Crypto.com CEO Demands Investigation Amidst $20 Billion in Exchange Liquidations

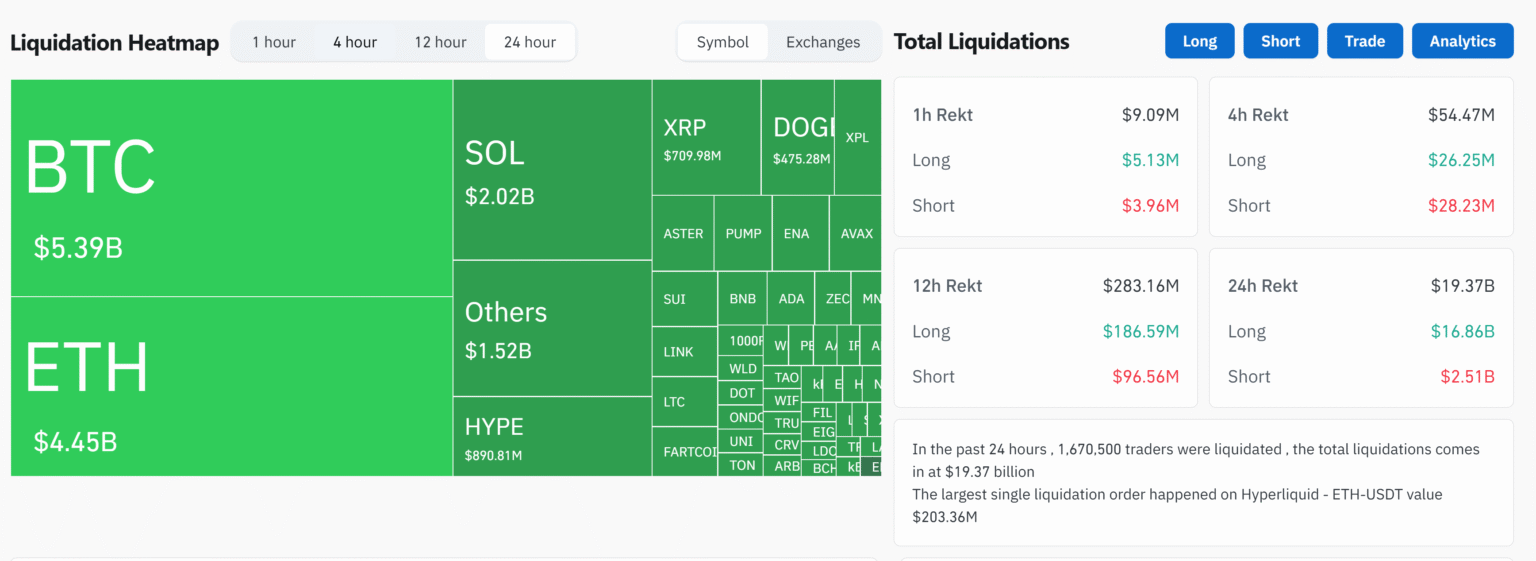

In recent weeks, the cryptocurrency market has faced significant turmoil, culminating in an unprecedented wave of exchange liquidations amounting to nearly $20 billion. This upheaval has led to calls for clarity and accountability within the industry, notably from Kris Marszalek, the CEO of Crypto.com, one of the leading cryptocurrency platforms globally. Amidst the chaos, Marszalek has publicly demanded a thorough investigation into the factors contributing to this massive liquidation event.

The Context of the Liquidation Crisis

Liquidations in the crypto market occur when leveraged positions are forcibly closed by exchanges due to insufficient collateral to cover margin calls. The recent downturn has been particularly brutal, with Bitcoin and other major cryptocurrencies plummeting in value, aggravating the situation and forcing traders—many of whom were over-leveraged—to succumb to significant losses.

Experts point to a combination of factors driving the market downturn: macroeconomic instability, rising interest rates, geopolitical tensions, and regulatory uncertainty have all weighed heavily on investor sentiment. However, Marszalek believes that a deeper investigation is needed to uncover potential manipulation or systemic failures that may have exacerbated the crisis.

A Call for Transparency

In his appeal for an investigation, Marszalek emphasizes the need for transparency within the cryptocurrency ecosystem. “The recent liquidations highlight vulnerabilities that could undermine trust in the broader market. It is essential that we investigate and understand the circumstances that led to these events, to ensure the protection of both retail and institutional investors,” he stated during a recent press conference.

Marszalek’s call has resonated with many in the crypto community, particularly as retail investors often face the brunt of market volatility. He urges regulators to collaborate with crypto exchanges and stakeholders to create a more robust framework that can withstand market shocks and prevent undue losses for investors.

The Role of Exchanges

As one of the prominent figures in the crypto exchange landscape, Crypto.com plays a crucial role in shaping the future of trading platforms. With the recent turmoil, the spotlight has turned toward exchanges and their risk management practices. Proper protocols, including margin requirements and liquidation policies, are essential for maintaining market stability.

Marszalek’s call for an investigation also implies a scrutiny of exchanges that may have inadvertently or deliberately leveraged the market conditions for their own gain. “Exchanges must operate with integrity and prioritize the interests of their users,” he commented.

The Need for Improved Regulation

The cryptocurrency industry has been plagued by a lack of uniform regulations, which has often led to confusion and exploitation. Marszalek’s request for an investigation aligns with broader calls for enhanced regulatory frameworks that can protect investors without stifling innovation.

Regulatory bodies worldwide are slowly beginning to respond to these concerns, with many countries drafting legislation aimed at bringing order to the crypto space. Marszalek believes accelerated efforts are needed, stating, “Swift and clear regulations can help prevent future crises and foster a more secure trading environment.”

Conclusion

As the dust begins to settle in the aftermath of the $20 billion liquidation crisis, the cryptocurrency community finds itself at a crossroads. Kris Marszalek’s vocal demand for an investigation highlights a growing recognition of the vulnerabilities that plague the market. It opens the door for necessary discussions about regulatory reforms, exchange practices, and market transparency.

The call for accountability reflects a growing sentiment among crypto advocates, users, and stakeholders who understand that the health of the industry hinges not merely on price valuations, but on the integrity of its operational foundations. As the cryptocurrency landscape continues to evolve, sustained efforts toward greater transparency and accountability will be critical in navigating future challenges and fostering a resilient market.