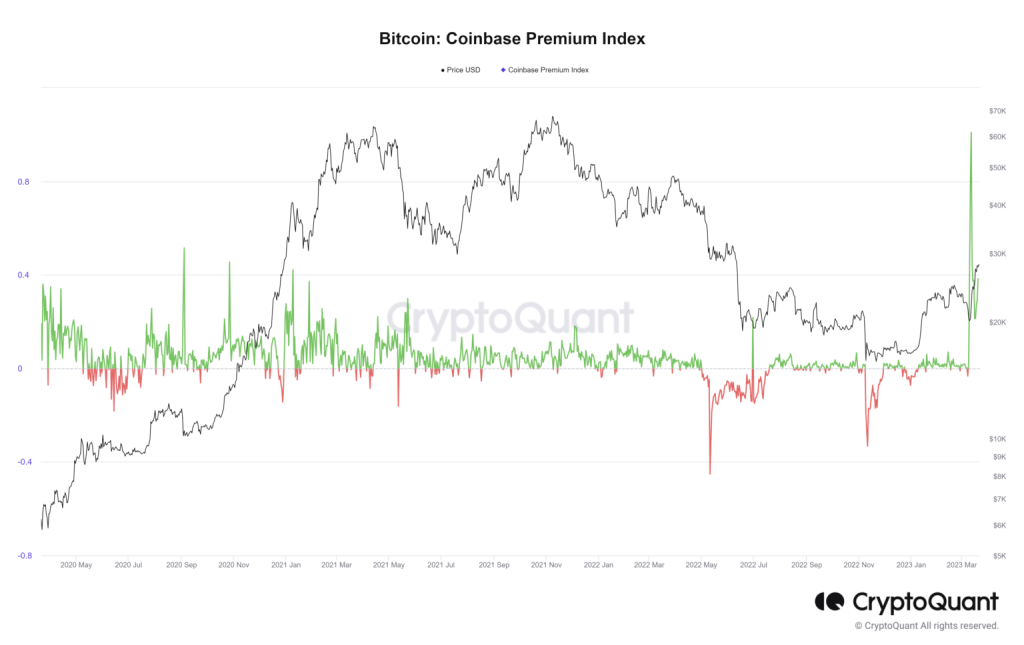

The Coinbase Bitcoin Premium Index has become a critical metric in evaluating market dynamics, currently reflecting a negative premium of -0.0413% after 20 consecutive days. This index, which compares the Bitcoin price on Coinbase to the global market average, serves as a barometer for Bitcoin market sentiment. A negative value indicates significant selling pressure, often influenced by a lack of enthusiasm from institutional investors and unfavorable capital flows in the U.S. market. Understanding the Coinbase Bitcoin Premium Index is essential for those looking to navigate the complexities of cryptocurrency trading, as it sheds light on the balance between supply and demand. By analyzing this index alongside Bitcoin premium trends, traders can gain insightful perspectives into market momentum and potential investment opportunities.

The Coinbase Bitcoin Premium Index provides vital insights into the cryptocurrency landscape, particularly regarding the U.S. market’s appetite for Bitcoin. By measuring the discrepancy between Coinbase’s Bitcoin price and its global counterparts, this gauge highlights fluctuations in investor sentiment, especially among institutional participants. When the index shows a negative reading, it often signals a downturn in bullish market attitudes and potentially transformative capital flows that could affect trading strategies. Recognizing the implications of this Bitcoin price differential is crucial for investors aiming to capitalize on market trends. As Bitcoin prices continue to fluctuate, the Coinbase Bitcoin Premium Index remains a pivotal indicator for understanding broader market dynamics and investor behavior.

Understanding the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium Index is a vital metric that provides insights into the price dynamics of Bitcoin within the U.S. market. Currently reflecting a negative premium for the past 20 days, the index stands at -0.0413%. This situation indicates that Bitcoin is trading at a lower price on Coinbase compared to the average in global markets. Investors and analysts closely monitor this indicator to gauge market health and identify potential trends in Bitcoin trading based on investor sentiment and market conditions.

A negative premium on the Coinbase Bitcoin Premium Index typically suggests selling pressure, signaling that investors may be retreating from the market. This phenomenon often results from increased market risk aversion or a decline in the appetite for riskier assets, reflecting broader economic uncertainties. Understanding these dynamics can help traders and institutional investors make informed decisions regarding their capital flows into or out of Bitcoin investments.

Impact of Market Sentiment on the Coinbase Price

Market sentiment plays a crucial role in determining the Coinbase price of Bitcoin and is often reflected through the Bitcoin premium. When the market sentiment is bullish, we typically see a positive premium, indicating strong demand and buying interest within the U.S. markets. This enthusiasm can lead to increased activity from institutional investors, who may be looking to capitalize on favorable conditions. However, the current negative premium indicates a shift in sentiment, as traders may be more cautious and willing to sell rather than buy.

A shift towards negative sentiment can lead to significant capital outflows, further exacerbating the downward pressure on Bitcoin prices on platforms like Coinbase. As institutional investors weigh their options under these conditions, the cautious atmosphere can influence decision-making and result in lower investment flows. By recognizing these shifts in market sentiment, investors can better position their strategies to mitigate risks and adapt to changing market dynamics.

The Role of Institutional Investors in Bitcoin’s Price Dynamics and Premium Index

Institutional investors have increasingly become a key component of the Bitcoin market, often impacting the Coinbase price and the Bitcoin Premium Index significantly. Their entry into the market typically brings a level of validation and retail investor confidence, often resulting in a positive premium. Conversely, in times of uncertainty or negative sentiment, these same institutional players may withdraw, leading to a negative premium as selling pressure outweighs buying.

Understanding the motivations of institutional investors can help individuals anticipate market moves. When these larger players show hesitance or pull back from the market, it often indicates a broader caution among investors. Tracking capital flows from these institutions can provide critical insights into the overall market sentiment toward Bitcoin and its perceived value, making it essential for all investors to monitor the movements and strategies of these influential players.

Analyzing Capital Flows and Bitcoin Premium Correlation

Capital flows directly influence the Coinbase Bitcoin Premium Index, with a negative premium often indicating capital outflows from the U.S. Bitcoin market. This can occur as investors seek better opportunities or safer investments elsewhere during periods of volatility. Understanding these flows can be integral for predicting future price movements and potential recoveries when market conditions stabilize.

On the flip side, a positive premium typically reflects strong capital inflows, showcasing a thriving interest among investors. By analyzing these trends, traders can align their strategies with the broader movements of capital towards or away from Bitcoin. This connection between capital flows, market sentiment, and the Coinbase price can develop a clearer picture of the market’s direction.

The Psychological Factors Behind Bitcoin Market Changes

The psychological aspects of trading and investment behavior significantly affect the Coinbase price and the Bitcoin Premium Index. Speculation, fear, overexcitement, and FOMO (Fear of Missing Out) can all impact whether investors choose to engage in buying or selling Bitcoin. When market sentiment swings negatively, these psychological factors often lead to panic selling, which in turn creates a downward trend for the premium.

Conversely, when positive market sentiment prevails, investors tend to flock to Bitcoin for potential gains, driving up both the price and premium. Recognizing and understanding these psychological trends is vital for investors looking to navigate the inevitable fluctuations in the Bitcoin market. Awareness of how sentiment can shift based on external events or market news enables traders to make informed decisions to enhance their investment strategies.

Deciphering Bitcoin Price Movements Through Technical Analysis

Technical analysis serves as a powerful tool for investors looking to understand the movements of Bitcoin prices and the Coinbase Bitcoin Premium Index. By analyzing historical data and price patterns, traders can identify potential support and resistance levels that inform their trading strategies. This analysis becomes even more critical in the current context of a negative premium, which could suggest potential reversal points or ongoing trends.

Incorporating technical indicators alongside the Bitcoin Premium Index allows traders to make more informed predictions about future price movements. Recognizing how price movements correlate with both sentiment and capital flows can provide traders with the edge needed to navigate uncertain market conditions effectively.

Global Market Comparison and Its Effects on Coinbase Price

The dynamics of the global Bitcoin market significantly impact the Coinbase price. As the Coinbase Bitcoin Premium Index indicates a negative premium, it reflects a broader discrepancy that could signal changing patterns in other markets. Factors such as regulations, institutional participation, and overall market sentiment in different regions can influence how Bitcoin is perceived and traded, impacting local exchanges like Coinbase.

Understanding these global comparisons is crucial for investors looking to realize potential gains or limit losses. By staying informed about international Bitcoin trading trends, investors can create strategies that capitalize on disparities in market performance, ensuring that their approach to the Coinbase price remains agile in response to global shifts.

Future Outlook: Are We Heading Towards a Recovery?

Despite the current negative sentiment evidenced by the Coinbase Bitcoin Premium Index, there is always the potential for recovery in the Bitcoin market. Historically, negative premiums are often followed by rebounds as market cycles play out. Observing external factors like macroeconomic trends, regulatory developments, and institutional buying can provide insights into whether the market is setting up for a recovery.

For traders and investors, keeping an eye on these indicators will be key to anticipating changes. As the market sentiment evolves, it will be essential to adapt strategies accordingly, especially if the Bitcoin market starts to show signs of renewed interest, potentially shifting back to a positive premium.

Leveraging News and Events Impacting Bitcoin Prices

Timely news and substantial events can dramatically impact the Coinbase Bitcoin Premium Index, precipitating swift changes in market sentiment and price action. Significant announcements from regulatory bodies, technological advancements, or major financial institutions entering the Bitcoin space can lead to heightened enthusiasm, shifting the premium into positive territory. Investors should remain vigilant and responsive to such developments to capitalize on potential opportunities.

Conversely, negative news, such as regulatory crackdowns or unfavorable market conditions, can lead to panic selling, pushing the Coinbase price down. Hence, integrating news analysis into trading strategies can enhance the ability to predict market reactions and inform better decision-making based on the overall sentiment and capital flows.

Frequently Asked Questions

What does a negative Coinbase Bitcoin Premium Index indicate?

A negative Coinbase Bitcoin Premium Index, such as the current reading of -0.0413%, indicates that the Bitcoin price on Coinbase is lower than the global market average. This situation typically reflects significant selling pressure in the U.S. market, a decrease in the risk appetite among investors, and potential capital outflows.

How can investors use the Coinbase Bitcoin Premium Index?

Investors can utilize the Coinbase Bitcoin Premium Index to gauge market sentiment and capital flows. Understanding whether the index is in a positive or negative state can inform decisions related to buying or selling Bitcoin, as a positive premium suggests strong demand and buying interest among institutional investors.

What factors contribute to the Coinbase Bitcoin Premium Index?

The Coinbase Bitcoin Premium Index is influenced by several factors including market sentiment, capital flows, and the behavior of institutional investors. When institutional demand is high and U.S. liquidity is abundant, the index may reflect a positive premium, indicating a bullish outlook among investors.

How does the Coinbase price compare with the global Bitcoin price?

The Coinbase Bitcoin Premium Index measures the difference between the Bitcoin price on Coinbase and the global market average price. A premium indicates that the Coinbase price is higher than the global average, while a negative premium signifies the opposite, providing critical insights into market conditions and investor sentiment.

What implications does a prolonged negative premium have for the Bitcoin market?

A prolonged negative premium, such as the current trend over 20 consecutive days, suggests that the Bitcoin market in the U.S. is experiencing significant challenges. It may indicate lower demand, heightened risk aversion among investors, and potential capital outflows, which can have broader implications for Bitcoin market sentiment.

Why is the Coinbase Bitcoin Premium Index important for institutional investors?

For institutional investors, the Coinbase Bitcoin Premium Index is a vital tool as it provides insights into market dynamics and investor sentiment in the U.S. A positive index can suggest a favorable environment for investing, while a negative index can signal caution, helping institutions make informed decisions about their capital flows.

| Key Points | Details |

|---|---|

| Current Status | Coinbase’s Bitcoin Premium Index stands at -0.0413%. |

| Duration of Negative Premium | The index has been negative for 20 consecutive days. |

| Significance of the Index | Measures the difference between the Bitcoin price on Coinbase and the global average. |

| Positive Premium Indications | Strong buying interest, institutional investments, abundant liquidity, optimistic sentiment. |

| Negative Premium Indications | Significant selling pressure, decreased investor risk appetite, market risk aversion. |

Summary

The Coinbase Bitcoin Premium Index has shown a significant negative trend, remaining in negative premium for the past 20 days, currently at -0.0413%. This metric is vital for tracking investor sentiment and capital movement within the U.S. market, reflecting a period of heightened caution among investors as indicated by the negative premium. Understanding the implications of the Coinbase Bitcoin Premium Index can provide insights into market dynamics, particularly regarding investment strategies and risk management.