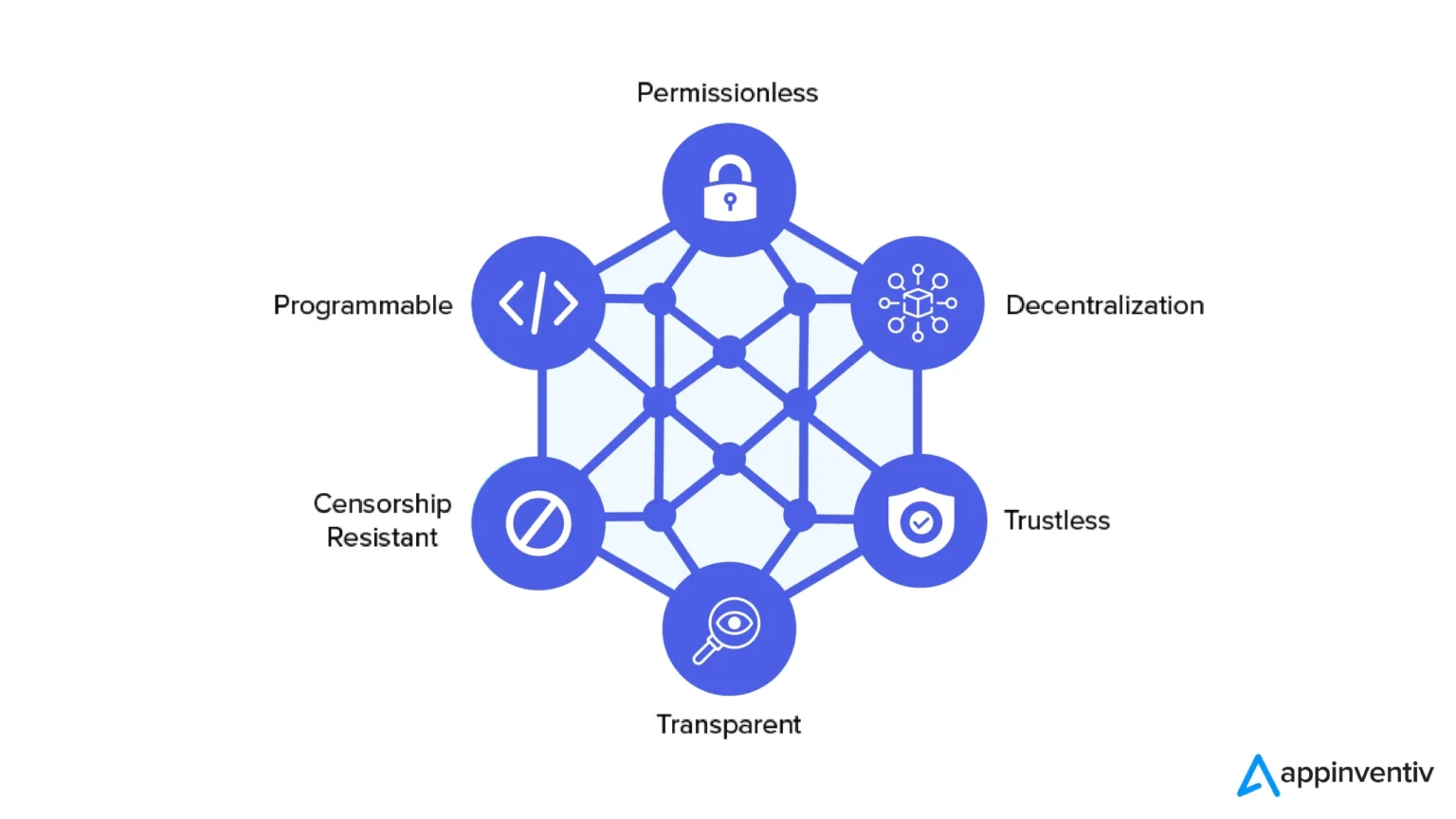

The concept of decentralized finance (DeFi) is becoming increasingly relevant for financial advisors navigating the evolving cryptocurrency space. DeFi refers to a financial system built on blockchain technology that operates without traditional intermediaries like banks. This innovative approach allows users to engage in various financial activities, such as lending, borrowing, and trading, directly through decentralized applications (dApps).

Key Takeaways

Advisors are exploring DeFi to understand its potential benefits and risks for their clients. The decentralized nature of DeFi can provide greater accessibility and transparency, enabling users to manage their assets without relying on centralized institutions. However, this also introduces unique challenges, including regulatory uncertainties and security risks associated with smart contracts.

As financial advisors consider incorporating DeFi into their practices, they must stay informed about the rapidly changing landscape. This includes understanding the various protocols and platforms available, as well as the implications of using digital assets in a decentralized environment. Advisors should also be aware of the importance of educating clients about the complexities and risks involved in DeFi investments.

In conclusion, DeFi represents a significant shift in the financial ecosystem, offering new opportunities and challenges for advisors and their clients. By gaining a comprehensive understanding of DeFi, advisors can better navigate this emerging sector and provide informed guidance to their clients.