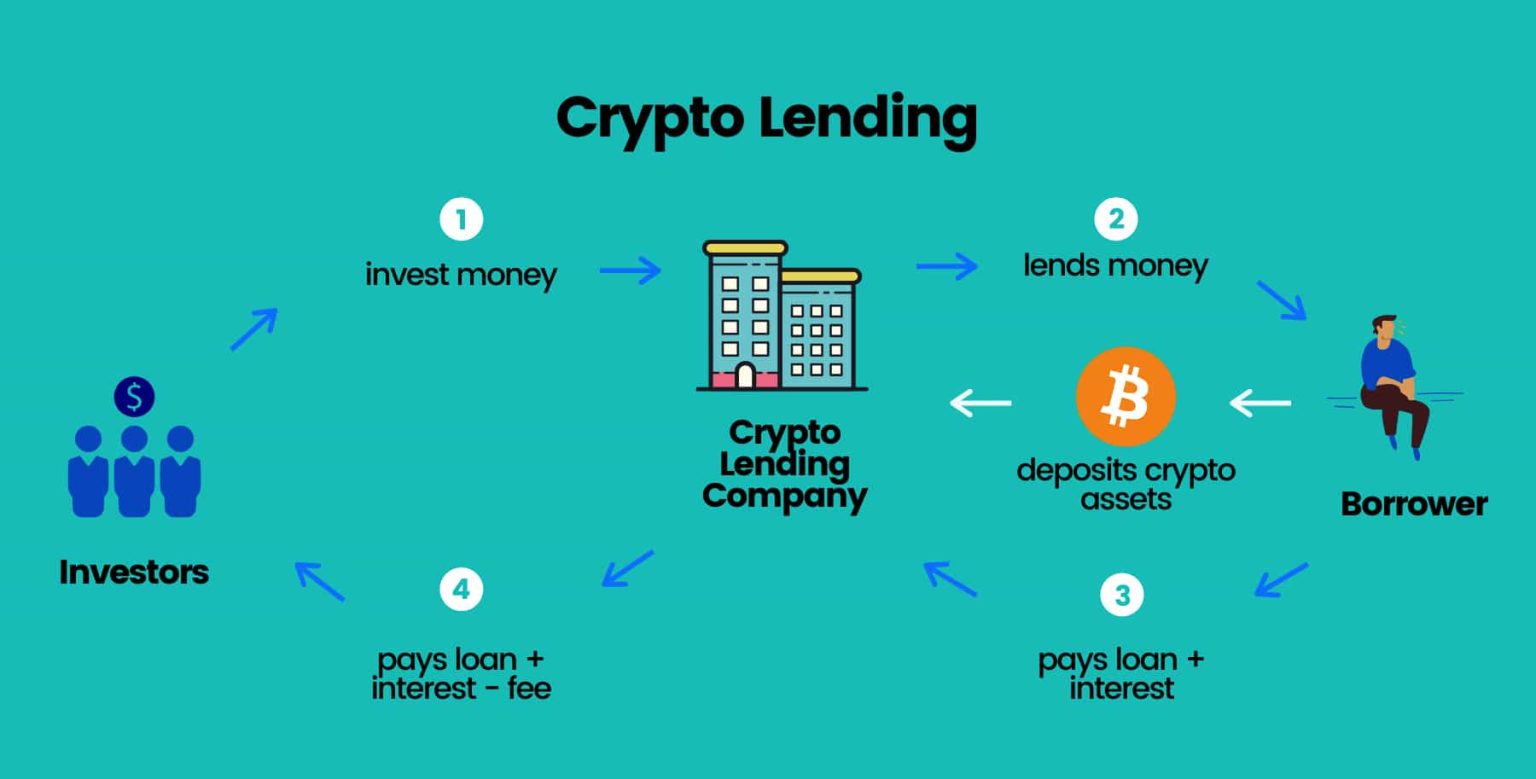

Crypto lending refers to the process of lending cryptocurrencies or digital assets to earn interest or to borrow against collateral. Within decentralized finance (DeFi), this process operates on blockchain technology, allowing users to transact directly without intermediaries. Borrowers provide cryptocurrency as collateral, and lenders earn interest on their lent assets, enhancing liquidity and value in the crypto ecosystem.

How does the new World Liberty Financial crypto lending platform operate?

World Liberty Financial’s crypto lending platform, named World Liberty Markets, enables users to borrow and lend using the USD1 stablecoin as collateral. The platform allows for lending and borrowing of various digital assets, including Bitcoin and Ether, while operating in a decentralized manner. The initiative aims to foster a resilient marketplace amidst the evolving regulatory landscape surrounding on-chain credit.

What role do stablecoins play in crypto lending?

Stablecoins, like World Liberty’s USD1, play a crucial role in crypto lending by providing a stable medium of exchange that mitigates volatility. They are often used as collateral in lending transactions, enabling users to lock in value while accessing liquidity without selling their core digital assets. This enhances the user experience in decentralized finance, particularly in lending and borrowing scenarios.

What are the risks and rewards of crypto lending?

The primary reward of crypto lending includes earning interest on idle digital assets, providing liquidity for borrowers. However, risks may include market volatility affecting collateral value, potential platform vulnerabilities, and insolvency risks of lenders. Understanding these factors is crucial for users engaging in crypto lending, particularly within decentralized finance where transparency and risk management are pivotal.

Can you explain on-chain credit in the context of cryptocurrency borrowing?

On-chain credit refers to the credit extended within decentralized finance platforms, where loans are secured through smart contracts on the blockchain. This process allows for real-time evaluation of collateral, hence enabling immediate lending and borrowing activities. Users can leverage their digital assets for liquidity while maintaining ownership, thereby fostering a more inclusive financial ecosystem.

What are the benefits of using decentralized finance for crypto lending?

Decentralized finance (DeFi) offers several benefits for crypto lending, including reduced reliance on traditional banks, transparency through blockchain technology, and access to global markets. DeFi platforms typically provide lower fees and faster transaction times, while also enabling users to retain control over their assets, making crypto lending more accessible and efficient.

How is regulatory clarity improving crypto lending opportunities?

Improved regulatory clarity is fostering confidence in crypto lending by setting frameworks that protect users and ensure the integrity of financial transactions. As regulations evolve, platforms like World Liberty Financial can innovate with stablecoins and lending solutions without the undue fear of legal repercussions, therefore stimulating growth in on-chain credit and decentralized finance markets.

What are some common types of collateral used in crypto lending?

Common types of collateral in crypto lending include cryptocurrencies like Ether (ETH), tokenized versions of Bitcoin (BTC), and stablecoins such as USD Coin (USDC) and Tether (USDT). As platforms evolve, additional collateral options like tokenized real-world assets (RWAs) may also become available, expanding the lending landscape within decentralized finance.

Why is demand for crypto lending rising in the current financial climate?

Demand for crypto lending is on the rise due to increasing investor interest in unlocking liquidity from digital assets without selling them, especially in a dynamic market. Enhanced regulatory clarity and the maturation of decentralized finance platforms further allow users to engage safely and securely in lending and borrowing activities, marking a resurgence in on-chain credit utilization.

What impacts have previous failures in crypto lending had on the market?

Past failures in crypto lending, such as the collapses of BlockFi and Celsius, have revealed issues related to centralized business models and lack of transparency. These events have led to a stronger focus on decentralized models that provide better risk management and regulatory oversight, prompting a shift towards on-chain credit solutions that aim to prevent similar pitfalls in the future.

| Key Points |

|---|

| World Liberty Financial launches crypto lending platform with USD1 stablecoin backing. |

| The platform, called World Liberty Markets, includes borrowing and lending of digital assets. |

| Initial collateral options include Ether (ETH), Bitcoin (BTC), USD Coin (USDC), and Tether (USDT). |

| Future plans involve expanding collateral options to tokenized real-world assets (RWAs). |

| Market capitalization of USD1 stablecoin reaches $3.4 billion, indicating significant growth. |

| The demand for crypto lending is rising as investors seek liquidity without selling assets. |

| Regulatory clarity is improving, contributing to the resurgence in on-chain lending activities. |

| Failures of centralized lending models in the past highlight the importance of transparency and risk management. |

| Decentralized finance (DeFi) platforms like Nexo and Babylon are showing increased activity in crypto lending. |

Summary

Crypto lending is witnessing a significant revival, driven by the launch of platforms like World Liberty Markets. As the demand for effective and transparent borrowing and lending solutions increases, the industry is poised for growth. With the backing of stablecoins and improvements in risk management, crypto lending stands to offer innovative ways for investors to unlock liquidity from their digital assets while navigating an evolving regulatory landscape.

Related: More from DeFi & Stablecoins | Aixovia Burns 90,357,968 AIXDROP Tokens On-Chain Proof | Arthur Hayes Liquidates DeFi Tokens: A $3.48 Million Loss You Should See