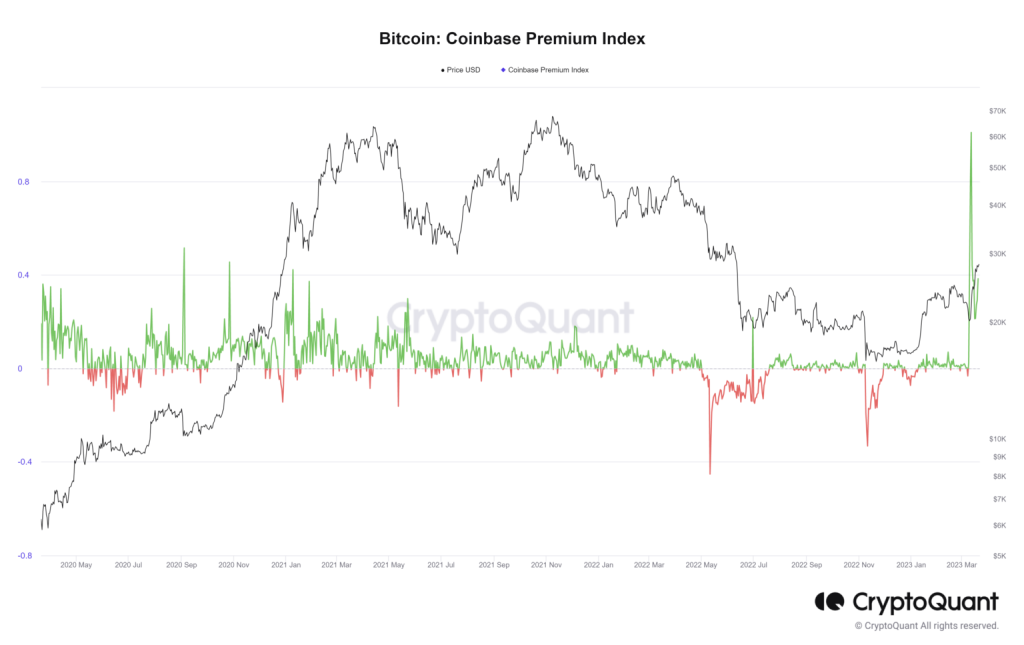

The Coinbase Bitcoin Premium Index, a critical measure of Bitcoin price dynamics, has recently recorded an alarming trend, remaining in negative premium for an unprecedented 18 consecutive days at -0.1714%. This index provides insight into the price difference between Bitcoin transactions on Coinbase—one of the largest U.S. trading platforms—and the global average price, revealing crucial market behaviors. A sustained negative premium is often indicative of heightened sell pressure within the U.S. market, suggesting that investors are experiencing increasing risk aversion and capital outflows. Such scenarios could potentially impact cryptocurrency valuations and signal broader market fluctuations. As investors navigate the complexities of the crypto landscape, understanding the implications of the Coinbase Bitcoin Premium Index is essential for grasping current market trends and risks.

Delving into the intricacies of the Bitcoin market, the phenomenon commonly referred to as the Coinbase Bitcoin Premium Index recently showcased a concerning trend, indicating persistent negative values over the last 18 days. This metric, recognized for assessing the disparity in Bitcoin pricing between U.S. exchanges like Coinbase and the global marketplace, highlights significant patterns in market sentiment. A continuous negative reading often reflects an increase in market sell pressure, compounded by shifts in investor confidence and a propensity for capital outflows. As the crypto ecosystem grapples with varying degrees of risk exposure, understanding the implications of this index becomes vital for stakeholders. Monitoring these price differentials not only sheds light on current economic sentiments but also aids in anticipating future movements in the cryptocurrency landscape.

Understanding the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium Index serves as a crucial indicator of market sentiment, particularly within the U.S. trading environment. It calculates the discrepancy between Bitcoin’s price on Coinbase and the global market average, providing insight into how U.S. investors perceive Bitcoin’s value. When this index is negative, as it has been for 18 consecutive days, it signals that Bitcoin is trading at a lower price on Coinbase compared to other exchanges, suggesting a bearish outlook among American traders.

This prolonged negative premium indicates underlying factors affecting the market, including an increase in sell pressure driven by both retail and institutional investors. With the current reading at -0.1714%, it is evident that investors are possibly experiencing uncertainty or caution, leading to capital outflows from Bitcoin and a reluctance to engage extensively in trades. Such periods of negative premium can serve as warning signs for potential shifts in market dynamics.

The Impact of Sell Pressure on the Bitcoin Market

The current sell pressure in the U.S. market, as suggested by the negative Coinbase Bitcoin Premium Index, has substantial implications for Bitcoin’s price trajectory. When more investors are inclined to sell rather than buy, it leads to a decrease in demand, pushing Bitcoin prices lower. This phenomenon is often exacerbated during market downturns, where traders become increasingly sensitive to crypto market risks and external economic factors, thus further influencing capital outflows.

The relationship between sell pressure and Bitcoin prices is complex, as it also intertwines with broader economic indicators. High levels of uncertainty in the financial markets may amplify the negative sentiment, prompting investors to adopt a risk-averse approach. As a result, the heightened perception of crypto market risks may deter new investments, creating a feedback loop that can exacerbate declines in the Bitcoin price, reinforcing the need for careful market analysis.

Factors Contributing to a Negative Premium Index

Several factors contribute to the emergence of a negative premium in the Coinbase Bitcoin Premium Index. Chief among these is the heightened sell pressure experienced in the U.S. market, which often correlates with negative investor sentiment and loss of confidence in crypto assets. Additionally, fluctuations in the global economic landscape can prompt capital outflows, as traders look to liquidate investments in favor of more stable assets during uncertain times.

Another critical factor may include the perceived risks associated with cryptocurrencies amidst regulatory changes or macroeconomic instability. Investors often respond to such uncertainties by retreating from the market, leading to a lower price point on platforms like Coinbase compared to broader trading markets. Understanding these dynamics is essential for both traders and analysts to navigate the complexities of the cryptocurrency landscape.

Monitoring Capital Outflows in the Crypto Market

Capital outflows from Bitcoin, reflected by the negative premium on the Coinbase Bitcoin Premium Index, have important implications for the overall crypto market. These outflows signal that investors are withdrawing their funds, which could lead to further decreases in market liquidity and price stability. Such behavior often stems from a broader risk aversion as market participants reassess their investment strategies in light of increasing uncertainty.

Monitoring these capital flows is vital for understanding market trends and potential recoveries. If outflows continue unabated, we might witness a more substantial drop in Bitcoin’s price, reinforcing the correlation between sell pressure and investor confidence. Conversely, should investors begin to re-enter the market, it could signal a shift towards a more optimistic outlook and potentially stabilize the Bitcoin price.

Assessing Market Risk and Bitcoin Investment Strategies

Evaluating market risk is essential for anyone looking to invest in Bitcoin or navigate the crypto landscape effectively. In light of the current negative Coinbase Bitcoin Premium Index and the associated sell pressure, discerning patterns of market behavior is crucial. Appropriate risk management strategies should be employed to hedge against potential downturns, particularly during periods of increased market volatility.

Investors may also need to adjust their strategies based on market sentiment and external economic indicators. By staying informed about changes in the Coinbase Bitcoin Premium Index and understanding the implications of capital outflows and market risks, investors can better position themselves to take advantage of potential upswings while minimizing exposure to downturns.

Frequently Asked Questions

What does it mean when the Coinbase Bitcoin Premium Index is in negative premium?

When the Coinbase Bitcoin Premium Index is in a negative premium, it indicates that there is a lower Bitcoin price on Coinbase compared to the global market average. This scenario, which has persisted for 18 consecutive days at -0.1714%, often signals significant U.S. market sell pressure and diminished investor confidence.

How does the Coinbase Bitcoin Premium Index relate to Bitcoin price differences?

The Coinbase Bitcoin Premium Index measures the Bitcoin price difference between Coinbase and the global average. A negative value suggests that Bitcoin is trading lower on Coinbase, reflecting underlying market dynamics such as U.S. market sell pressure and capital outflows.

Why is the negative premium index of the Coinbase Bitcoin Premium Index significant?

The negative premium index of the Coinbase Bitcoin Premium Index is significant because it highlights a trend of sell pressure in the U.S. market. A sustained negative premium, such as the current -0.1714%, can indicate higher market risk and potential capital outflows from Bitcoin investments.

What factors contribute to the negative premium in the Coinbase Bitcoin Premium Index?

Factors contributing to the negative premium in the Coinbase Bitcoin Premium Index include U.S. market sell pressure, changes in investor sentiment, increased market risk aversion, and overall capital outflows affecting Bitcoin price dynamics.

How can investors interpret the current -0.1714% reading of the Coinbase Bitcoin Premium Index?

Investors can interpret the current -0.1714% reading of the Coinbase Bitcoin Premium Index as a sign of market caution. This negative premium suggests that U.S. investors may be retreating from Bitcoin, reflecting concerns about market risk and potential economic conditions.

What implications does the Coinbase Bitcoin Premium Index have for the overall crypto market risk?

The Coinbase Bitcoin Premium Index serves as an indicator of overall crypto market risk. A negative premium often reflects increased volatility and uncertainty in the market, prompting investors to reassess their risk exposure and investment strategies.

| Key Points | |

|---|---|

| Definition | The Coinbase Bitcoin Premium Index measures the price difference between Bitcoin on Coinbase and the global market average. |

| Current Status | The index has recorded a negative premium for 18 consecutive days, currently at -0.1714%. |

| Market Implications | A negative premium indicates sell pressure in the U.S. market, decreasing investor confidence, and potential capital outflows. |

Summary

The Coinbase Bitcoin Premium Index has been in a state of negative premium for an extended period, currently at -0.1714%. This situation highlights a significant shift in market dynamics, suggesting that traders in the U.S. are experiencing heightened sell pressure coupled with a decreased appetite for risk. Understanding the Coinbase Bitcoin Premium Index is crucial for investors as it provides insights into market sentiment and potential future movements in Bitcoin prices.