In an unexpected move, Coinbase has announced the suspension of perpetual contract trading starting February 20, 2026, affecting prominent tokens like EDGE and FLOW. This decision has left many traders and investors in the cryptocurrency sphere reassessing their strategies, as the trading halt could significantly impact liquidity and market dynamics for perpetual contracts. Specifically, perpetual contracts affected by this suspension will see all open positions automatically settled, raising concerns about potential volatility. As part of our ongoing cryptocurrency trading news coverage, this latest development underscores the evolving landscape of digital assets. Stay tuned for Coinbase trading updates to navigate the consequences of this impactful decision.

In light of recent changes, Coinbase’s suspension of perpetual contract trading marks a pivotal moment for digital asset enthusiasts. Starting on February 20, 2026, users will notice a significant stop in trading various contracts, including those tied to EDGE and FLOW tokens. This suspension will prompt an automatic settlement of all existing positions, creating a ripple effect across the cryptocurrency market. The forthcoming trading halt raises important questions about the implications for traders relying on perpetual contracts. As we delve into this topic, let’s explore the broader implications and alternative trading opportunities in the realm of cryptocurrencies.

| Key Point | Details |

|---|---|

| Announcement | Coinbase will suspend perpetual contract trading for several tokens. |

| Suspension Date | The suspension will begin around 13:00 UTC on February 20, 2026. |

| Tokens Affected | EDGE, FLOW, and other listed perpetual contracts. |

| Automatic Settlement | Open positions will be automatically settled at the time of the trading halt. |

| Final Settlement Price | Calculated based on the average index price from the last 60 minutes before the halt. |

| Funding Rate | Set to zero during the last funding period before the final settlement. |

| Complete List of Tokens | Includes 24 tokens like EDGE-PERP, FLOW-PERP, and many more mentioned. |

Summary

Coinbase perpetual contract trading suspension is an important announcement for traders using the platform. On February 20, 2026, around 13:00 UTC, Coinbase will halt trading on perpetual contracts for several tokens, including EDGE and FLOW, causing all remaining open positions to settle automatically. Traders should be aware that the final settlement price will depend on the average index price from the final moments before trading stops. With the funding rate set to zero prior to this suspension, users must prepare for these changes and stay informed through further updates.

Understanding Coinbase Perpetual Contract Trading Suspension

Coinbase has taken a significant step in its cryptocurrency trading operations by announcing the suspension of perpetual contract trading for several tokens. This decision, effective February 20, 2026, at 13:00 UTC, will notably affect various contracts, including the well-known EDGE and FLOW tokens. Traders should be aware that during this suspension, all open positions will automatically settle. The average index price from the hour before the suspension will dictate the final settlement price, ensuring that the trading experience remains transparent despite these changes.

The implications of this suspension extend beyond just individual traders; the market sentiment may also sway as speculations arise regarding the future trading opportunities for EDGE, FLOW, and other affected tokens. It’s essential for users to keep an eye on further updates from Coinbase to fully understand the ramifications of this halt in trading. The suspension of perpetual contracts signifies a shift in trading dynamics, making it critical for investors to stay informed about potential adjustments and strategies to navigate this changing landscape.

Impact of EDGE and FLOW Token Trading Halt

The halt in trading for EDGE and FLOW tokens can alter trading strategies for many crypto investors. As perpetual contracts allow investors to engage in derivatives trading without expiration dates, their suspension might lead to increased volatility in the tokens’ prices. Investors might need to reconsider their positions and assess their risk appetites as they navigate this disruption. With the funding rate set to zero during the last funding period, traders will likely need to watch the price movements closely to optimize their recovery or exit strategies.

Furthermore, the suspension of these contracts may prompt traders to shift their attention to other cryptocurrency opportunities, including alternate tokens that may not be under trading restrictions. Keeping abreast of such changes in trading options will be essential as the market evolves. Following cryptocurrency trading news will help investors stay alert regarding updates on the reopening of trading for affected contracts or any new opportunities that may arise during this period.

Coinbase Trading Updates: What to Expect

In light of the recent trading suspension, Coinbase is expected to provide ongoing updates to its users. With perpetual contract trading specifically impacted for tokens like EDGE and FLOW, users are encouraged to monitor any announcements that may provide more clarity about when trading may resume or what new features may be implemented to enhance the trading platform. Cryptocurrency exchanges often make significant updates to adapt to market conditions and user feedback.

As such, staying informed about Coinbase trading updates will empower traders to make informed decisions. Whether it’s understanding the management of existing trades during the suspension or exploring new trading strategies, these updates will play a pivotal role in maintaining a profitable trading experience. Adapting to changing market dynamics and seizing opportunities will be crucial in the crypto landscape, especially during periods of uncertainty such as this.

Why Perpetual Contracts Are Important for Traders

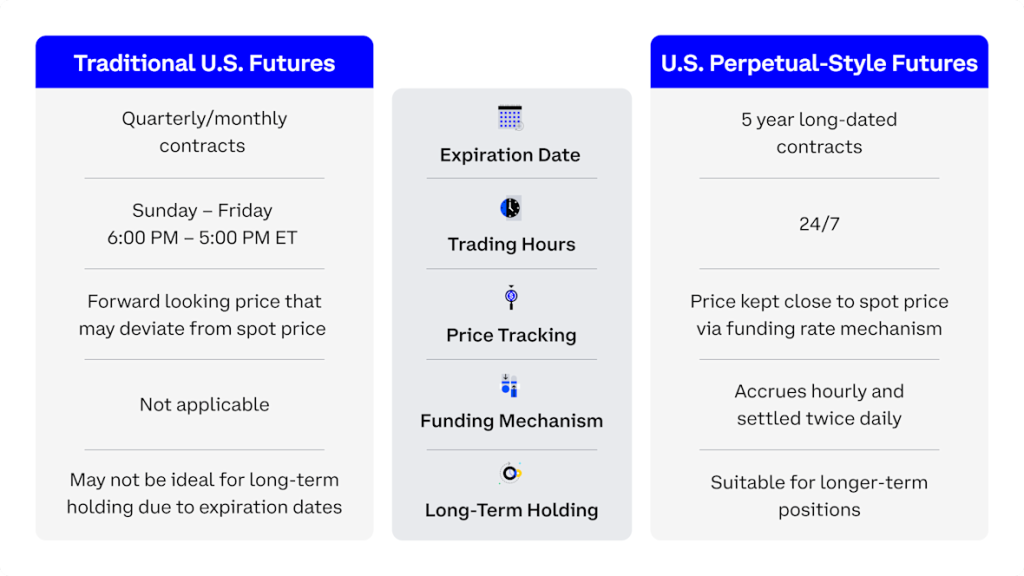

Perpetual contracts have become a cornerstone of cryptocurrency trading, providing investors with unique opportunities for leverage and flexibility. Unlike traditional futures contracts, they do not expire, allowing traders to hold positions indefinitely. This characteristic makes them appealing for both long-term investors and day traders alike. They offer a way to speculate on the future price movements of cryptocurrencies while managing risk through strategies like hedging.

In this context, the recent suspension of perpetual contracts for tokens including EDGE and FLOW underscores the importance of these trading instruments in the market. Traders relying on perpetual contracts will need to quickly adapt to the changes, seeking to understand how this suspension affects their portfolio strategies. By recognizing the significant role of perpetual contracts, traders can better navigate the potential challenges posed by the current trading halt.

Traders’ Reactions to the Coinbase Trading Suspension

The response from the trading community regarding the Coinbase perpetual contract trading suspension has been mixed. Some traders express concern over the impact this will have on their trading strategies, especially those who have leveraged positions in the affected tokens like EDGE and FLOW. Others, however, might view it as an opportunity to shift focus to different assets or to possibly rebalance their portfolios in light of the current market environment.

The discussions on cryptocurrency trading forums highlight the community’s desire for clearer communication from Coinbase regarding the reasons behind the suspension and the anticipated timeline for resuming trading. Traders expect timely updates to ensure they can adjust their strategies effectively, creating an environment where informed trading decisions can flourish amid uncertainty. Overall, community sentiment is a vital factor that exchanges must consider when implementing significant trading changes.

Market Sentiment and Trading Strategies

With the announcement of the Coinbase trading suspension, market sentiment has become a focal point of discussion among cryptocurrency investors. The unpredictability surrounding the trading halt for perpetual contracts has led to varied perspectives, with some investors fearing a downturn in token values, while others see it as a buying opportunity. Understanding the collective sentiment in the market can significantly influence individual trading strategies, as perceptions of risk and opportunity often dictate trading decisions during volatile periods.

Traders are advised to analyze market sentiment using tools such as sentiment indicators and community forums to gauge whether it trends bullish or bearish following the suspension. This analysis can inform whether to hold, sell, or buy into the affected tokens. By understanding market reactions and adjusting strategies accordingly, traders can position themselves competitively even amidst the uncertainty caused by the trading suspension.

The Future of Perpetual Contracts on Coinbase

As Coinbase navigates the complexities of cryptocurrency trading, the future of perpetual contracts on the platform remains an important topic of speculation. Traders are keen to know whether this suspension serves as a precursor to broader changes regarding how these contracts are managed or if it is a temporary measure to address specific market conditions or regulatory concerns. The future viability of trading perpetual contracts, especially for tokens like EDGE and FLOW, will largely depend on the platform’s response to current challenges.

Additionally, the potential introduction of new features or products could enhance the trading experience on Coinbase. If the platform learns from this suspension and integrates user feedback, it may ultimately refine its perpetual trading offerings. By keeping an eye on both industry trends and Coinbase’s forthcoming updates, traders can remain prepared for any shifts that might impact their trading strategies.

Understanding Cryptocurrency Trading Halts

Understanding the mechanics behind cryptocurrency trading halts is crucial for traders aiming to navigate turbulent market conditions effectively. Such halts may occur for various reasons, including market volatility, regulatory compliance, or operational decisions made by exchanges. For example, Coinbase’s recent suspension of perpetual contracts highlights a strategic response to manage trading risks associated with specific tokens. By grasping the rationale behind these halts, traders can better assess how to adapt their strategies.

Moreover, halts in trading can invoke a range of emotional responses within the trading community, which can further influence market dynamics. Reacting proactively rather than reactively to such situations can help traders to mitigate risks and capitalize on opportunities. Thus, educating oneself on the nature of trading halts enhances overall trading acumen and prepares investors to engage with changing market landscapes more confidently.

The Importance of Staying Informed in Cryptocurrency Trading

In the rapidly evolving world of cryptocurrency, staying informed is paramount for successful trading. The situation surrounding the Coinbase perpetual contract trading suspension underscores the necessity for traders to follow real-time updates and news regarding their investments. Timely information can provide crucial insights into market movements, regulatory changes, and potential trading opportunities, which can all significantly impact a trader’s portfolio.

Engaging with reliable cryptocurrency trading news sources, subscribing to updates from exchanges, and participating in discussions within trading communities can all contribute to a more informed trading approach. With the current trading dynamics characterized by rapid shifts and unexpected changes, a well-informed trader is better positioned to adapt and make strategic decisions that align with market conditions. This vigilance not only helps in navigating challenges like those presented by the Coinbase trading suspension but also fosters a proactive trading mindset.

Frequently Asked Questions

What is the reason behind the Coinbase perpetual contract trading suspension?

Coinbase has announced the suspension of perpetual contract trading due to ongoing evaluations of various tokens, including EDGE and FLOW. The decision reflects a strategic adjustment to enhance trading safety and compliance.

When will the Coinbase perpetual contract trading suspension take effect?

The Coinbase perpetual contract trading suspension will begin at 13:00 UTC on February 20, 2026. This marks the start of the cessation for trading certain tokens.

Which tokens are affected by the Coinbase perpetual contract trading suspension?

The tokens affected by the Coinbase perpetual contract trading suspension include EDGE-PERP, FLOW-PERP, and several others such as PROMPT-PERP and 1000SATS-PERP. A complete list of impacted tokens can be found in the updates from Coinbase.

How will open positions be handled during the Coinbase perpetual contract trading suspension?

All open positions in the affected perpetual contracts will be automatically settled at the time the trading is halted. The final settlement price will be determined based on the average index price in the hour prior to the suspension.

What will happen to the funding rate during the last period before the Coinbase perpetual contract trading suspension?

During the last funding period prior to the Coinbase perpetual contract trading suspension, the funding rate will be set to zero, ensuring that there are no funding costs for traders during this time.

Is there any news regarding the Coinbase EDGE suspension and its implications for traders?

The Coinbase EDGE suspension is part of the broader perpetual contract trading suspension affecting multiple tokens. Traders should prepare for automatic settlements and review the impacts on their trading strategies.

Where can I find more updates about the Coinbase perpetual contract trading suspension?

For the latest information and updates about the Coinbase perpetual contract trading suspension and other trading news, it is recommended to stay tuned to Coinbase’s official announcements and trading updates.