Could the Fed Reinitiate Quantitative Easing? Implications for Bitcoin

In the wake of economic turbulence, discussions around the Federal Reserve’s monetary policies have re-emerged, with particular focus on the potential reinitiation of Quantitative Easing (QE). This unconventional monetary tool involves the large-scale purchase of government securities or other financial assets to inject money into the economy to boost spending and lending. The necessity of such measures could become paramount as the U.S. economy faces challenges such as inflationary pressures, geopolitical instabilities, or recessionary threats. An understanding of these dynamics is crucial for investors and policymakers alike, especially considering the implications for emerging asset classes like Bitcoin.

Historical Context and the Role of QE

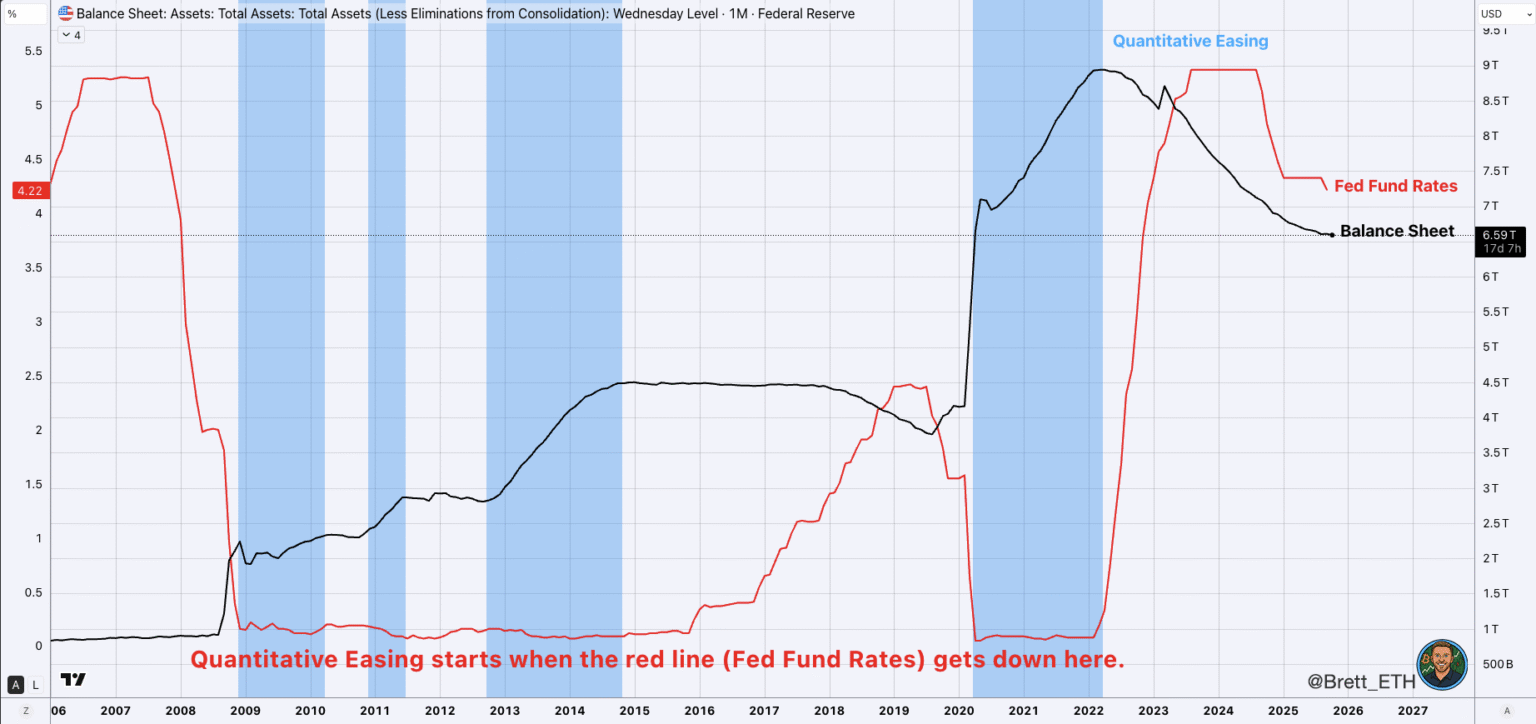

Quantitative Easing was prominently used during the 2008 financial crisis and the subsequent years to stabilize and stimulate the economy. By increasing the money supply and lowering interest rates, QE aims to encourage borrowing and investing. However, such measures also typically reduce the yield on bonds, pushing investors towards higher-risk assets, including stocks and increasingly, cryptocurrencies like Bitcoin.

Reinitiating QE: A Double-Edged Sword?

The reimplementation of QE in today’s economic landscape could be perceived as a necessary intervention or a sign of lingering economic weakness. On the one hand, flooding the market with liquidity could help ameliorate short-term financial strains by ensuring ample capital availability. On the other hand, it could exacerbate existing concerns about inflation, especially given the post-pandemic recovery phase, during which inflation rates have surged globally.

Implications for Bitcoin

Bitcoin, often touted as ‘digital gold’, is viewed by many of its proponents as a hedge against inflation. Its capped supply contrasts with fiat currencies, which can be issued indefinitely. Here lies the crux of Bitcoin’s potential reaction to a reinitiated QE:

-

Inflation Hedge Narrative Strengthens: If QE leads to higher inflation, Bitcoin could increasingly be seen as a safeguard against diminishing fiat currency value. The narrative of Bitcoin as an inflation hedge could attract both retail and institutional investors, potentially driving up its price.

-

Increased Investment Flows into Cryptocurrencies: Lower bond yields and an environment of abundant liquidity could push investors to seek alternative assets offering higher returns. Cryptocurrencies could benefit as a result, given their historical (albeit volatile) performance.

- Volatility and Regulatory Scrutiny: As Bitcoin and related assets may benefit from QE, their increased relevance and visibility could lead to heightened volatility and regulatory scrutiny. The dynamic interaction between expanding markets and regulatory frameworks will be critical to watch.

Global Economic Impacts

The effects of U.S. monetary policy are not confined domestically but ripple across the global economy. International markets and central banks often react to the Fed’s decisions, which could align more economies with similar policies, potentially creating a synchronized wave of inflation or asset price inflation.

Possible Constraints and Considerations

It’s important to note potential constraints in reapplying QE. With already low-interest rates and significant public debt levels, the efficacy and prudence of further QE are under debate. The long-term implications, such as asset bubbles and the undermining of fiat currencies, could pose significant risks.

Conclusion

As the Federal Reserve contemplates the reinitiation of QE in response to economic pressures, the implications for Bitcoin and the broader cryptocurrency market are significant. Investors and policymakers must navigate these complexities, balancing short-term economic benefits against long-term financial stability. For Bitcoin, much will depend on broader economic trends, investor sentiment, and regulatory developments. As with all investments, the mixture of opportunity and risk remains at the forefront of this evolving narrative.