The recent Coinbase stock sell-off has caught the attention of investors and analysts alike as ARK Invest, led by the renowned Cathie Wood, divested approximately $17.4 million in Coinbase shares. This marked a significant shift in strategy, especially as Coinbase shares decline by 37% year-to-date amidst a broader crypto market pullback. ARK’s decision to sell off a large amount of its Coinbase holdings while simultaneously investing in Bullish shares indicates a tactical reevaluation of their portfolio in response to current market conditions. As the cryptocurrency landscape continues to face turbulence, this move raises questions about the future trajectory of Coinbase and the crypto sector at large. Investors are now closely monitoring ARK Invest’s next steps amidst these changes and the impact it may have on the price movements of both Coinbase and the overall crypto market.

In light of recent trading developments, the divestment of Coinbase assets by ARK Invest has raised eyebrows within the financial community. This portfolio adjustment, displayed through a substantial sell-off of Coinbase stock, coincides with a noticeable downturn in market prices, prompting discussions about the viability of cryptocurrencies in the current climate. As Cathie Wood shifts her focus from traditional crypto investments to alternative platforms like Bullish, industry watchers are curious about the implications for both retail and institutional investors. The ongoing decline in Coinbase shares highlights broader trends affecting digital asset exchanges, as fluctuating investor sentiment continues to dictate market behavior. Observers are keen to analyze these strategic moves as they reflect the evolving landscape of cryptocurrency investments.

| Key Points |

|---|

| ARK Invest sold $17.4 million worth of Coinbase stock as shares fell by 37% year-to-date. |

| The selling included 119,236 shares of Coinbase (COIN), marking ARK’s first sale of Coinbase for 2026. |

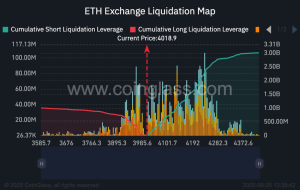

| Coinbase shares experienced a 13% drop, reaching multi-month lows during the trading session. |

| Simultaneously, ARK purchased $17.8 million worth of shares in Bullish (BLSH), indicating a strategic shift. |

| The cryptocurrency market, particularly Bitcoin, has faced significant pullbacks, influencing ARK’s trading strategy. |

| Despite the recent sale, ARK continues to hold $312 million in Coinbase stock across its funds. |

Summary

The Coinbase stock sell-off by ARK Invest highlights a crucial shift in investment strategy as the asset management firm moves away from cryptocurrency investments amid a declining crypto market. This decision, alongside ARK’s significant purchase of Bullish shares, emphasizes the challenges facing Coinbase and reflects the volatility of digital assets.

Cathie Wood’s Strategic Shift: The Coinbase Stock Sell-Off

Cathie Wood, the influential CEO of ARK Invest, has recently made headlines with her decision to sell off $17.4 million worth of Coinbase stock amid a significant market downturn. This strategic shift comes as Coinbase shares have plummeted by 37% year-to-date, reflecting broader challenges in the cryptocurrency market. The sell-off marks a key moment for ARK, traditionally known for its bullish stance on tech stocks, particularly those associated with Bitcoin and the wider digital asset ecosystem.

Keen market observers note that this decision aligns with ARK’s evolving investment strategy, especially as the crypto market faces increasing volatility. The rapid sale of 119,236 shares shows a tactical response not only to the declining performance of Coinbase but also highlights potential shifts towards more promising investments. In this context, ARK’s actions can be seen as a necessary pivot to safeguard investor interests during turbulent times in the crypto landscape.

Coinbase Shares Decline: Analyzing Market Trends

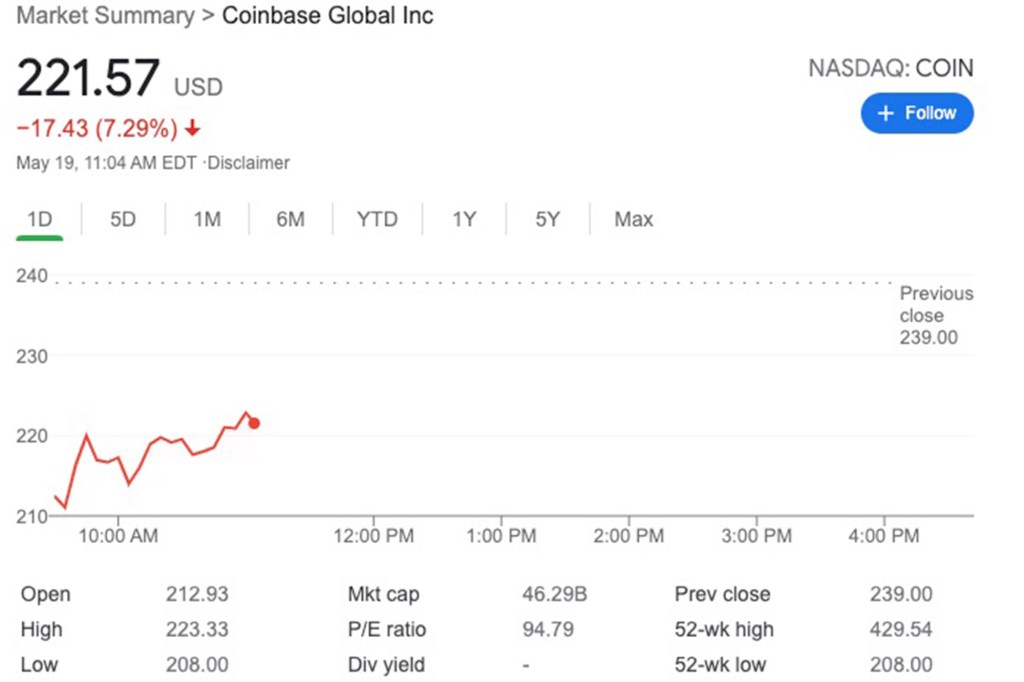

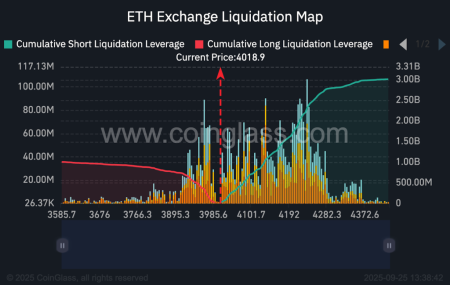

The decline of Coinbase shares resonates strongly with recent crypto market pullbacks, raising questions about investor sentiment and future performance. As Bitcoin’s price fluctuates dramatically, even dipping below $70,000 before temporarily touching $60,000, Coinbase’s entrenched position as a leading exchange appears to be under threat. With ARK’s recent sale, there is a prevailing sense that institutional investors are recalibrating their portfolios in response to these market conditions, suggesting a need to reassess long-term strategies regarding cryptocurrency investments.

Additionally, the fallout from ARK’s abrupt decision to offload Coinbase stock may signal broader trends affecting the crypto market and investments in digital assets. Many investors, particularly those who had previously adopted a bullish outlook, may now reconsider their positions in light of these developments. The perpetual volatility seen in crypto assets underscores the importance of staying informed and adaptable in an ever-changing investment landscape.

The Move Towards Bullish Shares: ARK’s New Direction

In a stark contrast to its Coinbase sell-off, ARK Invest diverted its funds to purchase $17.8 million in Bullish shares, a digital asset platform listed on the New York Stock Exchange. This move illustrates Cathie Wood’s continued belief in emerging opportunities within the crypto space. As the broader market grapples with uncertainty, this investment potentially positions ARK to capitalize on the next wave of digital asset innovation and fosters a narrative of resilience amidst market chaos.

Bullish’s performance, particularly its IPO, has faced trials as the shares have declined significantly, but ARK’s investment reflects a conviction that the future holds potential corrections and rebounds. Investors are now left pondering whether ARK’s shift from Coinbase to Bullish signifies an overarching trend in the asset management strategy towards companies regarded as capable of navigating the crypto market’s pitfalls effectively.

Current State of ARK’s Cryptocurrency Holdings

As of now, ARK Invest retains a substantial holding of $312 million in Coinbase shares across its various funds after the recent sale. This sizable investment underscores the firm’s long-term faith in Coinbase’s potential, despite the current adversity facing the company and its stock. Continued support from major investors like ARK, even during price declines, can be seen as a vote of confidence for the exchange’s future prospects within the cryptocurrency ecosystem.

This position allows ARK to benefit from Coinbase’s fundamental business model and its established user base, despite the ongoing volatility affecting the crypto market. While the retracement in Coinbase stock may be disheartening for many, for investors like Cathie Wood, it represents an opportunity to reassess and pivot strategies that align with the future of digital assets, maintaining a position that still harbors significant potential.

Market Outlook: Implications for Cryptocurrency Investments

The overall outlook for cryptocurrency investments appears clouded by the recent performance of major players like Coinbase. The intertwined fates of companies in the crypto space and their stock values are influenced heavily by the prevailing sentiment in the market. Following the drastic changes in ARK’s investment portfolio, investors might question where the next big opportunity lies within the volatile crypto environment. This could signal a shift towards less traditional assets or new platforms that present innovative solutions.

As volatility continues to reshape the digital asset landscape, investors must navigate carefully, weighing both risks and opportunities. The interplay between established companies like Coinbase and nascent competitors, along with ARK’s approach to investing, will likely shape the future trajectories for many involved in crypto. Staying informed and adapting to new insights will be key for anyone looking to thrive in this challenging but potentially rewarding sector.

ARK Invest vs. Market Volatility: A Case Study

ARK Invest’s recent moves provide a compelling case study on how asset management firms adjust their strategies in response to market volatility. With the sharp decline in Coinbase shares, ARK’s decision to sell off a significant amount while simultaneously investing in Bullish illustrates a tactical maneuver aimed at reducing exposure to riskier assets potentially facing greater instability. This scenario emphasizes the delicate balance between maintaining long-term investments and adapting to dynamic market conditions.

This case underlines the importance of active management in investment strategies, particularly in sectors such as cryptocurrency that experience rapid fluctuations. Investors examining such patterns might gain valuable insights into how to protect their portfolios and identify growth potential, even amidst market corrections. Consequently, ARK’s strategy could serve as a blueprint for other investors grappling with similar dilemmas in the cryptocurrency domain.

Understanding Bitcoin’s Influence on Coinbase Stock

The intricate relationship between Bitcoin prices and Coinbase’s stock performance cannot be overlooked. As the predominant cryptocurrency, Bitcoin often dictates market trends, and its volatility can have a direct impact on exchanges like Coinbase. When Bitcoin’s value fluctuates, often seen through significant drops like the recent dip below $70,000, the repercussions on Coinbase shares are immediate and evident, reinforcing the need to watch Bitcoin’s movements closely.

This correlation suggests that Coinbase’s health is not only tied to its operational metrics but also to the larger sentiment and trends within the cryptocurrency market led by Bitcoin. Investors should thus consider Bitcoin dynamics when forming strategies related to Coinbase investments. A deeper understanding of this relationship can provide clarity and context around the pricing and performance of Coinbase shares, helping investors make informed decisions.

Cathie Wood’s Perspective: Long-Term vs. Short-Term Gains

Cathie Wood has long been viewed as a visionary in the tech and crypto spheres, advocating for a long-term investment paradigm that aligns with transformative technologies. Recent moves, such as the selling of Coinbase stock, reflect her strategic reassessment during challenging market conditions. By reallocating funds to Bullish, Wood suggests a belief in potential long-term growth over immediate gains, which can inspire both confidence and caution among investors.

This perspective challenges the panic-driven responses typically seen in markets under duress, advocating for a more calculated approach to investing in digital assets. Understanding her philosophy on balancing growth potential against current market dynamics can provide investors with guidance on how to approach their portfolios amid uncertainties, aligning with trends that exhibit lasting potential over transient volatility.

Investor Sentiment and the Future of Cryptocurrency Stocks

Investor sentiment plays a crucial role in shaping the future of cryptocurrency stocks, with both euphoria and anxiety affecting trading patterns. Current declines in prominent stocks like Coinbase showcase how quickly sentiment can shift, impacting investor decisions significantly. As word of ARK’s sell-off of Coinbase stock spreads throughout investment circles, other market participants might follow suit, further amplifying challenges that the stock faces amid broader market headwinds.

Conversely, positive sentiment towards emerging players like Bullish can uncover new opportunities and shift capital flows away from struggling assets. The psychological factors underlying investor behavior must be understood as they can determine the trajectory of stocks within the cryptocurrency space. Future market recoveries or declines will be deeply influenced by prevailing sentiments, signaling to investors the importance of careful monitoring and strategic asset allocation.

Frequently Asked Questions

What caused the Coinbase stock sell-off by ARK Invest?

The Coinbase stock sell-off by ARK Invest was driven by a sharp decline in the company’s shares, which fell 37% year-to-date due to a broader crypto market pullback. This shift is reflected in ARK’s decision to offload over $17 million in Coinbase shares.

How much Coinbase stock did ARK Invest sell during the recent market downturn?

ARK Invest sold 119,236 shares of Coinbase stock, valuing approximately $17.4 million, as part of their strategy shift amid the ongoing decline in Coinbase shares.

Did ARK Invest buy any stocks after selling Coinbase shares?

Yes, following the Coinbase stock sell-off, ARK Invest purchased $17.8 million worth of Bullish shares, indicating a strategic pivot as Coinbase and broader crypto market conditions deteriorate.

What is the current status of ARK Invest’s holdings in Coinbase?

Despite the recent Coinbase stock sell-off, ARK Invest continues to hold approximately $312 million in Coinbase shares across their funds, highlighting their long-term commitment despite short-term market fluctuations.

How has the overall crypto market pullback affected Coinbase stock?

The overall crypto market pullback, including Bitcoin dipping below $70,000, significantly impacted Coinbase stock, contributing to a roughly 37% decline year-to-date, which prompted ARK Invest’s recent sell-off.

What does Cathie Wood’s decision to sell Coinbase stock signal for investors?

Cathie Wood’s decision to sell Coinbase stock signals a notable shift in investment strategy amid a weakening crypto market, which may prompt investors to reevaluate their positions in Coinbase and similar stocks.

What has been the trend of Coinbase shares since their IPO?

Since its IPO in April 2021, Coinbase shares have seen a dramatic decline of about 60%, from an opening price of $381 to current lows, fueled by ongoing volatility in the cryptocurrency market.