Coinbase wallet consolidation has become a hot topic among crypto enthusiasts and analysts. Recent comments from CryptoQuant’s CEO, Ki Young Ju, highlight significant concerns regarding Coinbase’s practices in this area. He argues that the consolidation often occurs under the pretense of enhancing privacy, which ultimately complicates financial transparency. The blending of the AOP (Account Balance) from both exchange and custodial accounts obscures the actual reserves, raising questions about Coinbase reserves accuracy. As investors monitor Bitcoin inflows and outflows, such consolidation can hinder essential crypto wallet analysis, impacting users’ understanding of their financial standing.

The discussion surrounding Coinbase’s management of its wallets has raised important questions about user privacy and transaction transparency. Known for its significant presence in the crypto market, Coinbase has faced scrutiny regarding its practices of merging different types of account balances. This has created a challenging environment for those engaged in cryptocurrency analysis, as it blurs the lines between exchange reserves and custodial holdings. Additionally, observers like CryptoQuant stress the importance of accurate reporting on Bitcoin movements, as it directly impacts the perceived stability and trustworthiness of various wallets. As the crypto community seeks reliable insights, the implications of these consolidation practices become ever more critical.

| Key Points | Details |

|---|---|

| Dissatisfaction with Coinbase | CryptoQuant’s CEO Ki Young Ju criticized Coinbase’s wallet consolidation practices on X. |

| Privacy Concerns | Coinbase disrupts wallets on the pretext of enhancing user privacy. |

| Mixing of Account Balances | The AOP published by Coinbase conflates exchange and custodial account balances. |

| Impact on Data Analysis | This mixing hinders accurate on-chain data analysis related to exchange reserves. |

| CryptoQuant’s Adjustments | CryptoQuant has adapted its clustering logic to monitor Bitcoin flows effectively. |

| Accuracy of Wallet Tracking | Their platform only marks wallets definitively linked to Coinbase to avoid errors. |

| Reserve Misrepresentation | Some platforms might report higher reserves, but this doesn’t guarantee accuracy. |

Summary

Coinbase wallet consolidation is a topic of significant concern among crypto analysts, particularly expressed by CryptoQuant’s CEO. The issues surrounding the mixing of custodial and exchange balances have led to challenges in data analysis and transparency. By addressing these practices, improving clarity in wallet tracking, and ensuring accurate reporting, Coinbase could enhance trust and utility for its users.

Coinbase Wallet Consolidation and Its Implications

The recent comments from CryptoQuant’s CEO, Ki Young Ju, highlight significant issues surrounding Coinbase’s wallet consolidation practices. By frequently reorganizing wallets, Coinbase aims to enhance users’ privacy; however, this strategy has raised concerns among crypto analysts. The consolidation process obscures the clarity needed for accurate crypto wallet analysis, making it increasingly difficult for stakeholders to trace and evaluate movements within the blockchain. Investors and analysts rely on this transparency to assess the underlying health of cryptocurrency networks, and any significant disruption can have downstream effects on market confidence.

Furthermore, the practice of consolidating wallets raises questions about the integrity of exchange data. The transparency surrounding assets held in custodial accounts versus those in exchange wallets is crucial for understanding a platform’s reserve and liquidity position. As users seek reliable information about their investments, Coinbase’s approach to wallet consolidation can inadvertently create confusion. Analytical tools must evolve to adapt to these changes, ensuring users can still glean insights from on-chain data without being misled by potential discrepancies in reported balances.

Frequently Asked Questions

What are the implications of Coinbase wallet consolidation on privacy concerns?

Coinbase wallet consolidation has raised several privacy concerns, as critics argue that the practice often disrupts user wallets under the pretext of enhancing privacy. By consolidating wallets, Coinbase may obscure the true ownership and movement of funds, making it challenging for users to track their Bitcoin inflows and outflows accurately.

How does Coinbase’s AOP account balance relate to wallet consolidation issues?

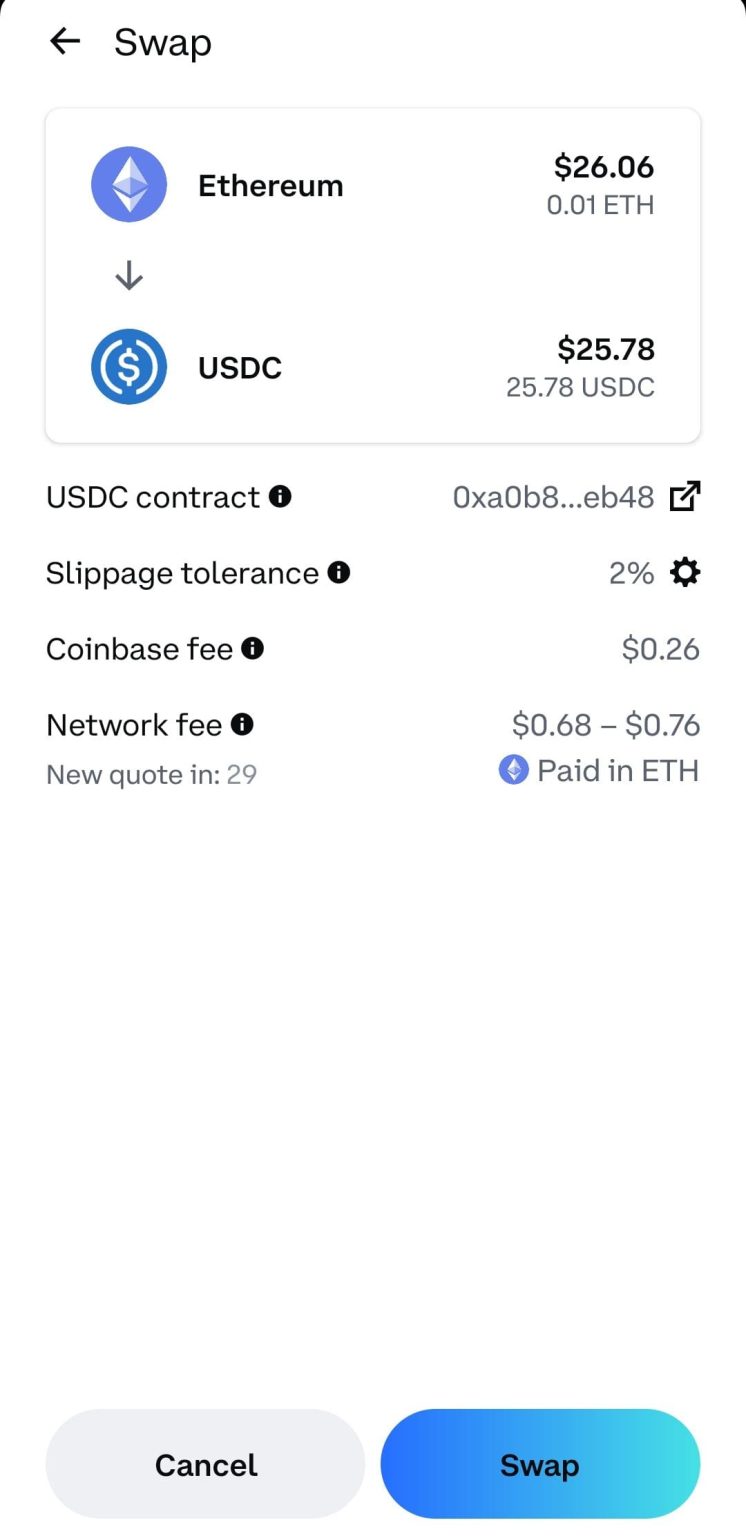

The AOP (Account Balance) published by Coinbase includes a mix of exchange and custodial account balances. This blending complicates user understanding regarding the actual reserves available for withdrawal, especially following wallet consolidation, as it obscures clear insights into Coinbase’s reserves accuracy and the health of user assets.

What role does crypto wallet analysis play in understanding Coinbase wallet consolidation?

Crypto wallet analysis is crucial in understanding Coinbase wallet consolidation as it helps users decode the mixing of account balances. By analyzing wallet activity, users can distinguish between actual Bitcoin reserves and those held in custodial accounts, providing better clarity on their holdings amidst consolidation practices from Coinbase.

How can Bitcoin inflows and outflows be affected by Coinbase wallet consolidation?

Coinbase wallet consolidation can significantly impact Bitcoin inflows and outflows by complicating the visibility of actual transaction volumes. Following the consolidation, users may find it harder to analyze their Bitcoin activity accurately, which complicates tracking trading behaviors and potentially impacts the perceived liquidity in the market.

What steps can be taken to ensure accurate monitoring of Coinbase reserves after wallet consolidation?

To ensure accurate monitoring of Coinbase reserves post-wallet consolidation, users should utilize crypto wallet analysis tools that can distinguish between Coinbase’s exchange and custodial balances. Following updates in tracking methodologies, as in the case with CryptoQuant’s adjustment of clustering logic, can also aid users in tracking real-time Bitcoin movements more accurately.