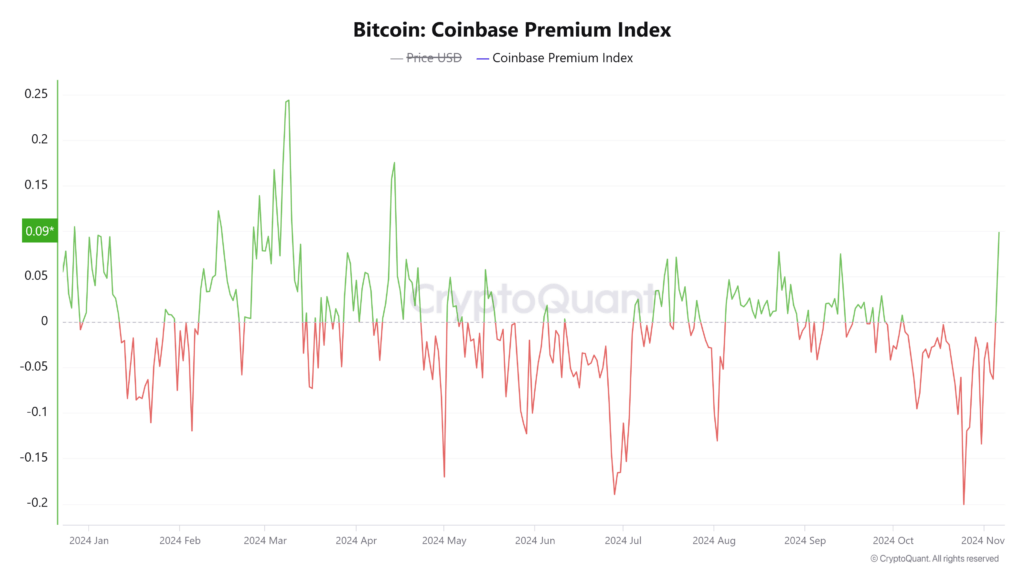

The Coinbase Bitcoin Premium Index serves as a significant barometer of Bitcoin pricing trends, reflecting the disparity between Bitcoin rates on Coinbase and the global market average. Recently, this index has been notably negative for 25 consecutive days, highlighting a concerning trend in market sentiment. Investors and analysts closely monitor this cryptocurrency index to gauge the level of institutional investing and trading activity on Coinbase. A consistent negative premium, currently at -0.0864%, signals escalating selling pressure and a waning appetite for risk among traders. Understanding the implications of the Coinbase Bitcoin Premium Index is crucial for those active in cryptocurrency markets, as it can influence strategic investment decisions.

The Coinbase Bitcoin Premium Index is a crucial metric that illustrates the variances in Bitcoin pricing across different trading platforms, particularly in terms of liquidity and market engagement. This trading index reflects prevailing market conditions, providing insights into investor confidence and institutional interest in digital currencies. Currently, the index reveals a prolonged phase of negative valuation, hinting at larger trends affecting cryptocurrency markets. Investors often rely on this index not just for trading decisions, but to better understand broader shifts in market dynamics and investor behavior. By analyzing such data, traders can better navigate the complexities of cryptocurrency investments.

| Key Points | Details |

|---|---|

| Current Status | The Coinbase Bitcoin Premium Index is currently reported at -0.0864%. |

| Consecutive Negative Premium Days | The Index has been in negative premium for 25 consecutive days. |

| Positive Premium Days in 2023 | Only two days of positive values this year: 0.011% on January 6 and 0.0023% on January 15. |

| Importance of the Index | It measures the difference in Bitcoin prices on Coinbase versus the global market average, reflecting U.S. market trends, institutional investments, and market sentiment. |

| Interpretation of Premium | A positive premium indicates higher prices on Coinbase, suggesting strong buying pressure, while a negative premium indicates lower prices and selling pressure. |

Summary

The Coinbase Bitcoin Premium Index has recently demonstrated a prolonged period of negative premium, highlighting significant selling pressure in the U.S. market. This index serves as a critical tool for investors and analysts to gauge market sentiment and liquidity. With only two days of positive values this year, it indicates a cautious sentiment among investors, suggesting a potential decline in risk appetite and capital outflows. Understanding the Coinbase Bitcoin Premium Index is essential for comprehending the dynamics of Bitcoin trading on Coinbase and the broader market implications.

Understanding the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium Index serves as a crucial metric for investors monitoring Bitcoin pricing trends. By comparing the price of Bitcoin on Coinbase to the global market average, this index highlights variations that can reveal market sentiment. When the premium is positive, it signals healthy demand for Bitcoin within the U.S., often driven by institutional investing. Conversely, a negative premium indicates a lack of local enthusiasm for purchasing Bitcoin, suggesting that traders have shifted their risk preferences and are less willing to invest.

As of February 8, 2026, the Coinbase Bitcoin Premium Index has remained in negative territory for an extended period, precisely 25 days. This consistent duration of a negative premium indicates a potential bearish sentiment in the U.S. cryptocurrency market. The index’s fluctuations can be an early indicator of broader trends in Bitcoin pricing, making it invaluable for traders and investors who need to make informed decisions based on market conditions.

The Impact of Negative Premium on Investor Behavior

A prolonged negative premium, such as the current 25-day stretch of the Coinbase Bitcoin Premium Index, can significantly impact investor behavior. Investors tend to interpret negative premiums as an indicator of declining market sentiment and a possible decrease in institutional interest. This situation can lead to a self-fulfilling prophecy where the lack of buying interest drives prices down further, discouraging additional investments. Traders often monitor this index closely to gauge when to enter or exit the market.

When institutional investors see persistent negative premiums, they may become hesitant to allocate funds to Bitcoin, leading to reduced capital inflows into the market. This trend creates a vicious cycle where decreasing prices push the index lower, further dampening the appetite for risk among potential buyers. Consequently, amidst these conditions, liquidity issues may arise, making it harder for transactions to occur at desired price levels.

Analyzing Market Sentiment Through the Coinbase Bitcoin Premium Index

The ability of the Coinbase Bitcoin Premium Index to reflect market sentiment cannot be understated. It acts as a real-time gauge of how investors perceive Bitcoin’s value against global standards. For instance, an extended period of negative premium can indicate fear among investors, suggesting they prioritize protecting their capital over speculative investment. This sentiment reflects broader attitudes toward cryptocurrency trading, particularly amid volatile market conditions.

Moreover, the index’s relationship with Bitcoin pricing is essential for understanding market dynamics. A significant drop in the premium might prompt some traders to expect a further decline in prices, hindering short-term bullish trends. On the other hand, should the premium turn positive, it might indicate renewed confidence among both retail and institutional investors, potentially revitalizing interest in Bitcoin trading and improving liquidity.

Institutional Investing and the Coinbase Bitcoin Premium Index

Institutional investing plays an integral role in shaping the cryptocurrency landscape, and the Coinbase Bitcoin Premium Index is a key metric for these entities. High-profile investors and institutions often rely on this index to ascertain the health of the U.S. market. A positive index can signal that major investment firms are actively participating, leading to higher demand and, consequently, increased Bitcoin prices. This trend showcases how institutional behavior directly influences market conditions.

As institutions are typically more risk-averse than individual investors, their presence in the market often brings stability. However, the current sustained negative premium may indicate decreasing involvement from these investors. This could be attributed to recent market fluctuations or a perceived lack of growth potential in Bitcoin, discouraging longer-term commitments. Observing the Coinbase Bitcoin Premium Index provides insights into the shifting priorities of institutional investments and the overarching health of the cryptocurrency market.

The Future of Bitcoin Pricing: Trends and Predictions

Understanding future Bitcoin pricing requires careful observation of indexes like the Coinbase Bitcoin Premium Index. Trends generated from this index can help predict potential market shifts driven by retail and institutional sentiment. Analysts often utilize historical data surrounding Bitcoin premiums to forecast future behavior, taking into account economic signals, technological advancements, and changes in regulation, all of which can impact investor confidence.

Furthermore, if the Coinbase Bitcoin Premium Index resumes a positive trend, it could indicate a resurgence in market enthusiasm and a robust demand for Bitcoin. In such scenarios, prices may rise significantly, attracting renewed attention from both seasoned investors and newcomers to the cryptocurrency arena. Hence, monitoring the Coinbase Bitcoin Premium Index provides critical insights into potential bullish or bearish trends that could shape the future of Bitcoin pricing.

Market Sentiment: Bullish or Bearish?

Market sentiment drives much of the behavior in cryptocurrency trading, with indicators like the Coinbase Bitcoin Premium Index highlighting fluctuations in investor emotions. When the premium remains negative, it often reflects widespread bearish sentiment among traders, which can lead to increased volatility and price drops. The psychological impact of these sentiments cannot be underestimated, as they directly affect willingness to buy or sell Bitcoin.

Additionally, understanding whether market sentiment leans bullish or bearish can help investors make strategic decisions. In a bullish scenario, an optimistic outlook might prompt significant buying activity, especially if the Coinbase Bitcoin Premium Index indicates a rising premium. Conversely, if negativity persists, it could suggest the need for caution, encouraging investors to reassess their positions before engaging further in the market.

How Coinbase Trading Influences Market Dynamics

Coinbase trading plays a significant role in shaping the dynamics of the cryptocurrency market, profoundly affecting the Coinbase Bitcoin Premium Index. As one of the largest and most popular trading platforms, Coinbase has a sizable influence on Bitcoin pricing in the U.S. market. Changes in trading volume on this platform can lead to fluctuations in the premium, and consequently impact overall market performance.

When trading activity on Coinbase increases, it can signal higher demand and greater investor confidence, contributing to a positive premium. On the other hand, low trading volumes often correlate with negative premiums, damping enthusiasm surrounding Bitcoin investments. Thus, Coinbase acts as a pivotal hub for traders, making its trading behaviors essential for understanding broader market trends and investor psychology.

Capital Outflows: Implications for Bitcoin and the Coinbase Index

Recent trends of capital outflows from Bitcoin can have significant implications for the Coinbase Bitcoin Premium Index. When investors withdraw substantial amounts of Bitcoin from exchanges like Coinbase, it can lead to liquidity issues and negatively impact the premium. This situation raises concerns about market stability, as declining investor participation often signals deteriorating confidence in Bitcoin’s value.

Moreover, capital outflows further contribute to a negative premium, showcasing a trend towards risk aversion among investors. Analysts predict that unless there is a substantial turnaround in market sentiment, the current negative premium may persist, influencing Bitcoin’s viability as a long-term investment. Keeping a close eye on capital movements in the Coinbase Bitcoin Premium Index could help traders anticipate shifts and make better-informed investment decisions.

Bullish Market Signals from the Coinbase Bitcoin Premium Index

Despite the current 25-day streak of negative premium, signals of a potential bullish turnaround can also stem from the Coinbase Bitcoin Premium Index. Historically, periods of extreme caution and low premiums often precede significant recoveries in Bitcoin pricing. If Bitcoin were to break the negative trend and post a positive premium, it could reignite investor enthusiasm and signal a favorable market turnaround for traders.

These bullish signals can often correlate with improved institutional interest and greater trading activities. Observing shifts from negative to positive premiums can give traders an advantage, prompting them to prepare for incoming inflows and price increases. Therefore, while the index currently suggests caution, the potential for bullish trends remains, and investors need to stay alert for signs of market recovery.

Analyzing Bitcoin’s Price Volatility Through the Coinbase Index

Bitcoin’s price volatility is notorious among cryptocurrencies, and the Coinbase Bitcoin Premium Index offers valuable insights into this phenomenon. The negative premium reflects a state of uncertainty among traders, contributing to fluctuations in Bitcoin prices. Understanding how this index interplays with price movements can help traders anticipate future market behavior and make better-informed decisions.

Additionally, a deeper analysis of the index in relation to historical price volatility can provide insights into potential corrective measures. Notable spikes in the index, whether positive or negative, often correspond with broader economic signals or events that affect market sentiment. As such, tracking the Coinbase Bitcoin Premium Index can enhance understanding of Bitcoin’s price dynamics and inform strategies for capitalizing on volatility.

Frequently Asked Questions

What does the Coinbase Bitcoin Premium Index indicate about Bitcoin pricing?

The Coinbase Bitcoin Premium Index indicates the difference in Bitcoin prices on Coinbase compared to the global market average. A positive index suggests higher prices on Coinbase, indicating strong buying pressure, while a negative index, like the recent -0.0864%, reflects selling pressure in the U.S. market.

How can I interpret a negative Coinbase Bitcoin Premium Index?

A negative Coinbase Bitcoin Premium Index, as seen in recent data, signifies that Bitcoin prices on Coinbase are lower than the global average. This typically points to increased selling pressure and reduced market sentiment among investors.

Why is the Coinbase Bitcoin Premium Index important for institutional investing?

The Coinbase Bitcoin Premium Index is crucial for institutional investing as it helps gauge market sentiment and liquidity in the U.S. market. A positive premium often indicates strong institutional interest, while persistent negative premiums can deter institutional investments.

How does the performance of the Coinbase Bitcoin Premium Index affect cryptocurrency trading strategies?

Traders monitor the Coinbase Bitcoin Premium Index to refine their cryptocurrency trading strategies. A positive index could signal a buying opportunity due to strong demand, whereas a negative index may prompt caution due to potential selling pressure.

What does it mean when the Coinbase Bitcoin Premium Index is positive?

When the Coinbase Bitcoin Premium Index is positive, it indicates that Bitcoin prices on Coinbase are above the global average. This scenario usually reflects significant buying interest in the U.S. market, often driven by institutional investments and bullish market sentiment.

How often does the Coinbase Bitcoin Premium Index change?

The Coinbase Bitcoin Premium Index changes frequently, as it reflects real-time pricing dynamics on Coinbase compared to the broader market average. Recent data shows it has been in a negative premium for 25 days, highlighting current market conditions.

Can the Coinbase Bitcoin Premium Index predict market trends for Bitcoin?

While the Coinbase Bitcoin Premium Index can offer insights into market trends, it should not be used in isolation. A positive or negative index can hint at potential shifts in market sentiment or investor behavior but should be considered alongside other market indicators.

What factors influence the Coinbase Bitcoin Premium Index?

Factors influencing the Coinbase Bitcoin Premium Index include market sentiment, buy/sell pressure within the U.S. market, trading volume on Coinbase, and broader macroeconomic conditions affecting risk appetite among investors.

How can the Coinbase Bitcoin Premium Index guide investors?

Investors can use the Coinbase Bitcoin Premium Index as a tool to assess market sentiment and inform their decisions. For instance, a positive index may encourage investment, while a negative index could suggest a reevaluation of risk.

Has the Coinbase Bitcoin Premium Index shown significant changes recently?

Yes, the Coinbase Bitcoin Premium Index has shown significant changes, remaining in negative territory for 25 consecutive days, indicating a sustained period of selling pressure in the U.S. market despite a few positive days earlier this year.