Coinbase Disrupts Bitcoin Backed Lending With Low Bar for Servicing Americans

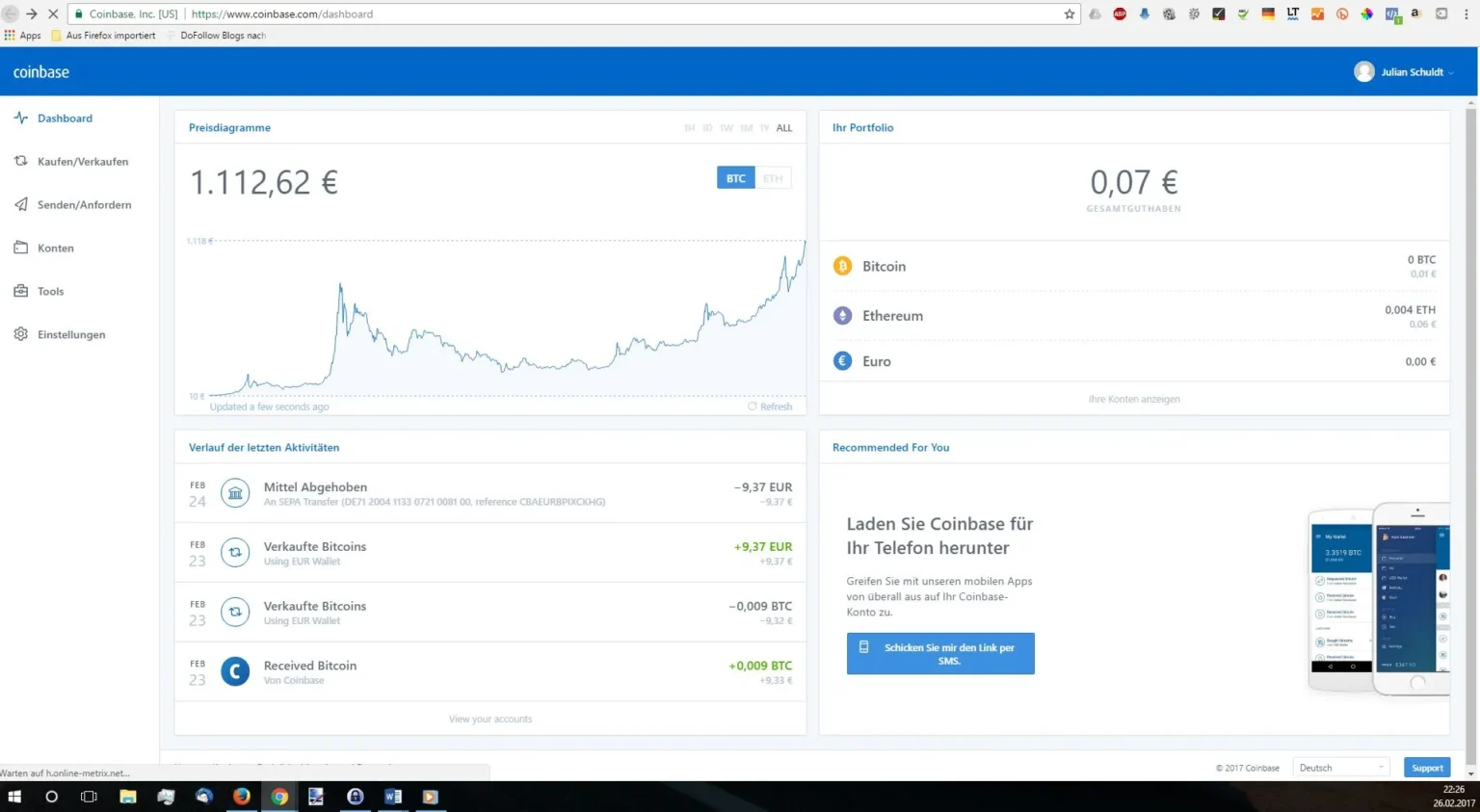

In a significant move that is set to redefine the Bitcoin lending landscape in the United States, Coinbase, a leading cryptocurrency exchange, recently launched a new service that allows American customers to obtain fiat loans by using Bitcoin as collateral. This innovative offering lowers the bar for entry for many American investors seeking liquidity without the need to liquidate their cryptocurrency assets.

Understanding the Concept of Bitcoin-Backed Lending

Bitcoin-backed lending isn’t a novel concept; several platforms globally allow users to leverage their cryptocurrency holdings to secure loans. Typically, these loans are overcollateralized, meaning the borrower must put up more in crypto value than the fiat currency they receive. This guards the lender against the volatile nature of cryptocurrencies. However, the entry of Coinbase into this space is particularly noteworthy because of its extensive user base and its conformity with American regulatory standards, which offers a significant layer of security and confidence for U.S.-based borrowers.

Coinbase’s Market Innovation

Coinbase’s new service essentially simplifies the process of borrowing against Bitcoin holdings. Borrowers can take out cash loans of up to 40% of their Bitcoin’s value, which as of the service announcement, means a user can borrow up to $1 million. The interest rates are competitive, especially compared to traditional personal loans, and the process does not involve a credit check, thereby broadening accessibility.

One of the key features of this service is its flexibility. Coinbase promises quick funding that can generally be processed within 2-3 days. Moreover, borrowers have the option to repay the loan at their convenience during the term with a relatively lower interest rate, which is a game-changer for those in need of short-term loans.

The Significance for American Investors

The introduction of Bitcoin-backed loans by Coinbase serves multiple purposes. Firstly, it provides liquidity to the cryptocurrency holders without forcing them to sell their assets, which they might foresee as more valuable in the future. This is particularly appealing in a bull market, where selling assets can lead to a significant opportunity loss.

Secondly, it opens up the benefits of investment in cryptocurrency to a broader audience, including those who might be hesitant to invest due to issues of liquidity and asset fluidity. By allowing investors to retain their crypto assets while still being able to access fiat currency, Coinbase is helping to stabilize the investment approach in digital currencies.

Regulatory Compliance and Security

Coinbase has made it clear that its lending service complies with the stringent regulations that govern financial services in the U.S. This compliance is crucial, not only for the protection of the investors but also in ensuring the longevity and legitimacy of cryptocurrency as a financial asset class. With robust security measures in place to protect stored Bitcoin, borrowers can have peace of mind knowing their collateral is safe.

Looking Forward

As the cryptocurrency market matures, the need for diverse financial products that cater to the needs of crypto holders is becoming evident. Coinbase’s entry into Bitcoin-backed lending is anticipated to trigger a trend among financial institutions in the U.S. to offer similar products, which will not only provide more options to crypto investors but also help in mainstreaming cryptocurrency use in everyday finance.

Coinbase’s move is a telling example of how traditional financial practices are evolving to incorporate the growing influence of cryptocurrencies. It reflects a shift in how financial services are conceptualized and delivered, potentially paving the way for more widespread acceptance and integration of digital currencies into the global economic system.