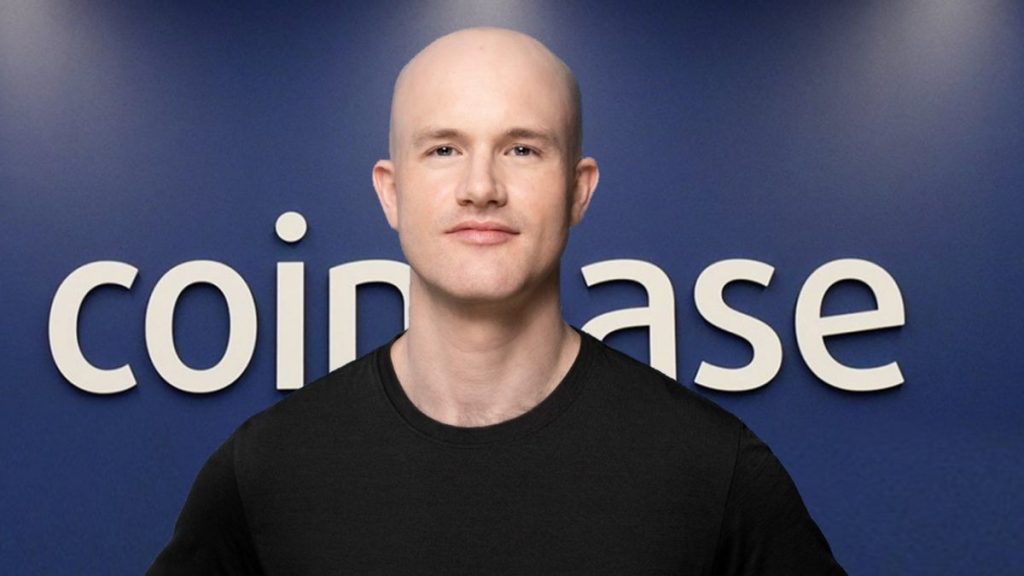

Coinbase CEO Brian Armstrong is leading the charge in improving capital access for private businesses, a hot topic in today’s financial landscape. Recently, he took to the X platform to highlight the pressing need for reforms that facilitate private companies’ access to capital. The rising challenges posed by regulation have created a scenario where many firms opt to remain private longer, resulting in profits largely benefiting only private and credit investors. Given the trends in stock performance after IPOs—which often leave much to be desired—Armstrong advocates for innovations like public offerings on-chain. This technology could streamline processes, cut costs, and provide better liquidity for companies looking to transition into the public sphere.

In the financial domain, the narrative surrounding Coinbase CEO Brian Armstrong emphasizes the growing urgency for private enterprises to secure funding more easily. The current financial environment, shaped by stringent regulations, shows that the trajectory of many startups is skewed towards prolonged private status, thus limiting broader investment opportunities. Investors often see disappointing returns from public listings, underscoring the inefficiencies in raising capital traditionally. Armstrong’s vision for on-chain public offerings aims to disrupt this status quo by creating a more efficient marketplace. By enhancing access to funding through innovative solutions, businesses can thrive without the constraints of excessive regulatory burdens.

| Key Point | Explanation |

|---|---|

| Need for Capital Access | Private companies need easier access to capital to thrive. |

| Impact of Regulations | Increased regulation negatively impacts large private enterprises. |

| Extended Private Duration | Companies remain private for longer, affecting profitability. |

| Poor Public Performance | Stock performance tends to be poor after going public. |

| Lack of Market Liquidity | During early lifecycle phases, there’s a lack of a liquid market for accurate valuation. |

| On-Chain Public Offerings | Future public offerings may be conducted on-chain, enhancing experience. |

| Cost and Accessibility Benefits | On-chain offerings will reduce costs and friction, improving accessibility. |

Summary

Coinbase CEO Brian Armstrong emphasizes the urgent need for improved capital accessibility for private companies. As increasing regulations pose challenges for these enterprises, the future of public offerings on-chain appears promising. This innovative shift is expected to alleviate costs and enhance the accessibility of capital, which could lead to more efficient market operations and improved valuations.

The Challenges of Capital Access for Private Companies

In recent discussions, it has become evident that the landscape for private companies seeking capital has grown increasingly complex. The need for more accessible funding options has become critical, especially for startups that are stifled by regulation and market conditions. Many private enterprises find themselves trapped in a cycle where they must rely on heavy private equity or credit funding instead of attracting broader investment opportunities. As a result, profits that would typically benefit public investors are now being funneled into a narrow pool, thus limiting growth potential and innovation.

The prolonged periods during which companies remain private often lead to frustration among potential investors. With the current regulatory climate, these firms navigate barriers that are not only financial but also bureaucratic. This can severely impact their ability to raise funds effectively when compared to their public counterparts. Therefore, addressing capital access is not merely a financial issue; it’s about creating a sustainable ecosystem where startups can thrive without being hindered by excessive regulatory measures.

The Impact of Regulation on Startups and Capital Access

Regulatory frameworks play a significant role in the ability of startups to access capital. In recent years, many entrepreneurs have found that increased scrutiny and compliance requirements have made it more difficult to secure the funding necessary for their growth. Regulation, while designed to protect investors, can have unintended consequences for smaller businesses that struggle to meet these mandates. Thus, many startups find themselves delaying their public offerings, opting to maintain their private status longer than originally intended.

Moreover, new startups often miss out on the potential benefits of going public, such as increased visibility and legitimacy, due to these regulations. They remain trapped in a space where capital access becomes a significant bottleneck that restricts their ability to scale effectively. A better understanding of these regulatory impacts, alongside innovative solutions like on-chain public offerings, could pave the way for a more fluid and efficient funding landscape for startups.

Coinbase CEO Brian Armstrong Advocates for On-Chain Public Offerings

Coinbase CEO Brian Armstrong has underscored the urgent need for reform in how private companies access capital, notably advocating for public offerings to be conducted on-chain. This innovative approach relies on blockchain technology to streamline the entire process, thereby reducing unnecessary costs and complexities associated with traditional IPOs. By enabling on-chain public offerings, companies can democratize access to investment opportunities, opening the door for a wider range of investors and enhancing liquidity in the marketplace.

Armstrong’s vision suggests that if more companies were to adopt on-chain approaches for public offerings, we could see a significant shift in stock performance post-IPO. Historically, many companies have witnessed lackluster returns in the early phases of their public offering journey, primarily due to a lack of proper valuation and liquidity. On-chain systems can address these issues by providing more transparent pricing, fostering investor confidence, and ultimately, improving market conditions for newly public stocks.

The Future of Stock Performance After an IPO

The performance of stocks post-IPO has been a topic of significant interest and concern for investors. Many companies experience a slump in stock value immediately after going public, primarily due to market uncertainty and perceived risks associated with new entrants. This phenomenon occurs largely because potential investors often fear volatility and the unknown factors surrounding a newly public company’s operational model and revenue generation capabilities.

However, if companies engage in on-chain public offerings, it could change the narrative dramatically. By utilizing blockchain’s inherent transparency and efficiency, firms may offer real-time access to data and performance indicators that could instill greater investor confidence. Over time, this can lead to healthier stock prices and more robust long-term investment relationships, as transparency breeds trust.

Unlocking Opportunities for Private Enterprises through Regulation Reform

Regulation reform is essential to unlocking opportunities for private enterprises. In the current landscape, excessive regulations can hamper growth and hinder capital access for startups, pushing them to seek funding alternatives that may not be in their best interest. More streamlined and user-friendly regulation can create a favorable environment for startups, encouraging innovation and competition within diverse sectors. This includes re-evaluating how regulations apply to companies at different stages of their growth lifecycle.

One promising reform could involve simplifying the requirements for going public while maintaining adequate investor protections. By lowering the barriers to entry, startups can retain their operational agility while still seeking the capital needed for growth. This balances the need for prudent oversight with the necessity for businesses to access the funding that fuels their development, ultimately benefiting the broader economy.

Blockchain Technology as a Catalyst for Change

Blockchain technology stands at the forefront of capital market evolution, offering practical solutions to the issues faced by private companies today. Its decentralized nature not only enhances transparency but also significantly reduces transaction costs, which have traditionally served as barriers for private companies looking to access capital markets. By harnessing blockchain, businesses can develop new models for fundraising that could minimize reliance on traditional funding sources, like venture capital.

Moreover, as we move towards a digital future, the adoption of blockchain for public offerings will likely lead to more efficient trading ecosystems. As highlighted by Brian Armstrong, this transition could enable a more equitable distribution of opportunities to invest and participate in the success of emerging firms. The capabilities of blockchain could transform how private businesses engage with potential investors, enhancing capital access and paving the way for innovative financing solutions.

Investing in the Future: Understanding Liquid Markets

One essential component of successful investing is the existence of liquid markets that allow for fair pricing and trading of securities. Unfortunately, many private companies do not have access to such markets, which can lead to inflated valuations and create significant risks for investors. Upon transitioning into the public sphere, companies often find that a lack of liquidity can lead to poor stock performance, with shares trading at lower valuations than anticipated.

To mitigate these challenges, developing a liquid market through smarter public offerings can encourage investor participation and foster better price mechanisms. The benefits of enhanced liquidity cannot be overstated, as they create dynamic environments that motivate capital attraction. With better access to capital markets, startups can thrive, leading to economic growth and improved stock valuations, ultimately benefiting investors in the long run.

The Journey to IPO: Understanding Investor Sentiment

Investors’ sentiments surrounding upcoming IPOs play a crucial role in determining their success in the market. Companies that can effectively communicate their business models and future prospects tend to attract more interest and investment during their IPOs. Conversely, those that fail to articulate their value proposition may struggle on the stock market, leading to a volatile post-IPO performance. Often, this sentiment is heavily influenced by the broader economic climate and regulatory landscape.

Startups looking to initiate public offerings must focus on building strong narratives that resonate with potential investors. This means highlighting growth potential, market fit, and how the company plans to navigate regulatory requirements. By understanding investor sentiment and addressing their concerns, companies can engineer their path to a successful IPO that reflects their true value and potential, rather than succumbing to market fears based on regulatory burdens or lack of transparency.

Innovations in Capital Access: The Role of Technology

Innovations in technology are reshaping how private companies access capital, leading to more dynamic funding solutions. As traditional barriers are challenged, innovative financial technologies are emerging that streamline the process for startups. From crowdfunding platforms to blockchain-based public offerings, new methods are being tailored to meet the demands for accessible capital and ease of transaction, allowing entrepreneurs to connect directly with investors.

Technology-driven solutions not only serve to alleviate the frictions associated with capital raising but also create a more transparent funding landscape. By leveraging these innovations, startups can bypass some of the complexities and expenses that come with traditional funding models, allowing them to focus on what matters most—growing their businesses and delivering value to their stakeholders.

Frequently Asked Questions

What is Coinbase CEO Brian Armstrong’s stance on private companies accessing capital?

Coinbase CEO Brian Armstrong emphasizes the need for enhanced access to capital for private companies. He highlights that increased regulation has made it more challenging for such businesses to raise funds, leading them to stay private for longer durations.

How does Brian Armstrong view the impact of regulation on startups?

Brian Armstrong has noted that the heightened regulatory environment negatively impacts startups by restricting their growth potential and access to necessary capital. He argues that easing these regulations could foster a healthier environment for innovation and funding.

What does Brian Armstrong say about public offerings on-chain?

Brian Armstrong advocates for the future of public offerings being conducted entirely on-chain. He believes this shift will lower costs, increase accessibility, and reduce the friction associated with traditional IPO processes, allowing companies to reach broader investor bases.

Why is access to capital important for private businesses according to Brian Armstrong?

According to Brian Armstrong, access to capital is crucial for private businesses to scale and compete effectively. With current regulations hampering their ability to go public, many firms are forced to rely on private or credit investors, limiting their growth potential.

What concerns does Brian Armstrong have regarding stock performance after an IPO?

Brian Armstrong has raised concerns that stock performance after an IPO often suffers, as newly public companies may experience volatility due to the lack of a liquid market during their early lifecycle. This volatility can deter potential investors from participating after the initial offering.